Fawry Bundle

How Does Fawry Revolutionize Egypt's Financial Landscape?

In the rapidly evolving world of fintech, Fawry stands out as a dominant force in Egypt's digital payment arena. With impressive financial results and a vast network, Fawry is transforming how millions manage their finances. This exploration unveils the inner workings of Fawry, examining its innovative approach to Fawry SWOT Analysis, and its impact on the Egyptian economy.

From its humble beginnings, Fawry has become synonymous with digital payment in Egypt, offering a seamless experience for both consumers and businesses. Understanding how Fawry works, its diverse services, and its strategic partnerships is essential for anyone looking to navigate the complexities of the e-payment ecosystem. This in-depth analysis will explore Fawry's operational model, revenue streams, and its competitive position within the dynamic fintech sector, providing valuable insights into the future of online payment in Egypt.

What Are the Key Operations Driving Fawry’s Success?

Fawry creates value by offering a comprehensive electronic payment network and a wide range of financial services in Egypt. Its core operations include facilitating bill payments, mobile top-ups, and online purchases. The company also provides financial services like money transfers and digital wallets, catering to both banked and unbanked populations, thus promoting financial inclusion.

The company's value proposition lies in providing convenient and accessible financial services. This is achieved through a vast omnichannel network, including physical POS terminals and online channels like the myFawry mobile application. Fawry's services are designed to simplify payment processes and provide access to financial tools for both consumers and businesses.

The operational processes are multifaceted, leveraging an extensive network. As of December 2024, Fawry's retail network included 372,400 Point-of-Sale (POS) terminals. The myFawry app saw cumulative downloads reach 17.34 million by December 2024, with annualized throughput growing by 237.9% to EGP 26.8 billion. Additionally, Fawry integrates with banking channels, enabling payments through ATMs and mobile wallets.

Fawry's widespread accessibility is supported by its supply chain and distribution networks. The company partners with merchants, financial institutions, and sales agents to expand its reach and service offerings. This extensive network is a key competitive advantage, providing convenience and a user-friendly interface for its users.

Fawry prioritizes secure and reliable transactions. Its proprietary payment gateway is built on stringent international security standards. This commitment to security differentiates Fawry from competitors, ensuring that users can trust the platform with their financial transactions.

Fawry's seamless integration of diverse financial products and services in an online/offline environment translates into significant customer benefits. These include simplified payment processes and access to financial tools for both consumers and businesses, enhancing the overall user experience.

Fawry collaborates with a wide range of businesses, including merchants and financial institutions. This expands its reach and service offerings, solidifying its position in the market. This collaborative approach is crucial to Fawry's growth and its ability to serve a broad customer base.

Fawry operates by providing a versatile e-payment system. This system allows users to make payments through various channels, including physical kiosks and the myFawry app. The platform facilitates a wide range of transactions, from bill payments to online purchases, making it a convenient solution for many.

- Extensive Network: Fawry's vast network of POS terminals and partnerships with merchants ensures widespread accessibility.

- Digital Wallet: The myFawry app enables users to manage their finances digitally, offering a convenient alternative to traditional banking.

- Security: Fawry employs stringent security measures to ensure all transactions are safe and reliable, building trust with its users.

- Financial Inclusion: Fawry's services extend to both banked and unbanked populations, promoting financial inclusion in Egypt.

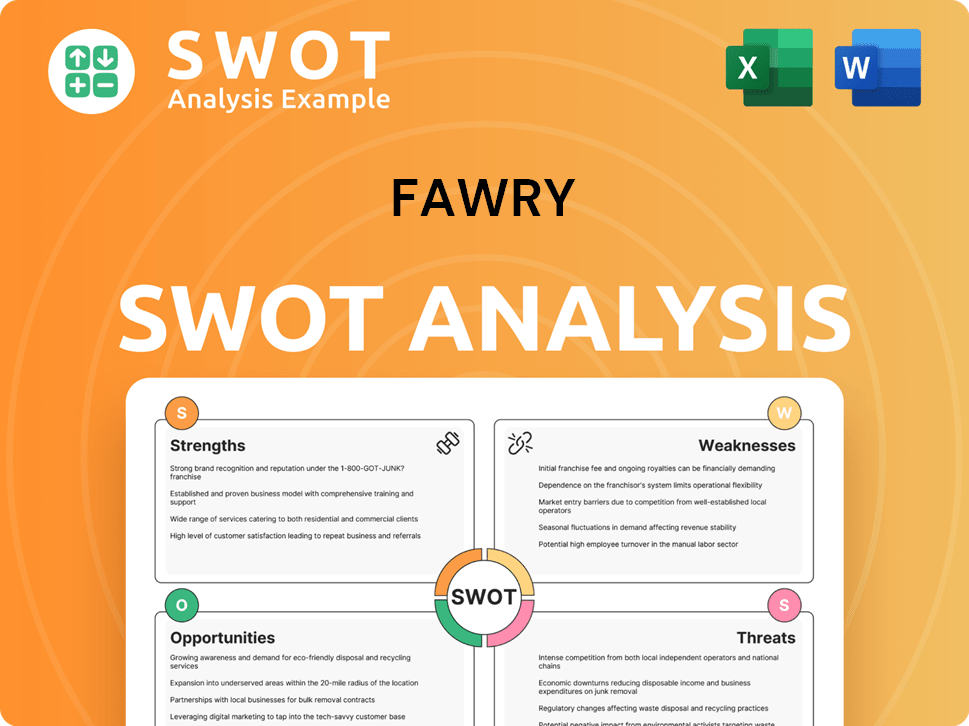

Fawry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fawry Make Money?

Understanding how the company generates revenue is crucial to grasping its financial health. Fawry's revenue streams are diverse, reflecting its evolution into a comprehensive financial services ecosystem. These streams include transaction fees, subscription fees, and a growing financial services segment.

The company's financial performance in 2024 and early 2025 showcases robust growth. In fiscal year 2024, total revenues reached EGP 5.51 billion ($121.6 million), marking a 68.4% year-on-year increase. Net profit also surged by 124.6% to EGP 1.61 billion ($35.5 million).

The company's monetization strategies are innovative and constantly evolving. Beyond transaction fees, it offers subscription-based services and has expanded into SME lending and BNPL services. The myFawry app integrates various features to enhance its value proposition and potential for cross-selling.

The company's revenue is segmented to provide a clear picture of its financial performance. Here’s a breakdown of key revenue contributions by segment in FY2024:

- Banking Services: This segment saw an 83.3% year-on-year increase, reaching EGP 2.31 billion in FY2024, accounting for 46.9% of the company's overall revenue increase. In Q1 2025, Banking Services revenue further rose by 55.9% year-on-year, comprising nearly 40% of total revenue.

- Alternative Digital Payments (ADP): ADP grew by 34.7% year-on-year in FY2024. In Q1 2024, ADP revenues grew by 27.8% year-on-year to EGP 354.8 million.

- Financial Services: This segment demonstrated exceptional growth, with revenues increasing by 137.7% year-on-year to EGP 1.01 billion ($22.3 million) in FY2024. In Q1 2025, Financial Services revenue soared by 164.2% year-on-year, accounting for 25.6% of total revenue.

- Supply Chain Solutions: This division recorded a 53.4% increase in revenue in FY2024, reaching EGP 347.2 million.

- Technology & Others: This segment also saw significant growth, with revenues surging by 127.0% year-on-year in Q1 2025.

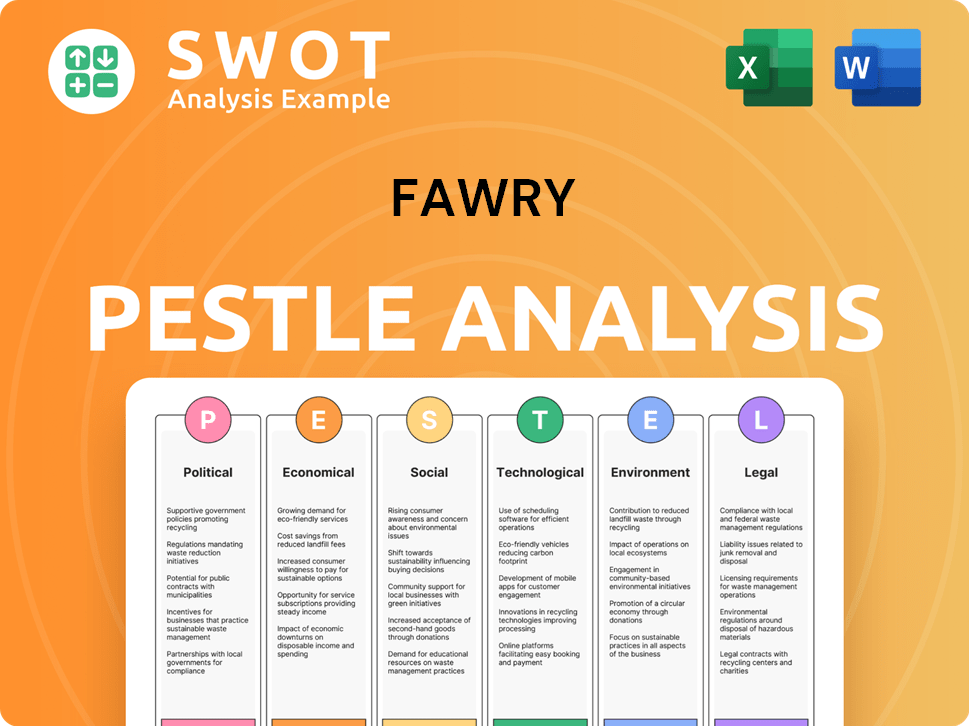

Fawry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Fawry’s Business Model?

Fawry has achieved several significant milestones, including reaching a $1 billion valuation in 2020, making it Egypt's first unicorn. The company has consistently demonstrated strong financial growth, with a record 2024, where revenue grew by 68.4% and operating profit by 160% year-on-year. In Q1 2025, Fawry continued its strong performance, with consolidated profits attributable to the parent company climbing 97.13% year-on-year to EGP 605.378 million, and consolidated operating revenues surging to EGP 1.794 billion.

Strategic moves have been central to Fawry's expansion and market leadership. The company has actively pursued a diversification strategy across multiple business segments, notably expanding its financial services offerings, including microfinance and Buy Now, Pay Later (BNPL) services. By the end of 2024, Fawry's loan portfolio surpassed EGP 3.1 billion, a 2.6x increase from 2023.

Fawry's competitive advantages are multifaceted. Its extensive network of over 372,400 POS terminals and partnerships with 36 member banks provide a wide reach and accessibility for both banked and unbanked populations. The company's strong brand recognition and customer trust, built on reliable and secure services, are key assets.

Fawry's valuation reached $1 billion in 2020, marking it as Egypt's first unicorn. The company showed strong financial growth in 2024, with revenue increasing by 68.4% year-on-year. In Q1 2025, consolidated profits attributable to the parent company climbed 97.13% year-on-year to EGP 605.378 million.

Fawry expanded its financial services, including microfinance and Buy Now, Pay Later (BNPL) services. The loan portfolio surpassed EGP 3.1 billion by the end of 2024, a 2.6x increase from 2023. The launch of 'Fawry Business' in February 2025, a suite of integrated digital solutions tailored for businesses, including SMEs and large corporations.

Fawry's extensive network includes over 372,400 POS terminals and partnerships with 36 member banks. The company has strong brand recognition and customer trust. Fawry's commitment to innovation and technology leadership is evident in its continuous investment in new solutions.

In February 2025, Fawry made strategic investments totaling EGP 80 million in three Egyptian technology companies—Dirac Systems, Virtual CFO, and Code Zone—acquiring majority stakes to expand its 'Fawry Business' ecosystem. In March 2025, Fawry partnered with Kuwait's Ottu to enhance Egypt's online payment infrastructure and broaden its partnership with Contact Financial Holding to integrate Contact's BNPL service into Fawry's network.

Fawry's strategic moves and competitive advantages position it strongly in the market. The company's focus on innovation and partnerships, such as the recent collaboration with Ottu, enhances its service offerings. Fawry's extensive network and technological advancements provide a significant barrier to entry for competitors.

- Fawry's 'Tap N Pay' Soft POS solution achieved MPOC certification.

- The company is expanding its 'Fawry Business' ecosystem through strategic investments.

- Partnerships with Ottu and Contact Financial Holding broaden Fawry's service capabilities.

- Fawry's established infrastructure and scale provide a competitive edge in the e-payment market.

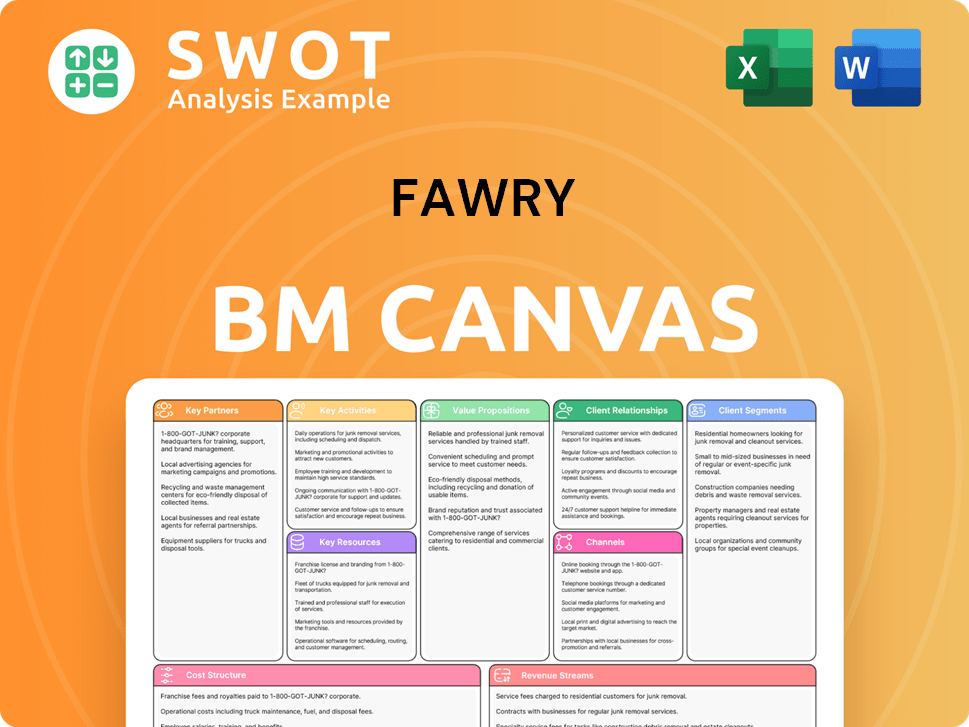

Fawry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Fawry Positioning Itself for Continued Success?

The company holds a leading position within Egypt's electronic payment sector. It is one of the largest e-payment platforms in Egypt, serving approximately 51 million users monthly. Its extensive network of over 372,400 POS terminals across Egypt further solidifies its dominance. Fawry's competitive advantages include a wide network of payment points, a user-friendly interface, strong brand recognition, and a diverse range of services.

Despite its strong market position, the company faces risks such as increased competition from traditional banks, mobile payment providers, and emerging fintech startups. Cybersecurity threats and regulatory changes in the rapidly evolving fintech landscape also pose challenges. Changing consumer preferences towards newer payment technologies also present a dynamic challenge. For more details, you can read about the Target Market of Fawry.

The company is the largest e-payment platform in Egypt. It processes over 4 million transactions daily. It has an extensive network of over 372,400 POS terminals.

Increased competition from traditional banks and fintech startups is a key challenge. Cybersecurity threats and regulatory changes pose significant risks. Consumer preference shifts towards newer payment technologies also present challenges.

The company is focused on strategic initiatives and innovation. The launch of 'Fawry Business' in February 2025 aims to streamline business operations. Expansion into financial services, particularly lending, is a priority.

The company is eyeing regional growth, particularly in Saudi Arabia. Strategic investments and partnerships are integral to expanding its ecosystem. The company continues to invest in technology and leverage its big data and AI platform.

The company's future outlook includes strategic initiatives and an innovation roadmap. It aims to sustain and expand its ability to generate revenue. The company is focused on expanding its financial services with a particular emphasis on lending.

- Expansion of financial services, including SME and BNPL lending. The consumer BNPL portfolio surpassed EGP 1 billion by the end of 2024 and reached EGP 1.3 billion as of Q1 2025.

- Regional growth, particularly in Saudi Arabia, to tap into remittances.

- Strategic investments and partnerships to expand its ecosystem.

- Continued investment in technology and leveraging big data and AI.

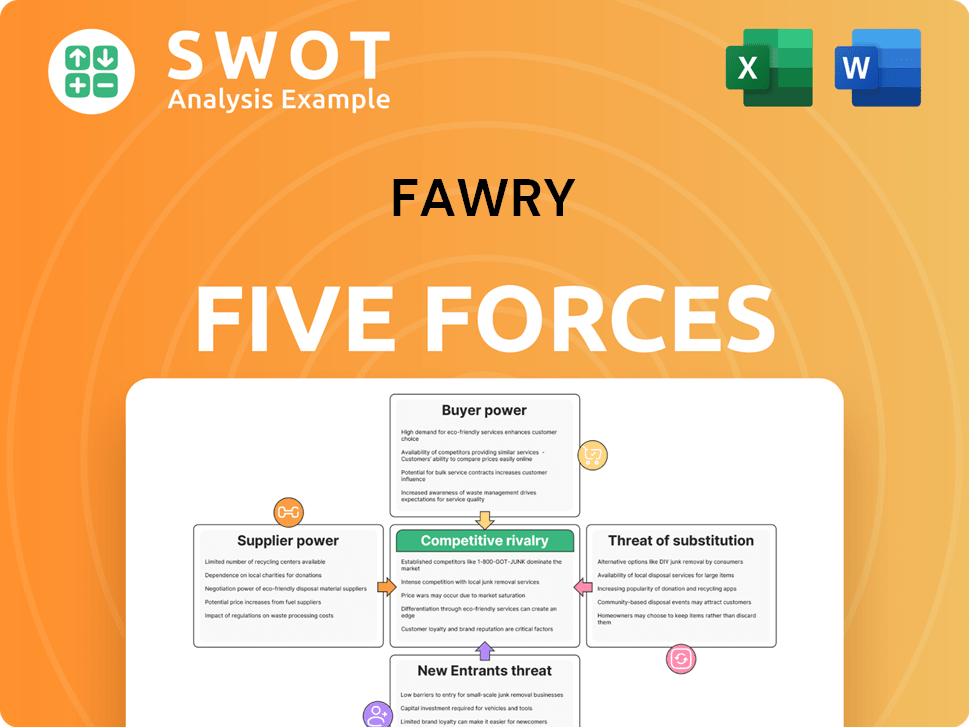

Fawry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fawry Company?

- What is Competitive Landscape of Fawry Company?

- What is Growth Strategy and Future Prospects of Fawry Company?

- What is Sales and Marketing Strategy of Fawry Company?

- What is Brief History of Fawry Company?

- Who Owns Fawry Company?

- What is Customer Demographics and Target Market of Fawry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.