Fawry Bundle

Can Fawry Maintain Its Fintech Dominance in Egypt?

Fawry has revolutionized Egypt's financial landscape, transforming how millions manage their money. From humble beginnings, it has become a fintech powerhouse, but the path to success is never without its challenges. This exploration delves into the Fawry SWOT Analysis, its market position, and the factors shaping its future.

Understanding the Fawry competitive landscape is crucial for anyone navigating the Egyptian fintech industry. This analysis provides a comprehensive look at Fawry competitors, their strategies, and how Fawry's business model contributes to its financial performance. We will explore Fawry's market analysis to understand its strengths, weaknesses, and the challenges it faces in a dynamic market.

Where Does Fawry’ Stand in the Current Market?

Fawry holds a significant market position in Egypt's digital payments sector. Its extensive network and diverse service offerings characterize its competitive landscape. While specific market share data for 2024-2025 is subject to ongoing market dynamics, Fawry has historically led in electronic bill payments and mobile top-ups. This strong foundation supports its continued growth and strategic initiatives.

The company's core operations revolve around facilitating digital financial transactions. This includes bill payments for utilities, telecommunications, and education, along with mobile top-ups and online payment gateway services. Fawry also offers other financial services. This comprehensive approach allows Fawry to serve a broad customer base, from individual consumers to large corporations, solidifying its role in the Egyptian fintech industry.

Fawry's value proposition lies in its convenience, accessibility, and reliability. It provides a seamless platform for various financial transactions, simplifying payments for both consumers and businesses. Its widespread agent network and user-friendly mobile application enhance accessibility, particularly in areas where traditional banking services may be limited. For more insights, explore the Growth Strategy of Fawry.

Fawry's market share is substantial, particularly in electronic bill payments and mobile top-ups. The exact percentages fluctuate, but its dominance is evident. Its reach extends across Egypt, with a vast network of retail agents and online channels, ensuring broad accessibility for its services.

Fawry's service portfolio includes bill payments, mobile top-ups, and online payment gateway services. It has expanded into e-commerce payment solutions, supply chain financing, and microfinance. This diversification allows Fawry to capture a larger share of the digital transaction market and cater to a wider array of financial needs.

Fawry serves a diverse range of customer segments. These include individual consumers who use its services for bill payments and mobile top-ups. It also caters to small and medium-sized enterprises (SMEs) and large corporations, providing payment solutions tailored to their needs. This broad customer base supports its market position.

Fawry's primary geographic focus is Egypt, where it has established a strong presence. It has a widespread network of retail agents, exceeding 293,000 as of 2024. While concentrated in urban and semi-urban areas, Fawry is expanding its reach into rural regions to increase its market penetration.

Fawry's financial performance highlights its market strength. In Q1 2024, the company reported a 103.5% year-on-year increase in net profit, reaching EGP 196.2 million. Revenues also saw a substantial rise of 58.7% year-on-year, totaling EGP 1.2 billion in Q1 2024.

- Strong revenue growth indicates increasing transaction volumes and market adoption.

- Significant profit growth underscores efficient operations and effective cost management.

- These financial results demonstrate Fawry's ability to maintain a leading position in the competitive Egyptian fintech market.

- The company's robust financial health supports its strategic initiatives and future expansion plans.

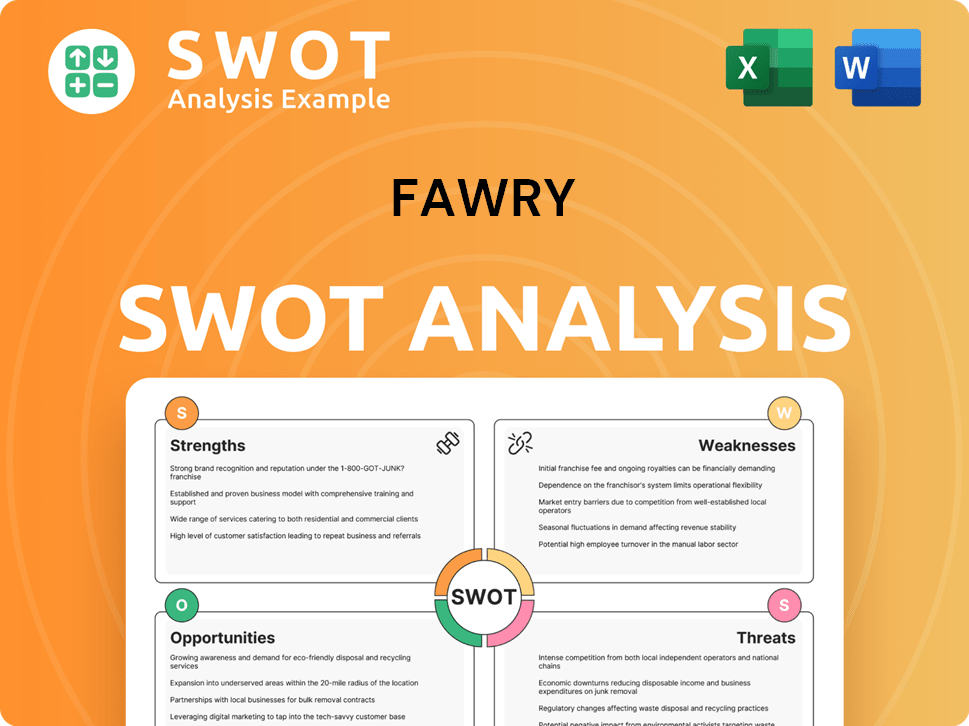

Fawry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Fawry?

The Growth Strategy of Fawry operates in a highly competitive environment within Egypt's digital payments sector. This landscape includes a mix of established financial institutions and agile fintech startups, all vying for market share. Understanding the competitive dynamics is crucial for assessing its strategic positioning and future prospects.

The competitive landscape is shaped by various factors, including pricing strategies, the expansion of agent networks, and the integration of diverse services. These elements directly influence the ability to attract and retain customers in the rapidly evolving digital payments market.

Direct competitors include banks and other payment service providers that offer similar services.

Indirect competition comes from entities like telecommunication companies and e-commerce platforms.

Emerging fintech startups are constantly disrupting the market with new technologies and business models.

Mergers, acquisitions, and strategic alliances also influence the competitive dynamics.

Competitive pricing is a key factor in attracting and retaining customers.

Expanding agent networks is crucial for reaching a wider customer base.

The Fawry competitive landscape is dominated by several key players. Understanding these Fawry competitors is essential for any Fawry market analysis. The competition includes both direct and indirect rivals, each with their own strengths and weaknesses. Here's a breakdown:

- Direct Competitors:

- National Bank of Egypt (NBE): Offers digital payment services through its mobile banking app.

- Commercial International Bank (CIB): Provides bill payment and transfer functionalities.

- Masary: Leverages agent networks for bill payment and mobile top-up services.

- Aman: Another payment service provider with an agent network.

- Indirect Competitors:

- Vodafone Egypt: Offers mobile money services like Vodafone Cash.

- Orange Egypt: Provides mobile money services.

- Etisalat by e&: Offers mobile money services.

- E-commerce Platforms: Integrating their own payment gateways and digital wallets.

- Fintech Startups: Specializing in niche areas like QR code payments and BNPL services.

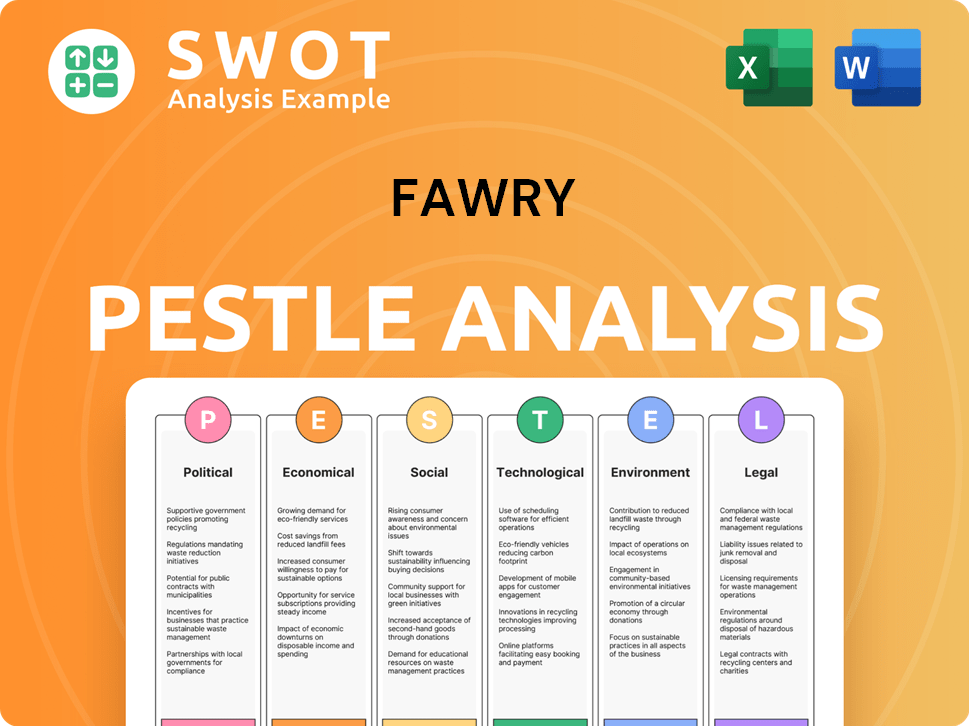

Fawry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Fawry a Competitive Edge Over Its Rivals?

The Marketing Strategy of Fawry highlights its strong position in the Egyptian fintech industry. Fawry's competitive advantages are built on its extensive agent network, robust technology, and strong brand recognition. This combination allows Fawry to maintain a significant edge in the market. Fawry's success is rooted in its ability to provide accessible and reliable financial services across Egypt.

Fawry's strategic moves and competitive edge are defined by its wide-reaching agent network, which consists of over 293,000 agents as of 2024. This extensive network is a key differentiator, enabling Fawry to reach a broad customer base, including the unbanked population. The company's technological infrastructure supports a high volume of transactions, ensuring efficiency and reliability. Fawry's brand equity and customer loyalty further strengthen its market position.

Fawry's business model focuses on providing a wide range of payment services, including bill payments, mobile top-ups, and e-commerce transactions. This approach has helped Fawry achieve significant financial performance. The company continues to invest in technology and expand its agent network to maintain its competitive advantage in the Egyptian fintech industry.

Fawry's core strengths include its vast agent network, proprietary technology platform, and strong brand recognition. These elements work together to create a sustainable competitive advantage. The company's ability to adapt to market changes and expand its service offerings further enhances its position.

- Extensive Agent Network: Over 293,000 retail agents across Egypt provide widespread accessibility.

- Technology Platform: A secure and scalable platform supports diverse financial services.

- Brand Equity: Strong reputation for convenience, reliability, and accessibility.

- Customer Loyalty: High customer stickiness due to reliable service and ease of use.

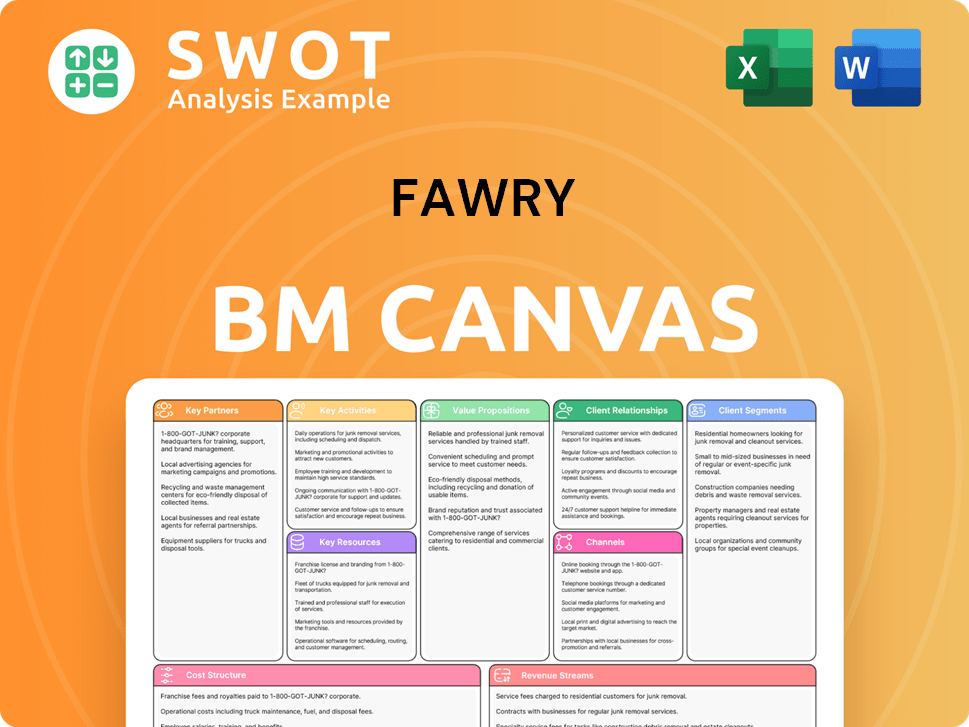

Fawry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Fawry’s Competitive Landscape?

The Egyptian digital payments industry is currently experiencing significant shifts, shaping the competitive landscape for companies like Fawry. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers. These trends influence the strategies and market positions of all players in the Egyptian fintech industry, creating both challenges and opportunities for growth. This Owners & Shareholders of Fawry article, provides insights into the company's position within this dynamic environment.

The market is evolving rapidly, with mobile banking, QR codes, and AI playing significant roles. The Central Bank of Egypt's initiatives to promote financial inclusion are also impacting the market structure. Consumer demand for convenient and secure digital payment methods is increasing, driven by smartphone penetration and digital literacy. These factors present opportunities and challenges for Fawry, influencing its competitive position and future outlook.

The Egyptian fintech market is witnessing a surge in mobile payments and digital transactions. QR code technology is gaining traction, and AI is being integrated into financial services. The Central Bank of Egypt's push for financial inclusion and cashless transactions is creating a more structured market.

Increased competition from mobile banking apps and fintechs could fragment Fawry’s market share. Enhanced regulatory scrutiny may increase compliance costs. Continuous investment in R&D is necessary to avoid technological obsolescence. Aggressive new competitors and a potential decline in agent-based services pose threats.

The large unbanked population in Egypt presents a significant growth opportunity. Expansion into the MENA region and product innovations, such as new lending or insurance services, offer potential. Strategic partnerships with e-commerce giants and fintechs could unlock new customer segments. Fawry's extensive agent network is a key advantage.

Fawry is likely to evolve towards a comprehensive digital financial ecosystem provider. Strategies include continuous technological innovation, expansion of services beyond payments, and potential strategic acquisitions or alliances. This approach aims to consolidate market leadership and capitalize on the growing digital economy.

Fawry's ability to navigate the evolving competitive landscape hinges on several factors. These include its capacity to adapt to technological changes, manage regulatory compliance, and effectively compete with both traditional and emerging players in the Egyptian fintech market. Furthermore, understanding the needs of the unbanked population is crucial.

- Continuous innovation in payment solutions.

- Strategic partnerships to expand service offerings.

- Focus on customer experience and security.

- Expansion into new financial services like lending and insurance.

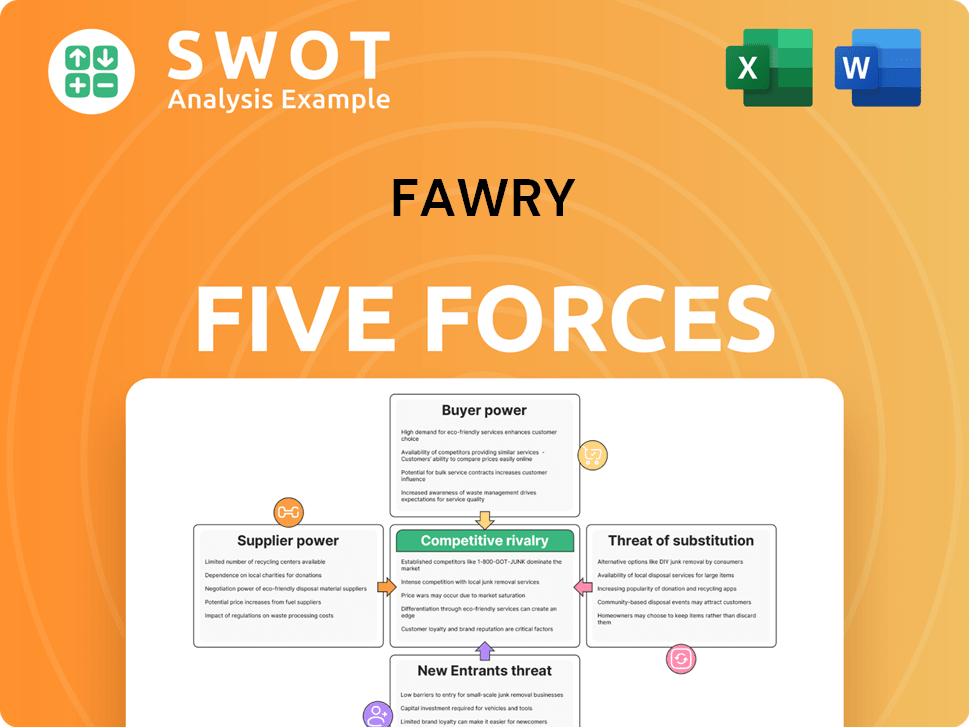

Fawry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fawry Company?

- What is Growth Strategy and Future Prospects of Fawry Company?

- How Does Fawry Company Work?

- What is Sales and Marketing Strategy of Fawry Company?

- What is Brief History of Fawry Company?

- Who Owns Fawry Company?

- What is Customer Demographics and Target Market of Fawry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.