Newmark Bundle

How Does Newmark Navigate the Cutthroat Commercial Real Estate Arena?

The commercial real estate (CRE) sector is a dynamic battleground, and understanding the Newmark SWOT Analysis is crucial for investors and strategists alike. Newmark Group, Inc., a global CRE powerhouse, has a rich history dating back to 1929, evolving from a local brokerage to a major player. This article unpacks the complexities of the Newmark competitive landscape, offering critical insights into its market position.

This deep dive into the real estate market will analyze Newmark's key rivals and dissect its core competitive advantages. We'll explore Newmark's financial performance compared to competitors, its market share, and strategic partnerships. Moreover, this industry analysis will examine the firm's growth strategies, geographic footprint, and technology integration, offering a comprehensive Newmark company overview and competitive positioning.

Where Does Newmark’ Stand in the Current Market?

Newmark Group, Inc. holds a significant position in the global commercial real estate advisory sector. The company's operations span across a wide array of services, including leasing advisory, capital markets solutions, property and facilities management, and valuation and advisory services. This comprehensive approach allows Newmark to serve a diverse clientele, encompassing property owners, tenants, investors, and developers worldwide. In the first quarter of 2024, Newmark reported total revenues of $626.6 million, underscoring its substantial presence in the industry.

The firm's extensive geographic footprint, covering the Americas, Europe, and Asia-Pacific, solidifies its status as a truly international advisory firm. Newmark has strategically expanded its reach to major global markets, adapting to the evolving digital landscape within the real estate sector. This strategic focus, combined with its comprehensive service offerings, positions Newmark competitively within the commercial real estate market.

Newmark's strategic shift towards a more integrated and technology-driven service model reflects its commitment to adapting to the digital transformation impacting the real estate industry. The company's focus on growth in emerging markets and specialized sectors further strengthens its market standing. This approach allows Newmark to maintain a strong position in major metropolitan areas globally while exploring opportunities for expansion and enhanced service delivery.

Newmark consistently ranks among the top-tier global commercial real estate firms. While specific market share figures are proprietary and fluctuate, the company's financial performance, including robust revenue growth, demonstrates its strong competitive position. Newmark's ability to secure and maintain a significant market share is a key indicator of its success.

Newmark's primary revenue streams are derived from its comprehensive service offerings. These include leasing advisory, capital markets solutions, property and facilities management, and valuation and advisory services. This diversified service portfolio allows Newmark to cater to a broad range of client needs and market conditions.

Newmark has a significant global presence, with operations across the Americas, Europe, and Asia-Pacific. The company's strategic expansion into major global markets has solidified its position as a truly international advisory firm. This broad geographic footprint enables Newmark to serve clients worldwide effectively.

Newmark is focused on integrating technology and innovation to enhance its service delivery. This includes leveraging digital tools and platforms to improve efficiency and provide clients with advanced real estate solutions. The company's commitment to technological advancements is a key factor in its competitive strategy.

Newmark's competitive advantages stem from its comprehensive service offerings, global presence, and strategic focus on technology and innovation. The company's ability to provide a wide range of services to a diverse client base, coupled with its international reach, positions it favorably in the Newmark competitive landscape.

- Comprehensive Service Portfolio: Offering a wide array of services to meet diverse client needs.

- Global Presence: Operating across the Americas, Europe, and Asia-Pacific.

- Technology Integration: Utilizing digital tools to enhance service delivery and efficiency.

- Strategic Partnerships: Collaborations that expand market reach and service capabilities.

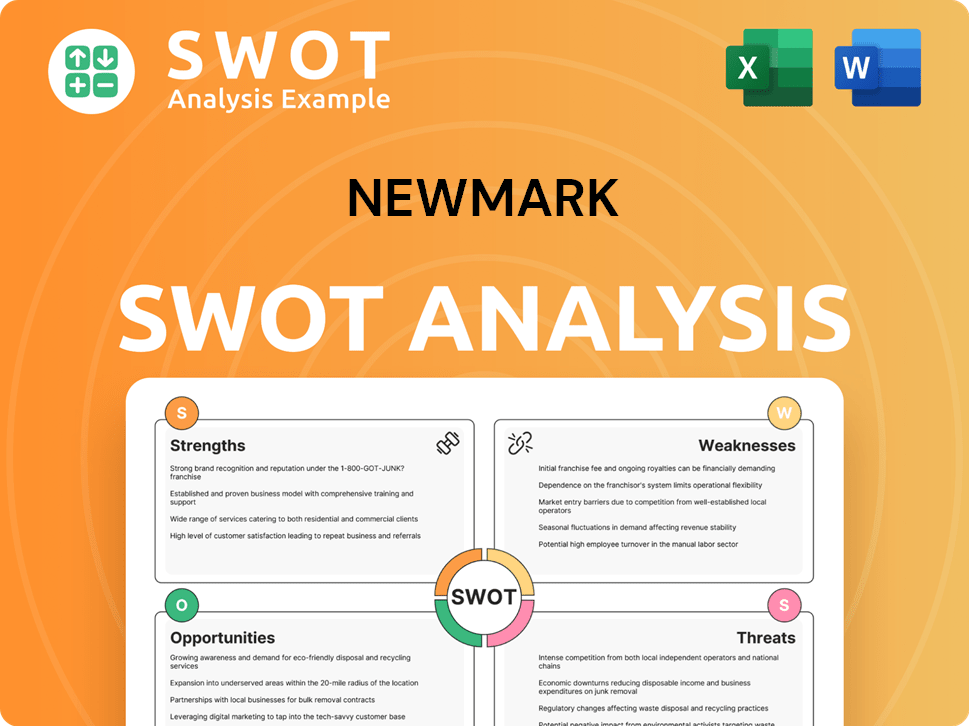

Newmark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Newmark?

The Newmark competitive landscape is shaped by a dynamic commercial real estate market. The firm faces competition from a variety of players, including large, diversified commercial real estate services companies, specialized firms, and technology-driven platforms. Understanding these competitors is crucial for assessing Newmark's market position and growth potential.

A thorough Newmark market analysis reveals the intensity of competition. The company competes for market share, top talent, and major mandates in key urban centers. The industry's consolidation through mergers and acquisitions further reshapes the competitive environment, creating larger and more formidable rivals. Key competitors and their strategies significantly influence Newmark's performance.

The competitive environment for Newmark is multifaceted, involving both direct and indirect rivals. Direct competitors offer similar services, while indirect competitors may disrupt traditional service models through technological innovation. The company's ability to adapt to these challenges is crucial for maintaining and improving its position within the real estate market.

Newmark's primary direct competitors include large, diversified commercial real estate services companies that offer a wide range of services, such as leasing, capital markets, and property management. These companies often have a global presence and extensive resources.

Cushman & Wakefield is a major competitor, offering similar services across leasing, capital markets, and property management. It has a strong global presence, competing directly with Newmark in many markets. The company's broad service offerings and global reach make it a significant rival.

CBRE Group, Inc. is often considered the world's largest commercial real estate services and investment firm. It offers a vast array of services and has a broad global reach, directly competing with Newmark across multiple business lines. CBRE's size and scope present a significant challenge.

JLL is another significant competitor, known for its strong advisory services, investment management, and extensive international operations. JLL's global footprint and diversified services make it a key player in the commercial real estate market, competing with Newmark in various sectors.

Beyond the global giants, Newmark faces competition from specialized firms that excel in particular segments, such as boutique investment sales firms and regional property management companies. Indirect competition also comes from in-house real estate departments of large corporations and PropTech companies.

PropTech companies are disrupting traditional service models through innovation in data analytics, virtual tours, and transaction platforms. These companies offer technology-driven solutions that can indirectly compete with Newmark by providing alternative services and platforms for real estate transactions.

The competition among these firms manifests in vying for major mandates, attracting top talent, and securing market share in key urban centers. The industry is also subject to consolidation through mergers and acquisitions, which continuously reshapes the competitive landscape, creating larger and more formidable competitors. Understanding these dynamics is crucial for assessing Newmark's strategic positioning.

- Market Share: The commercial real estate market is highly competitive, with firms constantly vying for market share.

- Talent Acquisition: Attracting and retaining top talent is critical for success in the industry.

- Strategic Partnerships: Forming strategic partnerships can help companies expand their service offerings and geographic reach.

- Technological Innovation: PropTech and other technological advancements are changing the way commercial real estate services are delivered.

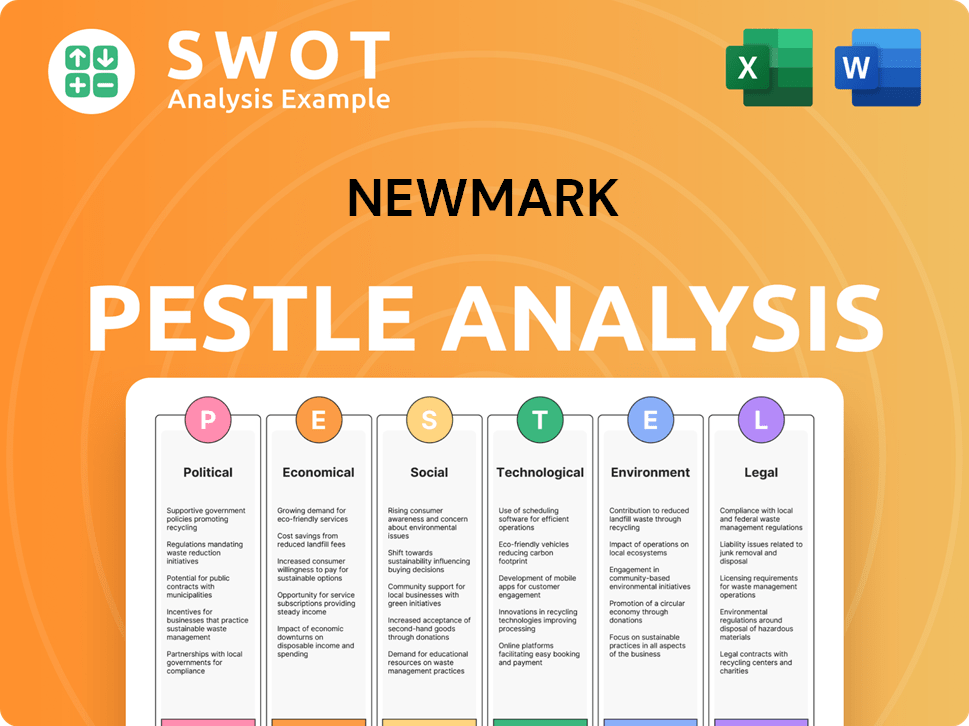

Newmark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Newmark a Competitive Edge Over Its Rivals?

The competitive advantages of Newmark stem from its comprehensive service offerings, global reach, and client-centric approach. Understanding Newmark's target market is crucial for assessing its competitive positioning within the commercial real estate sector. The firm's integrated platform, spanning leasing advisory, capital markets, property management, and valuation services, differentiates it from more specialized firms.

Newmark's extensive global network, spanning key markets across the Americas, EMEA, and Asia-Pacific, is a significant advantage, especially for cross-border transactions. The company leverages proprietary data and analytics to provide clients with informed market insights, which is critical in the real estate market. Its strong brand equity, built over nearly a century, fosters trust and attracts both clients and top-tier talent.

The ability to attract and retain experienced real estate professionals is another critical advantage for Newmark. These advantages have evolved with the market, with Newmark increasingly integrating technology and data science into its traditional advisory services. However, the firm faces threats from rapidly evolving PropTech solutions and aggressive talent acquisition strategies by competitors, necessitating continuous innovation and investment.

Newmark offers a seamless experience across various real estate services, including leasing advisory, capital markets, property management, and valuation. This integrated approach allows clients to work with a single point of contact, streamlining their diverse real estate needs. This comprehensive service model differentiates Newmark from specialized firms.

With a presence in key markets across the Americas, EMEA, and Asia-Pacific, Newmark can execute complex cross-border transactions. Its global network is a significant advantage in serving multinational clients. This broad geographic footprint allows Newmark to capitalize on international real estate opportunities.

Newmark uses proprietary data and analytics to provide clients with informed market insights and strategic advice. These capabilities support more precise valuations, market trend analysis, and the identification of investment opportunities. This data-driven approach enhances the firm's advisory services.

Built over nearly a century, Newmark's strong brand equity fosters trust and recognition in the industry. This reputation attracts both clients and top-tier talent. The company's focus on client relationships and expert advisory contributes to customer loyalty.

Newmark's competitive advantages include its integrated service platform, global reach, and data-driven insights. These strengths position the firm well against competitors in the commercial real estate market. However, the firm must continuously innovate to stay ahead.

- Integrated Services: Offers a comprehensive suite of services, differentiating it from specialized firms.

- Global Presence: Extensive network for cross-border transactions and serving multinational clients.

- Data and Analytics: Leverages proprietary data for market insights and strategic advice.

- Brand Reputation: Strong brand equity attracting clients and top talent.

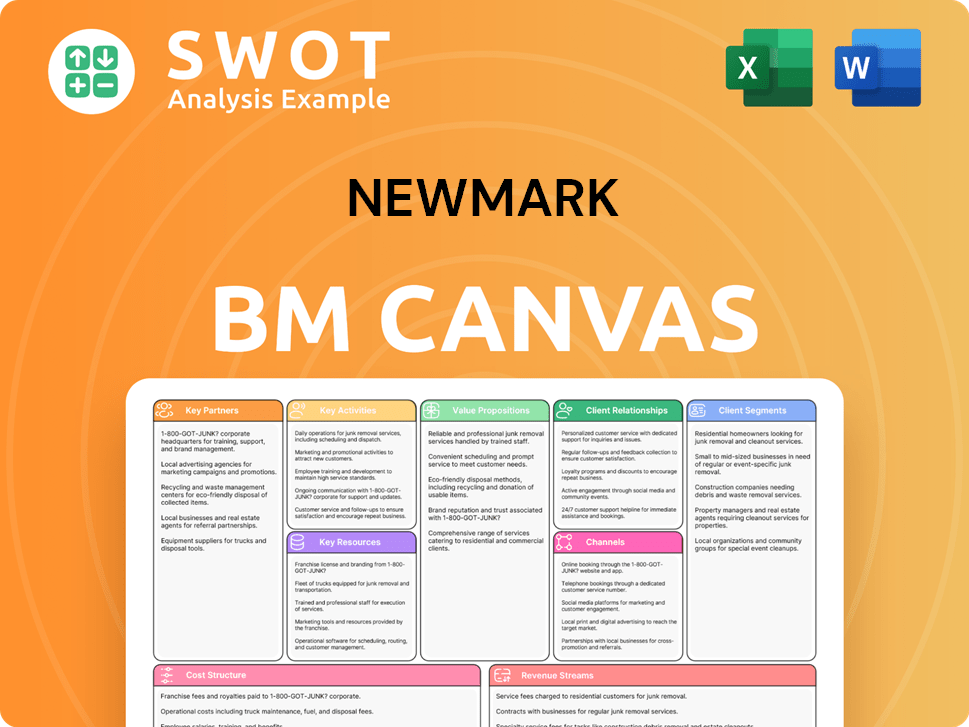

Newmark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Newmark’s Competitive Landscape?

The commercial real estate sector is currently undergoing significant transformation, impacting companies like Newmark. Key trends include technological advancements, evolving regulatory landscapes, and shifting consumer preferences. These factors shape the Newmark competitive landscape, creating both challenges and opportunities for growth and adaptation within the real estate market.

The future outlook for Newmark and its peers hinges on their ability to navigate these complexities. Economic uncertainties, the rise of PropTech, and changing demands for property types will test their resilience. Strategic responses, including technological integration and specialized advisory services, will be crucial for maintaining a strong market position. An in-depth industry analysis reveals the dynamics at play.

Technological disruption, particularly from PropTech, is streamlining processes and impacting traditional brokerage models. Sustainability mandates and zoning laws influence property development. Shifting consumer preferences, such as hybrid work models, are reshaping property utilization. These trends are essential for understanding the Newmark company market share 2024.

New, digitally native market entrants could disrupt traditional service lines. Increased regulation adds complexity and cost to transactions. Economic uncertainties, including interest rate fluctuations, may impact investment volumes. Understanding these challenges is key when analyzing Newmark's key strategic partnerships.

Demand for data analytics and technology integration presents an opportunity to enhance service offerings. ESG factors in real estate offer advisory services related to sustainable development. Evolving property types, such as data centers, offer new growth markets. This is a crucial part of the Newmark company overview and competitive positioning.

Continued investment in technology and strategic partnerships with PropTech innovators are critical. Focus on specialized advisory services that cater to emerging client needs is essential. Adaptation to evolving asset classes, such as life sciences facilities, is key. For a deeper understanding, see the Marketing Strategy of Newmark.

Newmark's competitive position depends on its ability to adapt to industry changes and address emerging challenges. The company must leverage technology and provide specialized services to maintain its market share. Strategic decisions will shape its future.

- Competitive Advantages of Newmark: Leveraging data analytics and providing specialized services.

- Newmark vs CBRE comparison: Both companies are major players, with CBRE often leading in revenue.

- Newmark vs JLL comparison: JLL also competes strongly, with a focus on global presence.

- Who are Newmark's biggest rivals: CBRE, JLL, and other commercial real estate companies.

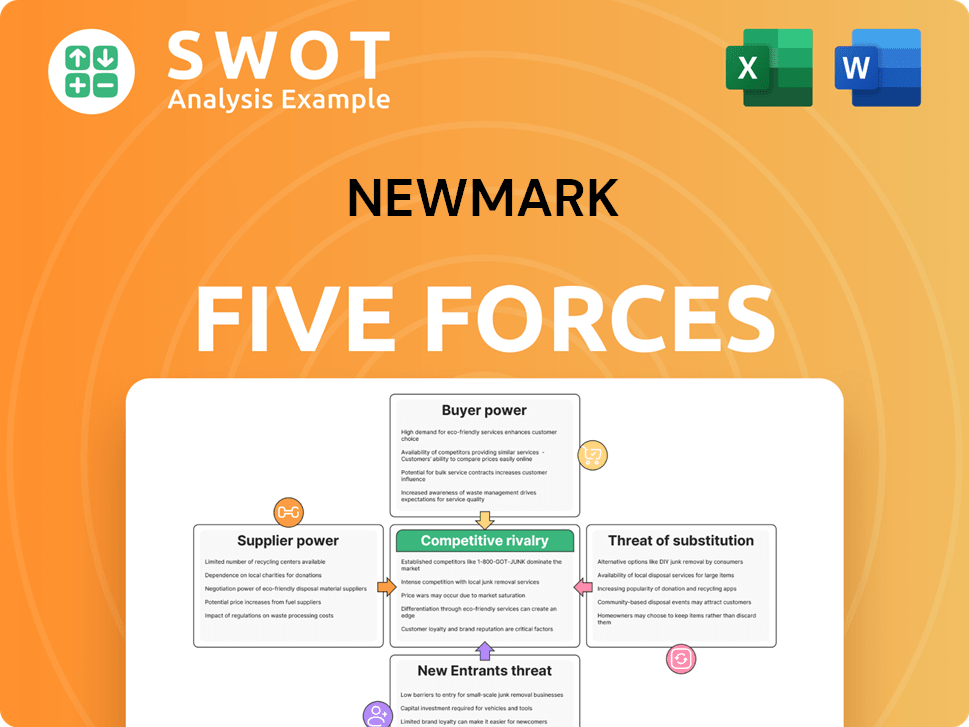

Newmark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Newmark Company?

- What is Growth Strategy and Future Prospects of Newmark Company?

- How Does Newmark Company Work?

- What is Sales and Marketing Strategy of Newmark Company?

- What is Brief History of Newmark Company?

- Who Owns Newmark Company?

- What is Customer Demographics and Target Market of Newmark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.