Superior Energy Services Bundle

Who Really Controls Superior Energy Services?

Understanding the ownership of a company is crucial for investors and strategists alike. The Superior Energy Services SWOT Analysis provides a framework to analyze the company's position. This exploration delves into the evolving ownership structure of Superior Energy Services (SES Company), a key player in the oilfield services sector, particularly after its significant shift in late 2024/early 2025.

From its founding by Terence Hall to its current status, the ownership of Superior Energy has undergone a dramatic transformation. This analysis will uncover the key players who shape the strategic direction of this energy company, examining the impact of the 'going private' transaction on its operations and future. We'll explore the company's corporate structure and the individuals who hold the reins, providing a comprehensive view of Superior Energy Services' current landscape.

Who Founded Superior Energy Services?

Terence Hall, a New Orleans attorney, founded Superior Energy Services (SES Company) in 1989. Hall's initial venture into the oilfield services sector began in 1984 with Connection Technology, which manufactured computer monitoring systems for drilling pipelines. This marked the beginning of a journey that led to the establishment of several companies under the Superior Group umbrella.

Hall expanded his business interests over the next five years, creating Superior Tubular Services and Superior Well Services Inc. These companies, along with Connection Technology, were brought together under Superior Group in 1989. This consolidation set the stage for the company's future growth and expansion within the oil and gas industry.

The evolution of Superior Energy Services' corporate structure is a key part of its history. The company's initial public offering (IPO) in 1995 was a significant milestone. This was achieved through a reverse merger with Small's Oilfield Services Corp., a company with roots dating back to 1966.

Terence Hall's initial involvement in the oilfield services industry started with Connection Technology in 1984. This company focused on computer monitoring systems for drilling pipelines.

In 1989, Hall consolidated his ventures under the Superior Group. This included Superior Tubular Services and Superior Well Services Inc., alongside Connection Technology.

Superior Energy Services went public in 1995 via a reverse merger with Small's Oilfield Services Corp. This strategic move allowed the company to enter the public market.

The IPO raised approximately $9.3 million, a portion of which was used to acquire Oil Stop Inc. This financial infusion supported the company's growth strategy.

Terence Hall served as CEO until 2010, when David Dunlap succeeded him. This marked a change in leadership for Superior Energy Services.

The company's history reflects a strategic evolution from its founding to its public listing. This included acquisitions and leadership changes.

The reverse merger gave the owners of the Superior subsidiaries a majority stake in the newly formed entity, which was then renamed Superior Energy Services, Inc. Simultaneously, the company raised $9.3 million through a public offering, part of which funded the acquisition of Oil Stop Inc. Revenue Streams & Business Model of Superior Energy Services highlights the company's financial strategies. Terence Hall remained CEO until 2010, when David Dunlap took over. The company's history is marked by strategic acquisitions and leadership changes, reflecting its growth and adaptation within the oilfield services sector. The company's ownership structure has evolved significantly since its inception. The company's financial reports provide detailed information about its performance over the years. Knowing who owns the company is key to understanding its direction.

The early ownership of Superior Energy Services involved:

- Terence Hall, the founder, initially as a consultant.

- The consolidation of several companies under Superior Group in 1989.

- The IPO in 1995 through a reverse merger with Small's Oilfield Services Corp.

- The raising of $9.3 million in the public offering.

- The transition in leadership from Terence Hall to David Dunlap in 2010.

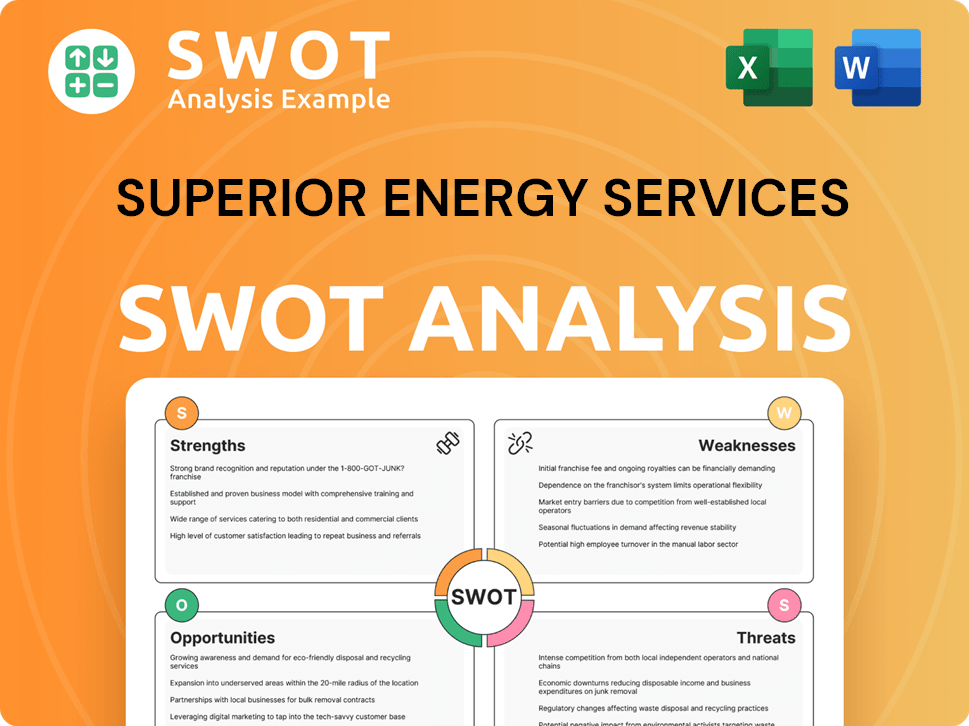

Superior Energy Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Superior Energy Services’s Ownership Changed Over Time?

The ownership structure of Superior Energy Services (SES Company) has seen significant changes, particularly in recent years. Initially listed on the New York Stock Exchange after its 1995 IPO, Superior Energy delisted in 2021 following a bankruptcy and restructuring. This process transformed the company into a privately held C-corporation.

As of 2022, GoldenTree Asset Management LP and Monarch GP LLC were identified as the majority beneficial owners of Superior Energy Services. More recently, in late 2024 and early 2025, the company undertook a 'going private' transaction. This involved a reverse stock split, followed by a forward stock split, designed to reduce the number of record holders to fewer than 300. This move allowed SES Company to suspend its SEC reporting obligations.

| Event | Date | Impact |

|---|---|---|

| IPO | 1995 | Public listing on the New York Stock Exchange. |

| Bankruptcy and Restructuring | Concluded January 2021 | Delisting from NYSE; transition to a privately held C-corporation. |

| 'Going Private' Transaction | Late 2024 - Early 2025 | Reverse and forward stock splits; reduced number of record holders; suspension of SEC reporting. |

The 'going private' transaction involved a 1-for-750 reverse stock split, followed by a 750-for-1 forward stock split. Shareholders with fewer shares than the minimum were cashed out at $80.00 per pre-split share. This restructuring is expected to leave institutional investors with substantial voting power. For more insights into the competitive landscape, consider exploring the Competitors Landscape of Superior Energy Services.

In the second quarter of 2024, Superior Energy Services reported $201.1 million in revenue and $29.5 million in net income from continuing operations.

- Total capital expenditures for 2024 were projected at approximately $100 million to $110 million.

- For Q1 2025, the company reported a net loss of $13 million.

- Adjusted EBITDA for Q1 2025 was $25 million.

- As of March 31, 2025, total debt was $516 million, and net debt was $462 million.

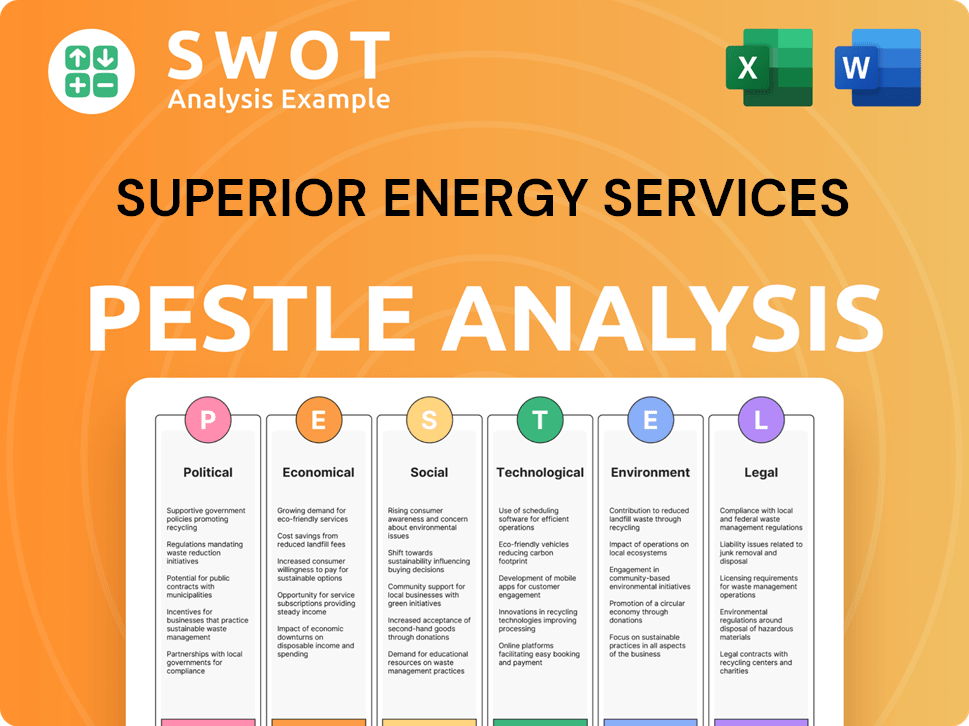

Superior Energy Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Superior Energy Services’s Board?

As of late 2024 and early 2025, the Board of Directors of Superior Energy Services (SES Company) has a pivotal role in the company's governance. The board's influence has become particularly pronounced following the transition to a privately held entity. While the specific names and individual shareholding percentages of board members are not publicly available for a private company, it is known that the Board, along with holders of a majority of the company's Class A Common Stock, approved the plan to suspend SEC reporting obligations in December 2024. This indicates that the board members, likely representing major institutional investors, wield substantial voting power.

With the 'going private' transaction, the voting structure has shifted from a publicly traded environment to one where institutional investors, such as GoldenTree Asset Management LP and Monarch GP LLC, as majority beneficial owners, exert considerable control. These institutional investors are expected to continue to hold the voting power to substantially affect or control the outcome of matters requiring a stockholder vote, including the election of directors and the approval of significant corporate matters. The company's decision to effect a reverse stock split and then a forward stock split was a mechanism to reduce the number of record holders to fewer than 300, thereby enabling it to cease public reporting, further consolidating control among the existing major shareholders. Brian Moore stepped down as President and CEO and as a board member in August 2024, with Dave Lesar, former CEO of Halliburton, appointed as CEO. Kyle O'Neill was appointed Chief Financial Officer effective February 3, 2025.

| Key Aspect | Details | Impact |

|---|---|---|

| Board Composition | Composed of individuals representing major institutional investors. | Ensures alignment with investor interests. |

| Voting Power | Institutional investors hold significant voting power. | Influences decisions on director elections and corporate matters. |

| Leadership Changes | Brian Moore stepped down; Dave Lesar appointed CEO; Kyle O'Neill appointed CFO. | Reflects strategic shifts and new direction. |

The shift in Superior Energy (SES Company) ownership structure to a private entity has led to a concentration of voting power among institutional investors. This change impacts the company's governance and decision-making processes. The board's decisions, such as suspending SEC reporting, demonstrate the influence of major shareholders in shaping the company's future. For more information on the company's history and operations, you can refer to this article about Superior Energy Services.

The Board of Directors of Superior Energy Services plays a crucial role in the company's governance as a privately held entity.

- Institutional investors hold significant voting power.

- Major shareholders influence decision-making.

- Leadership changes reflect strategic shifts.

- The company's structure is now more concentrated.

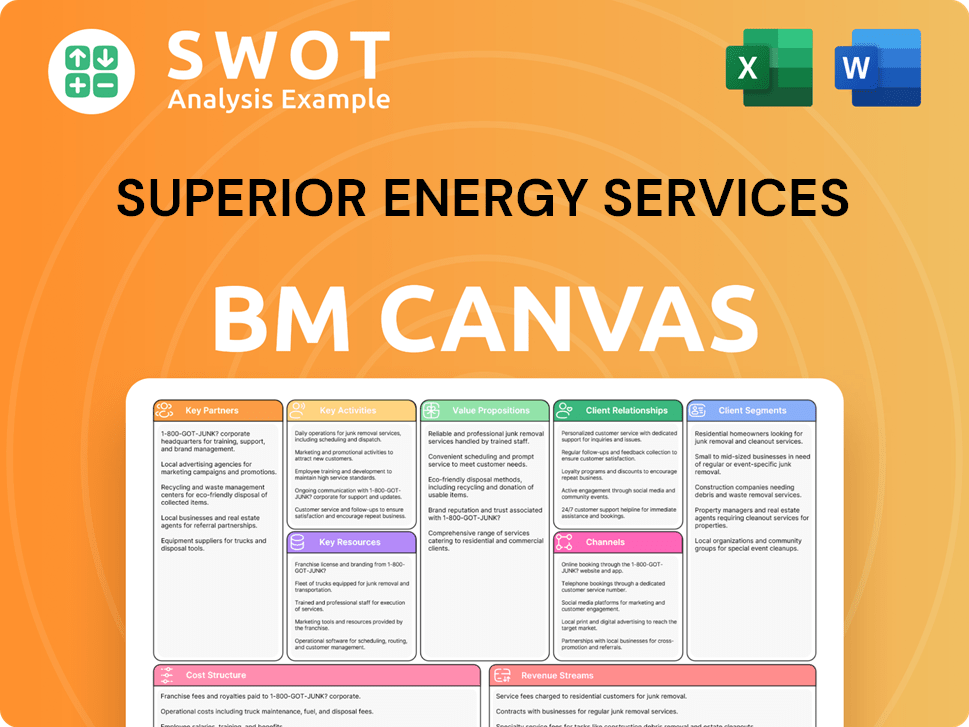

Superior Energy Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Superior Energy Services’s Ownership Landscape?

Over the last three to five years, the ownership structure of Superior Energy Services (SES Company) has undergone significant changes. The most notable is the transition from a publicly traded entity to a privately held one. This shift was largely finalized in late 2024 and early 2025 through a 'going private' transaction. This involved a reverse stock split followed by a forward stock split, which reduced the number of public shareholders, allowing the company to suspend its SEC reporting obligations. This move indicates a trend toward consolidating ownership among a smaller group of major stakeholders.

The primary stakeholders, GoldenTree Asset Management LP and Monarch GP LLC, became the majority beneficial owners after the company's restructuring in 2021. Strategic developments included exploring merger or acquisition opportunities in 2024. A key acquisition was Rival Downhole Tools in February 2025. In March 2024, a special dividend of approximately $250 million, or $12.38 per share, was announced. In 2024, approximately $177 million was returned to common shareholders through dividends and share repurchases, including the repurchase of about 4.2% of its outstanding public float during Q4 2024.

| Metric | Value | Year |

|---|---|---|

| Special Dividend | $250 million | March 2024 |

| Dividend and Share Repurchases | $177 million | 2024 |

| Expected Revenue | $780 million - $840 million | Full Year 2024 |

| Adjusted EBITDA | $235 million - $265 million | Full Year 2024 |

| Leverage Ratio | 3.7x | March 31, 2025 |

Leadership changes have also played a role in recent developments. Brian Moore stepped down as President and CEO in August 2024, and Dave Lesar took over. Kyle O'Neill was appointed Chief Financial Officer in January 2025, and Josh Shapiro joined as Vice President of Treasury and FP&A in March 2025. The company's financial updates were provided to shareholders through conference calls scheduled for May 2024, August 2024, November 2024, and March 2025. For the full year 2024, Superior Energy expected revenue between $780 million and $840 million, with Adjusted EBITDA in the range of $235 million to $265 million. The company's leverage ratio as of March 31, 2025, was 3.7x, with a target of approximately 3.0x by mid-2027. For more information on the target market, you can read this article: Target Market of Superior Energy Services.

The company shifted from public to private ownership, streamlining governance and strategic decision-making.

Focused on enhancing shareholder value through dividends, share repurchases, and potential acquisitions.

Key leadership appointments and departures reflect ongoing strategic adjustments within the company.

Mirroring broader trends of consolidation and institutional ownership within the oilfield services sector.

Superior Energy Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Superior Energy Services Company?

- What is Competitive Landscape of Superior Energy Services Company?

- What is Growth Strategy and Future Prospects of Superior Energy Services Company?

- How Does Superior Energy Services Company Work?

- What is Sales and Marketing Strategy of Superior Energy Services Company?

- What is Brief History of Superior Energy Services Company?

- What is Customer Demographics and Target Market of Superior Energy Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.