Superior Energy Services Bundle

Can Superior Energy Services Outmaneuver Its Rivals in the Oilfield Services Arena?

The oil and gas industry is a battlefield of innovation and competition, where survival hinges on strategic prowess. Superior Energy Services, a key player in specialized oilfield services, faces a dynamic competitive landscape. Understanding its position requires a deep dive into its rivals, strengths, and the shifting sands of the energy market.

This analysis will dissect the Superior Energy Services SWOT Analysis to determine its position among its industry rivals and the competitive advantages it leverages. We'll explore its market share, recent acquisitions, and service offerings within the oil and gas services sector. This comprehensive market analysis will also examine the challenges and opportunities shaping the future of this energy services company, providing insights for investors and industry watchers alike.

Where Does Superior Energy Services’ Stand in the Current Market?

Superior Energy Services holds a strong position in the specialized segments of the oilfield services industry. The company focuses on production-related services, well intervention, workover, and abandonment. Its primary goal is to optimize well performance and extend the economic life of oil and natural gas assets.

The company serves a diverse customer base, including independent producers and supermajors. It has strategically divested non-core assets to concentrate on production-related services. This focus allows Superior Energy Services to strengthen its competitive edge in key areas.

Financially, Superior Energy Services demonstrated resilience and growth. For the full year 2023, the company reported revenues of $1,058.4 million, a notable increase from $829.4 million in 2022. This financial performance highlights its significant presence in its target regions and service lines.

Superior Energy Services concentrates on production-related services, well intervention, and abandonment. This focus allows the company to build expertise and a competitive advantage. Its services are vital for optimizing well performance and extending the economic life of oil and gas assets.

The company has a strong presence in the U.S. Gulf Coast and major North American shale plays, such as the Permian Basin. This regional focus allows Superior Energy Services to efficiently serve its customers. Its strategic location is a key part of its market position.

Superior Energy Services reported revenues of $1,058.4 million for 2023, up from $829.4 million in 2022. This growth indicates a robust financial standing. The company's ability to increase revenue reflects its strong market position and operational scale.

Superior Energy Services serves a diverse customer base. This includes independent producers and supermajors. Serving a broad customer base helps the company maintain stability and growth. This diverse customer base supports its market position.

Superior Energy Services maintains a strong market position. It focuses on specialized oilfield services, particularly in production-related areas. The company's financial performance, with revenues of $1,058.4 million in 2023, underscores its success. To learn more about the company's strategic direction, see Growth Strategy of Superior Energy Services.

- Strong focus on production-related services.

- Significant presence in key regions like the U.S. Gulf Coast and Permian Basin.

- Demonstrated financial growth, with increased revenues.

- Diverse customer base, including independent producers and supermajors.

Superior Energy Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Superior Energy Services?

The competitive landscape for Superior Energy Services is defined by a mix of global giants and regional specialists within the oilfield services sector. Understanding the key players and their strategies is crucial for assessing the company's position and potential for growth. The market is dynamic, with constant shifts due to technological advancements, mergers, and acquisitions, and fluctuating oil prices.

Superior Energy Services faces a complex web of competitors, each with unique strengths and weaknesses. These rivals compete for market share in a sector that demands advanced technology, efficient operations, and strong customer relationships. A thorough competitive analysis is essential for investors and stakeholders to evaluate the company's prospects.

Halliburton, Schlumberger, and Baker Hughes are among the most significant competitors. These companies offer a wide array of services, often overlapping with Superior Energy Services' offerings. They leverage extensive global networks, advanced technological capabilities, and substantial financial resources to compete effectively.

Weatherford International provides services similar to Superior Energy Services, particularly in production optimization and well abandonment. These specialized companies focus on specific niches, allowing them to compete directly with larger firms in certain areas. They often concentrate on specific geographic regions or service lines.

Regional competitors, especially in the Permian Basin and the U.S. Gulf Coast, pose a challenge. These smaller companies can offer localized services and competitive pricing. They often have strong regional relationships and can respond quickly to market changes.

Emerging players focusing on digital oilfield solutions and advanced analytics represent a growing indirect competitive threat. These companies push the industry towards more data-driven approaches. They are leveraging technology to optimize production and improve efficiency.

Mergers and acquisitions among smaller service providers can alter market dynamics. These consolidations create new, formidable rivals. The competitive landscape is constantly evolving due to these strategic moves.

Key competitive factors include service offerings, pricing, geographic presence, and technological innovation. Companies that can offer comprehensive solutions and maintain competitive pricing are well-positioned. Technological advancements and geographic reach are also critical for success.

The competitive landscape also reflects broader industry trends, such as the increasing demand for efficiency and sustainability in oil and gas operations. For example, in 2024, the global oil and gas services market was valued at approximately $300 billion, with projections for continued growth driven by increased drilling activities and the need for enhanced production techniques. The Brief History of Superior Energy Services provides context on the company's evolution within this dynamic environment.

Superior Energy Services must navigate a complex market. Understanding the strengths and weaknesses of both the company and its competitors is essential for strategic planning. The company's ability to adapt to market changes, innovate, and maintain a strong customer base will be critical for its long-term success.

- Competitive Advantages: Strong regional presence in key areas, specialized service offerings, and established client relationships.

- Challenges: Competition from larger, integrated service providers; fluctuating oil prices; and the need for continuous technological innovation.

- Market Trends: Increasing demand for digital solutions, focus on operational efficiency, and the growing importance of environmental sustainability.

- Strategic Considerations: Investment in technology, expansion of service offerings, and strategic partnerships to enhance market position.

Superior Energy Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Superior Energy Services a Competitive Edge Over Its Rivals?

The competitive landscape for Superior Energy Services is shaped by its specialized expertise and operational efficiency within the oil and gas services sector. Focusing on production-related services, intervention, workover, and abandonment activities allows the company to cultivate specialized knowledge. This focus helps it develop tailored solutions that larger, more diversified competitors may not prioritize. This specialization translates into a higher level of technical proficiency and problem-solving capabilities, which are highly valued by oil and natural gas companies.

Superior Energy Services differentiates itself through proprietary technologies and a strong regional presence. The company deploys advanced tools and techniques for complex well challenges, particularly in mature fields or challenging unconventional plays. Its established infrastructure in key North American regions provides logistical advantages, enabling rapid service deployment. This regional density fosters strong customer relationships and repeat business, contributing to customer loyalty.

The sustainability of these advantages relies on continuous investment in technology, maintaining a skilled workforce, and adapting to industry shifts. The company's strategic focus has allowed it to refine its offerings and enhance operational efficiencies in its core segments. Analyzing the competitive advantages of Superior Energy Services requires a deep understanding of these factors and how they contribute to its market position. For more details, you can explore the Revenue Streams & Business Model of Superior Energy Services.

Superior Energy Services' deep focus on production-related services allows for specialized knowledge and tailored solutions. This specialization leads to higher technical proficiency and problem-solving capabilities, valued by oil and gas companies. The company's expertise in intervention, workover, and abandonment activities sets it apart from competitors.

The company utilizes advanced tools and techniques for complex well challenges. This technological prowess is particularly evident in mature fields and unconventional plays. Deploying these technologies gives Superior Energy Services a competitive edge.

Superior Energy Services has a strong presence in key North American regions like the U.S. Gulf Coast and Permian Basin. This regional density provides logistical advantages, enabling rapid service deployment. It also fosters strong customer relationships and repeat business.

Superior Energy Services focuses on refining its offerings and enhancing operational efficiencies in its core segments. Continuous investment in technology and a skilled workforce are crucial for maintaining these advantages. Adapting to industry shifts is also essential for long-term success.

Superior Energy Services' competitive advantages stem from its specialized expertise, proprietary technologies, and regional presence. These strengths allow the company to provide tailored solutions and efficient services to its clients.

- Specialized Knowledge: Deep expertise in production-related services.

- Technological Prowess: Advanced tools for complex well challenges.

- Regional Advantage: Strong presence in key North American regions.

- Customer Relationships: Fostering repeat business and loyalty.

Superior Energy Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Superior Energy Services’s Competitive Landscape?

The oilfield services sector, where Superior Energy Services operates, is experiencing significant shifts. These changes are driven by technological advancements, regulatory pressures, and global economic dynamics. A thorough market analysis is crucial for understanding the competitive landscape and the future prospects of Superior Energy Services.

The company faces both risks and opportunities in this evolving environment. Economic downturns and fluctuating commodity prices can directly impact the demand for oilfield services. However, the need for energy security and the optimization of existing assets provide avenues for growth. Understanding the industry trends is key to navigating these complexities.

Technological advancements, including digitalization, automation, and data analytics, are transforming well management and optimization. Regulatory changes, particularly concerning environmental protection and well abandonment, are increasing. The focus on reducing carbon emissions is also creating new opportunities.

Global economic shifts and fluctuating commodity prices pose ongoing challenges. Geopolitical instability can disrupt supply chains and investment flows. The need for significant investment in new technologies and a skilled workforce is also a challenge.

The optimization of existing assets and the increasing demand for abandonment services present opportunities. The growing focus on reducing carbon emissions could lead to new service offerings, such as carbon capture and storage. Strategic adaptation and innovation are critical.

To succeed, Superior Energy Services must embrace digital transformation and adapt to evolving regulations. Strategic pursuit of opportunities in growing segments of the energy transition is also important. Maintaining core strengths in production optimization and well abandonment remains crucial.

Superior Energy Services must navigate a dynamic environment to maintain its competitive landscape position. The company's ability to adapt to technological advancements and regulatory changes will be crucial. Understanding the oil and gas services market is key to making informed decisions. For more insights, consider the perspective of Owners & Shareholders of Superior Energy Services.

- Focus on digital transformation and automation to improve efficiency and reduce costs.

- Invest in specialized services to meet stringent environmental regulations.

- Explore opportunities in carbon capture and storage to diversify service offerings.

- Maintain a strong financial position to weather economic downturns.

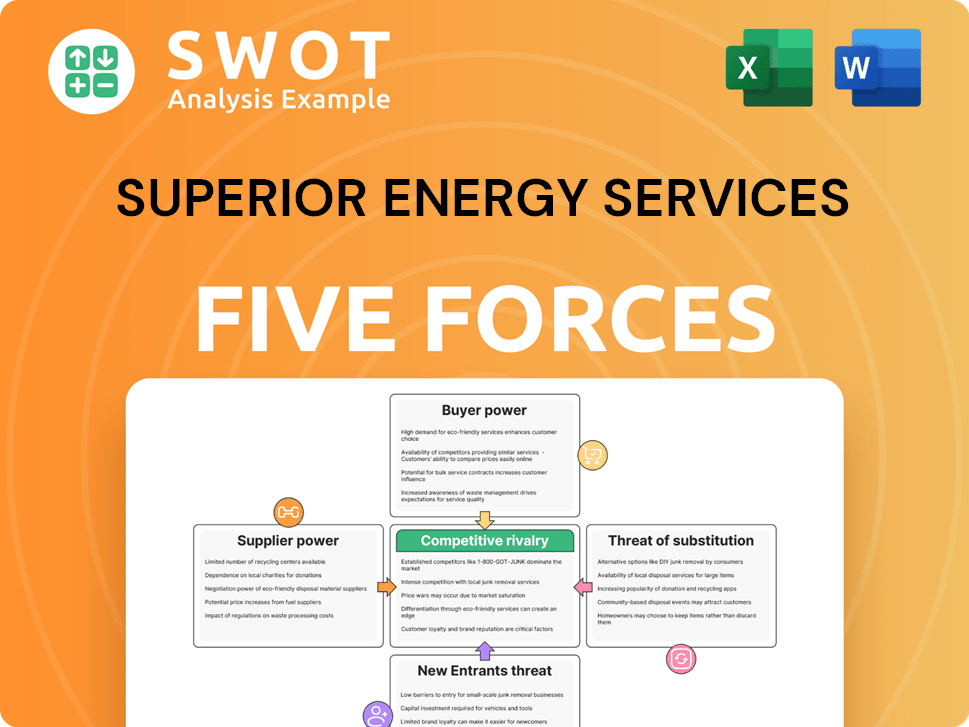

Superior Energy Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Superior Energy Services Company?

- What is Growth Strategy and Future Prospects of Superior Energy Services Company?

- How Does Superior Energy Services Company Work?

- What is Sales and Marketing Strategy of Superior Energy Services Company?

- What is Brief History of Superior Energy Services Company?

- Who Owns Superior Energy Services Company?

- What is Customer Demographics and Target Market of Superior Energy Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.