SK Bundle

How Does SK Company Navigate its Competitive Arena?

SK Inc., the powerhouse behind SK Group, is a major player in the global market, but who are its biggest challengers? Its strategic investments in biopharmaceuticals and advanced materials signal a bold move to stay ahead. Understanding the SK SWOT Analysis is key to grasping its position.

This exploration delves into the SK Company competitive landscape, providing a detailed SK Group competition analysis. We'll identify SK business rivals and assess their impact on SK's market position. Furthermore, we'll examine SK Company's key competitors in the energy sector and tech industry, offering a comprehensive SK Group industry position overview and a look at SK Company's market share analysis.

Where Does SK’ Stand in the Current Market?

SK Inc. operates as a holding company, and its market position is best understood through the collective strength and strategic positioning of its diverse subsidiaries across various industries. Its influence is evident through the leading positions held by its key affiliates. For example, SK Hynix is a global leader in the semiconductor memory market, holding a significant share in both DRAM and NAND flash memory, which are critical components in the digital economy.

The company's primary product lines and services are highly diversified, encompassing semiconductors, petrochemicals, refined petroleum products, telecommunications services, and increasingly, biopharmaceuticals and advanced materials. Geographically, SK Group has a strong presence in Asia, particularly South Korea, China, and Southeast Asia, while also expanding its footprint in North America and Europe, especially in the battery and biopharmaceutical sectors. SK Inc. has strategically shifted its positioning, moving beyond traditional heavy industries to embrace digital transformation and diversification into high-growth, technology-intensive areas.

The company's financial health is robust, with its consolidated revenue for 2023 reported at 184.8 trillion Korean Won (approximately 138 billion USD), reflecting its substantial scale compared to industry averages for diversified conglomerates. Its strategic focus on optimizing its portfolio companies and investing in future-oriented businesses aims to enhance its long-term financial performance and market standing. For more information about the company, you can read about Owners & Shareholders of SK.

The SK Group competition is intense across its diverse sectors. In semiconductors, SK Hynix faces strong competition from companies like Samsung Electronics and Micron Technology. In the telecommunications sector, SK Telecom competes with KT Corporation and LG Uplus.

SK Group market share analysis reveals varying positions across its subsidiaries. SK Hynix holds a significant share in the global DRAM market. SK Telecom maintains a dominant position in South Korea's mobile market. SK Innovation's market share varies by sector, with strong positions in refining and battery technology.

SK Company's competitive advantages include its diversified portfolio, technological innovation, and strategic investments. The company benefits from its strong presence in the South Korean market and its global expansion efforts. Its focus on future-oriented businesses, such as AI and sustainable energy, strengthens its position.

SK business rivals include Samsung Electronics, KT Corporation, and other global players. SK Group's competitive strategy involves innovation, strategic partnerships, and expansion into high-growth sectors. The company focuses on optimizing its portfolio and investing in emerging technologies to maintain its competitive edge.

SK Company's market positioning strategy involves a multi-faceted approach. This includes strengthening its core businesses, expanding into new markets, and investing in future-oriented technologies. The company aims to enhance its long-term financial performance and market standing through strategic initiatives.

- Focus on sustainable energy solutions and renewable energy projects.

- Strategic partnerships to enhance technological capabilities.

- Investments in AI, big data, and other digital transformation initiatives.

- Geographic expansion, particularly in North America and Europe.

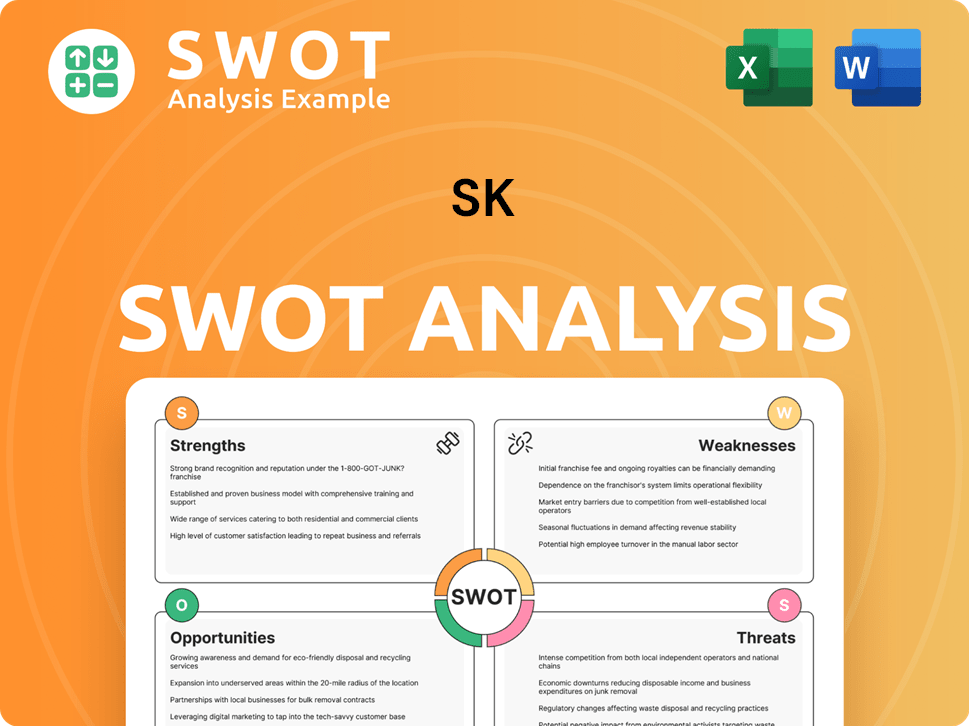

SK SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging SK?

The competitive landscape for SK Inc. is complex, spanning diverse sectors where it faces numerous rivals. Understanding the SK Company competitive landscape requires a sector-by-sector analysis, as the company's subsidiaries compete against both domestic and international players. The company's market position is constantly evolving due to technological advancements, market dynamics, and strategic initiatives by both SK and its competitors. This overview provides a detailed look at the key competitors across SK's main business areas.

SK Group competition is fierce, with each subsidiary battling for market share and innovation leadership. The competitive dynamics are shaped by global trends, regulatory environments, and the strategic decisions of both SK and its competitors. The company's ability to adapt and innovate is crucial in maintaining its competitive edge. An in-depth SK Company market analysis reveals the challenges and opportunities within each sector.

SK Inc., as a holding company, has a diverse portfolio, leading to a complex competitive environment. The following sections detail the key competitors in each of SK's major business areas, providing an SK competitors overview.

In the semiconductor industry, SK Hynix faces direct competition from global giants. These companies compete through aggressive pricing, rapid technological advancements, and substantial R&D investments. For example, in 2024, Samsung invested heavily in expanding its memory chip production capacity.

Samsung Electronics is a major competitor, holding a dominant position in DRAM and NAND flash memory. Micron Technology is another significant player, focusing on high-performance solutions. These companies challenge SK Hynix through technological innovation and production capacity.

Competitors employ strategies such as aggressive pricing, rapid technological advancements, and substantial R&D investments. For instance, Samsung's aggressive pricing strategies in 2024 impacted the profitability of other memory chip manufacturers. Micron focuses on high-performance solutions.

The memory market is highly dynamic, with rapid technological advancements and fluctuating demand. The increasing demand for data storage and processing drives competition. The global memory market was valued at approximately $130 billion in 2024.

R&D investments are critical for maintaining a competitive edge in the semiconductor industry. Companies continuously invest in developing advanced manufacturing processes and new memory technologies. SK Hynix's R&D spending in 2024 was approximately $4 billion.

Production capacity is a key factor in the semiconductor industry, with companies constantly expanding their manufacturing facilities. Samsung has the largest production capacity, followed by SK Hynix and Micron. Samsung's production capacity increased by 15% in 2024.

SK Innovation competes with major international oil companies and chemical producers. Competition is intense in refining capacity, product diversification, and sustainable energy solutions. The EV battery sector is particularly competitive, with LG Energy Solution and CATL as prominent rivals. The energy sector's transition towards sustainability has intensified the competition.

- Key Competitors: Major international oil companies like Saudi Aramco and ExxonMobil, and chemical producers such as LG Chem and Hanwha TotalEnergies Petrochemical.

- Competitive Strategies: Refining capacity, product diversification, and advancements in sustainable energy solutions, including battery technology.

- Market Dynamics: The global energy market is undergoing significant shifts due to the transition to renewable energy sources. The demand for electric vehicle batteries is rapidly increasing.

- EV Battery Sector: LG Energy Solution and CATL are prominent rivals. The global EV battery market is projected to reach $300 billion by 2027.

- Sustainability Focus: Companies are investing heavily in renewable energy and sustainable practices. SK Innovation has increased its investment in green technologies by 20% in 2024.

SK Telecom faces strong domestic competition from KT and LG Uplus. These companies compete on network quality, service innovation, and subscriber acquisition strategies. The 5G market is a key battleground, with companies investing heavily in infrastructure and marketing. The telecommunications sector is characterized by rapid technological advancements and intense competition.

- Key Competitors: KT and LG Uplus.

- Competitive Strategies: Network quality, service innovation, and subscriber acquisition strategies.

- 5G Market: Fierce marketing campaigns for 5G services and bundled offerings. The 5G subscriber base in South Korea grew by 15% in 2024.

- Network Quality: Investments in network infrastructure are crucial for maintaining a competitive edge. KT and LG Uplus have been actively expanding their 5G coverage.

- Service Innovation: Companies are continuously introducing new services and features to attract and retain subscribers. Bundled offerings and value-added services are common.

SK Inc. and its affiliates compete with established global pharmaceutical companies, specialized biotech firms, and diversified chemical companies. The CDMO space is particularly competitive. The biopharmaceutical sector is driven by innovation and the demand for new therapies. The advanced materials segment is crucial for various industries, including electronics and automotive.

- Key Competitors: Major global pharmaceutical companies, specialized biotech firms, and diversified chemical companies. Samsung Biologics and Celltrion are prominent in the CDMO space.

- Competitive Strategies: Innovation in drug development, manufacturing capabilities, and strategic partnerships.

- CDMO Space: The contract development and manufacturing organization (CDMO) market is highly competitive, with companies vying for contracts from pharmaceutical companies.

- Emerging Players: New and emerging players are focusing on disruptive technologies. Mergers and alliances are reshaping the market.

- Market Dynamics: The biopharmaceutical market is experiencing rapid growth, driven by an aging population and the development of new therapies.

The competitive landscape for SK Inc. is dynamic, with constant shifts in market share and technological advancements. The company's ability to adapt and innovate is crucial for its long-term success. For further insights into the company's strategic direction, consider reading about the Marketing Strategy of SK.

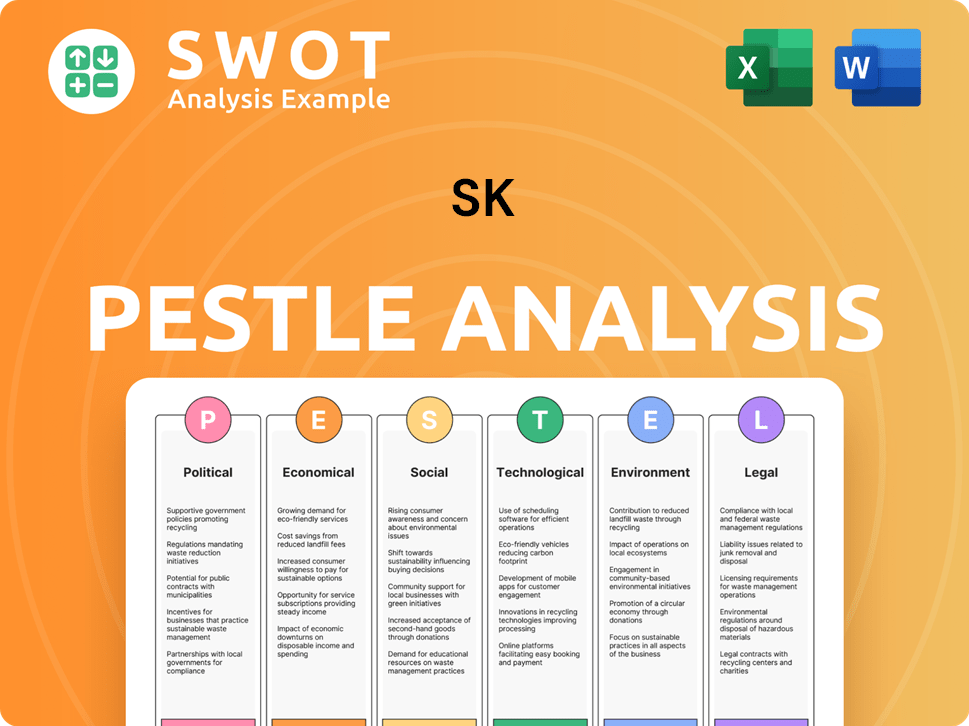

SK PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives SK a Competitive Edge Over Its Rivals?

The competitive landscape for SK Inc. is shaped by its diverse business interests and strategic positioning across several high-growth sectors. Understanding the SK Company competitive landscape requires an examination of its core strengths, including technological innovation, brand equity, and operational efficiency. These factors are critical in determining its ability to compete effectively against rivals in the global market.

SK Group competition is fierce, particularly in sectors like semiconductors, telecommunications, and energy. The company's ability to maintain and enhance its competitive advantages is central to its long-term success. Strategic moves such as acquisitions, partnerships, and investments in R&D are crucial for staying ahead of SK business rivals.

The company's competitive edge stems from its diversified portfolio, strategic vision, and financial stability. These elements enable it to capitalize on opportunities in various high-growth sectors. For example, SK Hynix's leadership in advanced memory semiconductors, including High Bandwidth Memory (HBM), is a key competitive advantage, particularly in the AI sector. This technological edge allows for superior product performance and often commands premium pricing. To further understand the business model, consider looking at the Revenue Streams & Business Model of SK.

SK Inc. benefits from proprietary technologies and intellectual property, particularly in advanced memory semiconductors through SK Hynix. This technological advantage enables superior product performance and premium pricing. Investments in R&D are critical for maintaining this edge.

Strong brand equity and customer loyalty across its subsidiaries, especially in South Korea, provide a significant competitive advantage. This is particularly evident in telecommunications (SK Telecom) and energy (SK Innovation). These loyal customers provide a stable base for the company.

Economies of scale, particularly in refining, petrochemicals, and semiconductor manufacturing, provide cost efficiencies. These efficiencies are difficult for smaller competitors to replicate. This allows for competitive pricing and higher profit margins.

Robust supply chain management, especially in securing raw materials for semiconductors and batteries, ensures operational stability. This mitigates supply risks. This is crucial for maintaining production and meeting market demands.

SK Inc.'s competitive advantages include its diverse business portfolio, strategic foresight, and a strong financial foundation. These advantages enable the company to navigate and capitalize on opportunities across high-growth sectors. The company's focus on sustainability and social value creation enhances its reputation and attracts top talent.

- Technological Leadership: SK Hynix's leadership in HBM for AI applications.

- Brand Strength: Strong brand equity in telecommunications and energy sectors.

- Operational Efficiency: Economies of scale in refining, petrochemicals, and semiconductor manufacturing.

- Supply Chain Resilience: Robust supply chain management for key materials.

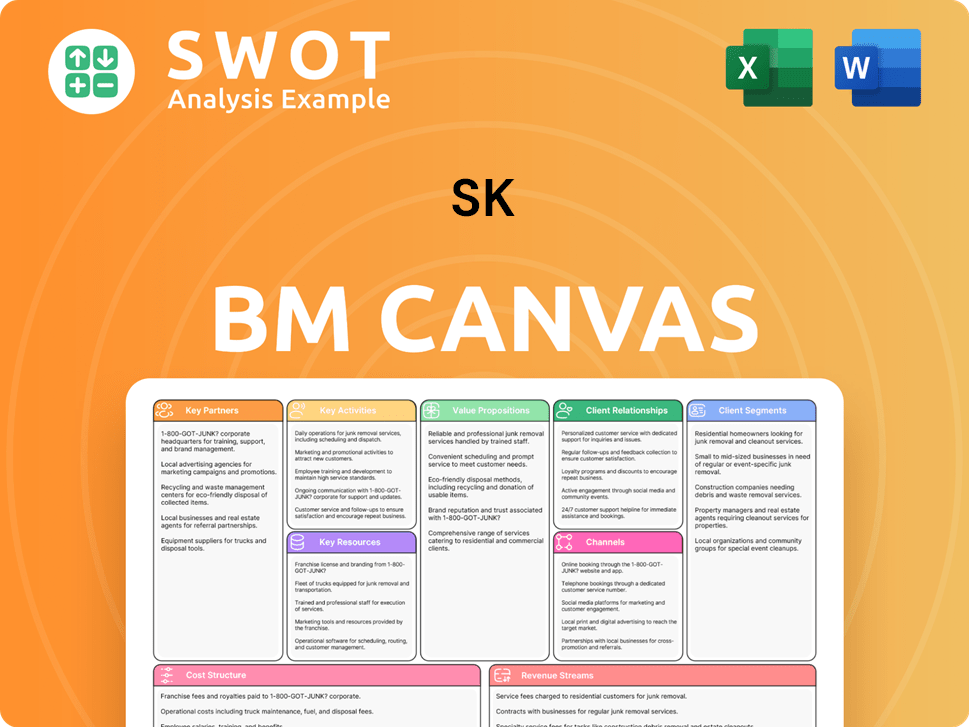

SK Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping SK’s Competitive Landscape?

The Brief History of SK Company and its competitive landscape are significantly shaped by industry trends, challenges, and opportunities. Technological advancements are a major driver, particularly in areas like artificial intelligence, advanced materials, and biotechnology. The company's ability to adapt to these changes and leverage its strengths will determine its future success.

SK Group's industry position is influenced by its diverse portfolio and strategic investments. The competitive landscape includes both established and emerging players, creating a dynamic environment. Understanding these factors is crucial for evaluating SK's long-term prospects.

Technological advancements, especially in AI, advanced materials, and biotechnology, are key drivers. Demand for high-bandwidth memory (HBM) for AI applications presents opportunities for SK Hynix. The shift towards sustainable energy solutions boosts the electric vehicle battery market for SK On.

Intense competition, particularly from Chinese manufacturers, poses a threat. Volatility in commodity markets affects the energy and chemical businesses. Geopolitical tensions and supply chain disruptions create risks. Rapid technological change requires continuous R&D investment.

Emerging markets, like Southeast Asia and North America, offer growth potential for battery and biopharmaceutical ventures. Product innovations, such as next-generation semiconductors, provide market leadership opportunities. Strategic partnerships are crucial for technology and geographic expansion.

SK Inc. is focusing on portfolio optimization and investing in growth engines such as AI and bio. Enhancing environmental, social, and governance (ESG) practices is a priority. The company aims to leverage its financial strength and innovation to adapt to future challenges.

SK Group's competitive landscape is characterized by a mix of established players and new entrants. The company's financial performance is closely tied to its ability to navigate market volatility and adapt to technological advancements. Strategic investments and partnerships are crucial for maintaining a competitive edge.

- Market Analysis: SK Group's diverse portfolio includes semiconductors (SK Hynix), energy and chemicals (SK Innovation), and telecommunications (SK Telecom).

- Competitive Advantages: Strong financial backing and a focus on innovation, especially in AI and sustainable technologies, give SK a competitive edge.

- Future Outlook: SK Company's future depends on its ability to capitalize on emerging markets and technologies while mitigating risks from competition and market volatility.

- Financial Performance: In 2024, SK Hynix reported a significant turnaround, with a focus on HBM demand. SK Innovation is investing in electric vehicle battery production.

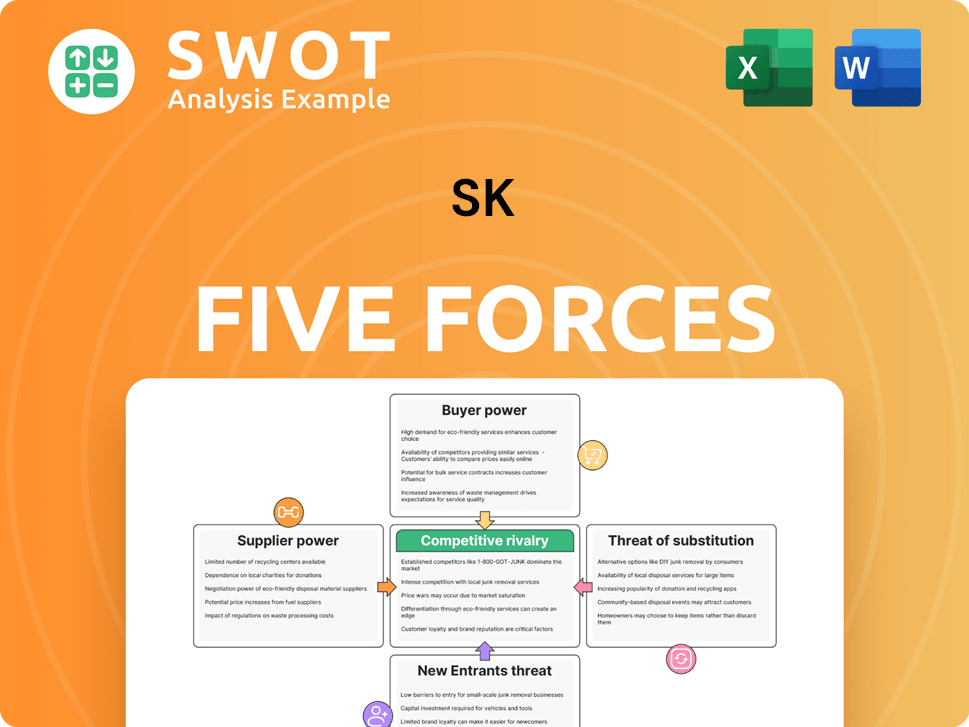

SK Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SK Company?

- What is Growth Strategy and Future Prospects of SK Company?

- How Does SK Company Work?

- What is Sales and Marketing Strategy of SK Company?

- What is Brief History of SK Company?

- Who Owns SK Company?

- What is Customer Demographics and Target Market of SK Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.