TPG Bundle

How Does TPG Company Connect Australia?

TPG Telecom Limited, a major force in Australian telecommunications, connects millions across the country. Born from a significant 2020 merger, TPG immediately became a leading telecom provider, challenging established competitors. This strategic move positioned TPG as a key player in the nation's digital infrastructure, offering a wide array of services.

Delving into the TPG SWOT Analysis, we uncover the intricacies of the TPG business model, exploring its diverse TPG services and revenue streams. Understanding TPG investment potential requires a deep dive into its operations, market positioning, and financial performance. This analysis aims to provide a comprehensive understanding of how TPG company operates, its strategic direction, and its impact on the Australian telecommunications landscape, making it a valuable resource for investors and industry observers alike.

What Are the Key Operations Driving TPG’s Success?

The core operations of the TPG company are centered around delivering comprehensive telecommunications services. This involves providing both fixed and mobile network solutions, ensuring reliable and accessible connectivity for a diverse customer base. The TPG business model focuses on offering a range of services, including fixed broadband, mobile plans, and business-specific voice and data solutions.

TPG's value proposition lies in its ability to deliver these services through an extensive infrastructure. This includes owning and operating a significant mobile network, which, as of February 2024, covered 96% of the Australian population, or around 23 million people. This infrastructure allows for greater control over service quality and reach, setting TPG apart from competitors.

The company's operational processes encompass network design, technology development, customer acquisition, and support. TPG leverages a multi-brand strategy, with brands like Vodafone focusing on mobile services, while TPG and iiNet concentrate on fixed broadband. Supply chain management and partnerships with technology vendors are also critical to its operations. TPG's unique operational effectiveness stems from its dual network strategy – leveraging both its own extensive infrastructure and wholesale agreements, enabling cost efficiencies and broader reach.

TPG Telecom's infrastructure is a key differentiator. The company operates Australia's second-largest mobile network. This extensive network coverage ensures reliable service delivery.

TPG provides a broad range of services. These include fixed broadband, mobile plans, and business solutions. The diverse portfolio caters to various customer needs.

The company focuses on operational efficiency. This is achieved through network optimization and strategic partnerships. This approach helps to maintain competitive pricing.

TPG prioritizes customer satisfaction. The company invests in customer support and service improvements. The multi-brand strategy allows for targeted marketing.

TPG's operational strategy provides several key advantages. These include extensive network ownership, a diverse brand portfolio, and competitive pricing. These factors contribute to the company's market position.

- Extensive Network Coverage: Owning a significant portion of the network ensures service reliability.

- Diverse Brand Portfolio: Targeting different customer segments with specific brands increases market reach.

- Competitive Pricing: Efficient operations and strategic partnerships enable competitive pricing.

- Customer-Centric Approach: Focusing on customer satisfaction drives loyalty and retention.

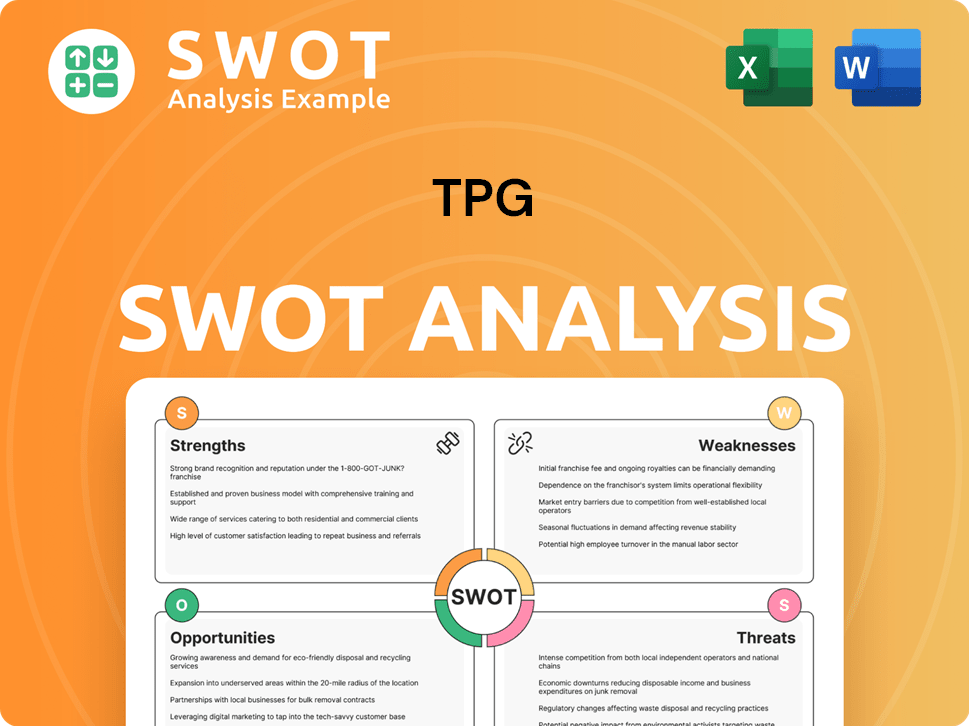

TPG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TPG Make Money?

Understanding the revenue streams and monetization strategies of the TPG company is crucial for investors and stakeholders. The TPG business model is built on a foundation of diversified services, primarily in the telecommunications sector. This approach allows the company to generate revenue from various sources, ensuring a degree of resilience in a competitive market.

The company's financial performance reflects its operational scale and market position. For instance, the company reported total revenue of $5,446 million and an EBITDA of $1,883 million in their FY23 results, showcasing its significant financial footprint. The TPG services are designed to cater to a wide range of customers, from individual consumers to large enterprises, each contributing to its revenue base.

TPG Telecom generates revenue through a diverse set of streams, primarily categorized into consumer and enterprise segments, reflecting its broad service offerings across fixed, mobile, and wholesale services. While specific granular breakdowns for 2024-2025 are subject to ongoing financial reporting, the company's revenue streams typically include: mobile service revenue, fixed broadband revenue, and enterprise, government, and wholesale revenue.

TPG investment in various sectors is supported by its robust revenue streams. The company employs several strategies to maximize revenue and customer value. These strategies include tiered pricing, bundled services, and cross-selling opportunities across its brands.

- Mobile Service Revenue: Derived from postpaid and prepaid mobile plans, including voice, SMS, and data usage.

- Fixed Broadband Revenue: Generated from residential and business customers subscribing to NBN, ADSL, and fibre broadband services.

- Enterprise, Government, and Wholesale Revenue: Revenue from providing connectivity solutions, data services, and voice services to businesses, government agencies, and other telecommunications providers.

- Tiered Pricing: Offering different data allowances and speeds at varying price points.

- Bundled Services: Combining mobile and fixed-line services to increase customer stickiness and ARPU.

- Cross-Selling: Leveraging its diverse brand portfolio to offer complementary services, such as offering a Vodafone mobile plan to an iiNet broadband customer.

The company's strategic acquisitions, such as the merger that created TPG Telecom, have expanded its revenue sources. The integration of mobile-centric revenue from Vodafone with the fixed-line strength of TPG demonstrates a strategic approach to market consolidation and service diversification. For more insights into the TPG company history and background and its growth strategies, you can refer to Growth Strategy of TPG.

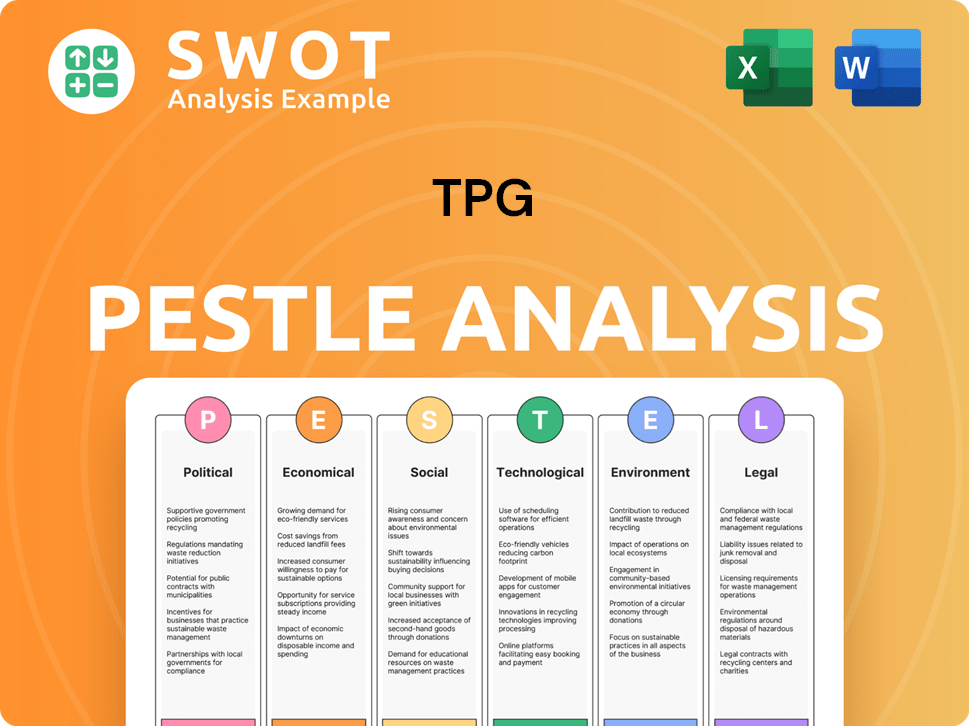

TPG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TPG’s Business Model?

The evolution of TPG Telecom has been marked by significant strategic shifts and pivotal moments that have shaped its current standing. The most transformative event was the merger of TPG and Vodafone Hutchison Australia in 2020. This merger was a game-changer, instantly establishing TPG Telecom as a major player in the Australian telecommunications market.

This strategic move allowed TPG Telecom to leverage combined resources. It created a more robust and diversified customer base. The merger enabled the company to integrate both fixed and mobile infrastructure. This led to improved network coverage and capacity, crucial for delivering high-quality services.

The company has faced challenges common in the telecom industry, including fierce competition, regulatory scrutiny, and the need for substantial capital expenditure. This is particularly true with the ongoing rollout of 5G technology. To navigate these hurdles, TPG Telecom has focused on operational efficiencies and network integration post-merger. Its competitive advantages are multifaceted.

The 2020 merger with Vodafone Hutchison Australia was a defining moment, creating a telecommunications giant. This merger significantly increased TPG Telecom's market share and operational capabilities. The integration of both companies' assets allowed for a more efficient and extensive network.

TPG Telecom has consistently invested in network upgrades, especially in 5G infrastructure. The company focuses on operational efficiencies to improve profitability. They have expanded their service offerings to meet evolving consumer demands.

TPG Telecom benefits from a strong brand portfolio, including Vodafone, TPG, and iiNet. This allows them to target different market segments. Their extensive network infrastructure provides broad coverage and high-quality service. Economies of scale, derived from a large customer base, enable cost efficiencies.

In recent financial reports, TPG Telecom has shown resilience in a competitive market. The company has focused on cost management and revenue growth. The financial health of TPG Telecom is closely watched by investors and analysts. For more details, you can read about Owners & Shareholders of TPG.

TPG Telecom’s competitive edge stems from several factors. Brand strength, encompassing diverse brands like Vodafone and TPG, allows it to cater to various market segments. Its extensive network infrastructure provides broad coverage and superior service quality, particularly in mobile services. Economies of scale, resulting from its large customer base and integrated operations, enable cost efficiencies.

- Strong brand portfolio, including Vodafone, TPG, and iiNet.

- Extensive network infrastructure, covering a vast majority of the Australian population for mobile services.

- Economies of scale derived from a large customer base and integrated operations.

- Ongoing investment in 5G infrastructure and service offerings.

TPG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TPG Positioning Itself for Continued Success?

The industry position of the TPG company in Australia is significant. It holds the second-largest market share in the telecommunications sector, just behind Telstra. TPG's extensive network infrastructure and diverse brand portfolio, including Vodafone, TPG, iiNet, and Internode, support its strong presence in both fixed broadband and mobile services.

Despite its strong market position, TPG faces several risks. These include regulatory changes, intense competition, and technological disruptions. The company must continuously invest in network upgrades and service innovation to meet evolving consumer demands.

TPG Telecom is a major player in the Australian telecommunications market. It has a substantial market share in fixed broadband and mobile services. The company's wide network coverage and strong customer loyalty contribute to its solid industry standing.

TPG faces risks from regulatory changes, competitive pressures, and technological advancements. Price wars and the emergence of new MVNOs also pose challenges. Adapting to changing consumer preferences and investing in network improvements are crucial for sustained performance.

TPG aims to expand revenue through network enhancements and customer acquisition. The company is focused on its 5G network rollout and exploring new service offerings. TPG's success will depend on its ability to navigate the evolving regulatory and competitive environment.

Ongoing initiatives include 5G network expansion and infrastructure optimization. TPG focuses on improving customer experience to drive retention. The company's leadership emphasizes network quality and leveraging integrated assets for growth.

TPG's future success depends on several key factors. These include effectively managing regulatory changes and competitive pressures. Continuous investment in network infrastructure and innovation is also essential. The company must also focus on customer satisfaction and exploring new market opportunities.

- Network expansion and optimization.

- Customer acquisition and retention strategies.

- Exploration of new service offerings.

- Adaptation to technological advancements.

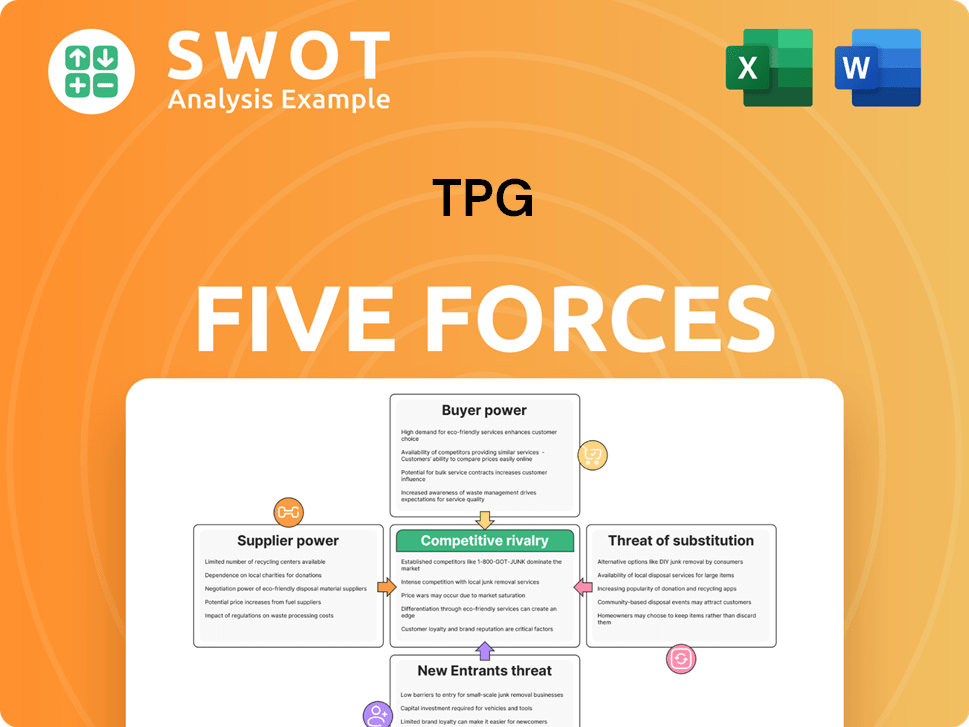

TPG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TPG Company?

- What is Competitive Landscape of TPG Company?

- What is Growth Strategy and Future Prospects of TPG Company?

- What is Sales and Marketing Strategy of TPG Company?

- What is Brief History of TPG Company?

- Who Owns TPG Company?

- What is Customer Demographics and Target Market of TPG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.