TPG Bundle

How Does TPG Telecom Navigate Australia's Telecom Wars?

TPG Telecom Limited, a major player in Australia's telecommunications sector, constantly faces a dynamic and competitive environment. Its strategic moves, such as the focus on 5G and fixed wireless, highlight its ambition to reshape connectivity for consumers and businesses. Understanding the TPG SWOT Analysis is crucial to grasp its position in this evolving landscape.

This analysis will delve into the TPG competitive landscape, examining its key competitors and the market dynamics shaping its future. We'll explore TPG's business strategy, providing a detailed TPG market analysis to understand its strengths and weaknesses. This deep dive will also cover TPG competitors, offering insights into their strategies and how TPG positions its investment portfolio for success within the TPG industry overview.

Where Does TPG’ Stand in the Current Market?

TPG Telecom holds a significant position in the Australian telecommunications market, serving residential, business, and wholesale customers. Its core operations revolve around providing fixed broadband, mobile services, and data solutions. The company’s value proposition centers on offering competitive pricing and a wide range of services across its extensive network infrastructure.

As of December 31, 2023, TPG Telecom reported having approximately 5.26 million mobile subscribers and 2.2 million fixed broadband subscribers. This strong subscriber base underscores its market presence and ability to attract and retain customers. TPG Telecom's brands, including Vodafone, TPG, iiNet, and Internode, allow it to compete effectively in both the mobile and fixed broadband sectors.

TPG Telecom's business strategy involves a focus on expanding its 5G mobile network and enhancing customer experience through digital transformation initiatives. The company's financial performance, with AUD 4.6 billion in total revenue and AUD 1.9 billion in EBITDA for the financial year ended December 31, 2023, positions it as a major player in the industry. To learn more about its growth strategy, consider reading Growth Strategy of TPG.

TPG Telecom's market share in both mobile and fixed broadband is substantial. It is one of the top three mobile network operators in Australia. In the fixed broadband sector, TPG Telecom's brands collectively hold a significant share of the NBN market.

TPG Telecom offers a comprehensive suite of services, including fixed broadband (ADSL, NBN, Fibre), mobile (prepaid and postpaid plans, 5G), voice services, and data solutions for businesses. This diversified portfolio caters to a broad range of customer needs.

TPG Telecom has a nationwide presence across Australia, leveraging its extensive fixed and mobile network infrastructure. This broad coverage enables the company to deliver services to a wide customer base.

With AUD 4.6 billion in revenue and AUD 1.9 billion in EBITDA for the financial year ended December 31, 2023, TPG Telecom demonstrates significant financial strength. This scale supports its competitive positioning and investments in network expansion and service enhancements.

TPG Telecom's market position is characterized by its strong subscriber base, diverse service offerings, and extensive network infrastructure. The company competes effectively in both the mobile and fixed broadband sectors, with a focus on value and innovation.

- Significant market share in mobile and fixed broadband.

- Comprehensive product and service portfolio.

- Nationwide presence with extensive network infrastructure.

- Strong financial performance supporting competitive investments.

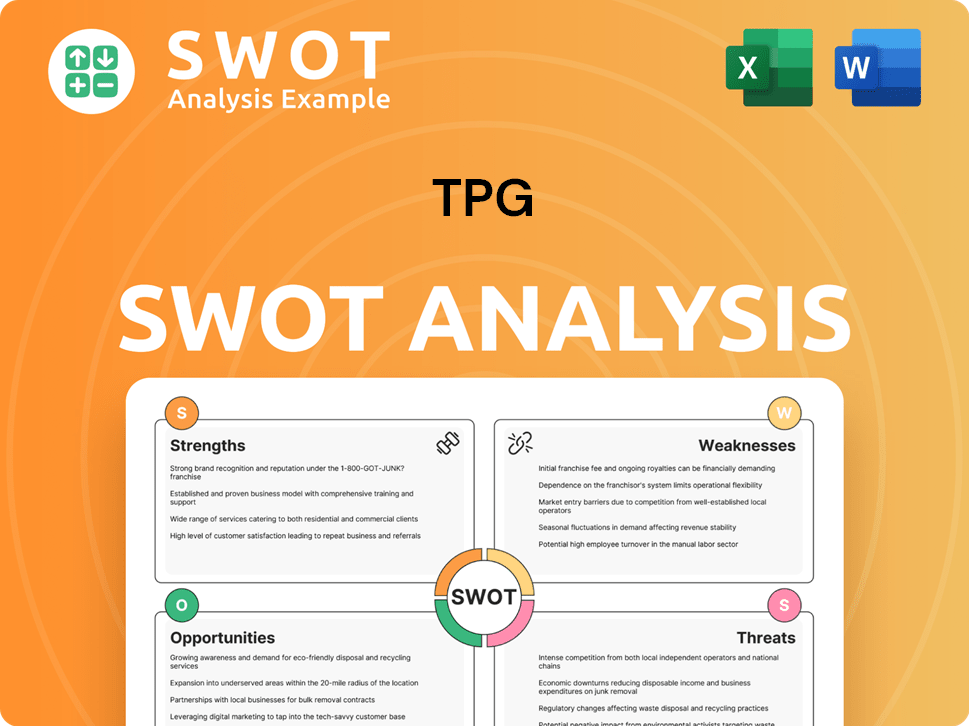

TPG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TPG?

The Australian telecommunications market is highly competitive, and the TPG competitive landscape is shaped by a mix of established players and emerging challengers. This dynamic environment requires TPG business strategy to be agile and responsive to maintain and grow its market share. Understanding the competitive forces at play is crucial for effective decision-making and strategic planning.

TPG market analysis reveals a landscape where innovation, pricing strategies, and network capabilities are key differentiators. The company's ability to adapt to changing consumer demands and technological advancements will be critical for long-term success. The following analysis provides a detailed look at TPG competitors and the broader industry context.

Telstra, as the largest telecommunications company in Australia, is a primary competitor. It holds a dominant market share across mobile, fixed-line, and enterprise services. Telstra's extensive network infrastructure and strong brand reputation provide a significant competitive advantage.

Optus, the second-largest provider, competes across mobile, fixed broadband, and business services. Optus often challenges TPG on price and innovation, especially in the mobile and NBN markets. They focus on bundling services to attract customers.

Aussie Broadband has gained market share through strong customer service and competitive NBN plans. They focus on providing excellent customer experiences. This focus has allowed them to carve out a significant portion of the market.

Mobile Virtual Network Operators (MVNOs) leverage existing networks to offer budget-friendly mobile plans. They provide price competition, and these companies often target specific customer segments. This includes companies that leverage the networks of Telstra, Optus, or TPG itself.

Dedicated enterprise service providers compete in the business and wholesale segments. These providers offer specialized services and solutions tailored to the needs of businesses. Competition in this area is intense, requiring specialized offerings.

The potential entry of new players leveraging emerging technologies like satellite internet presents a long-term indirect competitive challenge. This could reshape the competitive landscape, particularly in areas with limited existing infrastructure.

TPG's competitive advantages and disadvantages are shaped by several factors. The company's ability to maintain a competitive edge depends on its strategic responses to these factors. For more details, you can read about the Marketing Strategy of TPG.

- Network Infrastructure: Telstra's superior network coverage and Optus's investment in 5G infrastructure pose significant challenges.

- Pricing and Bundling: Optus and MVNOs often compete aggressively on price, requiring TPG to offer attractive packages.

- Customer Service: Aussie Broadband's focus on customer service highlights the importance of this factor.

- Innovation: The ongoing rollout of the NBN and the emergence of new technologies like satellite internet require continuous innovation.

- Mergers and Acquisitions: Mergers and alliances, like the TPG-Vodafone merger, have reshaped market dynamics.

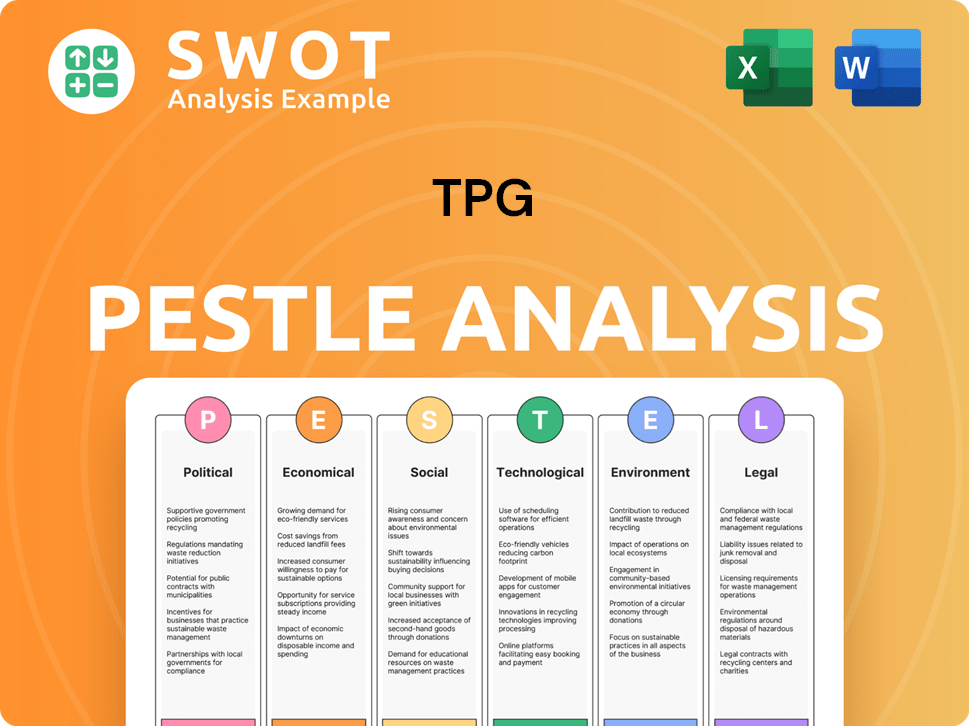

TPG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TPG a Competitive Edge Over Its Rivals?

Understanding the TPG competitive landscape requires a deep dive into its strategic advantages. The company, a major player in the Australian telecommunications market, has carved out a significant position through strategic moves and operational efficiencies. This analysis explores the key elements that define its competitive edge, including network infrastructure, brand portfolio, and innovation strategies.

The evolution of TPG's competitive position has been shaped by key milestones, notably the merger with Vodafone. This has fundamentally altered its capabilities and market presence. This strategic move has allowed the company to offer a wider array of services and compete more effectively against rivals. Further, TPG's focus on technological advancements, especially in 5G and fixed wireless solutions, underscores its commitment to staying ahead in a rapidly changing market.

Examining the TPG market analysis reveals a company leveraging its strengths to navigate the complexities of the telecommunications sector. By understanding these competitive advantages, investors and analysts can gain valuable insights into the company's potential for future growth and sustainability. For a deeper understanding of the company's origins, you can explore a Brief History of TPG.

TPG's extensive network infrastructure, including both fixed-line and 5G mobile networks, is a primary competitive advantage. This dual infrastructure provides greater control over service quality and the ability to offer converged services. The company's investment in 5G has been substantial, with a focus on expanding coverage and enhancing network capabilities.

The ownership of multiple brands, such as TPG, Vodafone, iiNet, and Internode, enables TPG to cater to a broad spectrum of customer segments. This multi-brand approach allows for effective market segmentation and targeted marketing strategies. This diverse portfolio helps maximize market reach and customer acquisition.

TPG benefits from economies of scale due to its large customer base and consolidated operations. This scale allows for efficient capital expenditure on network upgrades and optimized operational costs. The company's ability to negotiate favorable terms with suppliers also contributes to its competitive pricing strategies.

TPG has demonstrated a strong focus on innovation, particularly in the rollout of its 5G network and the development of fixed wireless solutions. This commitment to technological advancement allows the company to offer high-speed alternatives to traditional fixed broadband. The company's investment in new technologies positions it well for future growth.

TPG's competitive advantages are multifaceted, including its extensive network, multi-brand strategy, and economies of scale. These advantages are further strengthened by a focus on innovation and technological advancements. The company’s strategic approach involves bundled services and competitive plans across its brand portfolio, enhancing its market position.

- Network Expansion: Continuous investment in 5G and fixed-line infrastructure.

- Customer Acquisition: Targeted marketing campaigns across diverse brand offerings.

- Operational Efficiency: Streamlining operations to reduce costs and improve service delivery.

- Technological Innovation: Focus on 5G and fixed wireless solutions to enhance service offerings.

TPG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TPG’s Competitive Landscape?

The Australian telecommunications industry, where TPG Telecom operates, is dynamic and shaped by technological advancements, regulatory changes, and evolving consumer preferences. Understanding the current TPG competitive landscape and the broader TPG industry overview is crucial for assessing its future prospects. The company faces both challenges and opportunities as it navigates this complex environment. A thorough TPG market analysis reveals the key factors influencing its strategic direction and investment portfolio.

The industry's future hinges on how well TPG Telecom adapts to technological disruptions, manages its cost structure, and responds to competitive pressures. The company's success will depend on its ability to capitalize on emerging trends, such as the expansion of 5G networks and the increasing demand for high-speed internet. Strategic decisions regarding network investments, service offerings, and partnerships will be pivotal in determining its long-term competitive position and overall TPG business strategy.

The Australian telecommunications sector is driven by the 5G network rollout and increasing demand for higher bandwidth. Remote work, streaming services, and smart home technologies fuel the need for reliable connectivity. Regulatory changes and consumer preferences for bundled services and personalized experiences also play a significant role. These trends shape the TPG competitive landscape.

Potential disruptions include new entrants leveraging satellite internet and the growth of OTT communication services. Intense price competition, subscriber churn, and high capital expenditure for network upgrades pose significant challenges. TPG competitors and their actions will be crucial. The high capital expenditure required for network maintenance and upgrades is a constant challenge.

Growth opportunities exist in regional areas with improved connectivity, and in enterprise 5G and IoT segments. Product innovations in fixed wireless access and digital solutions for businesses offer differentiation. Strategic partnerships can enhance service offerings. The TPG investment portfolio can benefit from these areas. Strategic partnerships can further enhance its service offerings and customer appeal.

TPG Telecom is deploying strategies focused on leveraging its integrated fixed and mobile network and expanding its 5G footprint. Enhancing its multi-brand strategy is also a key focus. The company's future competitive position will depend on its ability to monetize network investments, adapt to consumer demands, and navigate the regulatory landscape. For more insights, you can read this article about TPG.

TPG Telecom's strategies are centered on network investments, service innovation, and strategic partnerships. The company aims to leverage its integrated fixed and mobile network to offer competitive services. Expanding its 5G footprint and enhancing its multi-brand strategy are also key priorities for TPG's main rivals.

- Focus on 5G expansion to enhance network performance.

- Develop innovative service bundles to attract and retain customers.

- Form strategic partnerships to expand service offerings and market reach.

- Adapt to regulatory changes and manage costs effectively.

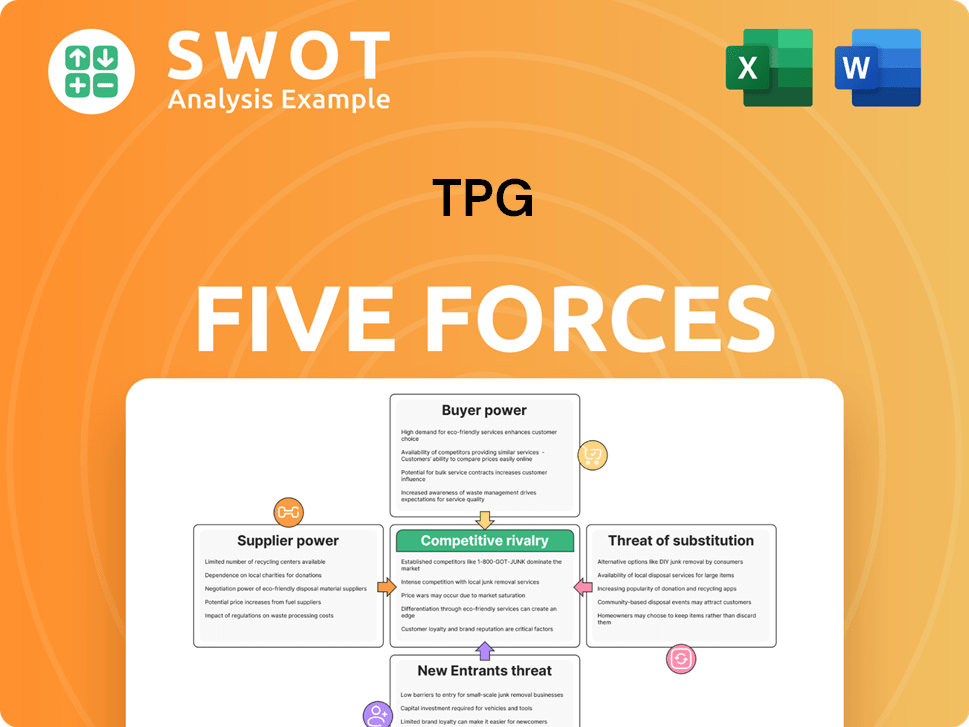

TPG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TPG Company?

- What is Growth Strategy and Future Prospects of TPG Company?

- How Does TPG Company Work?

- What is Sales and Marketing Strategy of TPG Company?

- What is Brief History of TPG Company?

- Who Owns TPG Company?

- What is Customer Demographics and Target Market of TPG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.