NRG Energy Bundle

Can NRG Energy Continue Its Ascent in the Dynamic Energy Sector?

The energy landscape is constantly evolving, forcing companies to adapt and innovate to stay ahead. NRG Energy, a prominent NRG Energy SWOT Analysis can provide a deep dive into its strategic positioning, has demonstrated significant growth, particularly with its strategic acquisition of Direct Energy. This success story, however, begs the question: what's next for this major player in the energy market?

This exploration delves into the NRG Energy's growth strategy, examining its past successes and future prospects. We'll conduct a thorough market analysis to understand the competitive environment and how NRG Energy plans to leverage its diverse generation portfolio and expand its customer base. Understanding the growth strategy for energy companies like NRG Energy is crucial, particularly in light of the push towards renewable energy and sustainable practices.

How Is NRG Energy Expanding Its Reach?

To understand the expansion initiatives of NRG Energy, it's essential to recognize the company's strategic focus on growth within the dynamic energy sector. Their approach involves a blend of organic expansion and strategic acquisitions to strengthen their market position. This strategy is designed to capitalize on emerging opportunities and adapt to the evolving needs of energy consumers.

A key element of NRG Energy's expansion strategy involves broadening its retail electricity and natural gas services. This involves entering new geographical markets and enhancing its direct-to-consumer offerings. The company aims to deliver bundled services, including energy management and home services, to increase customer lifetime value.

NRG Energy also actively seeks mergers and acquisitions that align with its long-term growth objectives. These strategic moves often focus on market penetration and technological integration. This approach allows the company to optimize its operations and enhance the customer experience.

NRG Energy aims to extend its reach by entering new geographical markets. This expansion leverages existing infrastructure and customer bases, particularly those gained through acquisitions. The goal is to increase market share and customer access.

The company focuses on enhancing its direct-to-consumer services. This includes bundled services, like energy management and home services. By offering these, NRG Energy seeks to boost customer lifetime value and diversify revenue streams.

NRG Energy evaluates strategic mergers and acquisitions aligned with long-term growth goals. These opportunities often aim to enhance market penetration or integrate new technologies. This approach supports the company's expansion objectives.

NRG Energy consistently works to optimize its retail operations. This includes improving the customer experience and streamlining processes. The focus is on continuous improvement and adapting to market changes.

While specific details about new market entries for 2024-2025 are not explicitly detailed, NRG Energy's focus on retail operations and customer experience suggests continued organic growth. This is coupled with opportunistic inorganic growth through acquisitions. For a comprehensive overview of the company's financial performance and strategic direction, you can refer to an article about the company's profile.

NRG Energy's expansion strategy includes several key areas. These initiatives are designed to drive growth and strengthen the company's position in the energy market. The focus is on both organic and inorganic growth opportunities.

- Expanding into new geographical markets to increase customer reach.

- Enhancing direct-to-consumer offerings with bundled services for greater customer value.

- Evaluating strategic mergers and acquisitions to boost market penetration and integrate new technologies.

- Optimizing retail operations and improving customer experience for sustained growth.

NRG Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NRG Energy Invest in Innovation?

The innovation and technology strategy of NRG Energy centers on leveraging digital transformation and customer-centric solutions to drive sustained growth. This approach is crucial for an Energy Company operating in a rapidly evolving market. Their focus includes enhancing operational efficiency, improving customer engagement, and optimizing energy management services through advanced analytics and data-driven platforms.

NRG Energy's commitment to innovation extends to providing diverse energy solutions, including renewable options, which indicates an ongoing evaluation and integration of new energy technologies. This strategic direction is vital for meeting evolving market demands and sustainability goals, positioning the company for future success. The integration of digital tools is particularly important for customer acquisition and service delivery.

The company's strategic emphasis on its retail segment implies an increasing reliance on digital tools for customer acquisition, service delivery, and energy efficiency programs. While specific details on R&D investments or proprietary technologies like AI or IoT in their generation assets are not extensively publicized, the focus on digital transformation is evident. This approach is crucial for an Energy Company to stay competitive.

NRG Energy is investing in digital transformation to enhance operational efficiency. This includes the deployment of advanced analytics and data-driven platforms. These platforms help to better understand energy consumption patterns.

The company focuses on customer-centric solutions to improve customer engagement. This involves offering tailored solutions to residential and commercial customers. This approach is critical for retaining and attracting customers.

NRG Energy is committed to providing diverse energy solutions, including renewable options. This indicates an ongoing evaluation and integration of new energy technologies. This helps meet evolving market demands and sustainability goals.

The deployment of advanced analytics and data-driven platforms is a key aspect of NRG Energy's strategy. These platforms help in understanding energy consumption patterns. This enables the company to offer tailored solutions.

The strategic emphasis on the retail segment implies an increasing reliance on digital tools. These tools are used for customer acquisition, service delivery, and energy efficiency programs. This helps in improving customer experience.

NRG Energy is optimizing its energy management services. This is achieved through digital transformation initiatives. This ensures efficient energy usage and better customer service.

NRG Energy's approach to innovation and technology is multifaceted, focusing on digital transformation and customer-centric solutions. The company is leveraging data analytics to understand customer behavior and optimize energy usage. This strategy is crucial for its Growth Strategy and future success. For more insights, check out the Target Market of NRG Energy.

- Digitalization: Implementing digital tools to enhance operational efficiency, improve customer engagement, and optimize energy management services.

- Data Analytics: Using advanced analytics and data-driven platforms to understand energy consumption patterns. This helps in offering tailored solutions to customers.

- Renewable Energy Integration: Evaluating and integrating new energy technologies to meet evolving market demands and sustainability goals. This includes investments in solar, wind, and other clean energy projects.

- Customer-Centric Solutions: Focusing on providing diverse energy solutions, including renewable options, to meet the evolving needs of residential and commercial customers.

NRG Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NRG Energy’s Growth Forecast?

The financial outlook for NRG Energy reflects a strategic approach focused on optimizing its portfolio, reducing debt, and returning capital to shareholders. This strategy is coupled with a commitment to pursuing growth opportunities, particularly in the evolving energy landscape. The company's financial targets are supported by efforts to enhance operational efficiency and effectively manage its diverse generation fleet.

For the full year of 2024, NRG Energy projects an adjusted EBITDA between $3.30 billion and $3.55 billion. This projection indicates a stable financial base from which to pursue future growth initiatives and investments. The company's financial strategy also emphasizes maintaining a strong balance sheet and a disciplined approach to capital allocation, ensuring long-term financial health and flexibility.

NRG Energy anticipates significant free cash flow before growth investments, with a projection of $1.82 billion to $2.07 billion for 2024. This strong free cash flow is a key indicator of the company's financial health and its ability to fund strategic initiatives, including investments in renewable energy projects and other business development opportunities. The company's financial performance, as evidenced by an adjusted EBITDA of $3.07 billion for the twelve months ended March 31, 2024, further underscores its robust financial standing.

NRG Energy's financial health is demonstrated through key metrics. The company's adjusted EBITDA for the twelve months ended March 31, 2024, was $3.07 billion. For 2024, the company projects adjusted EBITDA to be between $3.30 billion and $3.55 billion.

The company anticipates robust free cash flow. Projections for 2024 indicate free cash flow before growth investments to range from $1.82 billion to $2.07 billion. This strong cash flow supports strategic investments and shareholder returns.

NRG Energy's financial strategy includes optimizing its portfolio and reducing debt. The company is committed to returning capital to shareholders, showcasing its confidence in its financial stability. This approach is designed to create long-term value.

The company is focused on growth, particularly in renewable energy. Investments in new projects are supported by a strong financial foundation and disciplined capital allocation. The company's growth strategy is detailed in Competitors Landscape of NRG Energy.

NRG Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NRG Energy’s Growth?

The NRG Energy faces several potential risks and obstacles that could affect its growth. These challenges range from competitive pressures to the impacts of extreme weather events. Understanding these risks is crucial for investors and stakeholders evaluating the company's long-term prospects.

Market competition is a significant concern, especially in deregulated retail energy markets. Regulatory changes and supply chain vulnerabilities also pose operational risks. Furthermore, the increasing frequency of extreme weather events can disrupt operations and increase costs.

To mitigate these risks, NRG Energy employs a diversified generation portfolio. They also utilize risk management frameworks and scenario planning to prepare for potential disruptions and market shifts. For instance, the company's focus on its retail business and integrated model aims to provide greater stability against wholesale market volatility.

The retail energy market is highly competitive, with numerous providers vying for customers. This competition can lead to price wars and reduced profit margins. Maintaining market share and attracting new customers requires continuous innovation and effective marketing strategies.

Evolving environmental regulations and energy policies can introduce compliance costs. Changes in renewable energy standards or carbon pricing mechanisms could impact the company's operations. Staying compliant with these regulations is essential for continued operation and avoiding penalties.

Disruptions in the supply of fuel sources and equipment can impact power generation. Events like geopolitical instability or natural disasters can affect the availability and cost of essential resources. Diversifying suppliers and maintaining strategic reserves are important for mitigating these risks.

The increasing frequency and intensity of extreme weather events can disrupt operations. Hurricanes, floods, and other natural disasters can damage infrastructure and cause significant financial losses. Investing in resilient infrastructure and emergency response plans is crucial.

Fluctuations in energy prices and interest rates can affect NRG Energy's financial performance. Managing debt and hedging against price volatility are important strategies. The company must also navigate potential credit rating changes and maintain investor confidence.

Rapid advancements in Renewable Energy technologies could impact the company’s market position. The emergence of new energy storage solutions and smart grid technologies may require investments. Adapting to these changes is essential to remain competitive.

NRG Energy mitigates risks through a diversified generation portfolio, including fossil fuel, nuclear, and Renewable Energy sources. This approach reduces dependence on any single energy source. The company also uses risk management frameworks and scenario planning to prepare for potential disruptions and market shifts. For more details, you can read about the Marketing Strategy of NRG Energy.

The company's financial performance is closely tied to its ability to navigate market dynamics. Market Analysis is crucial for understanding customer preferences and competitive pressures. NRG Energy must adapt its strategies to maintain profitability and achieve its Growth Strategy goals. It is important to look at NRG Energy's financial performance in terms of revenue, operating income, and cash flow to gauge its ability to withstand financial risks.

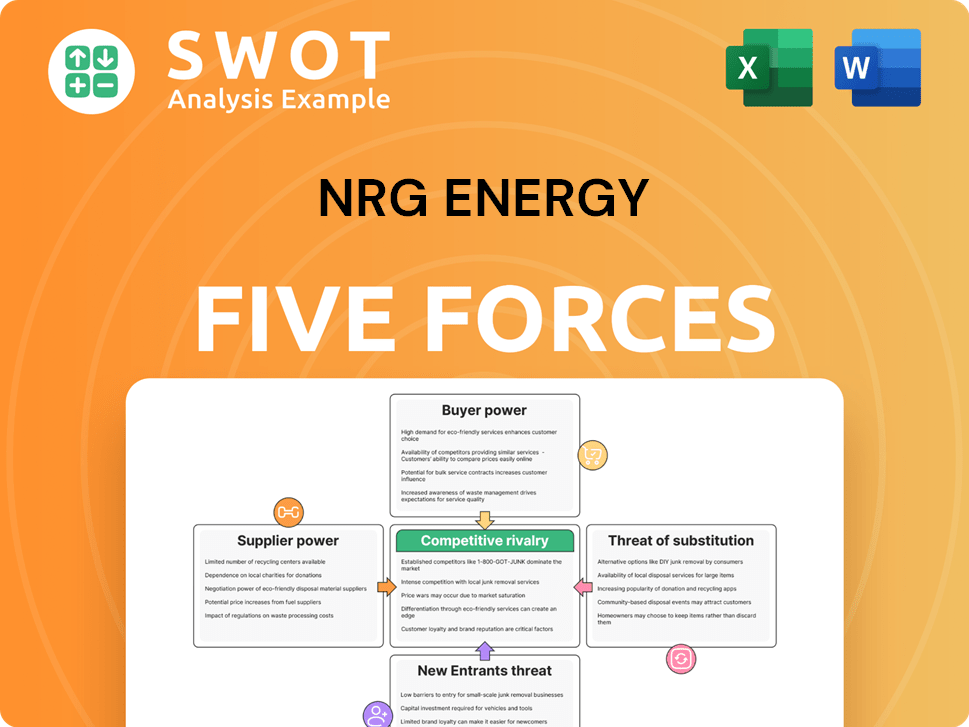

NRG Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NRG Energy Company?

- What is Competitive Landscape of NRG Energy Company?

- How Does NRG Energy Company Work?

- What is Sales and Marketing Strategy of NRG Energy Company?

- What is Brief History of NRG Energy Company?

- Who Owns NRG Energy Company?

- What is Customer Demographics and Target Market of NRG Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.