Superior Energy Services Bundle

How has Superior Energy Services shaped the oil and gas landscape?

Founded in 1989, Superior Energy Services (SES) quickly established itself as a key player in the energy services sector. Initially focused on meeting the needs of oil and gas companies, SES has evolved significantly. This Superior Energy Services SWOT Analysis will delve into the company's journey.

From its early years, Superior Energy Services has expanded its reach, offering specialized oilfield services and equipment across the globe. The company's history reflects a commitment to innovation and adaptation within the dynamic oil and gas industry. Understanding the brief history of Superior Energy Services company provides valuable insights into its current market position and future prospects.

What is the Superior Energy Services Founding Story?

The story of Superior Energy Services (SES) began in 1989 with Terence Hall, a Louisiana native. While the precise founding date isn't widely available, the roots of the company can be traced back to April 1991, with the incorporation of Small's Oilfield Services Corp., a precursor to SES.

The initial vision was to address the need for specialized services and equipment within the oil and gas industry. The focus was on supporting the drilling, completion, and production needs of oil and gas companies. This early focus laid the groundwork for what would become a significant player in the energy services sector.

In 1995, Small's Oilfield Services Corp. acquired Superior in a reverse merger, giving rise to Superior Energy Services. This strategic move was a pivotal moment in the history of SES. The company's original business model centered on providing well intervention services, marine services, and rental tools, particularly in the Gulf of Mexico.

The early offerings included pressure control equipment, specialty tubular goods, and liftboats, which are self-propelled, self-elevating work platforms. The initial public offering (IPO) in 1995 marked a significant milestone, with the company listing on the New York Stock Exchange.

- 1989: Founded by Terence Hall.

- April 1991: Small's Oilfield Services Corp. was incorporated.

- 1995: Small's Oilfield Services Corp. acquired Superior through a reverse merger, forming Superior Energy Services.

- 1995: Initial Public Offering (IPO) on the New York Stock Exchange.

Terence Hall remained CEO until 2010, guiding the company through its formative years and establishing its presence in the energy services market. The company's early focus on the Gulf of Mexico positioned it to capitalize on the region's significant oil and gas activity. While specific details about the initial funding sources are not widely publicized, the IPO in 1995 provided capital for expansion and growth.

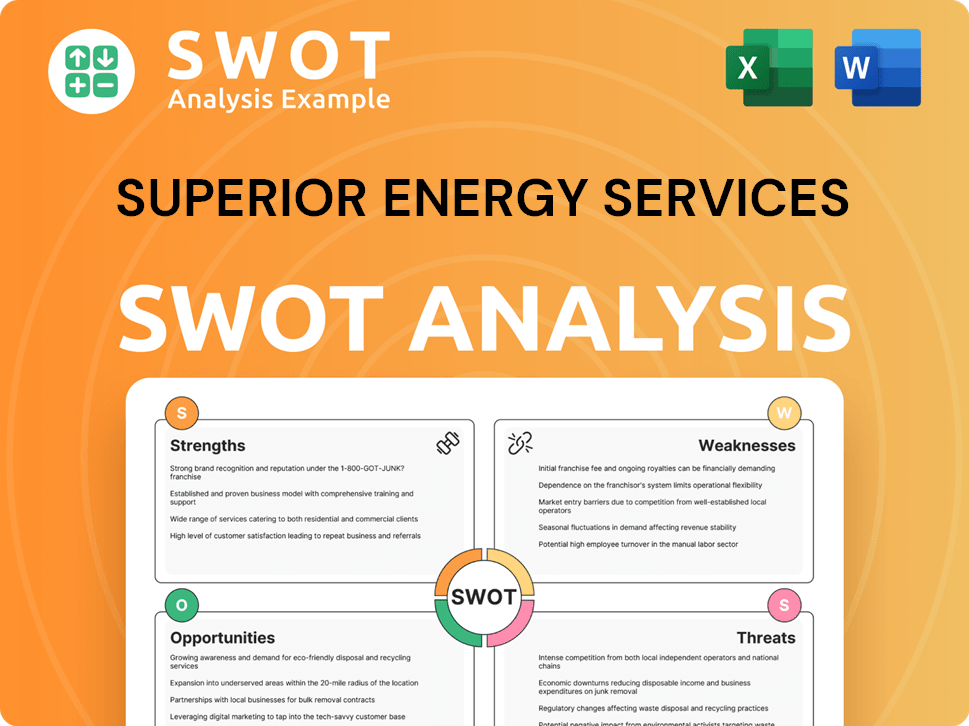

Superior Energy Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Superior Energy Services?

The early years of Superior Energy Services were marked by substantial growth, largely fueled by strategic acquisitions and the expansion of its service offerings. This period saw the company rapidly increase its presence in the energy services sector. These moves significantly broadened the company's capabilities and market reach within the oil and gas industry.

In 1997, Superior Energy Services reported revenues of $54.3 million, demonstrating early financial success. The company also achieved a net income of $9.5 million, indicating profitability during its initial growth phase. This financial performance laid the groundwork for future expansion and acquisitions.

A significant acquisition in 1999 was Cardinal Holdings Corp., a liftboat company. This acquisition was pivotal as it enhanced Superior Energy Services' capacity to provide a wider array of oilfield services. The addition of liftboats expanded the company's operational capabilities.

In 2000, the company further expanded its liftboat fleet by acquiring six vessels from Trico Marine Services, Inc. for $14 million. This brought the total number of liftboats to 48, significantly increasing its operational capacity. This expansion was a key step in solidifying its market position.

The early 2000s were marked by continued expansion through strategic acquisitions. In 2001, Superior Energy Services acquired Power Offshore Service and Reeled Tubing for $80.5 million, adding liftboats, coiled tubing units, and nitrogen units. Simultaneously, it acquired Workstrings, LLC, and Technical Limited Drillstrings, Inc., expanding its rental tubulars and accessories business.

Another significant acquisition was the $25 million purchase of Sub-Surface Tools, Inc. This acquisition specialized in the rental of tubulars and pressure control equipment. These acquisitions were crucial for expanding its service offerings.

By 2001, the company had doubled its sales to $257.5 million, reflecting the impact of its acquisitions. A net income of $18.3 million was also reported, indicating strong financial growth. These figures highlight the successful integration and strategic impact of the acquisitions.

These strategic acquisitions allowed Superior Energy Services to increase its exposure to the production side of the oil and gas industry. This diversification was a key element of its growth strategy. The company began acquiring mature shallow water oil and gas properties to develop remaining reserves and manage well decommissioning.

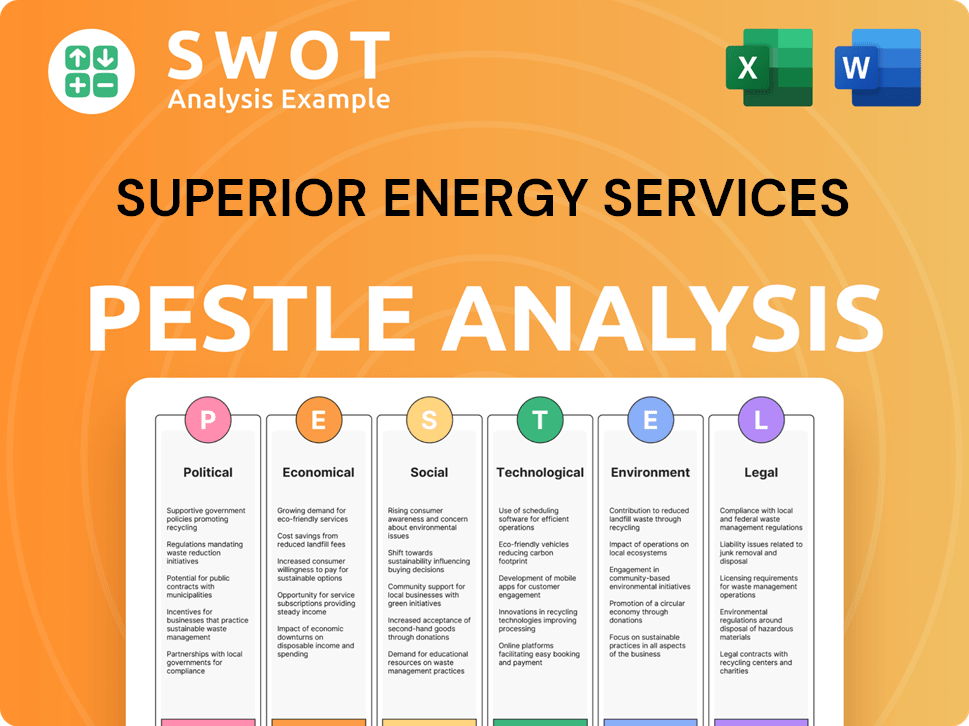

Superior Energy Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Superior Energy Services history?

The Superior Energy Services company has a history marked by significant events. The company has adapted to the dynamic changes within the oil and gas industry, experiencing both periods of growth and times of financial restructuring.

| Year | Milestone |

|---|---|

| 2020 | Announced intent to file for Chapter 11 bankruptcy protection. |

| January 2021 | Restructuring plan approved by the court. |

| February 3, 2021 | Emergence from bankruptcy. |

| July 2021 | Divested Complete Energy Services. |

| 2024 | Leadership transition with Brian Moore stepping down and Dave Lesar appointed as CEO. |

| January 2025 | Acquisition of Rival Downhole Tools. |

| January 2025 | Appointment of Kyle O'Neill as Chief Financial Officer. |

| March 2025 | Appointment of Josh Shapiro as Vice President of Treasury and FP&A. |

| January 2025 | Announced plan to voluntarily suspend reporting obligations with the SEC. |

A key innovation for Superior Energy Services has been the development and deployment of specialized oilfield services and equipment. The company has a strong focus on technological advancements, as evidenced by its portfolio of patents.

Superior Energy Services has developed and deployed specialized oilfield services. These services cover the entire economic life cycle of oil and gas wells.

The company is involved in the development of specialized equipment. This equipment is used throughout the oil and gas industry.

Superior Energy Services holds a portfolio of patents. This shows the company's commitment to technological advancement.

One of the most significant challenges for Superior Energy Services was the financial restructuring in 2020 and 2021. The company's strategic shift away from U.S. land-based commodity services also represents a challenge.

In 2020, the company announced its intent to file for Chapter 11 bankruptcy protection. This was a major challenge for the company.

The company went through a restructuring process. This restructuring was approved in January 2021.

Superior Energy Services divested Complete Energy Services. This was part of a strategic shift away from U.S. land-based commodity services.

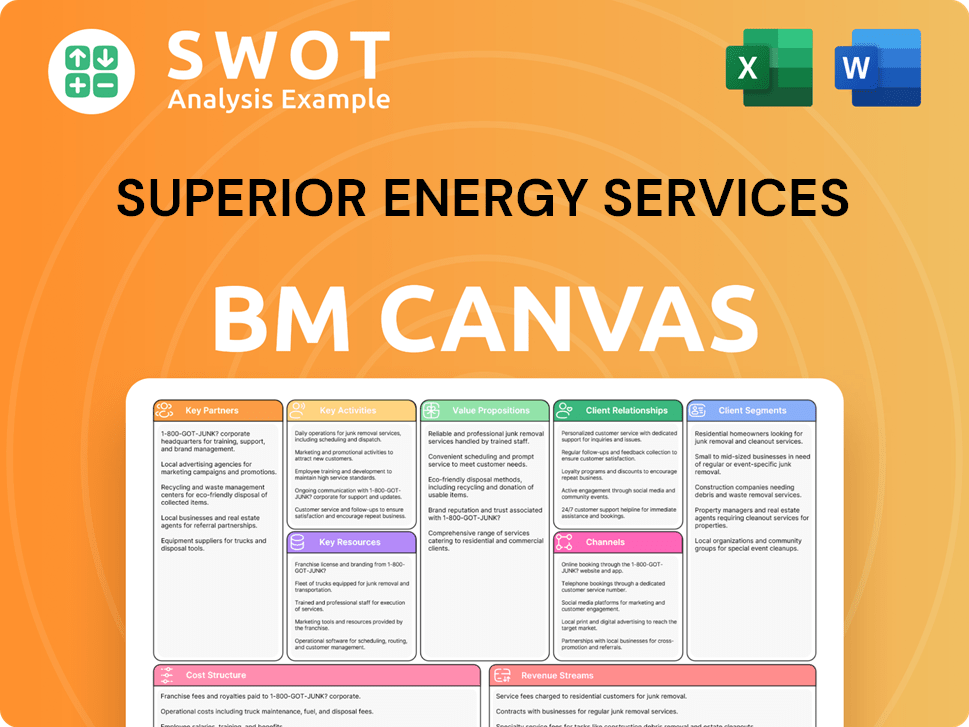

Superior Energy Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Superior Energy Services?

The Superior Energy history reflects significant shifts and strategic decisions within the energy services sector. Founded in 1989 by Terence Hall, the company has navigated market fluctuations and expanded its service offerings through acquisitions and strategic realignments. From its early days to its recent transition to a private entity, Superior Energy Services has demonstrated resilience and adaptability within the oil and gas industry.

| Year | Key Event |

|---|---|

| 1989 | Terence Hall founded Superior Energy Services. |

| 1991 | Small's Oilfield Services Corp., a predecessor, was incorporated. |

| 1995 | Small's acquired Superior in a reverse merger, leading to the company's public listing on the NYSE. |

| 1999 | Cardinal Holdings Corp. was acquired, enhancing liftboat capabilities. |

| 2001 | Significant service offerings and rentals expanded through the acquisition of Power Offshore Service, Reeled Tubing, Workstrings, LLC, and Technical Limited Drillstrings, Inc. |

| 2010 | David Dunlap replaced Terence Hall as CEO. |

| 2020 | The company announced its intent to file for Chapter 11 bankruptcy. |

| 2021 | Superior Energy Services emerged from Chapter 11 bankruptcy and sold Complete Energy Services. |

| August 2024 | Brian Moore stepped down as President and CEO, and Dave Lesar was appointed. |

| October 2024 | Superior Energy Services reported third-quarter 2024 results, with revenue of $197.31 million and net income of $21.92 million. |

| December 2024 | The company announced plans to suspend SEC reporting obligations as part of a 'going private' transaction. |

| January 2025 | Kyle O'Neill was appointed Chief Financial Officer, and stock split ratios for the 'going private' transaction were announced. |

| February 2025 | Acquisition of Rival Downhole Tools expanded its downhole drilling tools portfolio. |

| March 2025 | Josh Shapiro joined as Vice President of Treasury and FP&A. |

| May 2025 | Neil Fletcher was appointed Senior Vice President of Business Development. |

Superior Energy Services is focused on building its competitive advantage. This includes strategically deploying capital for growth. The company is committed to maintaining a framework of excellence, safety, and sustainability. The company's vision includes empowering its portfolio of brands to achieve market leadership.

The company is concentrating on specialized oilfield services and equipment. Key areas of focus include the U.S. Gulf Coast, Permian Basin, and other North American shale plays. The acquisition of Rival Downhole Tools in February 2025 demonstrates its commitment to expanding its position in key product lines.

In October 2024, Superior Energy Services reported revenue of $197.31 million. Net income for the same period was $21.92 million. The company's transition to a private entity is a significant strategic move. These financial results reflect the company's performance during a period of strategic restructuring.

Superior Energy Services aims to serve the evolving needs of oil and gas companies. This is a continuation of the founding vision. The company's strategy remains aligned with serving the entire economic life cycle of wells. The company's focus is on specialized oilfield services and equipment.

Superior Energy Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Superior Energy Services Company?

- What is Growth Strategy and Future Prospects of Superior Energy Services Company?

- How Does Superior Energy Services Company Work?

- What is Sales and Marketing Strategy of Superior Energy Services Company?

- What is Brief History of Superior Energy Services Company?

- Who Owns Superior Energy Services Company?

- What is Customer Demographics and Target Market of Superior Energy Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.