NRG Energy Bundle

How Well Do You Know NRG Energy?

NRG Energy Company, a major player in the North American energy market, is more than just an NRG Energy SWOT Analysis. It's a dynamic force providing electricity and natural gas to millions. But how does this integrated power company actually operate, and what makes it tick in today's evolving energy landscape? Uncover the inner workings of this electricity company and explore its strategic moves.

From its diverse power generation portfolio to its strategic acquisitions, understanding How NRG Energy Works is key. This deep dive into NRG Energy will explore its revenue streams, competitive advantages, and future outlook. Whether you're an investor, customer, or industry observer, gain valuable insights into this prominent energy provider and its position in the market.

What Are the Key Operations Driving NRG Energy’s Success?

NRG Energy Company operates by generating, wholesaling, and retailing electricity and natural gas, alongside offering related energy services. This multifaceted approach allows the company to serve a diverse customer base, including residential, commercial, industrial, and wholesale clients. Their core offerings include reliable electricity supply, natural gas delivery, and smart home products and services, enhancing customer value through integrated solutions.

The company's value proposition lies in its ability to provide integrated energy solutions. This includes power generation from a diversified portfolio of sources, such as natural gas, coal, nuclear, and renewable sources like solar and wind. This diversification allows NRG Energy to adapt to market changes and maintain supply stability. The integration of smart home solutions further differentiates the company by offering enhanced energy efficiency, security, and convenience.

NRG Energy leverages a robust supply chain that encompasses fuel procurement, power generation, and transmission grid management. They partner with transmission operators and local distribution companies to deliver energy to end-users. Sales channels include direct sales, digital platforms, and customer service centers, ensuring accessibility for its customers. This integrated approach, combining power generation with a strong retail presence and smart home solutions, allows for cross-selling and a more comprehensive customer relationship.

NRG Energy utilizes a diverse portfolio of power generation assets. This includes natural gas, coal, nuclear, and renewable sources. This diversification helps manage market fluctuations and fuel costs. As of late 2023, the company has increased its focus on renewable energy sources, aligning with sustainability goals.

NRG Energy provides multiple channels for customer interaction. These include direct sales, digital platforms, and customer service centers. The company aims to make it easy for customers to manage their accounts and access support. NRG Energy customer service phone number and online portals are readily available for inquiries and bill payments.

Through the integration of smart home products and services, NRG Energy enhances its value proposition. These offerings, such as those provided through Vivint Smart Home, provide customers with increased energy efficiency, security, and convenience. This integration helps NRG Energy to stand out from traditional energy providers.

NRG Energy's supply chain is a critical component of its operations. It includes fuel procurement, power generation, and transmission grid management. They collaborate with transmission operators and local distribution companies to ensure energy reaches end-users. This network is crucial for reliability and efficiency.

NRG Energy operates with a focus on integrated energy solutions, combining power generation with retail services. This integrated model allows for a comprehensive customer experience and cross-selling opportunities. The company's commitment to sustainability and customer service is also a key differentiator, as highlighted in recent NRG Energy reviews.

- Diversified Power Generation: Utilizing natural gas, coal, nuclear, and renewable sources.

- Integrated Retail Services: Offering electricity, natural gas, and smart home solutions.

- Strategic Partnerships: Collaborating with transmission operators and local distribution companies.

- Customer-Focused Approach: Providing accessible customer service channels and digital platforms.

NRG Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NRG Energy Make Money?

NRG Energy Company, a prominent energy provider, generates revenue through a multifaceted approach. The core of its business model revolves around the sale of electricity and natural gas. These sales are directed towards a diverse customer base, including residential, commercial, industrial, and wholesale clients.

The company's revenue streams are primarily driven by energy sales. However, NRG Energy has strategically expanded its monetization strategies. This expansion aims to create a more resilient revenue base, less vulnerable to the volatility of energy commodity prices.

In fiscal year 2023, NRG reported total revenues of $28.3 billion, underscoring the significance of its energy sales. While specific figures for 2024 and 2025 are pending financial reports, historical data indicates that retail electricity sales are a major contributor to the company's financial performance.

NRG Energy has diversified its revenue streams beyond traditional energy sales. This diversification includes the acquisition of Vivint Smart Home, which introduces new revenue streams from smart home product sales, installation services, and recurring subscription fees. This strategic move aims to enhance customer lifetime value and reduce churn. For more information about the company, you can read Owners & Shareholders of NRG Energy.

- Smart Home Integration: Sales of smart home products, installation services, and subscription fees contribute to revenue.

- Energy Management Services: Consulting fees and performance-based contracts from helping customers optimize their energy consumption.

- Bundled Services: Combining energy supply with smart home technology to increase customer lifetime value.

- Wholesale Energy Markets: Participation in wholesale energy markets to capitalize on market fluctuations.

NRG Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NRG Energy’s Business Model?

Understanding the operational dynamics of NRG Energy Company involves examining key milestones, strategic shifts, and the competitive advantages that define its market position. The company's evolution reflects its efforts to adapt to changes within the energy sector, including technological advancements, regulatory pressures, and shifting consumer preferences. These adaptations are crucial for maintaining its competitive edge in a dynamic industry.

One of the most significant moves for NRG Energy was the acquisition of Vivint Smart Home in March 2023. This strategic decision, valued at approximately $5.2 billion, marked a transition from a pure energy provider to a company offering integrated energy and smart home services. This diversification aimed to boost revenue streams and enhance customer retention. The company has also faced operational challenges, such as fluctuating commodity prices and extreme weather events, which have influenced energy demand and supply.

NRG Energy has responded to these challenges by optimizing its power generation, investing in resilience, and managing its retail portfolio. Its competitive advantages include a diverse power generation portfolio and strong retail presence. The integration of Vivint Smart Home provides a new competitive differentiator, offering a holistic home services solution that combines energy management with smart home technology. For more insights into the company's marketing approach, see the Marketing Strategy of NRG Energy.

The acquisition of Vivint Smart Home in March 2023 for $5.2 billion was a pivotal move. This acquisition marked a significant shift in NRG Energy's business model. The company has consistently adapted to market changes to maintain a competitive edge.

NRG Energy has focused on optimizing its generation fleet and managing its retail portfolio. The company has invested in cleaner energy technologies. These strategies are designed to meet the evolving demands of the energy market.

NRG Energy benefits from its extensive power generation portfolio and strong retail presence. The integration of Vivint Smart Home offers a unique competitive advantage. The company is also exploring investments in renewable energy.

Fluctuating commodity prices and regulatory changes present ongoing challenges. Extreme weather events also impact energy demand and supply. NRG Energy actively manages these risks to maintain stability.

NRG Energy is adapting to the increasing demand for renewable energy. The company is focused on offering innovative energy solutions. These efforts are designed to meet customer needs.

- Investing in cleaner energy technologies.

- Offering innovative energy solutions.

- Focusing on customer needs.

- Adapting to market demands.

NRG Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NRG Energy Positioning Itself for Continued Success?

The NRG Energy Company holds a significant position in the North American energy market, particularly in the retail electricity sector. It serves millions of customers across various regions, contributing to its strong market presence. The company focuses on customer loyalty, integrating smart home services to enhance engagement and retention. This strategic approach aims to solidify its market position and drive long-term growth.

However, NRG Energy faces several key risks, including commodity price volatility and regulatory changes. The competitive landscape is also evolving with new entrants in renewable energy and technology. To navigate these challenges, NRG Energy is focused on strategic initiatives like integrating the Vivint Smart Home acquisition, expanding its customer base, and optimizing operational efficiency. The company is committed to sustainability and exploring opportunities in the energy transition.

As an energy provider, NRG Energy has a substantial market share in the retail electricity sector. Its broad geographic reach and diversified customer base contribute to its strong standing. The company's focus on customer retention, including the integration of smart home services, enhances its competitive edge.

Key risks for NRG Energy include commodity price volatility, particularly for natural gas and coal, impacting generation costs. Regulatory changes, especially those related to environmental policies, pose ongoing challenges. Competition from renewable energy providers and technological disruptions further complicate the market.

NRG Energy is focused on expanding its customer base, enhancing bundled offerings, and optimizing operational efficiency. The company is committed to sustainability and exploring opportunities within the evolving energy transition. Strategic initiatives, like the Vivint Smart Home acquisition, aim to drive future growth.

The company is integrating Vivint Smart Home to become a leading smart home and energy company. It aims to offer innovative and integrated energy and home solutions. Leadership is focused on sustaining and expanding profitability through strategic growth and efficiency measures.

The NRG Energy Company is navigating a complex energy landscape. Its strategies involve leveraging the Vivint acquisition and focusing on customer-centric solutions. The company faces challenges from volatile commodity prices and evolving regulations, requiring adaptability and innovation. To learn more, read about the Growth Strategy of NRG Energy.

- Expansion of customer base through integrated services.

- Focus on operational efficiency and cost management.

- Investment in renewable energy options.

- Adaptation to changing regulatory and competitive environments.

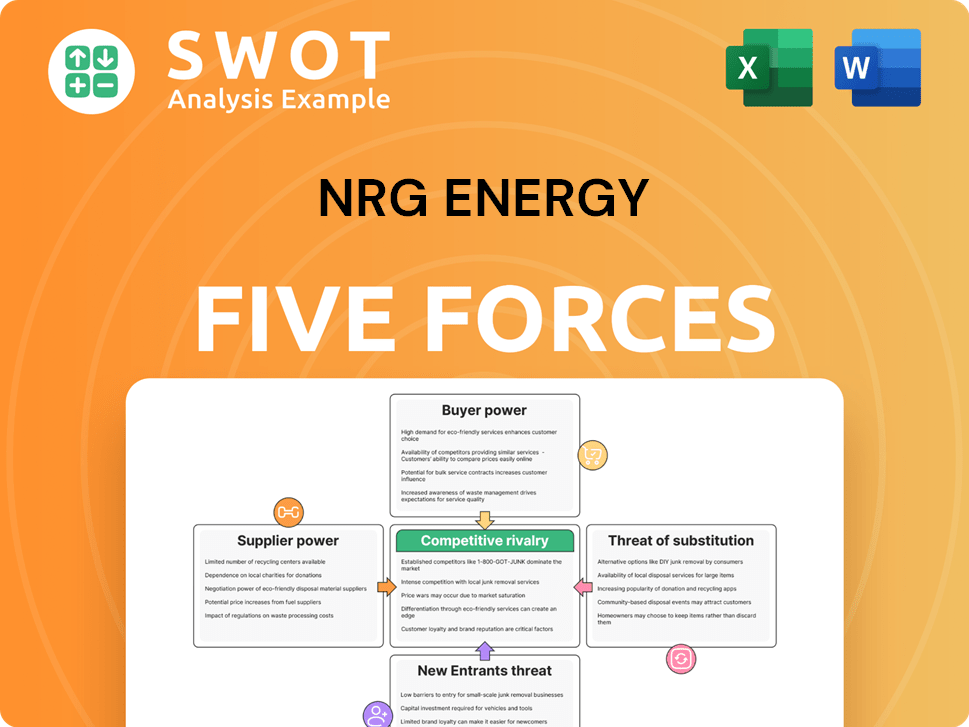

NRG Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NRG Energy Company?

- What is Competitive Landscape of NRG Energy Company?

- What is Growth Strategy and Future Prospects of NRG Energy Company?

- What is Sales and Marketing Strategy of NRG Energy Company?

- What is Brief History of NRG Energy Company?

- Who Owns NRG Energy Company?

- What is Customer Demographics and Target Market of NRG Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.