TPG Bundle

Can TPG Telecom Continue Its Ascent in the Australian Telecom Market?

From its humble beginnings as a small IT firm, TPG Telecom has transformed into a telecommunications giant. The 2020 merger with Vodafone Hutchison Australia was a game-changer, reshaping the competitive landscape. Now, learn how TPG plans to leverage strategic expansion and innovation to secure its future.

This TPG SWOT Analysis will delve into TPG's growth strategy, examining its current position and future prospects. We will explore the TPG Company Analysis, including its business model and recent TPG Investments. Furthermore, we'll analyze TPG's Financial Performance and its strategies for navigating the evolving telecom market, providing insights for investors and industry observers alike.

How Is TPG Expanding Its Reach?

TPG Telecom's expansion initiatives are multifaceted, focusing on both organic growth and strategic partnerships to enhance its market position. A core element of its strategy involves the ongoing expansion and improvement of its 5G network, aiming to broaden coverage and increase capacity across Australia. This network densification is crucial for attracting new mobile subscribers and improving service quality for existing customers, directly impacting the company's Owners & Shareholders of TPG.

The company is also leveraging its extensive fixed-line infrastructure to offer competitive broadband services, particularly in the National Broadband Network (NBN) wholesale market. Furthermore, TPG is actively exploring opportunities to bundle services, providing integrated mobile, broadband, and voice solutions to both residential and business customers. This approach aims to diversify revenue streams and cater to evolving industry demands.

TPG's growth strategy includes a strong emphasis on fixed wireless access (FWA) offerings, especially in areas where NBN services may face greater competition. Additionally, TPG continues to explore wholesale opportunities, utilizing its network assets to provide services to other telecommunications providers. These initiatives are designed to access new customer segments and diversify revenue beyond traditional mobile and fixed broadband services. While specific timelines for future mergers and acquisitions are not publicly detailed, TPG has shown a willingness to pursue such opportunities if they align with its strategic objectives and offer accretive value.

TPG's future prospects hinge on several key expansion initiatives designed to drive growth and enhance its market position. These include significant investments in 5G network upgrades and a focus on bundling services to attract and retain customers. The company is strategically positioned to capitalize on emerging opportunities within the telecommunications sector.

- 5G Network Expansion: Ongoing investment to increase coverage and capacity across Australia.

- Fixed-Line Infrastructure: Leveraging existing infrastructure for competitive broadband services.

- Service Bundling: Offering integrated mobile, broadband, and voice solutions.

- Wholesale Opportunities: Providing services to other telecommunications providers.

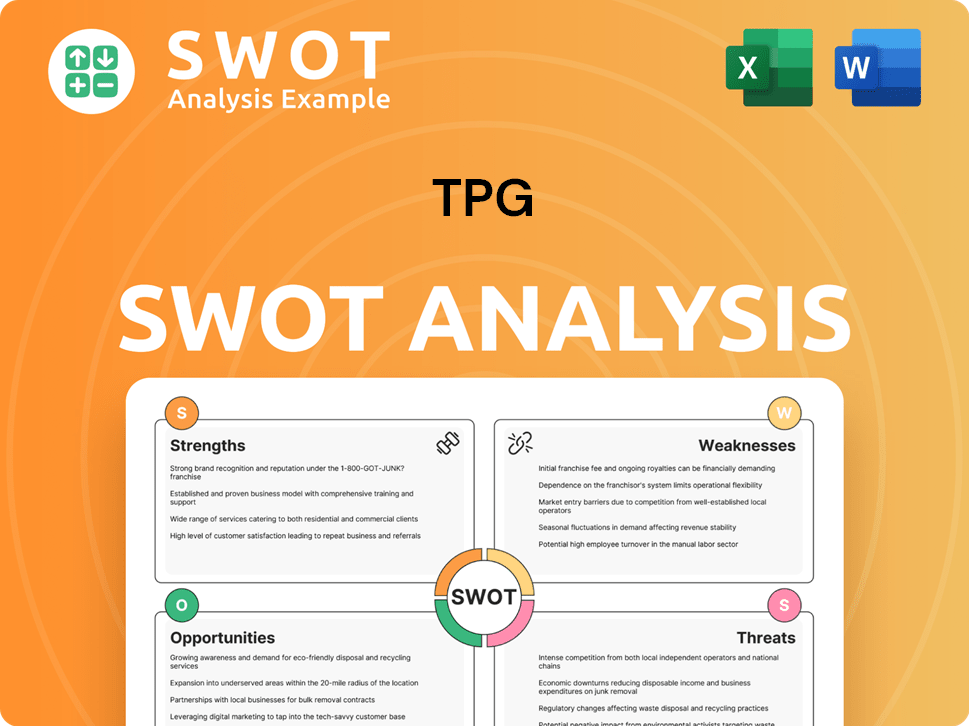

TPG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TPG Invest in Innovation?

The growth strategy of TPG Telecom is deeply intertwined with its commitment to technological advancement and innovation. The company strategically invests in research and development, both internally and through collaborations, to enhance its network capabilities and develop new customer-centric solutions. This focus is crucial for maintaining a competitive edge in the telecommunications industry.

A key aspect of TPG's technology strategy involves digital transformation, which streamlines customer interactions through improved online platforms and self-service tools. Automation is also a significant area of investment, aimed at optimizing network operations and enhancing service delivery efficiency. These initiatives are essential for improving customer satisfaction and operational effectiveness.

TPG Telecom actively deploys cutting-edge technologies, particularly in its 5G network, to provide faster speeds, lower latency, and support new applications like the Internet of Things (IoT). This investment is vital for meeting the evolving demands of consumers and businesses alike. For a deeper understanding of how TPG approaches its market strategies, you can refer to the Marketing Strategy of TPG.

TPG Telecom's continued investment in its 5G network infrastructure is a cornerstone of its technology strategy. By late 2023, the 5G network reached approximately 85% of the Australian population. This expansion is critical for offering advanced connectivity and supporting the growing demand for high-speed data services.

The company is exploring the application of artificial intelligence (AI) in network management, customer service, and data analytics. This integration aims to gain a competitive advantage by improving efficiency, personalizing customer experiences, and making data-driven decisions. AI-driven solutions are becoming increasingly important in the telecommunications sector.

Sustainability is integrated into TPG's technology strategy, with efforts to improve energy efficiency across its network infrastructure. This commitment to environmental responsibility aligns with global trends and enhances the company's corporate image. Reducing energy consumption is also a financially prudent move.

TPG Telecom's continuous network upgrades and service enhancements underscore its dedication to maintaining a leadership position in telecommunications innovation. These ongoing improvements ensure that the company remains at the forefront of technological advancements, providing superior services to its customers.

TPG's focus on digital transformation includes streamlining customer interactions through improved online platforms and self-service tools. This approach enhances customer experience and operational efficiency. Digital tools are becoming increasingly crucial for customer satisfaction and retention.

Automation is a key area of investment, aiming to optimize network operations and improve service delivery efficiency. This focus on automation helps reduce costs and improve the speed and reliability of services. Efficiency improvements are essential for maintaining profitability.

TPG Telecom's technology strategy is characterized by significant investments in several key areas. These investments are designed to support its long-term growth strategy and improve its competitive position in the market. The company's financial performance is closely tied to the success of these initiatives.

- 5G Network: Continued expansion to reach a wider audience.

- AI Integration: Application of AI in network management and customer service.

- Digital Transformation: Enhancing online platforms and self-service tools.

- Automation: Optimizing network operations and service delivery.

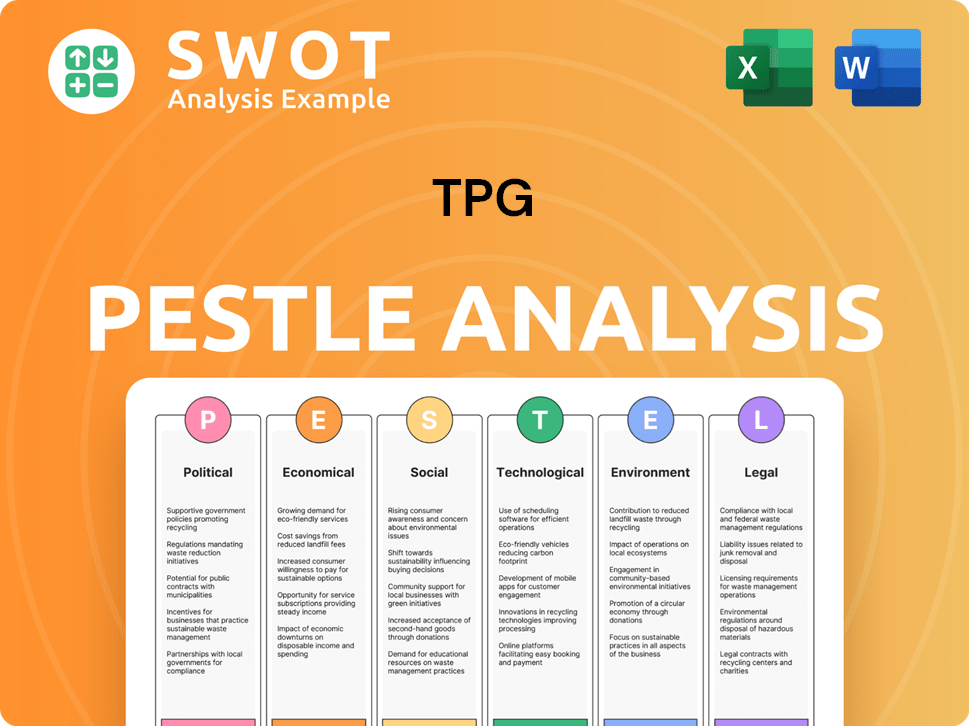

TPG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TPG’s Growth Forecast?

The financial outlook for TPG Telecom is shaped by its strategic initiatives and its strong position in the Australian telecommunications market. In 2023, TPG reported an EBITDA of $1,902 million, marking a 12% increase compared to the previous year. Total revenue for the same period reached $5,431 million, demonstrating the company's robust financial performance.

Looking ahead to FY24, TPG forecasts its EBITDA to be between $1,950 million and $2,025 million. This positive outlook reflects the company's ongoing efforts to boost subscriber numbers in both mobile and fixed broadband services, alongside optimizing operational efficiencies. The company's growth strategy is also supported by disciplined capital allocation, which is crucial for network expansion and enhancing its competitive edge.

TPG Telecom's financial health is also underpinned by its ability to generate strong free cash flow, which supports its network expansion plans and enhances its competitive position. The company's financial performance is closely monitored as it continues to execute its growth strategy in a dynamic market. For more details on its business model, consider reading Revenue Streams & Business Model of TPG.

TPG's capital expenditure for FY23 was $984 million. This investment supports its network infrastructure, including 5G and fixed wireless capabilities. These investments are crucial for maintaining and improving service quality, which is a key element of TPG's growth strategy.

The company aims to achieve further growth through increased subscriber numbers in both mobile and fixed broadband segments. This strategy focuses on expanding its customer base and increasing market share. TPG's business model is designed to capitalize on the growing demand for telecommunications services.

For FY24, capital expenditure is expected to be between $1,050 million and $1,150 million. This continued investment highlights TPG's commitment to enhancing its network infrastructure and its competitive position. This investment is a key element of TPG's future prospects.

TPG's growth strategy includes optimizing operational efficiencies. This involves streamlining processes and reducing costs to improve profitability. This approach helps the company to maintain a competitive edge and improve its financial performance.

TPG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TPG’s Growth?

The telecommunications industry presents several strategic and operational risks for TPG. Intense competition and the need to acquire and retain subscribers are constant challenges. Regulatory changes, particularly concerning spectrum allocation and network access, can also significantly impact the company's operations and profitability. For a comprehensive understanding of the company's values, consider reading Mission, Vision & Core Values of TPG.

Supply chain vulnerabilities, especially regarding network equipment, pose another risk. Technological disruptions, such as the emergence of new communication technologies, could also necessitate significant investment in new infrastructure. Managing the integration of various brands under the TPG umbrella remains a continuous task.

TPG addresses these risks through service diversification, robust risk management, and proactive engagement with regulatory bodies. Despite past successes, such as the TPG-Vodafone merger, emerging threats like increasing cybersecurity risks and the need for ongoing capital expenditure will shape its future trajectory. The company must navigate these challenges to maintain its TPG Growth Strategy and achieve its TPG Future Prospects.

The telecommunications market is highly competitive, with established players like Telstra and Optus vying for market share. Smaller niche providers add further pressure, making subscriber acquisition and retention a constant challenge. This competitive landscape directly impacts TPG Financial Performance.

Regulatory changes, particularly regarding spectrum allocation and network access, can significantly affect TPG. Changes to wholesale pricing models or consumer protection regulations could impact the company's profitability. The regulatory environment surrounding the NBN is a key factor.

Dependence on international vendors for network equipment and technology components creates supply chain vulnerabilities. Delays in network deployment or increased costs can result from disruptions. These factors directly affect the company's ability to execute its TPG Investments.

The rapid evolution of communication technologies and shifts in consumer behavior necessitate ongoing investment. New infrastructure or services are needed to stay competitive. These investments are crucial for maintaining TPG's growth strategy in the technology sector.

Managing the integration of various brands under the TPG Telecom umbrella is a continuous task. Ensuring a cohesive operational strategy and brand consistency is essential for success. This integration is vital for the overall TPG Business Model.

Increasing cybersecurity threats pose a significant risk to TPG's operations and customer data. Protecting against cyberattacks requires continuous investment in security measures. Addressing these risks is crucial for TPG's long-term growth strategy for portfolio companies.

Maintaining network competitiveness requires significant ongoing capital expenditure. This includes investments in infrastructure, technology upgrades, and expansion. These investments are crucial for driving TPG's future prospects in emerging markets.

Economic downturns can impact consumer spending and business investments in telecommunications services. Strategies to navigate economic downturns include cost management and service diversification. For example, in 2024, the telecommunications industry saw shifts in consumer spending patterns, requiring companies like TPG to adapt their offerings.

TPG's approach to ESG (Environmental, Social, and Governance) factors is becoming increasingly important. This includes sustainable practices, ethical sourcing, and corporate governance. These factors are crucial for TPG's impact on the companies it invests in.

TPG's future plans for expansion and diversification involve exploring new markets and service offerings. This may include expanding into new geographic areas or offering new services. These strategies are essential for the overall TPG Company Analysis.

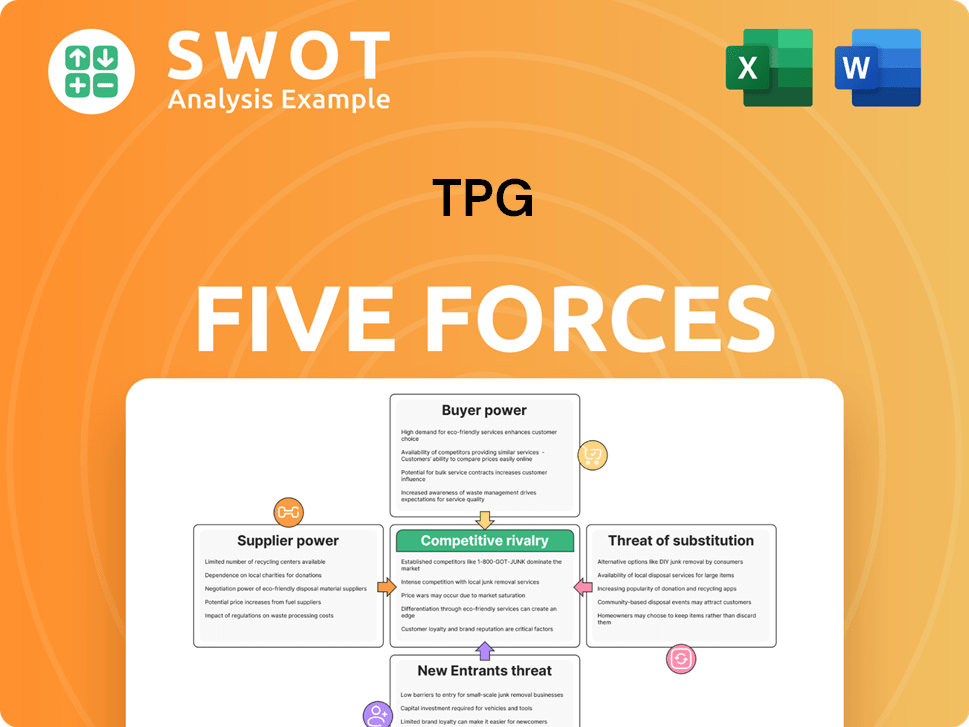

TPG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.