Newmark Bundle

How Did Newmark Company Become a Global Real Estate Powerhouse?

Embark on a journey through time to uncover the fascinating Newmark SWOT Analysis story, a titan in the commercial real estate world. From its humble beginnings in 1929 New York City, Newmark's evolution is a testament to strategic vision and adaptability. Discover the pivotal moments that shaped Newmark's trajectory, transforming it into a global leader.

This exploration of Newmark history will uncover the key milestones, acquisitions, and strategic decisions that propelled Newmark commercial real estate to its current status. Learn about the Newmark founders and their initial vision, which has guided the company through decades of market fluctuations. We'll examine the Newmark company timeline, its financial performance, and its expanding global presence, providing a comprehensive overview of this influential player in the real estate industry.

What is the Newmark Founding Story?

The Newmark Company, a significant player in the commercial real estate sector, has a rich Newmark history that began in 1929. Founded in Manhattan by Dave Newmark, the company's origins are rooted in the evolving commercial real estate landscape of New York City. While specific details about the initial challenges or opportunities Dave Newmark addressed are not extensively documented, the company's establishment during this period reflects a response to the growing needs of the city.

In 1953, Aaron Gural joined Newmark & Company as a real estate broker, later acquiring the company with partners in 1956. Gural's leadership, as Chairman from 1957 to 1998, was pivotal in shaping Newmark real estate through strategic acquisitions. The company's early focus on Manhattan properties, starting with 230 Fifth Avenue, marked the beginning of its expansion.

The initial business model likely revolved around traditional real estate brokerage and advisory services within the New York City market. Aaron Gural's foresight in recognizing the potential of restoring West Side industrial sites and abandoned lofts in the Garment District highlights an early strategic focus on identifying undervalued assets and opportunities. In 1978, Jeffrey Gural, Aaron Gural's son, and Barry Gosin took ownership of the company, marking a significant leadership transition. Information regarding the initial capital or funding in 1929 is not readily available, but the company's subsequent growth indicates a history of strategic investments and acquisitions.

The Newmark Company has a rich history, marked by strategic acquisitions and leadership transitions.

- Founded in 1929 in Manhattan by Dave Newmark.

- Aaron Gural joined in 1953 and acquired the company in 1956.

- Gural served as Chairman from 1957 to 1998, driving strategic acquisitions.

- Jeffrey Gural and Barry Gosin took ownership in 1978.

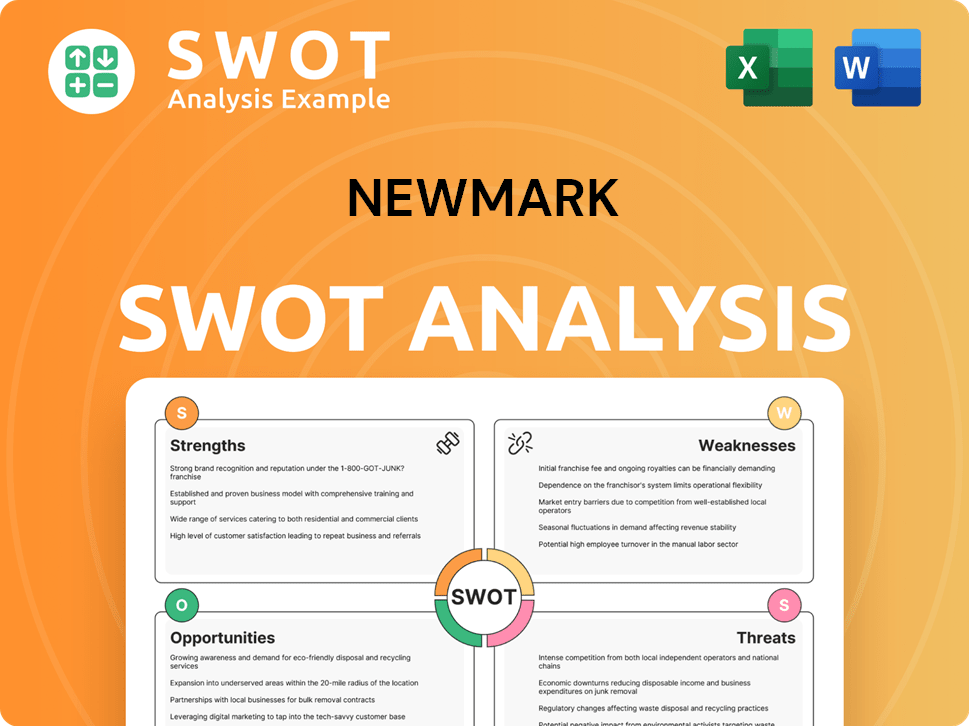

Newmark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Newmark?

The early growth and expansion of the Newmark Company marked a pivotal shift in its trajectory. Following the ownership transition, the company strategically expanded its brokerage and advisory divisions. This move was a calculated response to market dynamics, diversifying its service offerings beyond property ownership. This strategic shift helped solidify its position in the Newmark commercial real estate market.

A significant milestone in the Newmark history was the 2006 partnership with Knight Frank, leading to the establishment of Newmark Knight Frank. This alliance broadened the company's global footprint, enhancing its ability to serve clients worldwide. This expansion was a key element in the company's growth strategy.

In 2011, BGC Partners, Inc. acquired Newmark, injecting substantial capital and expanding its service offerings. This was followed by the acquisition of Grubb & Ellis assets in 2012, which were integrated to form Newmark Grubb Knight Frank (NGKF). These Newmark acquisitions demonstrate a consistent strategy of growth and market consolidation.

The company's expansion continued in 2014 with entries into South America through partnerships in several countries. This move highlighted the company's commitment to global growth and diversification. This geographical expansion was a crucial step in enhancing its overall market presence.

Between 2011 and 2022, Newmark experienced rapid growth, with total revenues increasing by over 1,000%. This impressive financial performance underscores the effectiveness of its strategic initiatives and market positioning. This growth reflects the company's strong performance in the real estate sector.

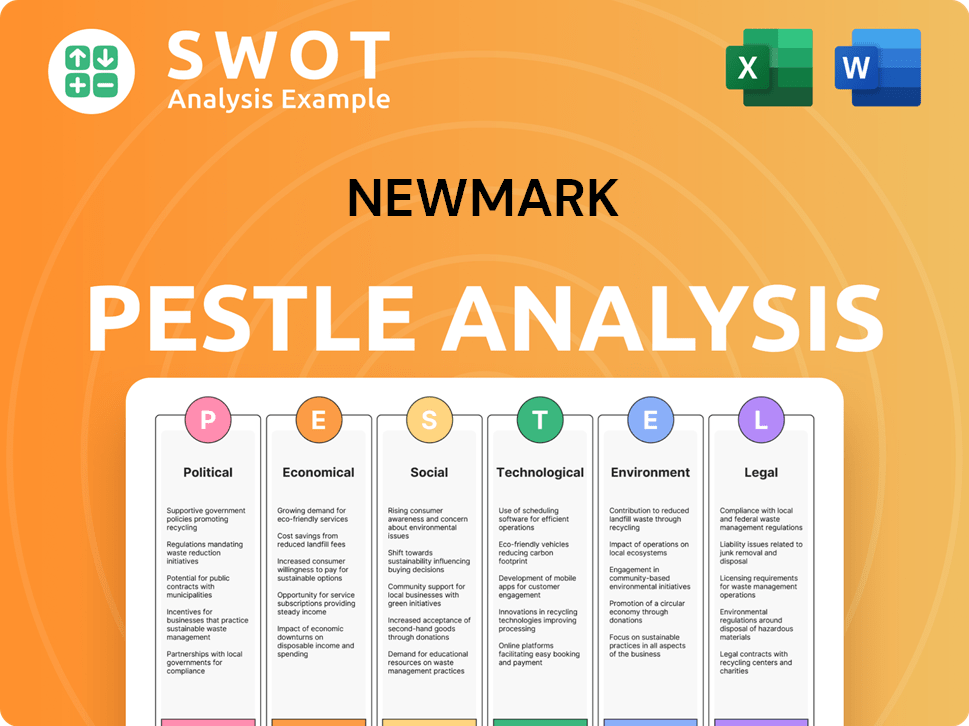

Newmark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Newmark history?

The Newmark Company has a rich Newmark history marked by strategic moves and significant growth in the Newmark commercial real estate sector. The company's journey includes pivotal moments that have shaped its position in the market.

| Year | Milestone |

|---|---|

| 2018 | Spin-off from BGC Partners, becoming an independent publicly traded company, enabling a focused growth strategy. |

| 2021 | Acquisition of Knotel's assets, expanding service capabilities and market presence. |

| 2024 | Increased total Capital Markets volumes by approximately 113% in Q4, excluding Signature transactions, outperforming the industry. |

Innovation at Newmark centers on leveraging technology and data analytics to provide superior market insights. They aim to lead with talent, data, and analytics, enhancing client decision-making processes.

Investment in technology and data analytics to provide clients with market insights and improve decision-making. This includes the introduction of the Debt Capital Market Snapshot in the 2025 Valuation & Advisory North American Market Survey.

Providing comprehensive market intelligence through tools like the Debt Capital Market Snapshot, offering valuable insights into financial benchmarks and equity indices.

The company faces challenges inherent in the dynamic commercial real estate market, including economic volatility and competitive pressures. Market downturns and the need to adapt to evolving workforce expectations and technological advancements are also significant hurdles.

Navigating market downturns and economic volatility, such as the slowdown in the industrial market in 2024, particularly in Q4.

Addressing competitive threats within the commercial real estate landscape, which is undergoing rapid transformation. Demand for higher-quality office space remains strong, while lower-quality office buildings have generally lost tenants.

Adapting to evolving workforce expectations, technological advancements, and sustainability imperatives within the commercial real estate market. This includes the need to strategically pivot in response to market conditions.

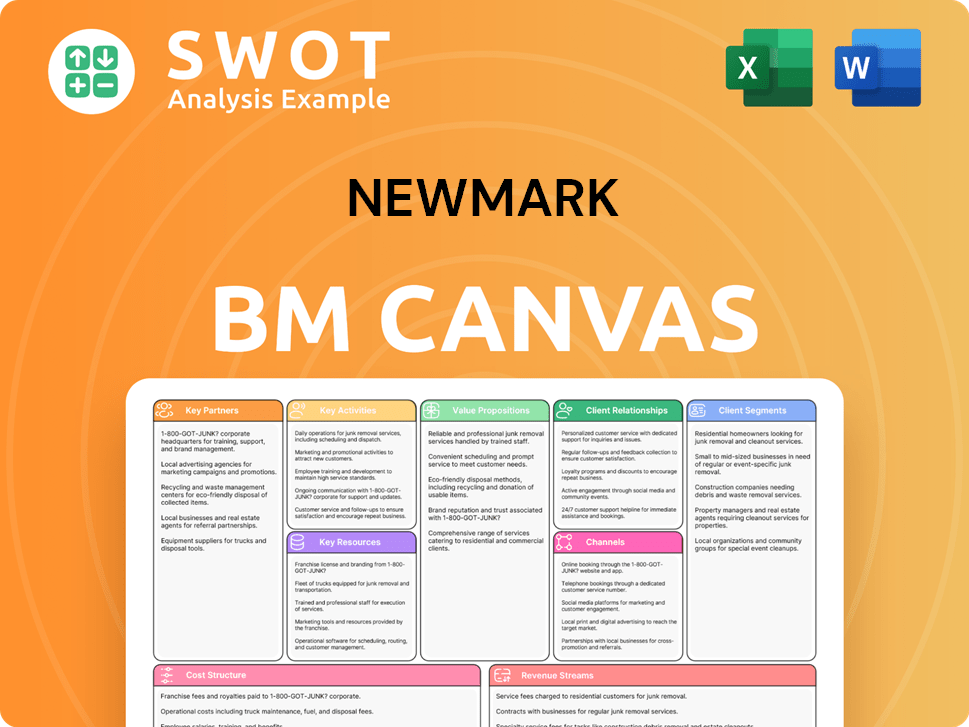

Newmark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Newmark?

The Newmark history is a story of consistent evolution and strategic positioning within the commercial real estate sector. From its inception in Manhattan to its current global presence, the company has navigated market changes and expanded its services through strategic partnerships and acquisitions. The trajectory of the

| Year | Key Event |

|---|---|

| 1929 | Dave Newmark founded Newmark in Manhattan. |

| 1956 | Aaron Gural and partners purchased Newmark & Company. |

| 1978 | Jeffrey Gural and Barry Gosin took ownership of the company. |

| 2006 | Newmark formed a partnership with Knight Frank, becoming Newmark Knight Frank. |

| 2011 | BGC Partners, Inc. acquired Newmark. |

| 2012 | BGC Partners acquired assets of Grubb & Ellis, forming Newmark Grubb Knight Frank. |

| 2014 | Newmark expanded into South America through partnerships. |

| 2018 | Newmark spun off from BGC Partners, becoming an independent publicly traded company. |

| 2021 | Acquisition of Knotel's assets. |

| FY 2024 | Newmark generated $2.754 billion in total revenues; Investment sales market share grew to 8.7%. |

| Q4 2024 | Revenues grew by 18.8% year-over-year to $888.3 million; Capital Markets revenues increased by 20.0%. |

| February 2025 | Newmark reported strong fourth quarter and full year 2024 financial results. |

| March 2025 | Newmark announced its 2025 Valuation & Advisory North American Market Survey. |

| April 2025 | Newmark promoted Luis Alvarado to Chief Operating Officer. |

| Q1 2025 | Newmark reported a 21.8% year-over-year increase in revenue, reaching $665.5 million. |

Newmark anticipates robust financial performance in 2025, with projected total revenues ranging from $2.9 billion to $3.1 billion. The company expects adjusted EPS to be between $1.40 and $1.50, reflecting its positive growth trajectory. This outlook is supported by strategic initiatives and market expansions.

The company is focused on expanding into alternative assets, technology, and recurring management services. Newmark aims to grow total revenues from management services and servicing businesses to over $2 billion within the next five years. These strategies aim to enhance revenue stability and improve operating margins.

Newmark is actively expanding its global footprint, particularly in Europe, with recent launches in Germany and talent acquisitions in France and the U.K. International markets contributed only 13.3% of revenues in 2024, indicating significant growth potential. This expansion is a key driver for long-term revenue growth.

Industry trends like hybrid work models and technological advancements are shaping the commercial real estate landscape. Newmark is well-positioned to capitalize on these trends through data-driven strategies and integrated service delivery. A disciplined approach to acquisitions and talent recruitment supports sustained revenue growth.

Newmark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Newmark Company?

- What is Growth Strategy and Future Prospects of Newmark Company?

- How Does Newmark Company Work?

- What is Sales and Marketing Strategy of Newmark Company?

- What is Brief History of Newmark Company?

- Who Owns Newmark Company?

- What is Customer Demographics and Target Market of Newmark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.