TPG Bundle

Who Are TPG's Customers, and Why Does It Matter?

In the ever-evolving telecommunications landscape, understanding the TPG SWOT Analysis is crucial for any investor or strategist. This deep dive into the TPG company will reveal the critical role of customer demographics and target market analysis in shaping its business strategy. From the merger with Vodafone to recent network-sharing agreements, TPG's journey highlights the importance of adapting to its customer base.

This analysis will explore the intricacies of TPG's target market, providing insights into its customer profile, including customer demographics, behaviors, and needs. We'll examine how TPG company utilizes market segmentation and audience analysis to refine its offerings and maintain a competitive edge, offering a comprehensive view of its customer acquisition strategies and customer lifetime value.

Who Are TPG’s Main Customers?

Understanding the customer demographics and target market of the TPG company is crucial for grasping its market position and strategic direction. TPG Telecom serves a diverse customer base, spanning various segments and demographics. This analysis provides insights into TPG's primary customer segments, offering a detailed view of their composition and behavior.

TPG Telecom's approach to market segmentation allows it to cater to a wide range of consumer and business needs. The company's strategies are designed to capture and retain customers across different demographics, ensuring its continued growth. This comprehensive view of TPG's customer base helps in understanding its market dynamics and future prospects.

The company's success is heavily influenced by its ability to understand and meet the needs of its diverse customer segments. This detailed examination of TPG's primary customers will help to provide a clear picture of who they are and how the company serves them.

TPG Telecom's consumer market includes a wide array of customers served through brands like Vodafone, TPG, iiNet, and others. These brands are tailored to meet different customer preferences and needs, covering various demographics. The company's mobile subscriber base reached 5.51 million by the end of 2024, reflecting a 1.8% increase, primarily driven by growth in prepaid digital brands.

In the fixed broadband market, TPG Telecom held a 20% market share in NBN fixed broadband services as of June 2024. The total fixed customer base decreased by 30,000 to 2.1 million by June 2024. However, TPG Telecom is the largest provider of Fixed Wireless services in Australia, with 245,000 subscribers as of June 2024, growing by an additional 18,000 in the first half of 2024.

The EGW segment represents a significant part of TPG Telecom's business, although service revenue remained flat in the first half of 2024. TPG is planning to sell its fibre network infrastructure and EGW Fixed business to Vocus Group for $5.25 billion, with the deal expected to close in the second half of 2025. This strategic move may shift the company's focus towards a more mobile-centric approach.

TPG's target market includes a mix of consumers, businesses, and government entities. The company's strategy involves offering various services through different brands to meet the needs of various demographics. The company's focus on both mobile and fixed-line services, along with its enterprise solutions, allows it to serve a broad spectrum of customers.

Analyzing TPG's customer base involves understanding the different segments and their specific needs. The company's market segmentation strategy is designed to target various demographics and customer profiles. Understanding these segments is vital for TPG's growth and success, as detailed in Growth Strategy of TPG.

- Consumer (B2C): This segment includes individual customers using mobile and fixed-line services.

- Business (B2B): Businesses of all sizes that require telecommunications solutions.

- Enterprise, Government & Wholesale (EGW): Large organizations and government entities needing specialized services.

- Fixed Wireless Subscribers: Customers relying on fixed wireless services, with a growing subscriber base.

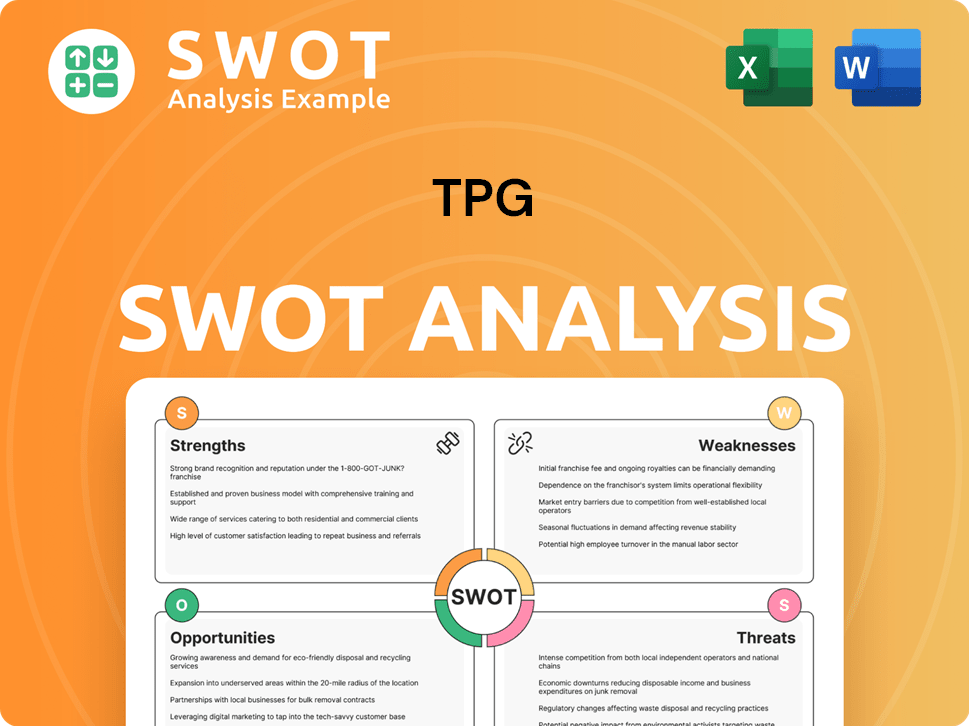

TPG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do TPG’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the TPG company, this means focusing on value, reliability, and comprehensive service offerings. The company's strategic direction, which prioritizes 'reinvigorated brands and services' and 'simplified and improved customer experience,' directly addresses these priorities. This approach is essential for effectively targeting and satisfying its diverse customer base, as well as for maintaining a competitive edge in the telecommunications market.

Customer demographics and the target market of TPG Telecom drive the company's strategies. In the mobile segment, the focus is on providing competitive pricing and extensive network access. For fixed broadband, the emphasis is on delivering high-speed internet and attractive pricing plans. These strategies are designed to meet the specific needs and preferences of different customer segments, ensuring that TPG remains relevant and competitive in the market.

The company's initiatives, such as the network sharing agreement with Optus and the simplification of service plans, are direct responses to customer feedback and market demands. These efforts aim to enhance the overall customer experience, increase brand differentiation, and improve responsiveness to customer needs. By understanding and addressing these key aspects, TPG aims to strengthen its market position and foster customer loyalty.

Customers in the mobile segment prioritize competitive pricing and broad network access. The regional network sharing agreement with Optus, operational from January 2025, significantly expands coverage.

The Optus agreement increases TPG Telecom's 4G and 5G mobile network coverage to 98.4% of the Australian population. This expansion is crucial for attracting customers in regional areas.

Fixed broadband customers value high-speed internet and competitive pricing. TPG offers an NBN price beat guarantee and various discounted plans to attract and retain customers.

TPG is simplifying its consumer mobile and fixed plans, aiming to reduce the number of plans from over 3,700 in FY21 to approximately 100 by the end of FY25. This simplification aims to make choices easier for customers.

The company is focusing on its Fixed Wireless offerings, which have seen growth. This indicates a customer preference for alternative broadband solutions.

Increased brand differentiation and digitalization are key to making TPG faster and more responsive to customer needs. This approach aims to improve overall customer satisfaction and loyalty.

TPG Telecom's strategies are deeply rooted in understanding and responding to customer needs, particularly in the areas of pricing, coverage, and ease of use. The company's initiatives are designed to enhance customer experience and strengthen its market position.

- Competitive Pricing: Offering attractive pricing plans, including discounts on NBN services, to attract and retain customers. For instance, as of April 2025, TPG offers a $30/month discount on NBN100 and $20/month on other NBN plans for the first six months.

- Expanded Network Coverage: The network sharing agreement with Optus significantly increases mobile network coverage, addressing the demand for broader access, especially in regional areas. The aim is to cover 98.4% of the Australian population.

- Simplified Plans: Reducing the number of service plans to make choices easier for customers. The goal is to streamline the offerings from over 3,700 in FY21 to approximately 100 by the end of FY25.

- Focus on Fixed Wireless: Capitalizing on the growth of Fixed Wireless offerings to meet the demand for alternative broadband solutions.

- Digitalization and Brand Differentiation: Enhancing digital capabilities and differentiating brands to improve responsiveness and customer experience.

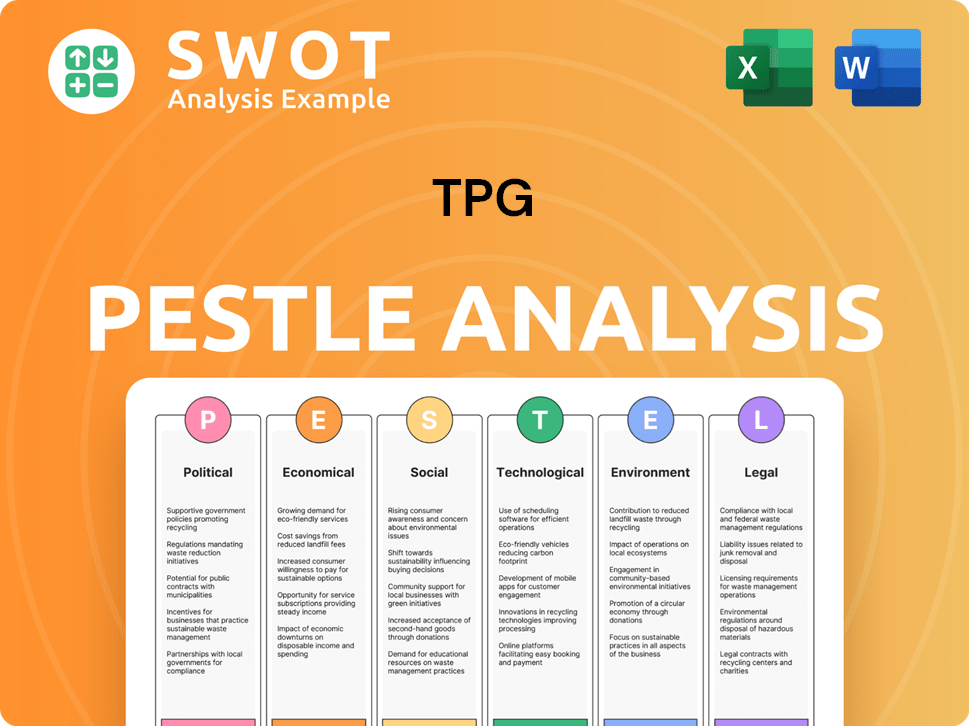

TPG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does TPG operate?

The primary geographical market for TPG Telecom is Australia. The company's infrastructure and customer base are largely concentrated within the country. Historically, TPG's mobile network presence was stronger in urban areas, but strategic expansions are changing this landscape. Understanding the Brief History of TPG helps to understand its market evolution.

A key development for TPG Telecom has been the expansion of its mobile network coverage through a strategic agreement. This expansion addresses previous limitations in regional areas, enhancing its ability to serve a broader customer base. This expansion is a crucial element in understanding its geographic market presence.

In the fixed broadband market, TPG Telecom has a significant presence across Australia. The company's focus on simplifying operations and increasing digitalization is expected to further enhance its responsiveness to customer needs. This approach is designed to improve its service delivery across its diverse geographical footprint.

In April 2024, TPG Telecom entered an 11-year regional network sharing agreement with Optus, which received regulatory approval in September 2024. This Multi-Operator Core Network (MOCN) agreement became operational in January 2025. This initiative is crucial for understanding the TPG target market analysis.

The MOCN agreement is set to dramatically expand TPG Telecom's mobile network coverage. The company's 4G network coverage will increase from approximately 400,000 square kilometers to around 1,000,000 square kilometers. This expansion allows TPG to reach 98.4% of the Australian population, which is vital for analyzing TPG's customer base.

As of June 2024, TPG Telecom held a 20% market share in NBN fixed broadband services. This strong presence indicates the company's ability to serve customers in NBN-connected regions across Australia. This data is essential for defining TPG's target market.

TPG Telecom remains the largest provider of Fixed Wireless services in Australia, with 245,000 subscribers. This demonstrates the company's success in offering alternative broadband solutions. Understanding TPG customer demographics by product is important.

TPG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does TPG Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of any telecommunications company. For TPG Telecom, these strategies are multifaceted, focusing on competitive pricing, enhanced customer experience, and expanded network coverage. The company strategically uses its brand portfolio and partnerships to attract and retain customers. A deep understanding of Marketing Strategy of TPG helps in formulating effective acquisition and retention plans.

One of the primary acquisition strategies involves competitive pricing and promotional offers. For instance, a recent brand refresh campaign in April 2025 offered significant discounts on NBN plans. This included a $30/month discount on NBN100 plans for six months, along with a contest offering a year of free internet to 100 customers. These initiatives are designed to highlight the value proposition and attract new customers. These campaigns, developed with marketing partners, are a key element of the company's customer acquisition efforts.

In terms of retention, TPG Telecom is simplifying its product portfolio to enhance customer experience. The goal is to reduce the number of consumer mobile and fixed plans from over 3,700 in FY21 to approximately 100 by the end of FY25. This simplification aims to make choices clearer and easier for customers, improving satisfaction and reducing churn. Furthermore, increased brand differentiation and digitalization also contribute to improved customer retention.

TPG Telecom employs several key strategies to acquire new customers, including:

- Competitive Pricing: Offering attractive discounts and promotions on NBN and mobile plans.

- Promotional Campaigns: Launching brand refresh campaigns with significant incentives, like discounts and giveaways.

- Strategic Partnerships: Collaborating with marketing partners to enhance reach and effectiveness.

TPG Telecom focuses on various strategies to retain its existing customer base:

- Product Simplification: Reducing the number of plans to streamline customer choices and improve satisfaction.

- Network Expansion: Leveraging regional network sharing agreements to provide wider coverage and better service.

- Digitalization: Enhancing digital sales capabilities and modernizing IT infrastructure for a better customer experience.

A major driver for both acquisition and retention is the expanded network coverage. The regional network sharing agreement with Optus, operational from January 2025, has significantly increased the company's mobile network coverage to 98.4% of the Australian population. This broader reach enables TPG Telecom to target new customers in regional areas and provide existing customers with an improved network experience.

Securing new mobile virtual network operator (MVNO) contracts, such as the one with Lyca Mobile, has also contributed to a strong increase in prepaid subscribers in FY24. This strategy helps in expanding the customer base and revenue streams.

TPG Telecom focuses on enhancing its digital sales capabilities and modernizing its IT infrastructure to support a more efficient and responsive customer journey. This focus on digital transformation is crucial for improving customer satisfaction and operational efficiency.

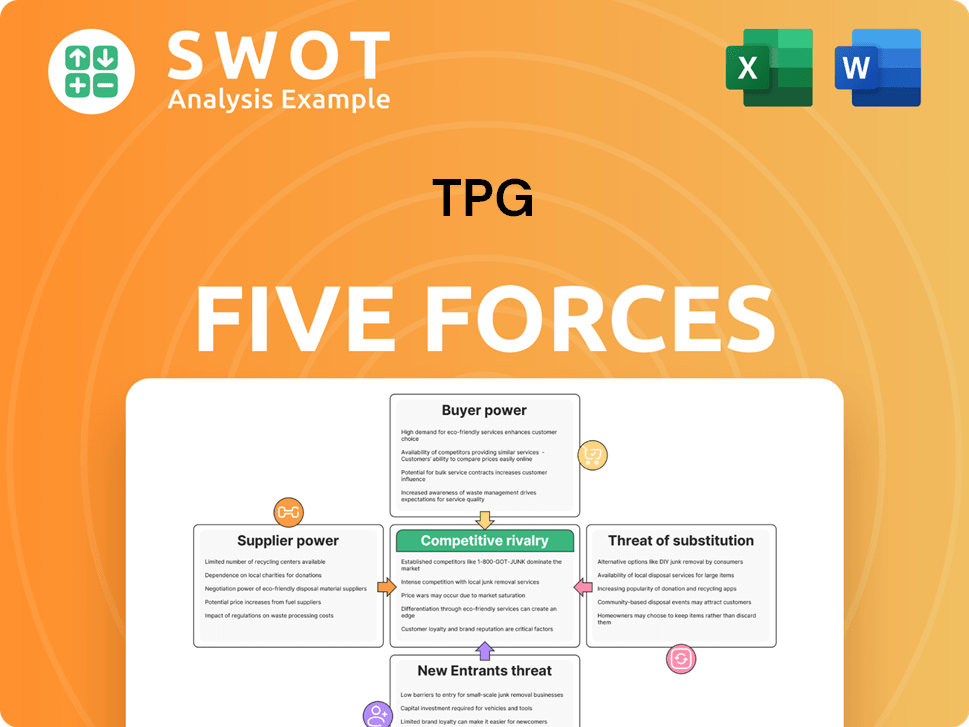

TPG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.