NRG Energy Bundle

What's the Story Behind NRG Energy's Rise?

Founded in 1989, NRG Energy, Inc. has carved a significant niche in the North American energy sector. Initially designed to capitalize on the deregulation of the power industry, NRG Energy quickly evolved to meet the growing demands for diverse energy solutions. Today, it stands as a leading integrated power company, serving millions with electricity, natural gas, and comprehensive energy services.

This NRG Energy SWOT Analysis is a deep dive into the NRG Energy company's history, exploring its transformation from a startup to a major player in power generation. We'll examine the key milestones that shaped the NRG history, its strategic shifts, and its impact on the energy market, including its embrace of renewable energy. Discover how this energy company has navigated challenges and capitalized on opportunities to become a leader in the industry.

What is the NRG Energy Founding Story?

The brief history of NRG Energy company begins in 1989. It was established as a subsidiary of Northern States Power Company (NSP), later known as Xcel Energy. The formation of NRG Energy was a strategic response to the evolving regulatory landscape of the U.S. power industry.

The initial focus of NRG Energy was to take advantage of deregulation trends. It aimed to develop, own, and operate power generation facilities. This strategic move set the stage for the company's entry into the independent power producer market.

The early operations of NRG Energy centered around acquiring and developing power plants. The goal was to build a diversified generation portfolio. This approach allowed the company to establish a strong foundation in the power generation sector.

NRG Energy's early business model involved wholesale power generation, selling electricity to utilities and large consumers. The company leveraged the expertise of its parent company, NSP, in power plant operations. This strategy helped NRG navigate the early challenges of the independent power market.

- The company benefited from internal funding and a strong understanding of the energy sector.

- NRG's initial focus was on power generation, selling electricity to utilities.

- The company aimed to capitalize on deregulation trends.

- The company's early operations involved acquiring and developing power plants.

As an energy company, NRG Energy positioned itself for future growth. The company's early years were marked by strategic acquisitions and developments. This approach allowed NRG to expand its footprint in the energy market.

The company's initial funding came from its parent company. This provided a stable financial base for NRG Energy. The company's early success was due to its strategic approach to the changing energy market. For more detailed information, you can read about the company's strategic decisions in this article about the NRG Energy company.

NRG Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of NRG Energy?

The early growth of NRG Energy, a prominent energy company, was marked by strategic moves in the 1990s and early 2000s. The company focused on acquiring power plants and developing new projects across the United States and internationally. This expansion was fueled by the deregulation of energy markets, allowing NRG Energy to capitalize on new opportunities in power generation.

NRG Energy significantly increased its generating capacity through acquisitions during this period. These acquisitions were crucial for expanding its market share and operational footprint. The company's growth strategy involved entering new geographical markets, both domestically and internationally, to maximize its reach in the power sector.

NRG Energy built a diverse portfolio of generation assets, including coal, natural gas, and oil-fired plants. The company also began exploring renewable energy projects, demonstrating an early commitment to sustainable energy sources. This diversification helped NRG Energy adapt to changing market demands and regulatory environments.

Leadership transitions during this phase often involved bringing in executives with expertise in complex regulatory environments. The market generally viewed NRG Energy favorably, recognizing it as a dynamic player in a transforming industry. By the early 2000s, NRG Energy had established itself as a major independent power producer, setting the stage for its future ventures.

While the primary focus was on traditional power sources, NRG Energy began exploring renewable energy projects. This early interest in renewables signaled a forward-thinking approach to the evolving energy landscape. For more information on the company's structure, you can read about the Owners & Shareholders of NRG Energy.

NRG Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in NRG Energy history?

The NRG Energy company has a rich NRG history marked by significant shifts and strategic decisions, establishing its position in the energy sector. The NRG company has consistently adapted to market changes, making it a key player in the power generation and renewable energy fields.

| Year | Milestone |

|---|---|

| 2003 | NRG Energy emerged from bankruptcy, allowing it to restructure and refocus its business strategy. |

| 2012 | NRG acquired GenOn Energy, significantly expanding its generation portfolio and market reach. |

| 2018 | NRG divested $5.2 billion in assets, including its renewable energy platform, to focus on its retail and generation businesses. |

| 2023 | NRG completed the acquisition of Vivint Smart Home, expanding its customer base and service offerings. |

NRG Energy has been at the forefront of innovation within the energy company sector, particularly in how it approaches customer engagement and service delivery. It has also invested heavily in smart home technology, integrating energy solutions with home automation.

NRG entered the retail electricity market, allowing it to directly serve residential and commercial customers. This move diversified its revenue streams beyond wholesale power generation.

NRG integrated smart home technologies to offer energy solutions with home automation. This involved acquiring Vivint Smart Home to enhance customer service offerings.

NRG shifted its focus towards a customer-centric model, enhancing its retail and generation businesses. This strategy was crucial in adapting to the evolving energy landscape.

NRG invested in digital platforms to improve customer experience and operational efficiency. These platforms provide customers with tools to manage their energy usage.

NRG has made significant investments in renewable energy projects, including solar and wind farms. This supports the company's commitment to a lower-carbon energy mix.

NRG has explored and implemented energy storage solutions to improve grid stability and reliability. These solutions are essential for integrating intermittent renewable energy sources.

NRG Energy has faced challenges such as volatile commodity prices and the need to adapt to stringent environmental regulations. The company has also had to navigate the complexities of transitioning to a lower-carbon energy mix.

NRG has had to manage the impact of fluctuating commodity prices on its power generation costs. This requires careful hedging strategies and operational efficiency.

The company has been affected by increasingly stringent environmental regulations, requiring investments in cleaner energy sources. Compliance with these regulations impacts operational costs.

NRG has faced the challenge of transitioning to a lower-carbon energy mix. This involves strategic investments in renewable energy sources and the phasing out of traditional fossil fuel plants.

NRG operates in a highly competitive market, requiring continuous innovation and efficiency improvements. The company must adapt to evolving customer demands and technological advancements.

Economic downturns can affect energy demand and pricing, impacting NRG's financial performance. The company must have a flexible business model to navigate economic challenges.

Technological advancements, such as smart grids and distributed generation, present both opportunities and challenges. NRG must stay ahead of these disruptions to maintain its market position.

For more insights into NRG Energy's strategic approach, consider exploring the Marketing Strategy of NRG Energy.

NRG Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for NRG Energy?

The history of NRG Energy is marked by significant developments in the energy company sector. It has evolved from its origins to become a major player in power generation and renewable energy. This timeline highlights key moments in the NRG Energy's journey. For more insights, check out the Mission, Vision & Core Values of NRG Energy.

| Year | Key Event |

|---|---|

| 1989 | The company, initially known as Northern States Power, is established, marking its entry into the energy market. |

| 1990s | NRG expands its operations, focusing on the development and acquisition of power plants. |

| 2000s | NRG undergoes significant growth through acquisitions and strategic investments, becoming a publicly traded company. |

| 2010s | The company shifts towards a more diverse energy portfolio, including investments in renewable energy sources. |

| 2020s | NRG Energy continues to adapt to market changes, focusing on customer-centric solutions and sustainable energy practices. |

NRG Energy is likely to continue expanding its footprint through strategic acquisitions and partnerships. The focus will be on enhancing its market share and broadening its service offerings. This could involve entering new geographic markets and diversifying its energy portfolio. The company's growth strategy is expected to adapt to evolving consumer demands and technological advancements.

A key area of focus for NRG Energy will be the development and integration of renewable energy projects. This includes solar, wind, and other sustainable sources. The company is expected to increase its investments in clean energy to meet growing consumer demand and regulatory requirements. This shift aligns with global efforts to reduce carbon emissions and promote environmental sustainability.

NRG Energy is poised to leverage technological advancements to improve its operational efficiency and customer experience. This includes smart grid technologies, energy storage solutions, and digital platforms. The company will likely invest in innovations to optimize energy distribution, enhance grid reliability, and offer more personalized services to its customers. These technological integrations will be critical to remaining competitive.

The energy company will navigate complex market dynamics, including fluctuating energy prices, regulatory changes, and increasing competition. NRG Energy will need to adapt to these challenges by implementing robust risk management strategies and fostering innovation. Successfully managing these aspects will be essential for maintaining profitability and achieving long-term growth. The company must stay agile to capitalize on emerging opportunities.

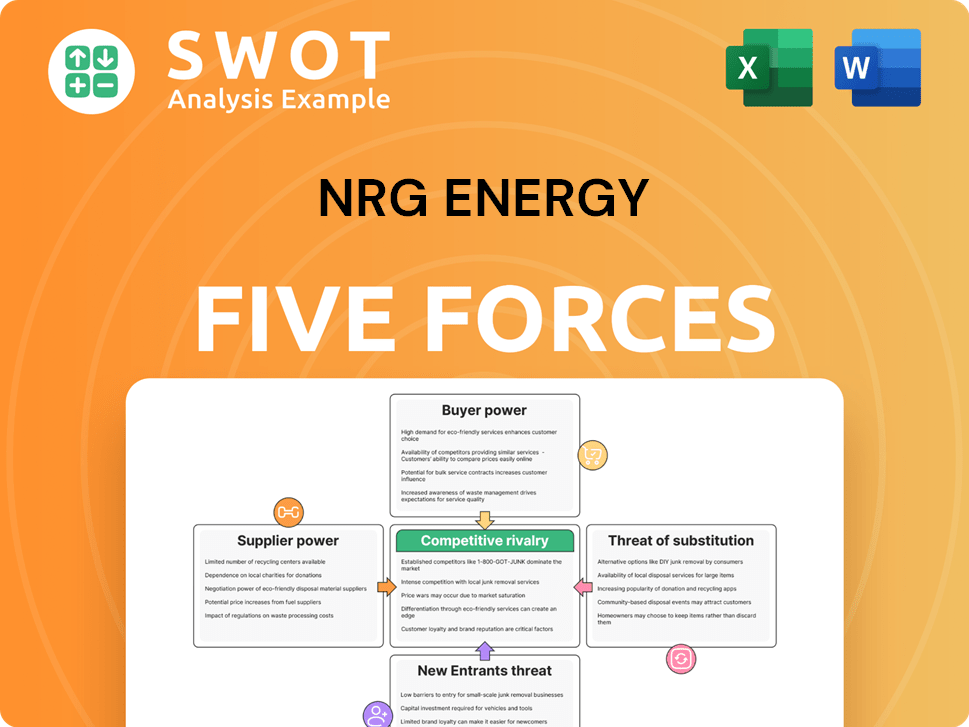

NRG Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of NRG Energy Company?

- What is Growth Strategy and Future Prospects of NRG Energy Company?

- How Does NRG Energy Company Work?

- What is Sales and Marketing Strategy of NRG Energy Company?

- What is Brief History of NRG Energy Company?

- Who Owns NRG Energy Company?

- What is Customer Demographics and Target Market of NRG Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.