SK Bundle

Unveiling the Inner Workings of SK Company: A Deep Dive

SK Inc., the strategic heart of South Korea's SK Group, is a powerhouse driving innovation across diverse sectors. From energy and chemicals to cutting-edge biopharmaceuticals, its influence is felt globally. Understanding the SK SWOT Analysis is key to grasping its competitive advantages and future potential.

This overview will explore the intricate SK business model, its core operations, and how it generates revenue. We'll examine the roles of SK subsidiaries and the strategic investments that fuel its growth, including SK Corporation's commitment to new technologies. Whether you're a seasoned investor or a business strategist, this analysis provides critical insights into SK holdings and its impact on the global market and the South Korean economy.

What Are the Key Operations Driving SK’s Success?

The core operations of SK Inc. revolve around its role as a holding company, strategically managing a diverse portfolio of subsidiaries. Its value proposition centers on enhancing the overall value of these businesses through strategic oversight, capital allocation, and fostering synergies. The company's structure allows it to navigate various sectors, including energy, chemicals, information and communication technology, biopharmaceuticals, and advanced materials, to create a robust and adaptable business model.

The SK business model is built on a foundation of strategic investments and operational excellence across multiple sectors. This approach enables the company to not only manage its current assets but also to identify and cultivate new growth engines. This includes significant investments in areas like biopharmaceuticals and advanced materials, which are crucial for future technological advancements and market expansion. The emphasis on identifying growth opportunities and integrating its subsidiaries' strengths underscores its commitment to long-term value creation.

SK Inc.'s approach is unique due to its focus on 'deep change' and ESG management, aiming to create both social and economic value. This includes sustainable business practices and investments in renewable energy. The company’s core capabilities in strategic investment, portfolio management, and fostering collaboration among its diverse business units create significant customer benefits, such as innovative products, reliable services, and a commitment to sustainability. This differentiates SK Inc. from competitors with a narrower focus.

Through subsidiaries like SK Innovation, SK Inc. is involved in oil refining, petrochemicals, and battery manufacturing. This sector serves industrial and consumer markets globally. In 2024, SK Innovation reported revenues of approximately ₩78.6 trillion, demonstrating its significant market presence.

SK Telecom, a key subsidiary, provides telecommunication services, smart infrastructure, and digital solutions. This caters to a vast customer base. SK Telecom's 2024 revenue was around ₩17.6 trillion, showcasing its importance in the digital landscape.

SK Inc. invests heavily in biopharmaceuticals and advanced materials, focusing on drug development and contract manufacturing. These ventures involve extensive R&D and strategic partnerships. The biopharmaceutical market is expected to grow significantly, offering substantial opportunities.

The company's supply chain is highly integrated, leveraging subsidiaries' strengths in sourcing, manufacturing, and distribution. SK Inc. is committed to ESG principles, focusing on eco-friendly materials and renewable energy. This commitment is increasingly important for long-term value creation.

SK Inc.’s strategic initiatives focus on identifying and nurturing new growth engines while also prioritizing ESG management to create long-term value. This includes significant investments in promising sectors and sustainable practices.

- Strategic Investments: Allocating capital to high-growth sectors like biopharmaceuticals and advanced materials.

- ESG Management: Implementing sustainable business practices and investing in renewable energy to create social and economic value.

- Global Expansion: Expanding its presence in international markets to diversify revenue streams and increase market share.

- Technological Innovation: Investing in R&D to foster innovation and maintain a competitive edge in the market.

SK Inc.'s approach to global expansion and its commitment to innovation are key elements of its strategy. For a deeper understanding of how SK approaches its marketing strategies, you might find insights in this article: Marketing Strategy of SK. This holistic approach, combined with a focus on sustainability and technological advancement, positions SK Inc. for continued success in a rapidly evolving global market. The company's financial performance reflects its strategic investments and operational efficiency, with diversified revenue streams across multiple sectors.

SK SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SK Make Money?

The revenue streams and monetization strategies of SK Company are multifaceted, reflecting its status as a holding company with diverse interests. The company's financial performance is driven by a combination of dividends, brand royalties from its subsidiaries, and profits from direct investments. Understanding the contributions of its key subsidiaries, such as SK Innovation and SK Telecom, is crucial to grasping its overall revenue model.

A substantial portion of SK Group's revenue is generated through its subsidiaries across various sectors. SK subsidiaries like SK Innovation and SK Telecom are major contributors, with SK Innovation reporting KRW 77.289 trillion in revenue in 2023. SK Telecom, in the same year, reported KRW 17.518 trillion, demonstrating the significance of the ICT sector. The biopharmaceutical segment, through companies like SK Biopharmaceuticals, also plays a vital role, contributing through drug sales and licensing agreements.

Monetization strategies include product sales, service fees, licensing agreements, and strategic investments. The company leverages its intellectual property, particularly in biopharmaceuticals and technology. Strategic investments in startups and venture funds offer potential capital gains. Furthermore, its focus on ESG initiatives influences monetization by attracting impact investors and securing favorable financing. The company's commitment to sustainability and long-term growth is evident in its shift towards advanced materials, biopharmaceuticals, and digital transformation services.

The primary revenue drivers for SK Corporation include dividends and brand royalties from its subsidiaries, and profits from direct investments. SK holdings employs various monetization strategies, including product sales, service fees, licensing agreements, and strategic investments. The company's focus on ESG initiatives also influences its monetization, attracting impact investors and securing favorable financing. For more information about SK Company's target market, you can read this article: Target Market of SK.

- SK Group's revenue is diversified across sectors like energy, telecommunications, and biopharmaceuticals.

- SK Innovation's revenue in 2023 was KRW 77.289 trillion, with a growing battery business.

- SK Telecom's revenue in 2023 was KRW 17.518 trillion, with enterprise solutions showing growth.

- The company focuses on licensing agreements and strategic investments for monetization.

SK PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SK’s Business Model?

The evolution of SK Inc. is marked by significant key milestones and strategic moves that have shaped its current operational and financial landscape. A pivotal shift has been its aggressive push into new growth engines, notably biopharmaceuticals and advanced materials. This expansion has allowed SK Inc. to diversify its portfolio and reduce reliance on traditional sectors.

SK Inc. has also faced operational and market challenges, including global economic downturns, supply chain disruptions, and intense competition. To navigate these complexities, SK Group, including SK Inc., has emphasized 'deep change' – a strategic imperative to innovate and transform its business models, focusing on sustainability and digital transformation. This includes significant investments in AI, big data, and cloud technologies across its subsidiaries to enhance operational efficiency and develop new services.

SK Inc.'s competitive advantages are multifaceted. Its strong brand strength, built over decades, provides a significant edge in various markets. Technology leadership, particularly in semiconductors through SK Hynix and in battery technology through SK On (a subsidiary of SK Innovation), is a core differentiator. Economies of scale, derived from its vast operational footprint and diversified businesses, allow for cost efficiencies and competitive pricing. Furthermore, its robust ecosystem, comprising numerous subsidiaries and strategic partnerships, creates synergistic effects, enabling cross-selling opportunities and integrated solutions. The company continuously adapts to new trends by actively pursuing mergers and acquisitions, fostering internal innovation, and collaborating with global partners to stay at the forefront of technological advancements and market shifts.

SK Biopharmaceuticals' successful development and FDA approval of new drugs, such as XCOPRI (cenobamate) for partial-onset seizures, is a major milestone. SK Siltron's expansion in silicon carbide (SiC) wafer manufacturing is another key strategic move. These moves establish a strong foothold in the global market.

The company has focused on 'deep change' to innovate and transform its business models, focusing on sustainability and digital transformation. SK Inc. invests heavily in AI, big data, and cloud technologies across its subsidiaries. These investments aim to enhance operational efficiency and develop new services.

SK Inc. benefits from its strong brand strength, built over decades, providing a significant edge. Technology leadership, especially in semiconductors through SK Hynix and in battery technology through SK On, is a core differentiator. The company's robust ecosystem creates synergistic effects.

SK Inc. has faced challenges, including global economic downturns and supply chain disruptions. Intense competition in various sectors also poses a significant challenge. The company adapts by actively pursuing mergers and acquisitions and fostering internal innovation.

SK Inc.'s strategic advantages include strong brand recognition and technological leadership. Its diversified business model and robust ecosystem contribute to its competitive edge. These factors enable the company to navigate market complexities effectively.

- Strong brand strength and market presence.

- Technological leadership in semiconductors and battery technology.

- Economies of scale and cost efficiencies.

- Robust ecosystem with synergistic effects.

- Adaptability through M&A and innovation.

To gain a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of SK. This analysis provides insights into how SK Company operates its businesses and its position relative to competitors.

SK Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SK Positioning Itself for Continued Success?

As the holding company of SK Group, a major South Korean conglomerate, SK Inc. holds a strong industry position. Its subsidiaries are leaders in their respective sectors. For example, SK Hynix is a global leader in memory semiconductors, and SK Innovation is a significant player in energy and petrochemicals. The company’s customer loyalty is supported by the established brands of its subsidiaries and its dedication to quality and innovation. Its reach is worldwide, with operations and investments across continents, especially in Asia, North America, and Europe.

Despite its strong standing, SK Inc. faces several risks. These include regulatory changes, intense competition, technological disruption, changing consumer preferences, and geopolitical uncertainties. These factors can impact its financial performance and supply chains.

SK Inc. benefits from the strong market positions of its subsidiaries. SK Hynix, for instance, is a key player in the global semiconductor market. SK Innovation is significant in the energy and petrochemical sectors. The Growth Strategy of SK involves leveraging these positions for further expansion.

SK Inc. faces risks from regulatory changes, especially in environmental regulations, impacting energy and chemical businesses. Competition from global players and startups also pressures innovation. Technological disruptions, like AI and quantum computing, require continuous R&D investment. Changing consumer preferences, such as the shift to EVs, pose risks.

The future outlook for SK Inc. is shaped by its strategic focus on 'deep change' and 'ESG management'. The company is investing in 'Green Business' and 'Bio Business' for growth. Leadership is committed to sustainable growth, digital transformation, and global expansion through partnerships and M&A activities.

SK Inc.'s business model is diversified, with a focus on high-growth sectors. It leverages its technological capabilities and global presence. The company aims to generate revenue by diversifying its portfolio further into high-growth, high-value-added sectors. This approach emphasizes environmental and social responsibility.

SK Inc. is actively pursuing strategic initiatives to drive future growth. These initiatives include significant investments in green and bio businesses, focusing on areas like battery production and biopharmaceuticals. The company is also focused on sustainable growth and digital transformation across its business units.

- Investments in Green Business: Expanding battery production capacity and developing advanced materials.

- Bio Business Expansion: Advancing biopharmaceutical pipelines and research.

- Digital Transformation: Implementing digital solutions across all business units to improve efficiency.

- Global Expansion: Strengthening its global presence through strategic partnerships and M&A activities.

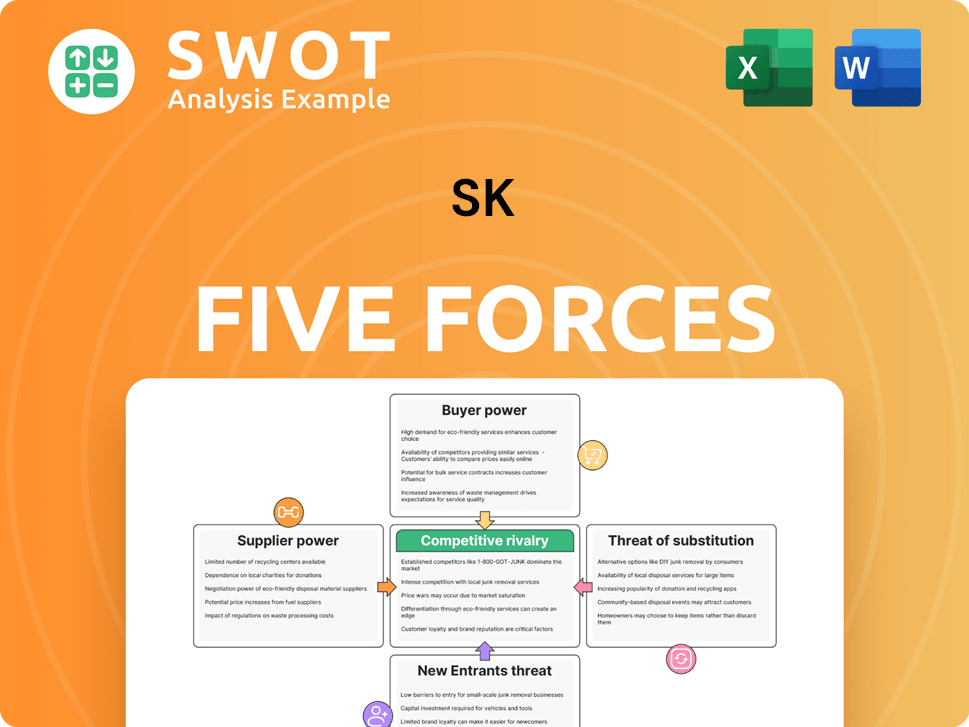

SK Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SK Company?

- What is Competitive Landscape of SK Company?

- What is Growth Strategy and Future Prospects of SK Company?

- What is Sales and Marketing Strategy of SK Company?

- What is Brief History of SK Company?

- Who Owns SK Company?

- What is Customer Demographics and Target Market of SK Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.