Superior Energy Services Bundle

How Does Superior Energy Services Thrive in the Energy Sector?

Delving into the operational mechanics of Superior Energy Services SWOT Analysis unveils a critical player in the oil and gas services landscape. This company is a vital partner, focusing on specialized well services that boost hydrocarbon production and extend the life of oil and natural gas assets. Understanding the SES company's approach is paramount for anyone tracking the energy market's evolution.

Superior Energy Services, a key provider of energy solutions, offers services essential for exploration and production companies. The company's strategic focus on well services, intervention, workover, and abandonment activities positions it within crucial North American shale plays. As the energy sector evolves, grasping how the SES company operates and its financial performance becomes increasingly important for investors and industry stakeholders.

What Are the Key Operations Driving Superior Energy Services’s Success?

The SES company creates value by offering specialized oilfield services and equipment. These services are designed to improve well performance and extend the life of oil and gas assets. This includes services related to production, well intervention, and abandonment, all tailored to meet the specific needs of its clients.

The core operations of Superior Energy Services involve deploying advanced equipment and skilled personnel to well sites. This includes sophisticated tools for wellbore intervention and specialized rigs for workovers. The company focuses on helping clients optimize their output, address operational challenges, and comply with environmental regulations.

The company's supply chain is critical for ensuring the timely availability of specialized equipment and materials. Superior Energy Services strategically positions itself in major North American basins, like the Permian Basin and the U.S. Gulf Coast, to maintain close proximity to its clients. This localized approach, combined with its expertise, sets it apart from competitors.

The company provides a range of services including production-related services, well intervention, workover operations, and well abandonment activities. These services are designed to optimize well performance and extend asset life. This helps clients maximize the economic recovery of hydrocarbons.

The value proposition includes improved well productivity, reduced downtime, enhanced safety, and cost-effective management of mature assets. By providing essential services, Superior Energy Services helps clients manage their assets responsibly. This focuses on the entire well lifecycle.

In 2024, the oil and gas services sector saw significant activity, with companies focusing on efficiency and cost-effectiveness. Superior Energy Services likely adapted to these market dynamics, leveraging its expertise in well services. The company's strategic locations in key basins, such as the Permian Basin, allowed for quick responses to client needs.

- Focus on production-related services to optimize well output.

- Emphasis on well intervention and workover operations to extend asset life.

- Strategic supply chain management to ensure timely equipment availability.

- Commitment to helping clients comply with environmental regulations.

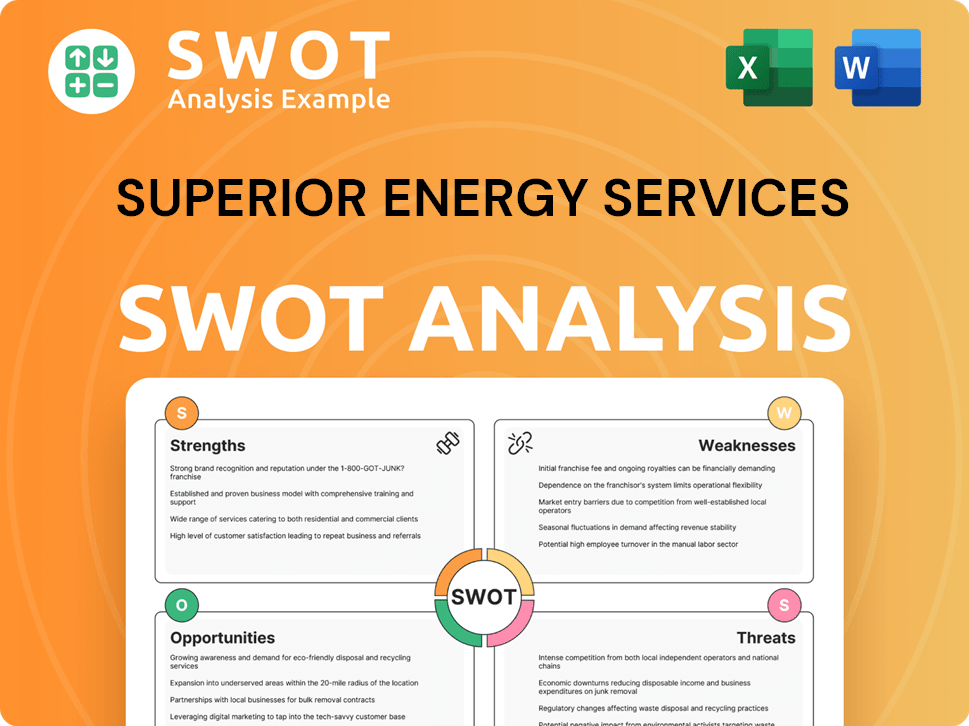

Superior Energy Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Superior Energy Services Make Money?

The SES company generates revenue mainly by offering specialized oilfield services and renting or selling related equipment. While specific revenue breakdowns for 2024-2025 aren't readily available in public filings, the company's income streams generally fall into service lines such as Production-Related Services, Intervention, Workover, and Abandonment. These services are essential for maintaining and improving well output.

Production-related services, including activities like coiled tubing and wireline, likely contribute a significant portion of the revenue. Intervention and workover services, which address issues within existing wells, also represent substantial income streams. Well abandonment services, a regulatory requirement for depleted wells, provide a consistent revenue source for the SES company.

The company's monetization strategies typically involve project-based charges, considering factors like job duration, operational complexity, and equipment use. Equipment rentals also contribute to revenue, especially for specialized tools. The company may use tiered pricing based on service scope and intensity. For more information, you can read the Brief History of Superior Energy Services.

SES company's revenue is heavily influenced by drilling activity and production levels in the key basins it serves, making it sensitive to commodity price fluctuations. The company focuses on integrated solutions for well lifecycle management, potentially offering comprehensive service packages to optimize client spending and secure longer-term contracts.

- Project-Based Services: Charges are calculated based on the duration, complexity, and equipment used for each project.

- Equipment Rentals: Revenue from renting specialized tools and machinery.

- Tiered Pricing: Pricing structures may vary depending on the scope and intensity of the services provided.

- Integrated Solutions: Potential for offering comprehensive service packages for well lifecycle management.

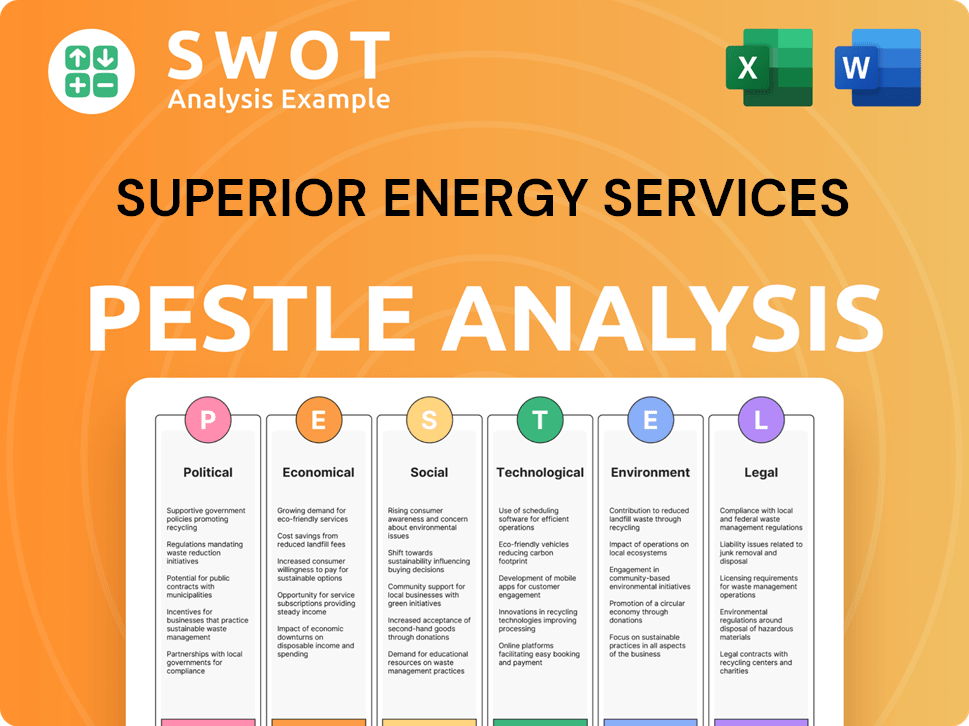

Superior Energy Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Superior Energy Services’s Business Model?

The SES company has strategically evolved within the volatile oil and gas sector. While specific recent milestones for 2024-2025 are not publicly available, its history reflects growth through acquisitions, broadening its service offerings and geographic reach. This strategy has allowed the company to integrate various oilfield services, creating a comprehensive provider for its clients.

The company has faced significant challenges, particularly during periods of low commodity prices and industry downturns. These downturns often lead to reduced E&P spending, directly impacting demand for oilfield services. The SES company has responded by focusing on cost efficiencies, optimizing its asset base, and emphasizing services critical to maintaining existing production, such as intervention and workover.

The competitive edge of Superior Energy Services stems from its specialized expertise in complex well operations, particularly in mature basins. This regional focus enables deep operational knowledge and strong customer relationships. Furthermore, the company benefits from its fleet of specialized equipment and highly skilled personnel, which are essential for executing intricate well interventions and workovers safely and efficiently. The company's ability to provide integrated solutions for the entire well lifecycle, from initial completion support to abandonment, also provides a competitive edge by simplifying vendor management for its clients.

Historically, Superior Energy Services has used acquisitions to expand its service offerings. These acquisitions have been crucial in integrating diverse oilfield services, creating a more comprehensive solution provider. This strategy has allowed the company to adapt to the evolving needs of the energy market and enhance its competitive position.

During industry downturns, Superior Energy Services has focused on cost efficiencies. This includes optimizing its asset base and emphasizing services critical to maintaining existing production. This adaptability has been key to navigating the cyclical nature of the oil and gas industry.

The company's specialized expertise in complex well operations is a significant advantage, particularly in mature basins. This regional focus allows for deep operational knowledge and strong customer relationships. Additionally, the company's fleet of specialized equipment and skilled personnel contribute to its competitive edge.

The company continues to adapt to new trends, such as the increasing emphasis on environmental regulations. They are refining their service offerings to meet evolving industry needs. This includes a focus on more efficient and less carbon-intensive operations.

The SES company has historically demonstrated a strategic focus on providing comprehensive oil and gas services. This has involved a combination of organic growth and strategic acquisitions. The company's ability to adapt to market fluctuations and maintain a strong presence in key basins has been critical to its success. The company's strategic moves have positioned it to capitalize on opportunities in the energy market.

- Focus on specialized well services.

- Emphasis on operational efficiency and cost management.

- Strategic acquisitions to broaden service offerings.

- Adaptation to environmental regulations and market trends.

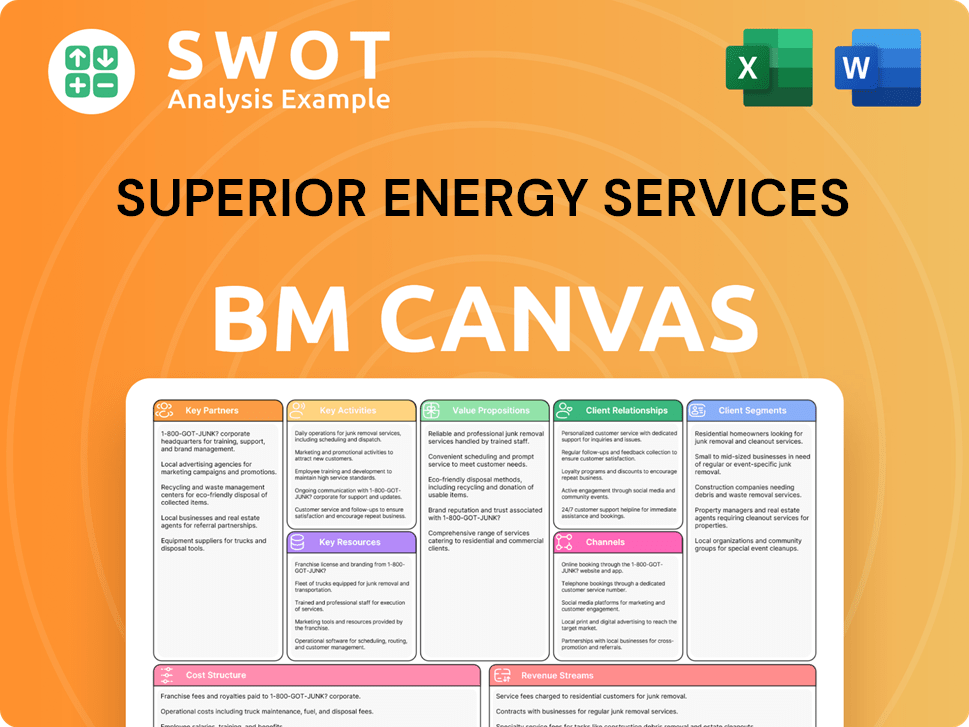

Superior Energy Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Superior Energy Services Positioning Itself for Continued Success?

The SES company holds a strong position within the specialized segments of the North American oilfield services market. It is particularly focused on production-related services, intervention, workover, and abandonment activities. Its market share benefits from a long-standing presence and deep operational expertise in key regions, including the U.S. Gulf Coast and the Permian Basin. This allows the company to serve a diverse client base of oil and natural gas companies effectively.

However, the company operates in a competitive industry, facing challenges from larger, diversified service providers and smaller, specialized local firms. The future outlook for Superior Energy Services depends on its ability to adapt to the evolving energy landscape and manage operational costs effectively.

Superior Energy Services is a key player in the oil and gas services sector, particularly in production-related activities. The company has a strong foothold in major oil-producing regions, such as the Gulf Coast and Permian Basin. Its strategic locations and specialized services contribute to its competitive advantage.

Key risks include fluctuations in oil and gas prices, which directly impact demand for oilfield services. Regulatory changes, especially those related to environmental protection and well abandonment, can also affect operational costs. The emergence of new technologies and the shift towards renewable energy pose long-term challenges.

The future of SES company depends on its ability to optimize service offerings and adapt to the energy transition. Opportunities may arise in carbon capture, utilization, and storage (CCUS) or geothermal energy services. Strategic initiatives will likely focus on operational efficiency and technological advancements.

The oil and gas industry is subject to volatile price swings and geopolitical instability. Supply chain disruptions can affect equipment costs and availability. The company must navigate these challenges while responding to increasing environmental concerns and the push for cleaner energy sources. For more details, you can read about Owners & Shareholders of Superior Energy Services.

To maintain its market position, Superior Energy Services needs to focus on several key areas. These include operational efficiency, technological advancements, and strategic partnerships. Adapting to the evolving energy landscape and potential diversification into renewable energy services could also be critical for long-term success.

- Enhancing operational efficiency to reduce costs and improve service delivery.

- Investing in technological advancements to stay competitive in the oil and gas services market.

- Forming strategic partnerships to expand market reach and enhance service capabilities.

- Exploring opportunities in CCUS or geothermal energy to diversify the portfolio.

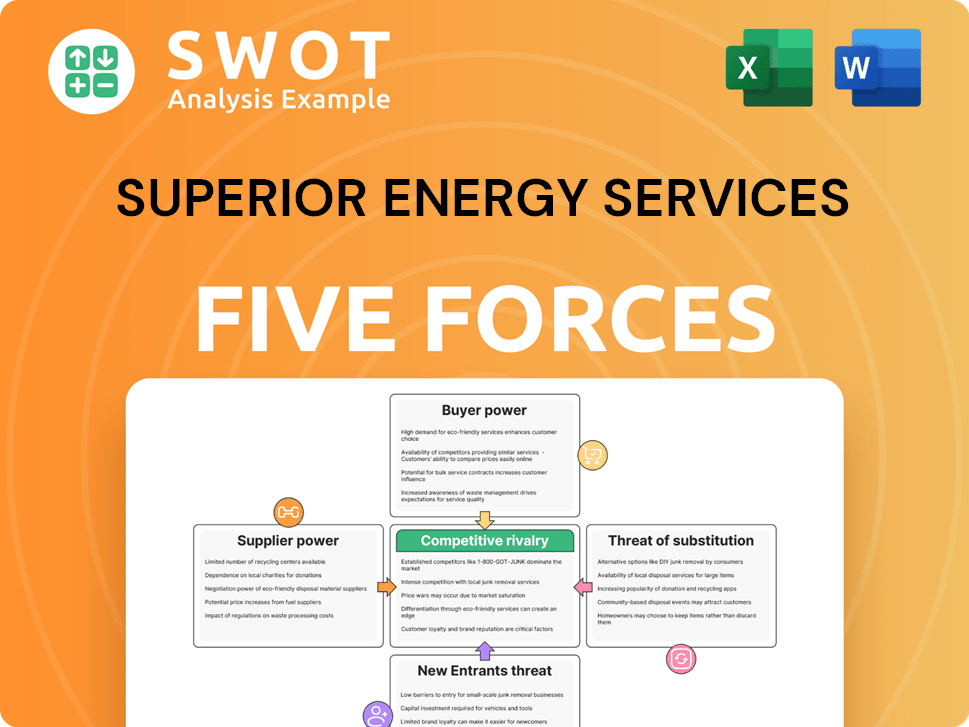

Superior Energy Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Superior Energy Services Company?

- What is Competitive Landscape of Superior Energy Services Company?

- What is Growth Strategy and Future Prospects of Superior Energy Services Company?

- What is Sales and Marketing Strategy of Superior Energy Services Company?

- What is Brief History of Superior Energy Services Company?

- Who Owns Superior Energy Services Company?

- What is Customer Demographics and Target Market of Superior Energy Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.