Superior Energy Services Bundle

What's Next for Superior Energy Services in the Dynamic Oil and Gas Sector?

Superior Energy Services, a key player in the oilfield services sector, has a fascinating history of navigating market fluctuations. Their story, starting in 1989, showcases how strategic resilience is vital in the energy market. This exploration delves into their evolution and future growth prospects.

From its roots in Louisiana, Superior Energy Services has become a significant force in the North American Superior Energy Services SWOT Analysis. The company's journey, marked by strategic expansion and operational excellence, highlights a successful trajectory. Looking ahead, the company's future hinges on its capacity to adapt and innovate within the ever-changing Oil and Gas Industry, ensuring its continued relevance and growth. This Energy Services Company is poised to leverage technological advancements and strategic financial planning to maintain its competitive edge. A thorough Market Analysis is crucial to understanding its Future Prospects.

How Is Superior Energy Services Expanding Its Reach?

The expansion strategy of Superior Energy Services focuses on strengthening its presence within its established geographic areas. This approach prioritizes deepening service offerings and increasing operational capacity in key regions rather than broad geographical diversification. The company aims to optimize production for its clients, extend the economic life of wells, and capitalize on the ongoing activity in the Oil and Gas Industry.

A key element of this strategy involves continuous enhancements to its service lines, including the integration of advanced tools and techniques. While major acquisitions haven't been the primary focus, smaller, targeted investments and collaborations are common to boost technological capabilities. These initiatives aim to strengthen customer relationships, increase market share, and diversify revenue streams through an expanded service portfolio.

The Growth Strategy of Superior Energy Services emphasizes deepening its presence in the U.S. Gulf Coast and the Permian Basin. This includes expanding its fleet of specialized equipment and increasing its operational capacity to meet rising demand for production-related services, intervention, workover, and abandonment activities. The company is focused on optimizing production and extending well life, driving demand for advanced intervention and workover solutions.

The company continuously introduces new tools and techniques to improve its service lines. This includes strategic procurement and internal development of new technologies. These enhancements are designed to offer more efficient and comprehensive solutions to clients.

Superior Energy Services often engages in smaller, targeted investments and collaborations. These partnerships are aimed at bolstering technological capabilities and expanding service reach. This approach allows the company to adapt to changing market demands quickly.

The primary focus remains on key North American shale plays, including the U.S. Gulf Coast and the Permian Basin. This concentration allows for efficient resource allocation and specialized service provision. The strategy leverages existing infrastructure and expertise.

Investment in advanced intervention and workover solutions is a key area of focus. This includes the development and procurement of new technologies to meet evolving client needs. Technological advancements are crucial for extending well life and optimizing production.

The company's expansion strategy focuses on enhancing service offerings, technological advancements, and strategic partnerships within its core operating areas. This approach is designed to strengthen customer relationships and increase market share.

- Expansion of specialized equipment fleet to meet rising demand.

- Continuous introduction of enhanced tools and techniques.

- Strategic procurement of new technologies to improve service reach.

- Focus on optimizing production and extending well life.

Superior Energy Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Superior Energy Services Invest in Innovation?

The core of the Revenue Streams & Business Model of Superior Energy Services lies in its commitment to innovation and technology. This focus is crucial for the company's Growth Strategy and maintaining a competitive edge in the dynamic Oil and Gas Industry.

The Energy Services Company continually invests in research and development to enhance its service offerings. This includes developing specialized tools and techniques to optimize production and improve operational efficiency. These advancements directly contribute to the company's ability to offer value-added solutions to its clients.

Technological advancements are central to the Superior Energy Services approach, driving efficiency, safety, and effectiveness. This includes the development and deployment of specialized tools and techniques for production optimization, well intervention, and abandonment activities.

The company's innovation strategy emphasizes the creation and deployment of specialized tools and techniques. These tools are designed to address specific needs in production optimization and well intervention.

While specific R&D investment figures are not always publicly detailed, the company's ongoing commitment to improving its service offerings indicates continuous investment in technological advancements. This includes in-house development and strategic collaborations.

The company is actively engaged in digital transformation to optimize operational workflows and data analysis. This involves leveraging digital platforms for remote monitoring and predictive maintenance.

While not explicitly focused on AI or IoT in the same way as some software-centric companies, Superior Energy Services integrates these technologies where they can enhance its core services. This includes advanced sensor technology and data-driven decision-making.

Sustainability initiatives are increasingly integrated into the company's technological advancements. The focus is on solutions that reduce environmental impact and improve resource efficiency during well operations.

New technical capabilities and improved service platforms directly contribute to Superior Energy Services' growth objectives. This allows the company to offer more competitive and value-added solutions to its clients.

The company's technological strategy is multifaceted, focusing on several key areas to drive growth and efficiency. These strategies are designed to improve service delivery and enhance client value.

- Development of specialized tools and techniques for production optimization.

- Integration of digital platforms for remote monitoring and predictive maintenance.

- Use of advanced sensor technology for downhole operations.

- Data-driven decision-making for well interventions.

- Emphasis on sustainability through resource-efficient solutions.

Superior Energy Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Superior Energy Services’s Growth Forecast?

The financial outlook for Superior Energy Services is closely tied to the dynamics of the Oil and Gas Industry. The company's performance is significantly impacted by the levels of drilling and production activity, particularly within North America. Assessing the company's future prospects requires an understanding of its financial strategies, including capital allocation, operational efficiency, and response to market fluctuations.

Superior Energy Services focuses on generating strong cash flow and maintaining a healthy balance sheet. This approach is crucial for navigating industry volatility and supporting growth initiatives. The company's ability to adapt its cost structure and service offerings has been a key factor in sustaining profitability.

The financial strategy of Superior Energy Services emphasizes sustainable growth through operational efficiency and strategic investment. This involves a disciplined approach to capital expenditure and a focus on high-value services. The company's financial narrative highlights its commitment to long-term profitability within the energy sector.

Superior Energy Services generates revenue primarily through its service offerings in the oil and gas sector. These services include well intervention, completion, and production services. The company's revenue streams are directly influenced by the volume of drilling and production activities.

Efficient capital allocation is a cornerstone of Superior Energy Services' financial strategy. The company prioritizes investments in equipment upgrades, technological advancements, and operational expansions. This strategic approach aims to maximize returns and support long-term growth.

Superior Energy Services focuses on managing its cost structure to maintain profitability, especially during challenging market conditions. The company's ability to adapt its operational expenses is crucial for financial resilience. This includes optimizing service offerings and streamlining operations.

Maintaining a healthy balance sheet is a key financial objective for Superior Energy Services. This involves managing debt levels and ensuring sufficient liquidity to support operations and growth initiatives. The company's financial health is essential for weathering industry downturns.

The Mission, Vision & Core Values of Superior Energy Services provide insight into the company's long-term objectives and strategic direction. The company's financial performance is often discussed in terms of its ability to generate strong cash flow and maintain a healthy balance sheet. Recent reports and analyst forecasts for companies in this sector often highlight a cautious optimism for 2024 and 2025, driven by stable commodity prices and sustained drilling activity in key basins.

Market analysis plays a crucial role in shaping Superior Energy Services' financial strategies. Understanding market trends, including oil and gas prices and drilling activity, is essential for making informed decisions. This analysis helps the company adapt to changing market conditions.

The future prospects of Superior Energy Services are closely tied to the overall health of the Oil and Gas Industry. The company's ability to capitalize on emerging opportunities and adapt to industry changes will determine its long-term success. Strategic planning and innovation are key to navigating future challenges.

Technological advancements are critical for Superior Energy Services. The company invests in new technologies to improve efficiency, reduce costs, and enhance service offerings. Staying at the forefront of technological innovation is a key component of its growth strategy.

Superior Energy Services may have expansion plans that involve strategic acquisitions or entering new markets. These initiatives require careful financial planning and execution. Expansion is a key element of the company's growth strategy.

Sustainability initiatives can impact the financial outlook of Superior Energy Services. The company may invest in environmentally friendly practices and technologies. These initiatives can improve its reputation and potentially attract new customers and investors.

The financial performance of Superior Energy Services is closely monitored by investors and analysts. Key metrics include revenue, profit margins, and cash flow. The company's ability to generate strong financial results is essential for its long-term success.

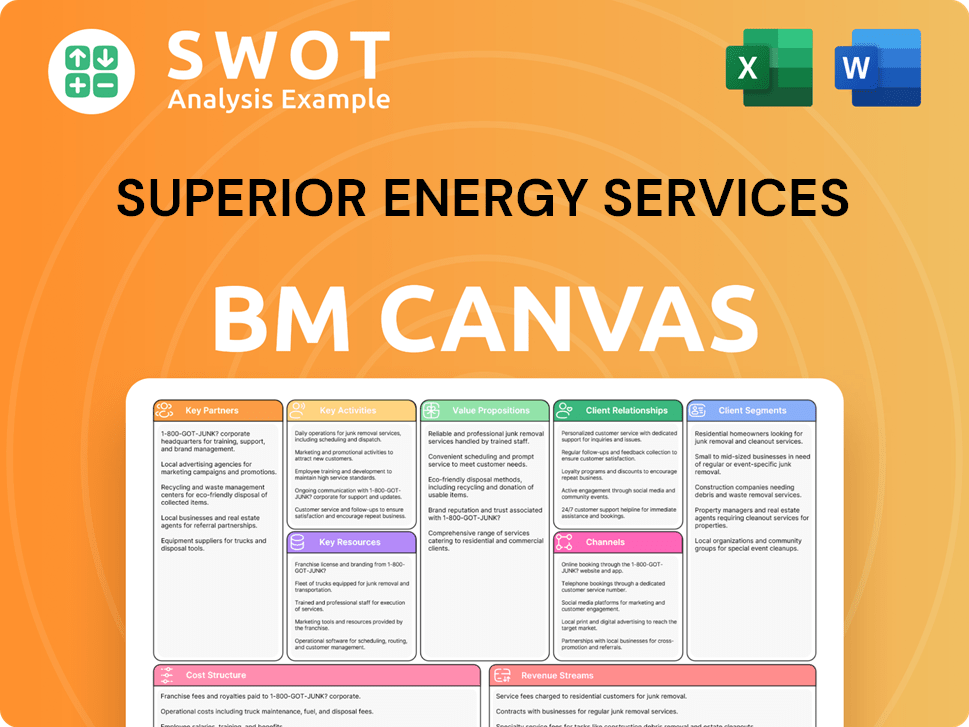

Superior Energy Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Superior Energy Services’s Growth?

The path for Superior Energy Services, an Energy Services Company, towards growth is fraught with potential risks and obstacles. These challenges stem primarily from the volatile nature of the Oil and Gas Industry and the highly competitive landscape in which it operates. Understanding these risks is crucial for assessing the company's Future Prospects and formulating effective strategies.

Market competition is a significant hurdle, with numerous players vying for contracts, leading to pricing pressures and potential erosion of market share. Regulatory changes, especially those related to environmental policies and drilling permits, pose another substantial risk. Shifts in regulatory frameworks can increase operational costs, limit drilling activity, or necessitate significant investments in compliance, thereby affecting profitability and growth. Supply chain vulnerabilities, particularly for specialized equipment and materials, can also impede operations and increase costs.

Technological disruption is a constant factor; while Superior Energy Services embraces innovation, the rapid pace of technological advancements means that competitors could introduce more efficient or cost-effective solutions, potentially rendering existing technologies less competitive. Internal resource constraints, such as the availability of skilled labor or capital for large-scale investments, could also limit the company's ability to execute its growth strategies effectively.

The oilfield services sector is intensely competitive, with numerous companies vying for contracts. This competition can lead to price wars and reduced profit margins, affecting Superior Energy Services' financial performance. For instance, a Market Analysis in 2024 showed a tightening of margins across various service lines due to increased competition.

Changes in environmental regulations and permitting processes can increase operational costs and limit drilling activities. Compliance with new regulations often requires significant capital investments. Recent data indicates that environmental compliance costs have increased by approximately 15% in the past year for some Energy Services Company.

Disruptions in the supply chain, especially for specialized equipment, can lead to delays and increased costs. Geopolitical events and economic instability can exacerbate these vulnerabilities. In 2024, supply chain issues caused delays in project completion for about 10% of oilfield service projects.

Rapid technological advancements can render existing technologies obsolete, requiring continuous investment in new solutions. Competitors may introduce more efficient and cost-effective technologies, impacting Superior Energy Services' competitiveness. The adoption rate of new technologies has increased by 20% in the last 2 years.

Limited access to skilled labor and capital can hinder the execution of growth strategies. Securing funding for large-scale investments is crucial. The availability of skilled labor has decreased by 5%, increasing operational costs. The article Target Market of Superior Energy Services provides additional insights.

Geopolitical events can significantly impact global energy demand and commodity prices. Political instability in key oil-producing regions can disrupt supply and affect Superior Energy Services' operations. Oil price volatility has increased by 30% in the last year.

Superior Energy Services typically manages these risks through diversification of its service offerings, a robust risk management framework, and a focus on operational efficiency. Diversification helps to mitigate the impact of downturns in specific segments. A well-defined risk management plan is essential.

Emerging risks that could shape its future trajectory include increased pressure for decarbonization within the energy sector and ongoing geopolitical instability. The transition to sustainable practices will require significant investment and adaptation. Geopolitical instability can impact global energy demand and commodity prices.

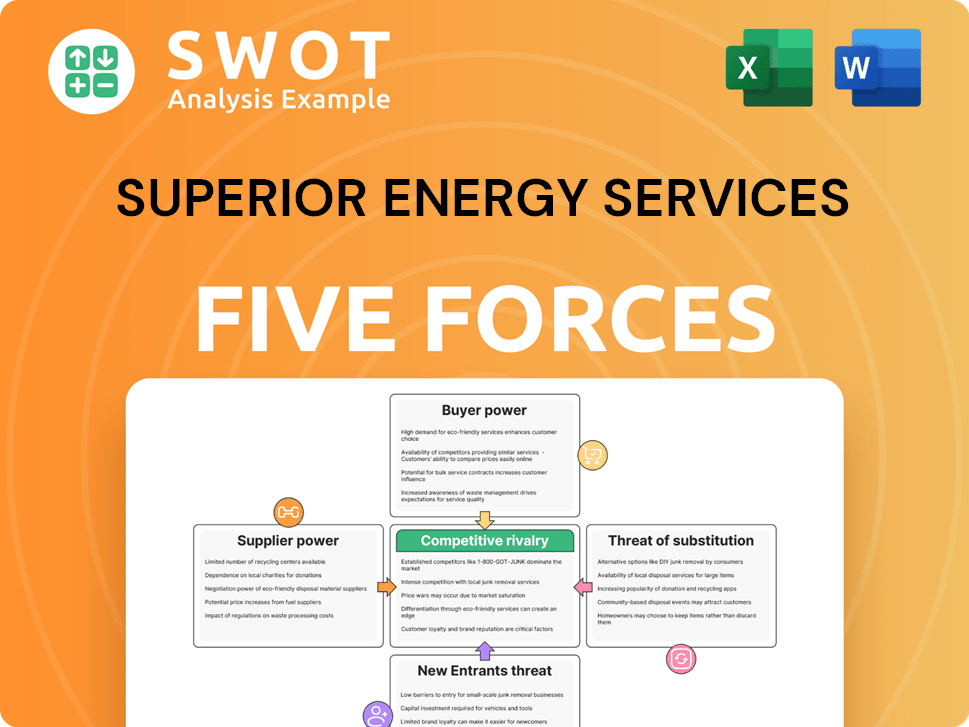

Superior Energy Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Superior Energy Services Company?

- What is Competitive Landscape of Superior Energy Services Company?

- How Does Superior Energy Services Company Work?

- What is Sales and Marketing Strategy of Superior Energy Services Company?

- What is Brief History of Superior Energy Services Company?

- Who Owns Superior Energy Services Company?

- What is Customer Demographics and Target Market of Superior Energy Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.