TPG Bundle

How Did TPG Telecom Rise to Telecommunications Dominance?

TPG Telecom's journey is a compelling story of strategic pivots and ambitious growth within the ever-evolving telecommunications sector. From its initial focus on computer sales to its current status as a major player, the TPG SWOT Analysis reveals the key drivers behind its success. Understanding the TPG history is crucial for grasping its current market position and future potential.

The TPG company story begins in 1986, evolving from a hardware provider to a telecommunications giant. This transformation, marked by strategic TPG acquisitions and investments, showcases the adaptability of the TPG founders and their vision for the future. Examining the TPG timeline reveals the pivotal moments that shaped the company's trajectory and its impact on the tech industry, offering valuable insights for investors and industry observers alike. The company's early investments and successes provide a foundation to understand its current investment portfolio overview and its global presence and operations.

What is the TPG Founding Story?

The story of the TPG company begins in December 1986. It was founded as Total Peripherals Group by David Teoh and his wife, Vicky Teoh. This marked the initial steps of what would become a significant player in the telecommunications industry.

Initially, the company's focus was on reselling computers and related peripherals. David Teoh, with his background in electronics, saw the potential in the growing market for personal computers. This early venture laid the groundwork for the company's future. The evolution of TPG, from its early days to its current status, showcases its adaptability and strategic foresight.

The name 'Total Peripherals Group' directly reflected its initial business, importing and distributing computer hardware. As the internet gained traction, the company shifted its focus towards telecommunications. This strategic pivot was crucial for TPG's transformation into a telecommunications provider. This transformation is a key part of the Marketing Strategy of TPG.

TPG's founding was driven by David Teoh and his wife, Vicky Teoh, in December 1986. The company initially focused on reselling computer peripherals, later transitioning to telecommunications. TPG's early growth was largely self-funded, allowing for agile adaptation to market changes.

- Founded in December 1986 as Total Peripherals Group.

- Primary focus: Reselling computers and peripherals.

- Key figures: David Teoh and Vicky Teoh.

- Strategic shift: Transition to telecommunications.

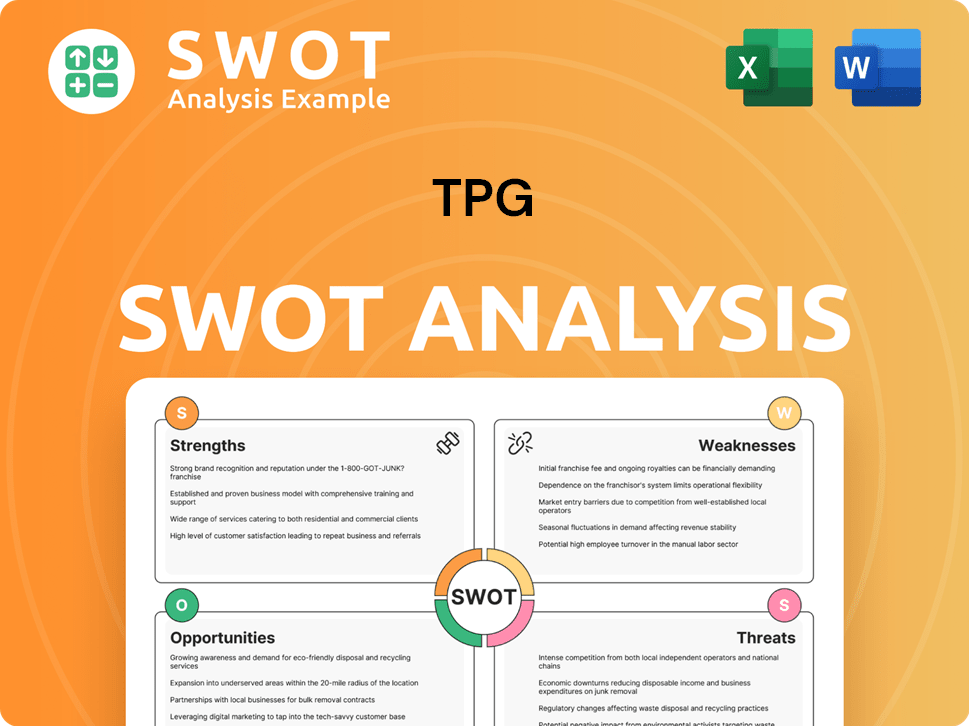

TPG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of TPG?

The early growth of the company, now known as TPG, in the telecommunications sector was marked by strategic acquisitions and expansion. Initially, the company transitioned from a computer peripherals reseller to a significant internet service provider. This shift was crucial in establishing its presence in the evolving telecommunications landscape. The company's journey provides valuable insights into its strategic moves and market adaptability.

Following its shift in focus, the company began offering dial-up internet services in the late 1990s, capitalizing on the rising demand for internet access. This move was a direct response to the growing need for internet connectivity among consumers. The early adoption of dial-up services helped establish a customer base.

The company's first major strategic move in telecommunications was the acquisition of various smaller internet service providers. This allowed the company to rapidly expand its customer base and network infrastructure. These acquisitions were key to the company's early growth.

A significant turning point in the company's early growth was its aggressive expansion into the broadband market. As ADSL technology became more prevalent, the company invested in its own network infrastructure, moving away from relying solely on wholesale agreements. This enabled them to offer more competitive pricing and better control over service quality.

Key acquisitions during this period included the purchases of Chariot Internet in 2003 and PIPE Networks in 2009. The acquisition of PIPE Networks, a dark fiber network provider, was particularly significant as it provided the company with extensive fiber optic infrastructure, forming the backbone of its fixed-line network. This strategic move allowed the company to significantly reduce its reliance on Telstra's network and enhance its competitive edge.

The company also expanded its offerings beyond residential broadband to include business and wholesale services. The company's growth metrics during this period were impressive, with consistent increases in subscriber numbers and revenue. The expansion included services tailored for business clients.

The initial team expansion focused on technical expertise to manage and build out the network, alongside customer service representatives to support the growing subscriber base. The company's early customer acquisition strategies often involved aggressive pricing and bundling of services, which resonated well with cost-conscious consumers. The market reception was generally positive, as the company provided a strong alternative to the incumbent providers. For a deeper understanding of the company's strategies, consider reading about the Growth Strategy of TPG.

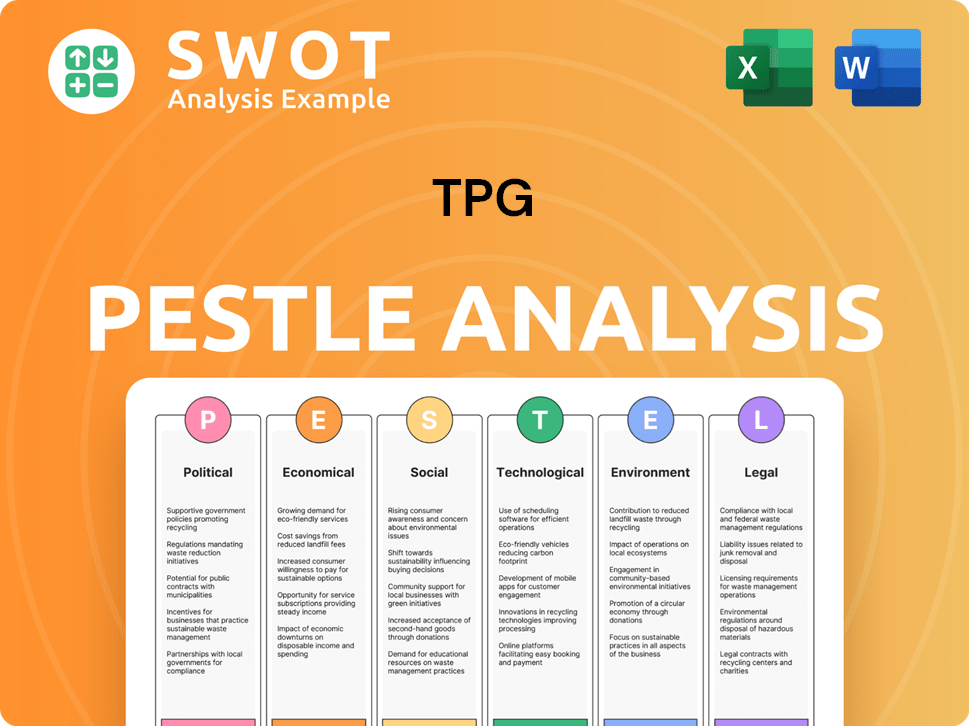

TPG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in TPG history?

The TPG company has a rich history, marked by significant milestones that have shaped its evolution in the telecommunications sector. From its early days to its current status, the company has navigated a complex landscape, achieving notable successes and adapting to various challenges. The TPG timeline demonstrates its resilience and strategic acumen.

| Year | Milestone |

|---|---|

| 1992 | Founded as a computer hardware and software supplier, setting the stage for future TPG investments. |

| 2000s | Transitioned into the internet service provider (ISP) market, marking a strategic shift in focus. |

| 2009 | Acquired PIPE Networks, significantly expanding its fixed-line infrastructure and capabilities. |

| 2010s | Launched competitive Naked DSL offerings, attracting a new generation of internet users. |

| 2020 | Merger with Vodafone Hutchison Australia approved, creating a stronger competitor in the mobile market. |

One of the key innovations was the early and aggressive investment in its own fixed-line network infrastructure. This strategic move allowed the company to control network quality and offer competitive broadband plans, disrupting the market dominated by larger players.

Early and significant investments in fixed-line infrastructure, including the acquisition of PIPE Networks. This investment strategy allowed for greater control over network quality and service offerings.

Offering highly competitive broadband plans to attract and retain customers. This strategy was crucial in gaining market share against established competitors.

Pioneering Naked DSL, which provided broadband without the need for a traditional landline. This innovation appealed to a new segment of internet users.

The company faced intense competition in the Australian telecommunications market, which consistently pressured profit margins. The rollout of the National Broadband Network (NBN) necessitated a shift in the business model, requiring significant adaptation and investment.

Intense price wars and regulatory scrutiny in the Australian telecommunications market. This competitive environment consistently put pressure on profit margins.

The rollout of the National Broadband Network (NBN) presented both opportunities and challenges. It required a shift in the business model and significant investment in new systems.

Navigating regulatory hurdles and internal integration challenges, particularly during the merger with Vodafone Hutchison Australia. Ensuring a seamless transition for customers was a key focus.

TPG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for TPG?

The TPG company, a prominent global investment firm, has a rich history marked by significant milestones and strategic shifts. Understanding the TPG history and TPG timeline provides valuable insights into its evolution and impact on various industries.

| Year | Key Event |

|---|---|

| 1992 | TPG was founded by David Bonderman, James Coulter, and William S. Price III, initially focusing on leveraged buyouts. |

| 1990s | The firm expanded its investment scope, making significant investments in the airline and technology sectors. |

| 2000s | TPG continued its growth, undertaking major acquisitions and expanding its global footprint. |

| 2022 | TPG completed its initial public offering (IPO), marking a significant step in its corporate history. |

TPG's future outlook involves continued expansion and diversification across various sectors. The firm is likely to focus on investments in high-growth areas such as technology, healthcare, and renewable energy. TPG's global presence and operations will be crucial as it seeks new investment opportunities. The firm's strategy includes a focus on both private equity and public market investments.

TPG is expected to increase its focus on technology-driven investments. The firm is likely to invest in companies that are at the forefront of technological advancements, including artificial intelligence, cloud computing, and cybersecurity. The firm's involvement in the tech industry will be a key driver of its future growth. TPG's investments in innovative companies will help it stay ahead of market trends.

TPG's global presence and operations will be essential for its future success. The firm is expected to expand its investments in emerging markets, leveraging its international network and expertise. TPG's ability to navigate different regulatory environments and market dynamics will be crucial. The firm's geographic expansion will support its long-term growth strategy.

TPG is anticipated to place an increased emphasis on environmental, social, and governance (ESG) factors in its investment decisions. The firm is likely to invest in companies that prioritize sustainability and have strong ESG practices. TPG's focus on ESG will align with the growing investor demand for responsible investing. The firm's commitment to sustainability will enhance its long-term value creation.

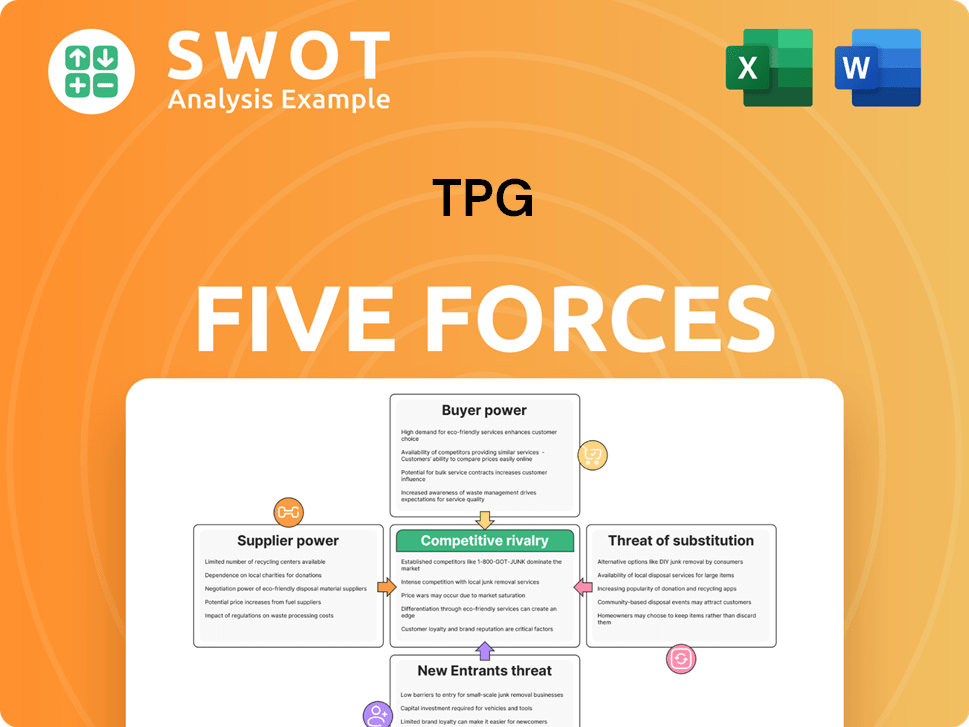

TPG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of TPG Company?

- What is Growth Strategy and Future Prospects of TPG Company?

- How Does TPG Company Work?

- What is Sales and Marketing Strategy of TPG Company?

- What is Brief History of TPG Company?

- Who Owns TPG Company?

- What is Customer Demographics and Target Market of TPG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.