SK Bundle

Who Really Controls SK Company?

Understanding who owns a company is crucial for investors, analysts, and anyone interested in its future. From its humble beginnings in 1953 as Sunkyong Textiles Ltd., SK Group has transformed into a global powerhouse. This exploration unveils the intricate SK SWOT Analysis of SK Company ownership, its evolution, and the key players shaping its destiny.

Delving into the SK Group owner structure reveals a complex web of holdings and influence, critical for understanding strategic decisions. Knowing who controls SK is vital for assessing risk and opportunity in the dynamic market. The ownership structure of SK Corporation, and SK holdings, directly impacts its performance and future trajectory, making this analysis essential for informed decision-making. The SK Group's history and background is key to understanding its current position.

Who Founded SK?

The story of SK Group, and therefore the question of 'Who owns SK Company?', begins with its founder, Chey Jong-gun. He acquired Sunkyong Textiles in 1953, setting the stage for what would become a major South Korean conglomerate. His initial focus on textiles, driven by post-Korean War demand, laid the groundwork for the company's future expansion and diversification.

Chey Jong-gun's vision emphasized vertical integration, a strategy that proved crucial in shaping SK Group's growth. This approach allowed the company to control various stages of production, enhancing efficiency and competitiveness. After Chey Jong-gun's passing in 1973, his brother, Chey Jong-hyon, took over leadership, further solidifying the family's influence.

Chey Jong-hyon played a pivotal role in transforming the company. He expanded its scope significantly. This included a strategic move into the energy sector, which would later become a core part of the group's business. He also initiated the 'From Petroleum to Fibers' strategy, which involved expanding into areas like polyester film production through SKC Company in 1976.

The acquisition of Sunkyong Textiles in 1953 by Chey Jong-gun marked the formal beginning of the SK Group.

Chey Jong-hyon took over leadership of the company in 1973 after his brother's passing. He was crucial in the company's expansion.

The 'From Petroleum to Fibers' strategy started in 1975, which saw the company expand into polyester film production through SKC Company in 1976.

The purchase of Korea Oil Corporation in 1980 (later renamed Yukong and then SK Innovation) was a major step in the company's growth.

From the beginning, the Chey family's control established a chaebol structure.

The company's strategy of vertical integration played a key role in its success.

The 1980 acquisition of Korea Oil Corporation, later renamed Yukong, was a landmark move. This acquisition, with Chey Jong-hyon at the helm, propelled the group to become a leading conglomerate in South Korea. While specific details about the initial equity splits or shareholding percentages are not readily available in public records, the succession within the Chey family clearly established a family-controlled chaebol structure from the early days. The current Target Market of SK includes a wide range of industries, reflecting the company's diversified business model. This diversification, a result of strategic decisions made by the early leadership, has been a key factor in the company's long-term success and its current market capitalization.

Understanding the early ownership of SK Group is crucial to understanding its current structure. Here are some key points:

- Chey Jong-gun founded the company with the acquisition of Sunkyong Textiles in 1953.

- Chey Jong-hyon expanded the business significantly, especially in the energy sector.

- The Chey family's control established a chaebol structure from the start.

- The acquisition of Korea Oil Corporation was a major strategic move.

- Vertical integration was a key strategy from the beginning.

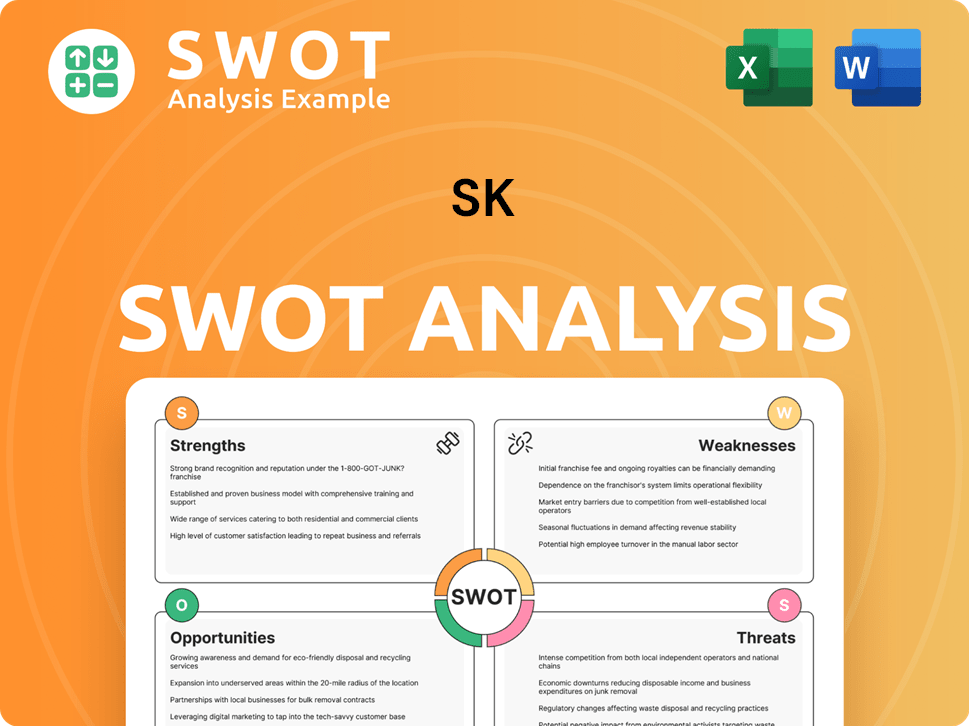

SK SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has SK’s Ownership Changed Over Time?

The ownership structure of SK Inc. has evolved significantly since its establishment. Initially formed in 2007 as the holding company of SK Group, following a restructuring of SK Corporation, the move aimed to enhance corporate transparency and governance after a dispute with Sovereign Asset Management in 2003. This reorganization marked a pivotal shift in the company's structure, setting the stage for future ownership changes and strategic realignments.

A key event impacting the ownership structure was the merger of SK Innovation and SK E&S Co. Ltd. in November 2024. This consolidation boosted SK Inc.'s stake in SK Innovation, reflecting a strategic move to bolster the subsidiary's operations, especially in the crucial EV battery sector. This strategic shift underscores the company's focus on strengthening its core business areas and streamlining its corporate structure.

| Shareholder | Equity Ownership (as of December 31, 2024) | Notes |

|---|---|---|

| Tae-won Chey | 17.90% | Largest individual shareholder |

| National Pension Service of Korea | 7.61% | Significant institutional investor |

| Ki-won Choi | 6.65% | Key shareholder |

As of December 31, 2024, the major shareholders of SK Inc. include Tae-won Chey with 17.90%, the National Pension Service of Korea with 7.61%, and Ki-won Choi with 6.65%. The largest shareholders and related parties collectively hold 25.5% of SK Inc.'s shares. SK Inc. holds a substantial 55.91% stake in SK Innovation Co., Ltd. as of December 31, 2024, a rise from 34.45% in 2023. SK Square holds 20.1% of SK Hynix's common stock as of March 27, 2025. These ownership dynamics significantly influence the company's strategic direction and operational decisions.

Understanding the dynamics of SK Company ownership is crucial for investors and stakeholders. The ownership structure is shaped by key shareholders and strategic mergers.

- Tae-won Chey is the largest individual shareholder.

- The National Pension Service of Korea is a significant institutional investor.

- Mergers, like the one with SK E&S, have reshaped ownership stakes.

- SK Inc. strategically supports its subsidiaries, like SK Innovation.

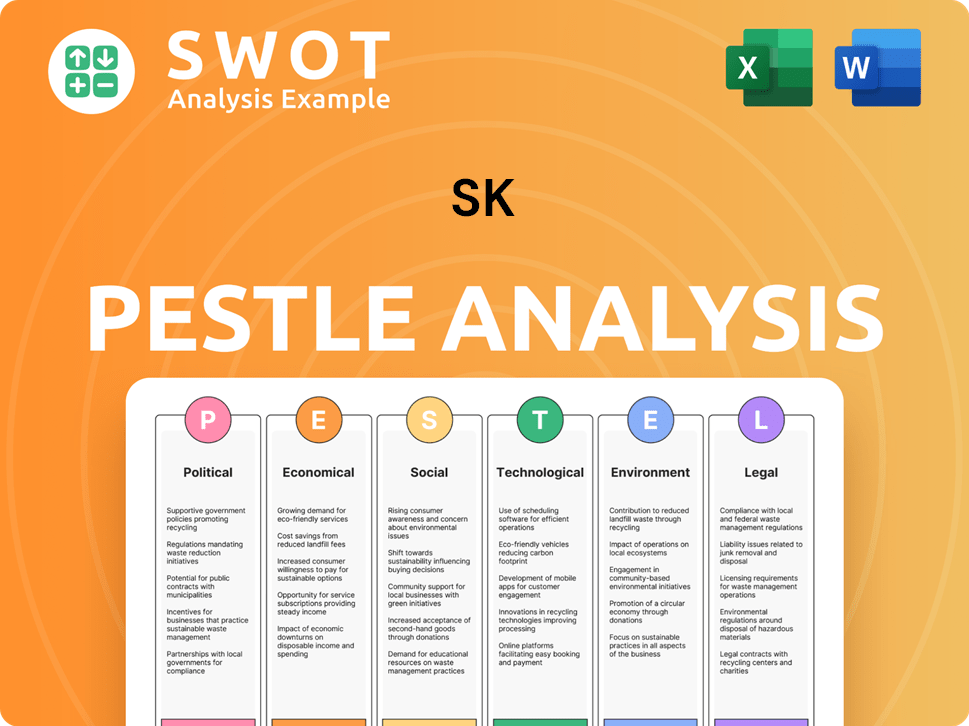

SK PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on SK’s Board?

As of March 26, 2025, the board of directors of SK Inc. comprises both executive and independent directors. The executive directors include CEO Chey Tae-won, CEO Jang Yong-ho, and Director Kang Dong-soo. Chey Tae-won, serving as Chairman and CEO of SK Inc., also holds chairman positions at SK Hynix and SK Innovation. Jang Yong-ho is the CEO and Representative Director of SK Inc.

Independent directors on the board include Lee Kwan-young and Jeong Jong-ho, with Yoon Chi-won appointed on March 27, 2024, and Pak Hyun Ju Helen on March 29, 2023. These independent directors often serve on critical committees like the Audit, Compensation, and Governance Committees. Understanding the Marketing Strategy of SK is crucial to grasping the company's overall direction.

| Director | Title | Date of Appointment |

|---|---|---|

| Chey Tae-won | Chairman and CEO | N/A |

| Jang Yong-ho | CEO and Representative Director | N/A |

| Kang Dong-soo | Director | N/A |

| Lee Kwan-young | Independent Director | N/A |

| Jeong Jong-ho | Independent Director | N/A |

| Yoon Chi-won | Independent Director | March 27, 2024 |

| Pak Hyun Ju Helen | Independent Director | March 29, 2023 |

The voting structure of SK Inc. generally follows a one-share-one-vote principle for common stock. However, the concentration of ownership by Chairman Chey Tae-won and related parties, who collectively hold 25.5% of the shares, provides them with significant control. For instance, in the case of SK Hynix, SK Square, as the major shareholder, holds 20.1% of the common stock and associated voting power. Recent governance discussions within SK Group have revolved around corporate restructuring and efforts to enhance financial stability, which can impact decision-making.

Understanding who controls SK is essential for investors and stakeholders alike. The board of directors includes both executive and independent members, ensuring a balance of internal leadership and external oversight.

- Chey Tae-won, as Chairman and CEO, holds significant influence.

- Independent directors provide crucial oversight through key committees.

- The Chey family's ownership concentration gives them substantial control.

- Corporate restructuring and financial stability are ongoing priorities.

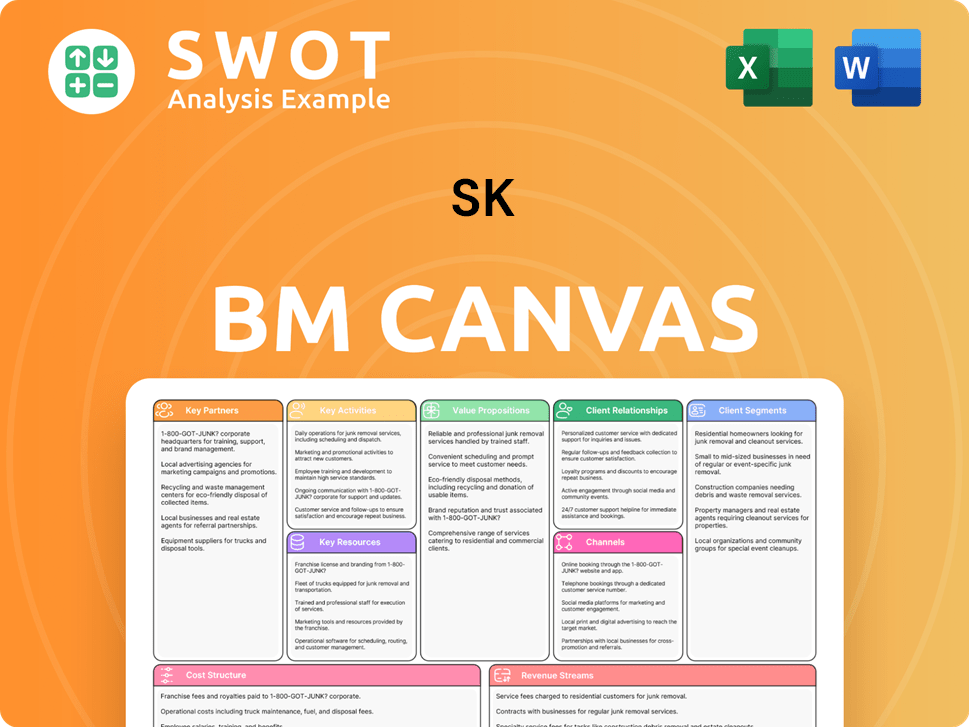

SK Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped SK’s Ownership Landscape?

Over the past few years, the ownership structure of SK Group, often referred to as SK Corporation or SK holdings, has undergone significant shifts. These changes are largely driven by strategic restructuring, market dynamics, and leadership adjustments. A major move was the merger of SK Innovation and SK E&S Co. Ltd. in November 2024. This increased SK Inc.'s stake in SK Innovation to 56%, up from 36%, aiming to stabilize and diversify the business, especially given challenges faced by its EV battery unit. Understanding Revenue Streams & Business Model of SK can provide further insights into these strategic shifts.

SK Group, the primary SK Group owner, is also focusing on artificial intelligence (AI) and semiconductors, planning to invest approximately 106.4 trillion won (around $77 billion) in these areas through 2028. This strategic pivot is part of a broader 'New SK Declaration' to transform the conglomerate. Recent leadership changes, including appointments in December 2024, reflect this focus, with new presidents named for SK Discovery and SK Hynix. The group has also been actively divesting non-core assets to bolster its financial position.

| Key Development | Details | Impact |

|---|---|---|

| Merger of SK Innovation and SK E&S | Completed in November 2024 | Increased SK Inc.'s ownership in SK Innovation to 56% |

| AI and Semiconductor Investment | Planned investment of 106.4 trillion won by 2028 | Strategic shift towards core profitable businesses |

| Asset Divestitures | SK Networks sold its rental car unit; talks to sell SK Siltron | Enhances financial strength |

In August 2024, SK Networks sold its rental car unit for 820 billion won (approximately US$618 million). Furthermore, SK Inc. is in discussions to sell SK Siltron, its semiconductor wafer subsidiary, potentially valued in the mid-3 trillion won range. These ongoing asset sales and restructuring efforts are anticipated to continue into 2025, with the chemical and energy sectors leading M&A activity in South Korea. These moves are crucial in understanding who controls SK and the company’s future direction.

SK Group has been actively restructuring its ownership to streamline operations and focus on key growth areas like AI and semiconductors. This includes mergers and strategic divestitures.

The company is making significant investments in AI and semiconductors, totaling approximately $77 billion by 2028. This is a major strategic shift.

Recent leadership appointments reflect the group's strategic direction, with new presidents appointed across key subsidiaries. This indicates a focus on technological advancement.

SK Group is divesting non-core assets, such as its rental car unit and potentially SK Siltron, to improve financial health and streamline operations.

SK Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SK Company?

- What is Competitive Landscape of SK Company?

- What is Growth Strategy and Future Prospects of SK Company?

- How Does SK Company Work?

- What is Sales and Marketing Strategy of SK Company?

- What is Brief History of SK Company?

- What is Customer Demographics and Target Market of SK Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.