TPG Bundle

Who Really Owns TPG Telecom?

Understanding the ownership structure of a major telecommunications player like TPG Telecom (ASX: TPG) is crucial for any investor or strategist. Knowing who controls a company dictates its strategic direction, investment priorities, and overall performance. This knowledge is particularly vital in the dynamic telecommunications sector, where rapid technological advancements and intense competition are the norm.

This deep dive into TPG SWOT Analysis will illuminate the TPG ownership landscape, revealing the key TPG investors and stakeholders that shape its future. We'll explore the evolution of TPG company from its inception, examining the influence of major shareholders, the roles of TPG executives, and the impact of TPG Global strategies on its trajectory. Whether you're interested in TPG stock, or simply curious about TPG company ownership structure, this analysis provides a comprehensive overview.

Who Founded TPG?

The story of the TPG company begins in 1986, with David Teoh and his wife, Vicky, at the helm. They started what would become a telecommunications giant as a computer retailer. Through strategic moves, including key acquisitions, they transformed TPG into a significant internet service provider in Australia.

David and Vicky Teoh's vision was crucial in building TPG Telecom into one of Australia's largest broadband businesses. Their entrepreneurial spirit set the foundation for the company's growth. This early phase shaped the TPG ownership structure.

While specific details on the initial equity split aren't publicly available, David Teoh's significant ownership stake was a defining feature. Even after the merger with Vodafone Hutchison Australia in July 2020, the Teoh family and their associates maintained a substantial presence.

David Teoh and his wife, Vicky, founded the company in 1986.

Initially, the company operated as a computer retailer.

Through acquisitions, TPG evolved into a major internet service provider.

David Teoh and associates held a substantial stake after the 2020 merger.

Agreements like escrow periods influenced the ownership structure.

The Teoh family's shareholding demonstrated their lasting influence.

As of TPG's 2021 Annual Report, David and Vicky Teoh, along with their associates, held a substantial 14.2% stake in TPG Telecom. This illustrates the enduring influence of the founding family on the company's ownership. Early agreements, such as escrow periods that restricted the sale of shares by major shareholders, including the Teoh family, Vodafone, and Hutchison, further shaped the early post-merger ownership structure. For more insights into the company's strategic direction, consider exploring the Target Market of TPG.

The founders, David and Vicky Teoh, played a pivotal role in the company's evolution. Their strategic vision was instrumental in transforming TPG into a major player in the Australian telecommunications market. The Teoh family’s continued significant ownership stake post-merger highlights their enduring influence.

- Founders: David and Vicky Teoh.

- Initial Business: Computer retailer.

- Transformation: Strategic acquisitions led to ISP status.

- Ownership: Teoh family retained a significant stake post-merger.

- Influence: Early agreements shaped the ownership structure.

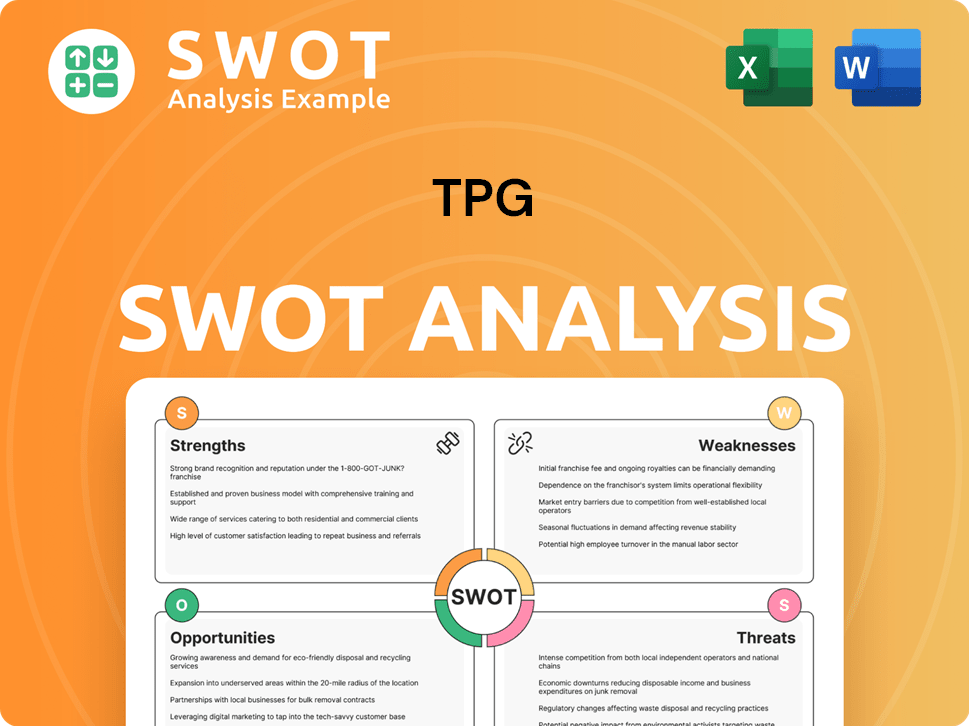

TPG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TPG’s Ownership Changed Over Time?

The ownership structure of the TPG company has seen significant changes, especially following a major merger. Before its listing on the Australian Securities Exchange (ASX) in 2008, TPG Telecom (formerly TPG Corporation Limited) operated independently. The current entity, TPG Telecom Limited, emerged from the merger of Vodafone Hutchison Australia (VHA) and TPG Corporation Limited, finalized on June 30, 2020. This merger reshaped the ownership landscape, bringing together two major players in the telecommunications sector.

The merger in July 2020 was a pivotal moment, creating a new entity with a diverse ownership base. At the time of the merger, Vodafone and Hutchison Telecommunications (Australia) Limited (HTAL) each held an economic interest of 25.05% in the new company, while TPG shareholders held the remaining 49.9%. This consolidation aimed to enhance market competitiveness and leverage the combined strengths of both entities. The evolution of TPG ownership reflects strategic shifts and market dynamics within the telecommunications industry.

| Stakeholder | Economic Interest (February 28, 2025) | Notes |

|---|---|---|

| CK Hutchison Holdings Limited (CKHH) | 25.05% | Major shareholder |

| Vodafone Group Plc | 25.05% | Major shareholder |

| Teoh Family Interests | 14.21% | Founders' interests |

| Washington H Soul Pattinson and Company Limited | 12.78% | Significant stake |

Currently, the major stakeholders in TPG Telecom include CK Hutchison Holdings Limited (CKHH) and Vodafone Group Plc, each with a 25.05% economic interest as of February 28, 2025. The Teoh family interests, representing the founders, held a 14.21% economic interest as of the same date. Additionally, Washington H Soul Pattinson and Company Limited holds a significant stake, recorded at 12.78% as of February 28, 2025. These key TPG investors and the founding family's holdings significantly influence company strategy and governance. To understand more about the company's market approach, you can explore the Marketing Strategy of TPG.

The ownership structure of TPG company is largely influenced by major shareholders, including CK Hutchison Holdings Limited and Vodafone Group Plc. The Teoh family, as founders, also plays a significant role.

- CKHH and Vodafone each hold a substantial 25.05% economic interest.

- The Teoh family's 14.21% stake reflects the founders' continued influence.

- Washington H Soul Pattinson and Company Limited holds a noteworthy 12.78% stake.

- These stakeholders collectively shape the company's strategic direction.

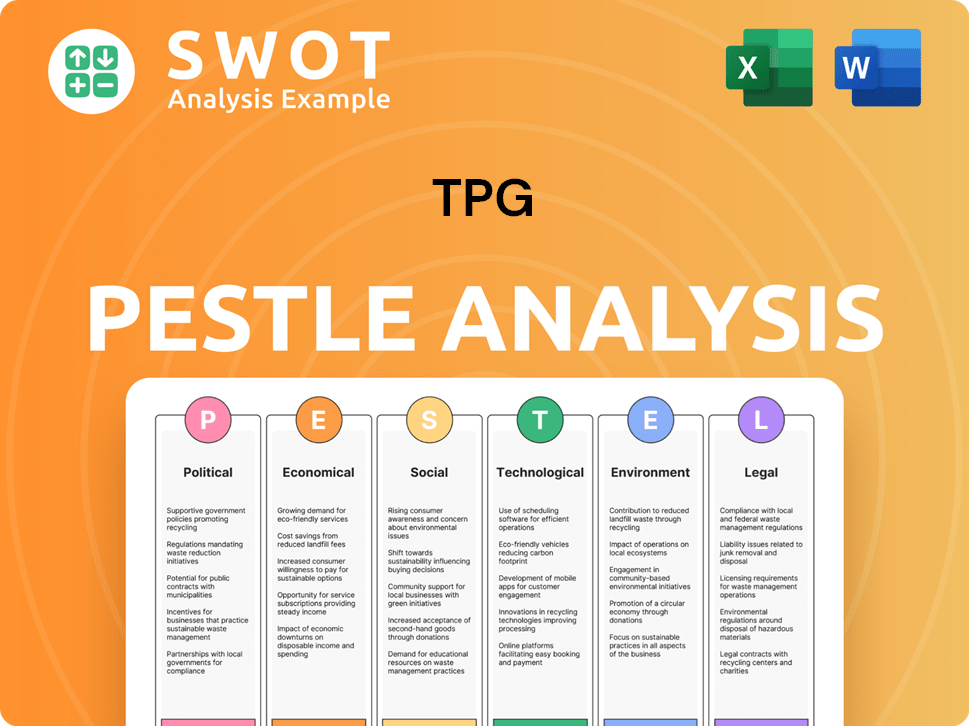

TPG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TPG’s Board?

As of April 4, 2025, the Board of Directors of the TPG company includes Canning Fok as Chairman, and Iñaki Berroeta as Chief Executive Officer and Managing Director. The board also includes Non-Executive Directors. Frank Sixt and Pierre Klotz represent major shareholders CK Hutchison Holdings Limited and Vodafone Group Plc, respectively. Jack Teoh, representing the Teoh family interests, also serves as a Non-Executive Director. Independent Non-Executive Directors include Paula Dwyer, appointed on October 21, 2024, and Dr. Helen Nugent AC.

This composition reflects the influence of major TPG investors. The structure, approved during the 2020 merger, has fewer independent directors than many ASX companies, a detail acknowledged by the company. This structure is a direct result of the TPG ownership composition and the influence of key stakeholders.

| Director | Role | Shareholder Representation |

|---|---|---|

| Canning Fok | Chairman | N/A |

| Iñaki Berroeta | Chief Executive Officer and Managing Director | N/A |

| Frank Sixt | Non-Executive Director | CK Hutchison Holdings Limited |

| Pierre Klotz | Non-Executive Director | Vodafone Group Plc |

| Jack Teoh | Non-Executive Director | Teoh family interests |

| Paula Dwyer | Independent Non-Executive Director | N/A |

| Dr. Helen Nugent AC | Independent Non-Executive Director | N/A |

TPG Telecom's voting structure generally follows a one-share-one-vote basis for its common stock. The governance framework, established during the 2020 merger, shows the significant influence of major TPG investors. Understanding the TPG company ownership structure is key to grasping the company's strategic direction. For more insights into the company's background, consider reading this article about TPG.

The board reflects the influence of major shareholders, including CK Hutchison and Vodafone.

- Canning Fok serves as Chairman.

- Iñaki Berroeta is the CEO and Managing Director.

- The board includes independent and non-executive directors.

- The voting structure is primarily one-share-one-vote.

TPG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TPG’s Ownership Landscape?

Over the past few years, there have been significant shifts in the ownership profile of the TPG company. A notable change occurred with the departure of founder David Teoh from the board in March 2021, followed by his son Shane Teoh's resignation. Despite these changes, David Teoh remained a major shareholder, holding a 17.2% stake initially. As of February 2025, the Teoh family continues to hold a 14.21% economic interest, indicating ongoing influence within the company.

In October 2024, a major strategic move was announced: the sale of the fibre network infrastructure assets and Enterprise, Government, and Wholesale (EGW) fixed business to Vocus Group for an enterprise value of A$5.25 billion (US$3.5 billion). This deal, expected to finalize in the second half of 2025, is designed to streamline operations and optimize capital structure, with net cash proceeds ranging from A$4.65 billion to A$4.75 billion. Following this transaction, the TPG company will focus on its mobile radio network infrastructure and consumer/small office/home office fixed retail businesses, including fixed wireless, with Vocus providing fixed network services back to TPG. These developments reflect a strategic shift towards a more mobile-focused entity, influencing the dynamics of TPG investors.

The Teoh family's continued significant economic interest highlights the founders' enduring influence. The sale of the fibre network assets to Vocus Group signals a strategic pivot. This move is intended to streamline the company's focus and optimize its financial structure.

The Multi-Operator Core Network (MOCN) partnership with Optus, activated in January 2025, has doubled the mobile network coverage. This partnership, approved by the ACCC in September 2024, allows TPG to leverage Optus's assets. These partnerships are essential for TPG's regional expansion.

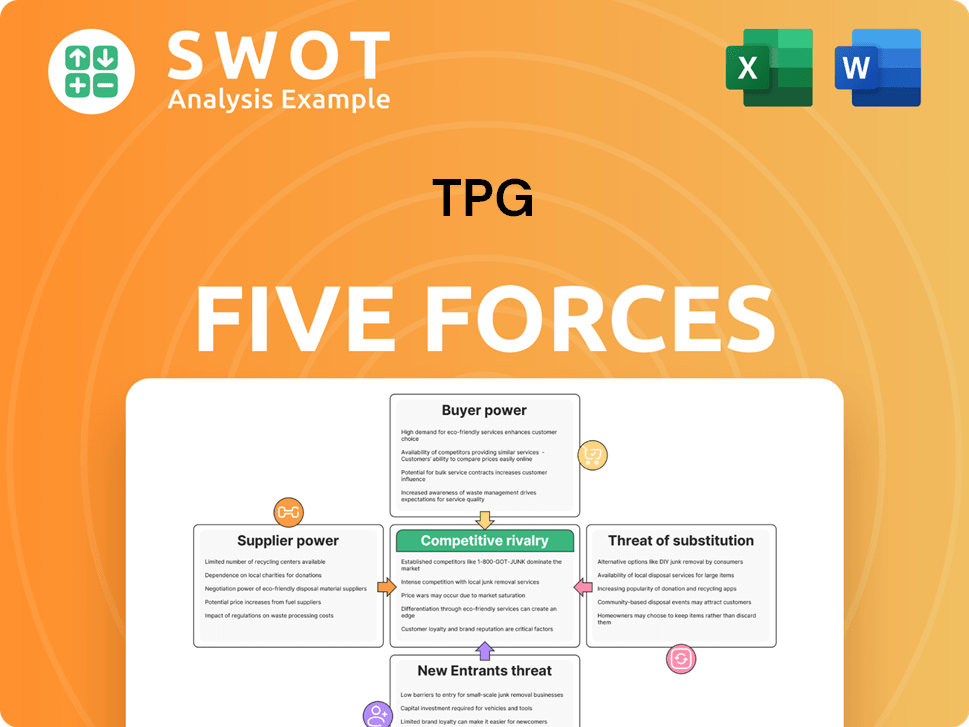

TPG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TPG Company?

- What is Competitive Landscape of TPG Company?

- What is Growth Strategy and Future Prospects of TPG Company?

- How Does TPG Company Work?

- What is Sales and Marketing Strategy of TPG Company?

- What is Brief History of TPG Company?

- What is Customer Demographics and Target Market of TPG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.