AutoZone Bundle

Can AutoZone Maintain Its Dominance in the Ever-Changing Auto Parts Market?

The automotive aftermarket is a high-stakes battleground, constantly reshaped by technological leaps and consumer preferences. AutoZone, a veteran of this dynamic sector, has built a formidable presence since its 1979 launch. But, how does this retail giant navigate the complexities of e-commerce, electric vehicles, and supply chain shifts? This article provides a deep dive into the AutoZone SWOT Analysis and its competitive landscape.

This analysis will explore the AutoZone competitive landscape, identifying key AutoZone competitors and dissecting the strategies that fuel its success. We'll conduct a thorough AutoZone market analysis, examining its strengths and weaknesses within the auto parts industry. Understanding AutoZone's position requires a close look at its business strategy, customer demographics, and how it tackles the challenges and opportunities within the automotive aftermarket.

Where Does AutoZone’ Stand in the Current Market?

AutoZone holds a significant position in the automotive aftermarket industry, particularly in the Do-It-Yourself (DIY) segment. It also serves the Do-It-For-Me (DIFM) professional installer market. The company's extensive network of stores supports its strong geographic presence, offering a wide selection of products for cars, trucks, and SUVs.

The company offers replacement parts, maintenance items, accessories, and tools. AutoZone's strategic expansion includes services like diagnostic testing and loan-a-tool programs. This caters to both DIY enthusiasts and professional mechanics. AutoZone maintains a strong presence in the Southern and Southwestern United States, where store density is high.

As of late 2024, AutoZone had over 7,000 locations globally, with more than 6,300 in the U.S., 800 in Mexico, and 90 in Brazil. This widespread physical footprint allows it to reach a broad customer base. AutoZone consistently ranks among the top automotive aftermarket retailers, often competing with peers like Advance Auto Parts and O'Reilly Auto Parts.

AutoZone is a leading player in the auto parts industry. It consistently competes for the top spot with other major retailers. The company's market share is a key indicator of its success in the competitive landscape.

AutoZone has demonstrated robust financial health. Net sales reached $4.2 billion for the second quarter of fiscal year 2025. This represents a 4.6% increase from the prior year's second quarter, highlighting its operational efficiency.

AutoZone has a strong geographic presence with a vast network of stores. Its extensive store network allows it to serve a broad customer base. The company's store density is particularly high in the Southern and Southwestern United States.

AutoZone offers a wide range of products for cars, trucks, and SUVs. It provides replacement parts, maintenance items, accessories, and tools. The company has expanded its offerings to include services like diagnostic testing.

AutoZone's market position is shaped by several key factors. These include its extensive store network, strong financial performance, and comprehensive product and service offerings. Its ability to cater to both DIY and DIFM customers is also crucial.

- Extensive Store Network: Over 7,000 locations globally.

- Financial Strength: Net sales of $4.2 billion in Q2 FY2025.

- Customer Focus: Serving both DIY and professional customers.

- Product Range: Wide selection of auto parts and accessories.

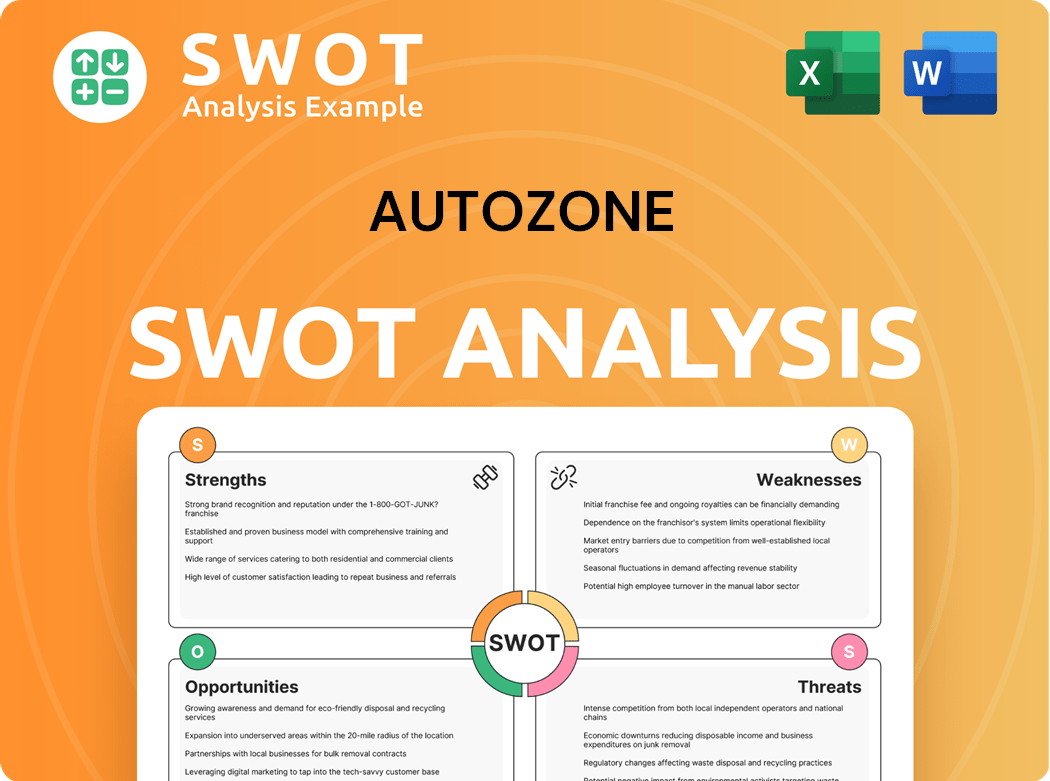

AutoZone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AutoZone?

The Owners & Shareholders of AutoZone operate within a highly competitive environment, particularly in the automotive aftermarket. Understanding the AutoZone competitive landscape is crucial for assessing its market position and future prospects. This analysis considers both direct and indirect competitors, evaluating their strategies and market impact.

The Auto parts industry is characterized by intense rivalry, influenced by factors like product availability, pricing, customer service, and the rise of e-commerce. The AutoZone market analysis must account for these dynamics to provide a comprehensive view of the competitive environment. This involves examining the strengths and weaknesses of key players and assessing their impact on AutoZone's market share.

AutoZone's competitors include a mix of national retail chains, regional players, online retailers, and mass merchandisers, each vying for a share of the automotive aftermarket. The competitive landscape is constantly evolving, with mergers, acquisitions, and the emergence of new technologies shaping the industry's future. This dynamic environment requires continuous monitoring and strategic adaptation to maintain a competitive edge.

Direct competitors are primarily national retail chains specializing in automotive parts and accessories. These companies compete head-to-head with AutoZone, offering similar products and services to the same customer base. Competition is fierce, driven by factors such as pricing, product availability, and customer service.

O'Reilly Auto Parts is a major direct competitor, known for its strong presence in both the DIY and professional installer segments. The company has a vast product selection and a robust commercial program. O'Reilly has demonstrated consistent revenue growth, with net sales reaching approximately $4.1 billion in Q1 2024.

Advance Auto Parts is another significant direct competitor, operating a large store network and focusing on the professional installer market. They often use acquisitions and partnerships to expand their reach. In Q1 2024, Advance Auto Parts reported net sales of approximately $3.5 billion.

Both O'Reilly and Advance Auto Parts compete aggressively on product availability, pricing strategies, and customer service. These companies continually invest in their supply chains and store networks to enhance their competitive positions. This includes expanding their store footprints and improving their online presence.

Beyond the national chains, AutoZone faces competition from smaller regional chains and independent auto parts stores. These entities often have a strong local presence and may specialize in certain product categories or services. The fragmented nature of this segment makes it a challenge to assess market share accurately.

E-commerce giants like Amazon and eBay, along with specialized online auto parts retailers, pose a significant indirect threat. These online platforms offer convenience, competitive pricing, and a wide selection, often without the overhead of physical stores. The growth of online sales continues to impact the retail automotive industry.

Indirect competitors include mass merchandisers like Walmart and Target, which carry basic maintenance items and accessories. These retailers compete on price and convenience, attracting customers looking for general automotive products. The competitive landscape also includes emerging players focused on specific niches, such as electric vehicle parts or specialized diagnostic tools, which could disrupt the traditional market.

- Walmart and Target: Offer basic automotive products, competing on price and convenience.

- E-commerce Platforms: Amazon, eBay, and specialized online retailers provide competitive pricing and vast selection.

- Specialized Retailers: Focus on specific niches, such as electric vehicle parts or diagnostic tools.

- Market Dynamics: Mergers and acquisitions among distributors and service providers influence market share.

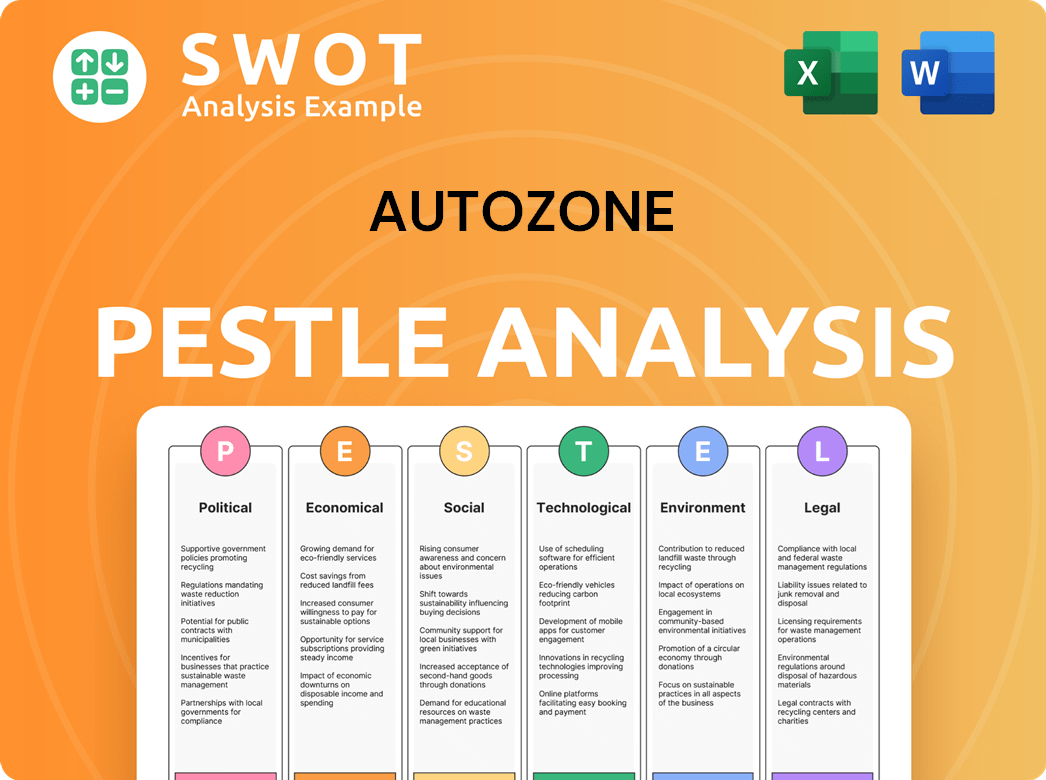

AutoZone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AutoZone a Competitive Edge Over Its Rivals?

Understanding the AutoZone competitive landscape requires a deep dive into its strengths. The company has consistently demonstrated a robust business model. A key factor in its success is its extensive store network, providing convenient access for both DIY customers and professional installers. This widespread presence, coupled with efficient inventory management, ensures high in-stock rates, which is crucial for customers seeking immediate solutions. For a deeper understanding, explore the Growth Strategy of AutoZone.

AutoZone's competitive edge also stems from its brand reputation and customer loyalty. Over the years, the company has cultivated a strong brand image, known for reliability, product availability, and helpful customer service. The 'Loan-A-Tool' program and diagnostic services further enhance customer convenience and build loyalty. Furthermore, AutoZone benefits from economies of scale in purchasing and distribution, allowing it to maintain competitive pricing.

The automotive aftermarket is highly competitive, but AutoZone has consistently maintained a strong position. The company's focus on customer service, product availability, and strategic store locations has allowed it to thrive. This focus has helped AutoZone navigate the challenges of the Auto parts industry and maintain its market share.

AutoZone's vast store network provides unparalleled convenience, with over 6,000 stores across the United States, Mexico, and Brazil. This extensive footprint ensures that customers can easily access parts and services. These strategically located stores are a key component of AutoZone's competitive advantage, allowing them to serve a wide customer base effectively.

AutoZone's efficient inventory management systems ensure high in-stock rates, a critical factor for customers needing immediate repairs. This allows them to fulfill customer needs quickly and efficiently. The company’s ability to maintain a wide selection of parts and products is a significant advantage in the competitive automotive aftermarket.

The proprietary ALLDATA software provides a significant advantage, especially in attracting and retaining professional mechanics. This comprehensive automotive diagnostic and repair information system gives mechanics essential tools and data. This service enhances customer loyalty and provides a competitive edge in the AutoZone competitive landscape.

AutoZone has built a strong brand reputation over decades, known for reliability and helpful customer service. The 'Loan-A-Tool' program and diagnostic services enhance customer convenience and build loyalty. This focus on customer satisfaction has played a key role in AutoZone's sustained success in the retail automotive sector.

AutoZone's competitive advantages are multifaceted, including its extensive store network, robust inventory management, and strong brand reputation. These factors contribute to its leading position in the automotive aftermarket. The company’s strategic approach to customer service and product availability further solidifies its market share.

- Extensive Store Network: Over 6,000 stores provide convenient access for customers.

- Robust Inventory Management: High in-stock rates ensure immediate availability of parts.

- ALLDATA Software: Attracts and retains professional mechanics with essential data.

- Brand Equity: Strong reputation for reliability and customer service.

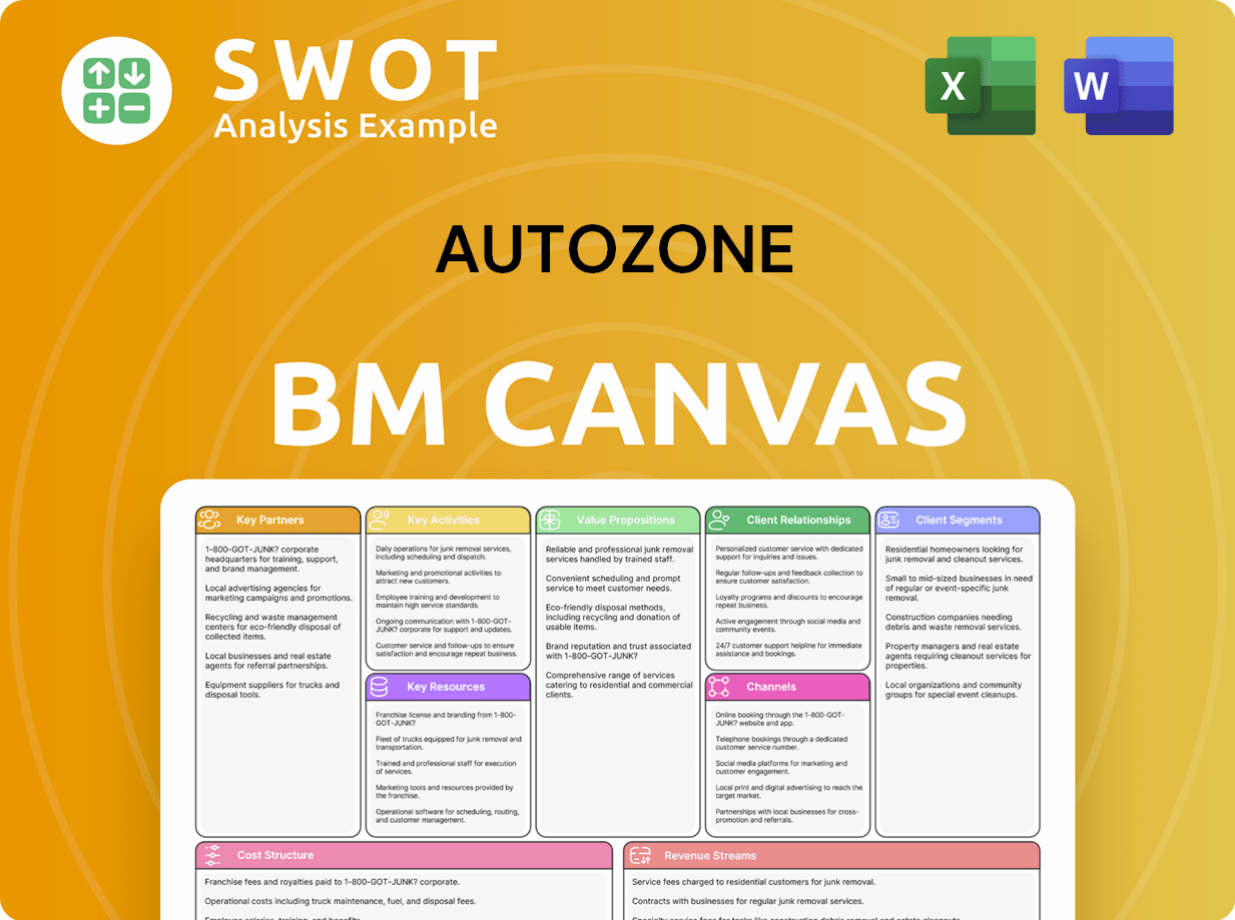

AutoZone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AutoZone’s Competitive Landscape?

The automotive aftermarket industry is undergoing significant shifts, impacting the Growth Strategy of AutoZone. These changes include technological advancements, evolving consumer preferences, and regulatory adjustments. Understanding these trends is crucial for evaluating AutoZone's competitive landscape and future prospects. The company faces both challenges and opportunities as it navigates this dynamic environment.

The primary risks involve adapting to the rise of electric vehicles (EVs) and increasing competition from online retailers. However, the aging vehicle fleet and expansion into new markets provide significant growth opportunities. Strategic initiatives, such as enhancing digital capabilities and expanding commercial business, are essential for maintaining market share and driving future success.

The automotive aftermarket is influenced by technological advancements, particularly the rise of EVs. Changing consumer behaviors favor e-commerce and convenient service options. Regulatory changes concerning emissions and data access also play a role. These trends present both challenges and opportunities for AutoZone.

Key challenges include the transition to EVs, which require different maintenance and fewer traditional parts. Increased competition from online retailers and potential economic downturns also pose risks. An aging vehicle fleet that is increasingly complex to repair may slow down DIY activity.

The aging vehicle fleet in the U.S., with an average age of 12.6 years in 2024, drives demand for replacement parts. Emerging markets like Latin America offer growth potential. Product innovations, such as ADAS calibration tools, represent new revenue streams. Strategic partnerships can strengthen market position.

AutoZone is focusing on enhancing its digital capabilities and optimizing its supply chain. Expanding its commercial business and adapting its product assortment to meet the needs of both ICE and EV owners are also key strategies. These initiatives aim to maintain a competitive edge.

The

Auto parts industry

is influenced by factors such as vehicle technology and consumer behavior. The shift towards EVs necessitates adaptation in product offerings and service models. The company's success depends on its ability to respond to changing market demands and maintain its competitive advantage.- EV Transition: The growth of EVs requires adjustments in parts offerings and service capabilities.

- E-commerce: Increasing online sales and omnichannel strategies are essential for meeting consumer expectations.

- Aging Fleet: The aging vehicle fleet continues to drive demand for replacement parts.

- Market Expansion: Expanding into emerging markets offers significant growth opportunities.

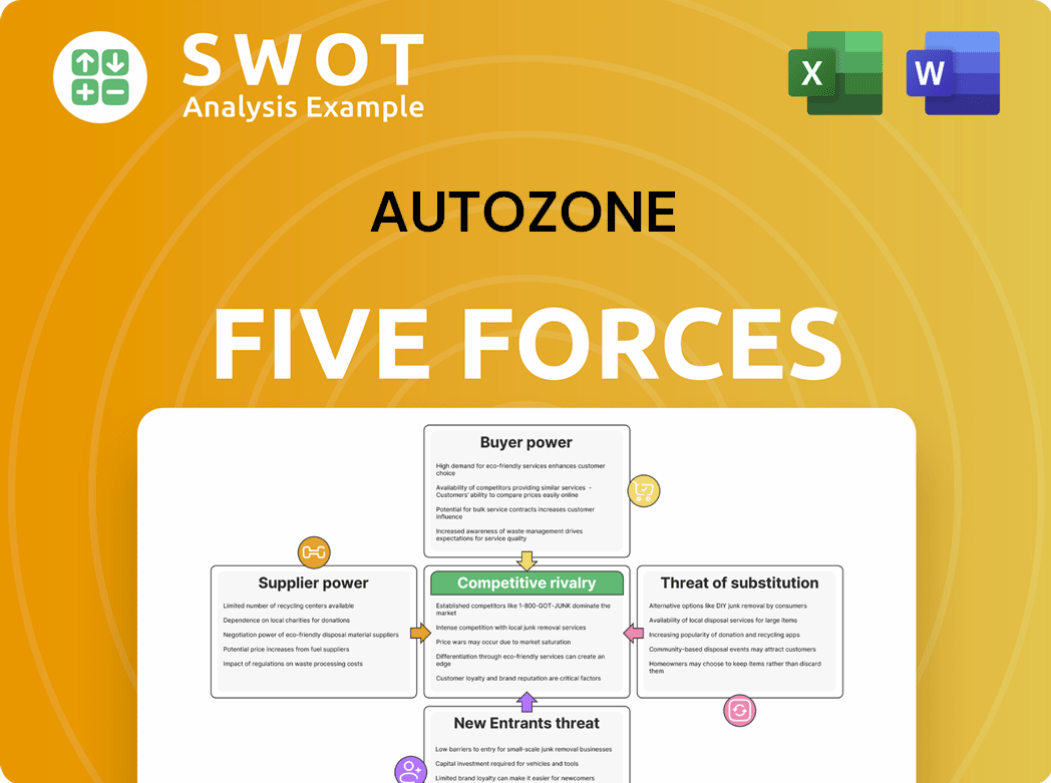

AutoZone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoZone Company?

- What is Growth Strategy and Future Prospects of AutoZone Company?

- How Does AutoZone Company Work?

- What is Sales and Marketing Strategy of AutoZone Company?

- What is Brief History of AutoZone Company?

- Who Owns AutoZone Company?

- What is Customer Demographics and Target Market of AutoZone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.