SK Bundle

How Did a Textile Business Become a Global Tech Powerhouse?

From humble beginnings in post-war South Korea, SK Company has transformed into a global force. Its story is a compelling narrative of strategic pivots and bold investments. Discover how SK Group, now a massive Korean conglomerate, built its empire.

SK Inc., the holding company of SK Group, boasts a fascinating SK SWOT Analysis. Initially rooted in textiles, the company's journey showcases remarkable adaptability. This article delves into the key milestones of SK Company history, exploring its evolution across various business sectors, from its founding to its current status as a leader in AI and semiconductors, and its significant impact on the Korean economy.

What is the SK Founding Story?

The story of the SK Group begins in the challenging aftermath of the Korean War. Founded in 1953 by Chey Jong-gun, the company started as Sunkyong, focusing on rebuilding the textile industry.

This initial venture involved restoring weaving machines, a crucial step in reviving the nation's manufacturing capabilities. Sunkyong quickly evolved, becoming a pioneer in exporting fabrics and integrating its operations to include yarn production.

The company's early years were marked by resourcefulness and a focus on essential goods. The rebranding to SK in 1998 signaled a major shift, establishing its modern corporate identity. For more insights, explore Mission, Vision & Core Values of SK.

Here's a look at some important moments in the history of SK Company:

- 1953: Chey Jong-gun establishes Sunkyong, focusing on textile manufacturing.

- 1960: Sunkyong becomes the first Korean company to export fabrics to Hong Kong.

- 1970s: The company expands into the energy sector.

- 1998: Sunkyong is rebranded as SK, modernizing its corporate identity.

- 2024: SK Group continues to be a major player in South Korea and internationally, with diverse business interests.

The company's evolution reflects its adaptability and strategic vision. From its textile roots, SK Group has expanded into various sectors, including energy, telecommunications, and semiconductors. The company's early focus on textiles was critical for the post-war economy, and its subsequent diversification has solidified its position as a major Korean conglomerate.

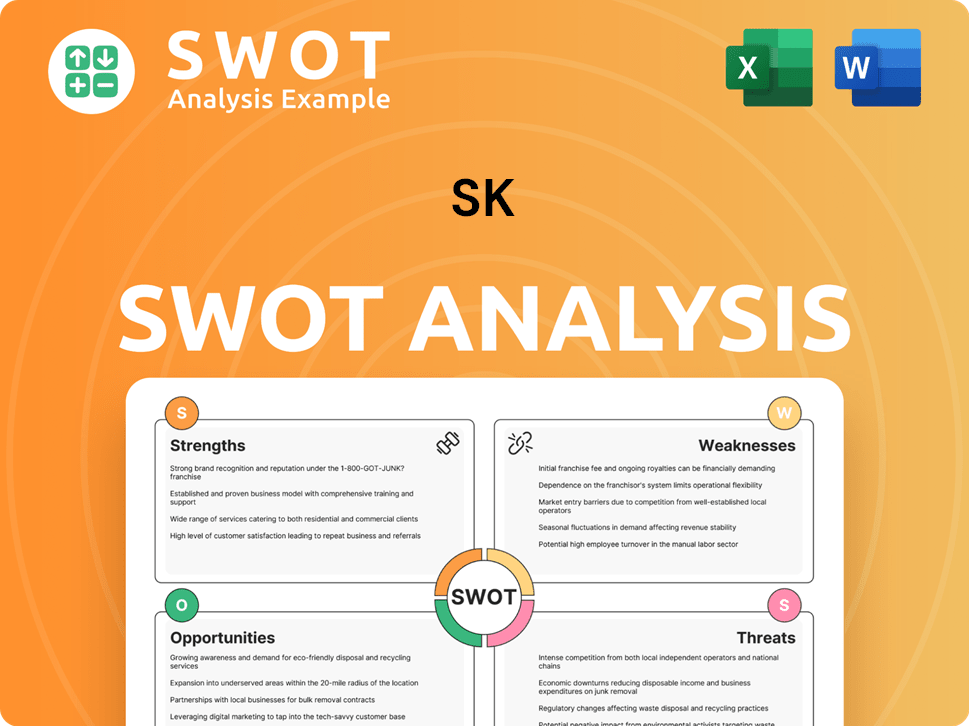

SK SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of SK?

The early growth and expansion of the SK Group, a prominent Korean conglomerate, showcases a strategic shift from its textile origins to diversified sectors. This period was marked by significant acquisitions and ventures, laying the groundwork for its future success. The company's evolution reflects a dynamic adaptation to changing market conditions and a commitment to vertical integration, shaping its trajectory within the Korean economy.

In 1969, SK Group, initially known for textiles, expanded into polyester fiber production through a joint venture with Teijin Japan, establishing Sunkyong Artificial Textiles. By the end of the same year, the company began exporting artificial textiles to Germany and Japan. This marked the beginning of SK's diversification strategy, moving beyond its initial focus. This early diversification was a key element in the Revenue Streams & Business Model of SK.

The acquisition of the Seoul Walkerhill hotel in 1973 signaled SK's entry into new business sectors. Sunkyong Chemicals achieved a significant milestone in 1977 by becoming the first Korean company to develop polyester film successfully. These strategic moves demonstrated SK's ambition to broaden its business portfolio and explore growth opportunities beyond its core competencies.

The 1980s saw SK make a pivotal move into the energy sector with the acquisition of Korea Oil Corporation, later renamed Yukong, in 1980. This acquisition was instrumental in the group's drive towards full vertical integration. By 1985, Yukong's refinery capacity expanded to 345,000 barrels per day. The energy sector became a cornerstone of SK's business model.

In June 1994, SK ventured into the telecommunications business, becoming the largest shareholder of Korea Mobile Telecommunication Service. SK Telecom launched Korea's first commercial CDMA cellular phone service in January 1996. By July 1999, SK Telecom introduced 'TTL,' a mobile phone brand targeting the new generation, reflecting SK's forward-thinking approach.

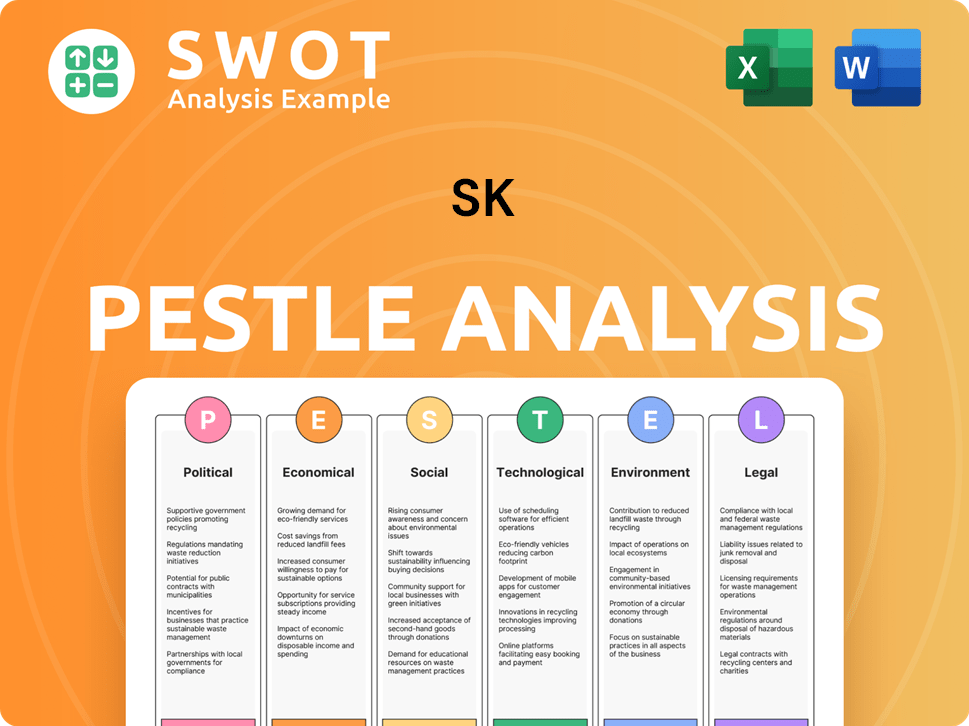

SK PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in SK history?

The SK Company history is marked by significant milestones across various sectors. The Korean conglomerate has consistently expanded its business operations and technological capabilities, influencing the Korean economy significantly.

| Year | Milestone |

|---|---|

| 1996 | SK Telecom achieved the world's first successful commercialization of CDMA technology. |

| 2002 | SK Telecom launched the world's first commercial CDMA 1X EV-DO technology. |

| 2004 | SK Telecom launched the world's first DMB satellite service. |

| 2006 | SK Telecom initiated the world's first commercial 3.5-generation HSDPA service. |

| 2012 | SK acquired Hynix Semiconductor, rebranding it as SK Hynix. |

| 2019 | SK Telecom launched the world's first nationwide 5G service, and SK Hynix began mass production of the world's first 128-layer 1Tb TLC 4D NAND-Flash. |

| 2024 | SK Hynix achieved its best-ever performance and solidified its leadership in the global AI memory industry. |

The company has consistently been at the forefront of technological advancements, particularly in telecommunications and semiconductors. These innovations have driven growth and positioned SK Group as a leader in several key markets.

SK Telecom's early adoption and commercialization of CDMA technology in 1996 marked a pivotal moment. This technological leap enabled the transition from 1G analog to 2G digital mobile phone services, establishing SK as a pioneer in the industry.

The launch of the world's first commercial CDMA 1X EV-DO technology in 2002 and the nationwide 5G service in 2019 further cemented SK Telecom's leadership. These advancements provided faster and more reliable telecommunications services to consumers.

SK Telecom's launch of the world's first DMB satellite service in 2004 was another innovative step. This service provided mobile access to multimedia content, enhancing the user experience.

The initiation of the world's first commercial 3.5-generation HSDPA service in 2006 improved mobile data speeds. This innovation supported the growing demand for high-speed internet access on mobile devices.

SK Hynix's mass production of the world's first 128-layer 1Tb TLC 4D NAND-Flash in 2019 showcased its technological prowess. This innovation supported the increasing need for high-density storage solutions.

SK Hynix's achievement of its best-ever performance in 2024 solidifies its leadership in the global AI memory industry. This highlights the company's ability to innovate and meet the demands of emerging technologies.

Despite its successes, SK Group has faced challenges, including market volatility and strategic shifts. The company's subsidiaries have navigated economic downturns and the need for portfolio adjustments.

SK Hynix, formerly Hynix Semiconductor, faced court receivership before its acquisition by SK, illustrating the volatile nature of the semiconductor industry. This acquisition was a strategic move to diversify and strengthen the group's portfolio.

In 2024, SK Innovation experienced mounting losses post-merger with SK E&S, and its EV battery unit faced a demand plateau. This led to a leadership change in May 2025, with Choo Hyeong-wook becoming the new CEO.

SK Group reduced its debt ratio from 145% at the close of 2023 to 128% by the end of the third quarter of 2024, demonstrating resilience. The company is actively restructuring its business portfolio to enhance financial stability.

The consideration of selling a controlling stake in SK Siltron Co., a semiconductor wafer subsidiary, reflects the company's strategic adjustments. These actions aim to optimize the business structure and support long-term growth.

The semiconductor market's fluctuations have presented challenges for SK Hynix. Managing these market dynamics requires strategic investments and operational agility to maintain competitiveness.

Leadership changes, such as the appointment of Choo Hyeong-wook, reflect the need for adapting to evolving market conditions. These transitions are crucial for steering the company through challenges and capitalizing on opportunities.

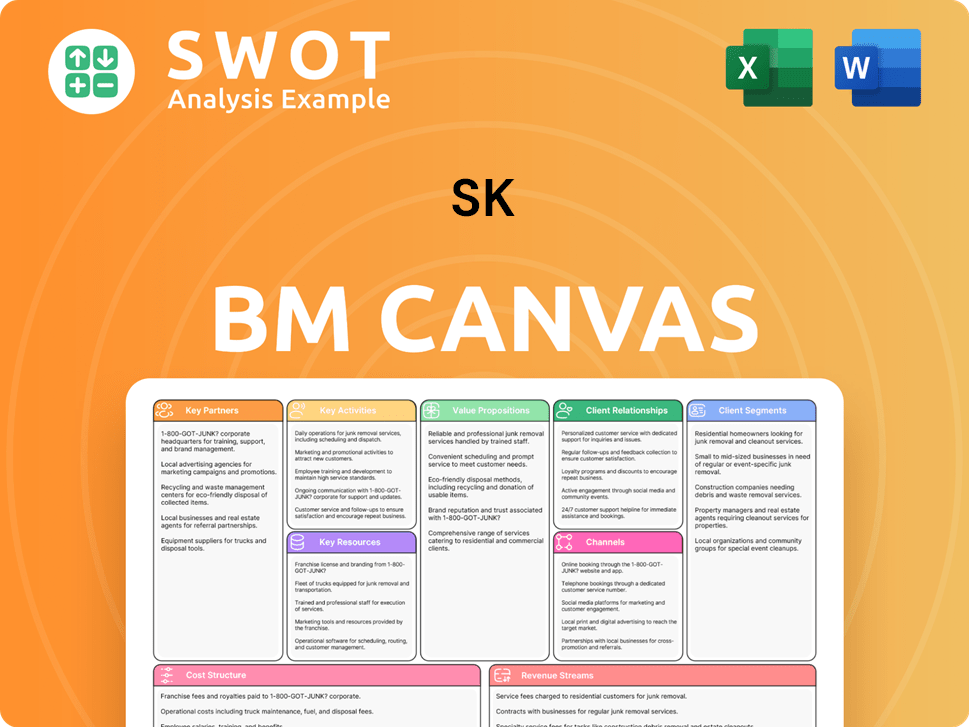

SK Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for SK?

The SK Company history is a story of continuous evolution and strategic expansion. From its origins in textiles, the Korean conglomerate, SK Group, has diversified into energy, telecommunications, semiconductors, and biopharmaceuticals. Key milestones highlight its adaptability and innovation, establishing it as a major player in the global market. The group's journey reflects South Korea's economic growth, with SK Group's subsidiaries playing a vital role in various sectors.

| Year | Key Event |

|---|---|

| 1953 | Chey Jong-gun revives the textile business, marking the founding of what would become SK. |

| 1960 | Becomes the first Korean firm to export fabrics to Hong Kong and ventures into yarn business. |

| 1969 | Enters polyester fiber production with a joint venture, Sunkyong Artificial Textiles. |

| 1977 | Sunkyong Chemicals develops Korea's first polyester film. |

| 1980 | Acquires Korea Oil Corporation, later renamed Yukong, entering the energy sector. |

| 1994 | Enters the telecommunications business by becoming the largest shareholder of Korea Mobile Telecommunication Service. |

| 1996 | SK Telecom launches Korea's first commercial CDMA cellular phone service. |

| 1998 | Sunkyong is rebranded to SK. |

| 2007 | Transforms into a holding company structure, with SK Inc. and SK Energy. |

| 2012 | Acquires Hynix Semiconductor, rebranding it as SK Hynix, establishing a new growth engine in semiconductors. |

| 2019 | SK Telecom launches the world's first nationwide 5G service; SK Hynix begins mass production of the world's first 128-layer 1Tb TLC 4D NAND-Flash. |

| 2021 | SK Biopharmaceuticals becomes the first Korean company to receive FDA approval for an independently developed epilepsy treatment. |

| 2024 | Declares the 'New SK' vision, signaling transformation into an AI-driven company with large-scale investments in AI and semiconductors. SK Innovation and SK E&S merge to form the largest private energy company in the Asia-Pacific region. |

| 2025 | SK Group plans significant investments in AI-ready data centers, high-tech agriculture, and logistics in Vietnam. SK Chemicals aims for 4 trillion won in sales by 2025, focusing on eco-friendly materials and biopharmaceuticals. SK Inc. aims to raise its enterprise value to over $120 billion by 2025. SK Hynix aims to achieve positive net cash and sustainable growth, focusing on Operational Improvement 2.0. |

SK Group is heavily investing in AI and semiconductors. At CES 2025, SK Group showcased its AI technologies and services under the theme 'Innovative AI, Sustainable Tomorrow.' SK Hynix plans to showcase its 5th generation HBM, HBM3E 16-layer product samples, and the D5-P5336 122TB product, solidifying its leadership in AI memory.

The group is actively exploring partnerships for AI and energy collaboration with the US and Japan. They propose a trilateral industrial coalition utilizing South Korea's manufacturing, US software capabilities, and Japan's expertise in materials and equipment. These collaborations aim to boost innovation and market presence.

SK Innovation and SK E&S merged to form the largest private energy company in the Asia-Pacific region. This move highlights SK's commitment to sustainable energy solutions. SK Chemicals aims for 4 trillion won in sales by 2025, focusing on eco-friendly materials and biopharmaceuticals, driving growth.

SK Inc. aims to raise its enterprise value to over $120 billion by 2025. SK Hynix aims to achieve positive net cash and sustainable growth, focusing on Operational Improvement 2.0. These financial targets reflect the group's ambitious growth strategy and market confidence.

SK Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.