AutoZone Bundle

How Does AutoZone Dominate the Auto Parts Market?

AutoZone, a titan in the automotive aftermarket, isn't just about selling auto parts; it's a masterclass in retail strategy and customer service. With a network of over 7,000 AutoZone locations across the US, Mexico, and Brazil, the company has established itself as a go-to destination for car repair needs. In fiscal year 2024, AutoZone's impressive $19.6 billion in net sales highlights its robust financial performance and market dominance.

Whether you're a DIY enthusiast searching for "AutoZone near me open now" or a professional mechanic seeking quality auto parts, understanding AutoZone's operational blueprint is key. This deep dive will explore how AutoZone makes money, examining its core value propositions, competitive advantages, and strategic initiatives. For a deeper dive into their strategic positioning, consider exploring an AutoZone SWOT Analysis to understand their strengths, weaknesses, opportunities, and threats. We'll also touch on AutoZone services, from AutoZone battery testing to understanding their auto part warranty, providing a comprehensive view of this industry leader.

What Are the Key Operations Driving AutoZone’s Success?

The core of AutoZone's operations revolves around providing a wide array of aftermarket auto parts, accessories, and maintenance items. They cater to both the do-it-yourself (DIY) retail customer and the commercial 'do-it-for-me' (DIFM) market. Their primary offerings include replacement parts like brakes, batteries, filters, and engine components, alongside accessories, tools, and chemicals.

AutoZone's value proposition centers on convenience, product availability, competitive pricing, and knowledgeable customer service. This approach allows them to serve a broad customer base, from individual car owners to professional garages and dealerships. The company's strategic focus on these elements has helped solidify its position in the auto parts industry.

Operational efficiency is crucial for AutoZone. They manage their processes meticulously to ensure product availability and efficient delivery. A sophisticated supply chain and distribution network, including regional distribution centers and cross-dock facilities, enable rapid inventory replenishment in their stores. Their logistics support a 'hub-and-spoke' model, where larger stores serve as hubs for smaller locations, ensuring quick access to a wide variety of parts. They also use advanced inventory management systems to optimize stock levels and minimize out-of-stocks. You can learn more about Growth Strategy of AutoZone.

AutoZone's extensive network ensures a wide range of auto parts are readily available. They leverage a robust supply chain and distribution system to maintain high inventory levels. This operational strategy is crucial for meeting customer demands promptly, whether at an AutoZone location or through online orders.

Knowledgeable staff and helpful services are key. AutoZone provides free in-store diagnostic testing for check engine lights. They also offer a 'Loan-A-Tool' program, which allows customers to borrow specialized tools. These services help differentiate AutoZone and support DIY repairs.

AutoZone aims to offer competitive prices on its products. They regularly assess market prices to ensure they remain attractive to customers. This pricing strategy supports their goal of attracting and retaining customers, both DIY and DIFM.

They collaborate with various suppliers to ensure a diverse and high-quality product offering. These partnerships are vital for maintaining operational effectiveness and differentiation in the market. This helps AutoZone meet the diverse needs of its customer base.

AutoZone's operations are designed to support its value proposition of convenience, product availability, and customer service. They utilize a sophisticated supply chain, efficient logistics, and strategic partnerships to maintain their market position. These elements are crucial for their success.

- Extensive Store Network: As of fiscal year 2024, AutoZone operates over 6,300 stores across the United States, Mexico, and Brazil.

- Distribution Centers: The company has a robust network of distribution centers to support its store operations and ensure timely delivery of parts.

- Inventory Management: AutoZone employs advanced inventory management systems to optimize stock levels and minimize out-of-stocks, ensuring products are available when customers need them.

- Customer Service Initiatives: They offer services like free in-store diagnostic testing and a 'Loan-A-Tool' program to enhance customer experience and support DIY repairs.

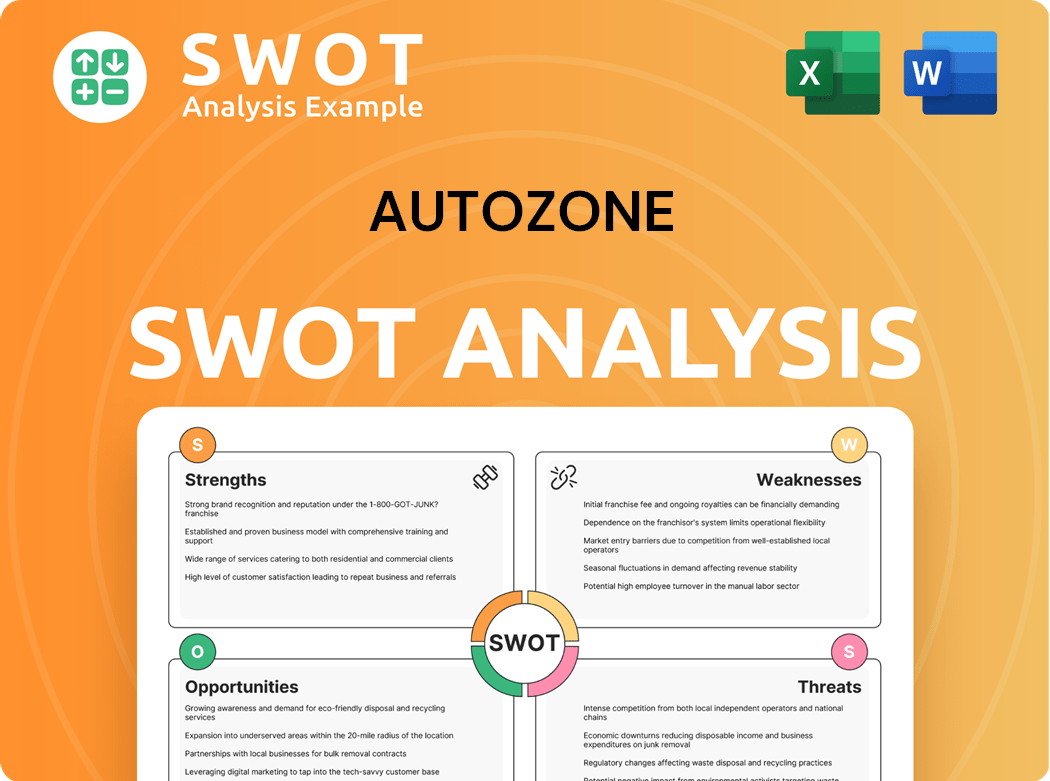

AutoZone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AutoZone Make Money?

The primary revenue stream for AutoZone comes from selling auto parts, accessories, and maintenance items. The company operates through retail (DIY) and commercial (DIFM) sales channels, with retail sales being the larger contributor. In fiscal year 2024, AutoZone reported net sales of approximately $19.6 billion, highlighting the significance of product sales.

AutoZone's business model focuses on both individual consumers and professional mechanics. This dual approach allows for a diversified revenue mix, which can help mitigate risks. The company's consistent growth in both domestic and international markets, including Mexico and Brazil, indicates successful monetization across its diverse geographical footprint.

While direct product sales are the main source of revenue, AutoZone employs strategies to enhance monetization. These include the Loan-A-Tool program, which encourages product sales by enabling customers to complete repairs. Services like free battery testing and diagnostic code reading also drive foot traffic and subsequent purchases. AutoZone also generates revenue through its ALLDATA subsidiary, which provides automotive repair information and shop management software to professional repair shops, representing a recurring revenue stream through subscriptions.

Beyond direct sales, AutoZone leverages several strategies to boost revenue. These include:

- Loan-A-Tool Program: This program encourages customers to purchase parts by providing tools for repairs.

- Free Services: Offering free services like battery testing and diagnostic code reading attracts customers and boosts sales.

- ALLDATA Subscriptions: The ALLDATA subsidiary provides repair information and shop management software to professional repair shops, creating a recurring revenue stream.

- Market Expansion: AutoZone's growth in international markets, such as Mexico and Brazil, demonstrates successful monetization strategies across different regions. If you want to know more about the company, you can read the Competitors Landscape of AutoZone article.

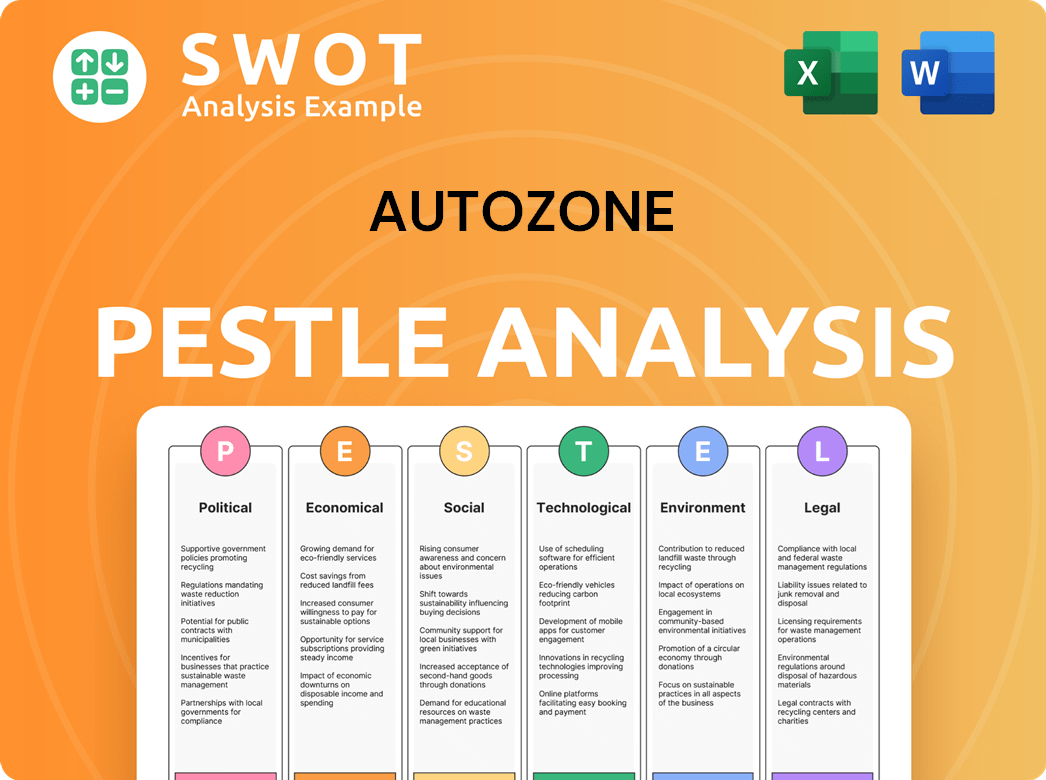

AutoZone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AutoZone’s Business Model?

The journey of AutoZone has been marked by significant milestones and strategic initiatives that have shaped its position in the auto parts industry. The company has consistently focused on expanding its physical presence and enhancing its operational capabilities. These efforts have been crucial in maintaining its competitive edge and adapting to the evolving demands of the automotive market.

A key strategic move has been the ongoing expansion of AutoZone locations, both domestically and internationally. This expansion strategy has been instrumental in increasing its market share and revenue streams. Simultaneously, investments in supply chain and distribution networks have enhanced the efficiency of delivering parts to both retail and commercial customers. These strategic actions underscore AutoZone's commitment to growth and operational excellence.

Operational challenges, such as supply chain disruptions and the advancement of vehicle technology, have been addressed through strategic adjustments. AutoZone has responded by optimizing inventory management and expanding its product offerings. These proactive measures have helped the company navigate market complexities and maintain its strong market position.

AutoZone's history is marked by consistent store expansion, both within the U.S. and in international markets. In Q1 of fiscal year 2024, they opened a total of 35 new stores. The company's strategic moves include investment in supply chain and distribution to improve efficiency.

The company has focused on expanding its store network and enhancing its supply chain. International expansion, particularly in Mexico and Brazil, has been a key strategy. AutoZone continues to invest in its digital platforms to meet the growing demand for online services.

AutoZone's competitive advantages include strong brand recognition, an extensive store network, and economies of scale. Customer service, including diagnostic testing and the Loan-A-Tool program, also sets them apart. The company is adapting to online ordering and in-store pickup.

The company has successfully navigated supply chain issues and technological advancements. They have optimized inventory management and expanded offerings to include parts for newer vehicle models. AutoZone continues to evolve to meet customer needs.

AutoZone's competitive edge is built on several factors, including brand recognition and an extensive store network. They also benefit from economies of scale and efficient distribution. The company's focus on customer service, including diagnostic services and the Loan-A-Tool program, enhances customer loyalty.

- Brand Recognition: Decades of building a strong brand.

- Store Network: Extensive locations providing convenience.

- Economies of Scale: Large purchasing power and efficient distribution.

- Customer Service: Knowledgeable staff and value-added services.

For more details, you can read about the Growth Strategy of AutoZone.

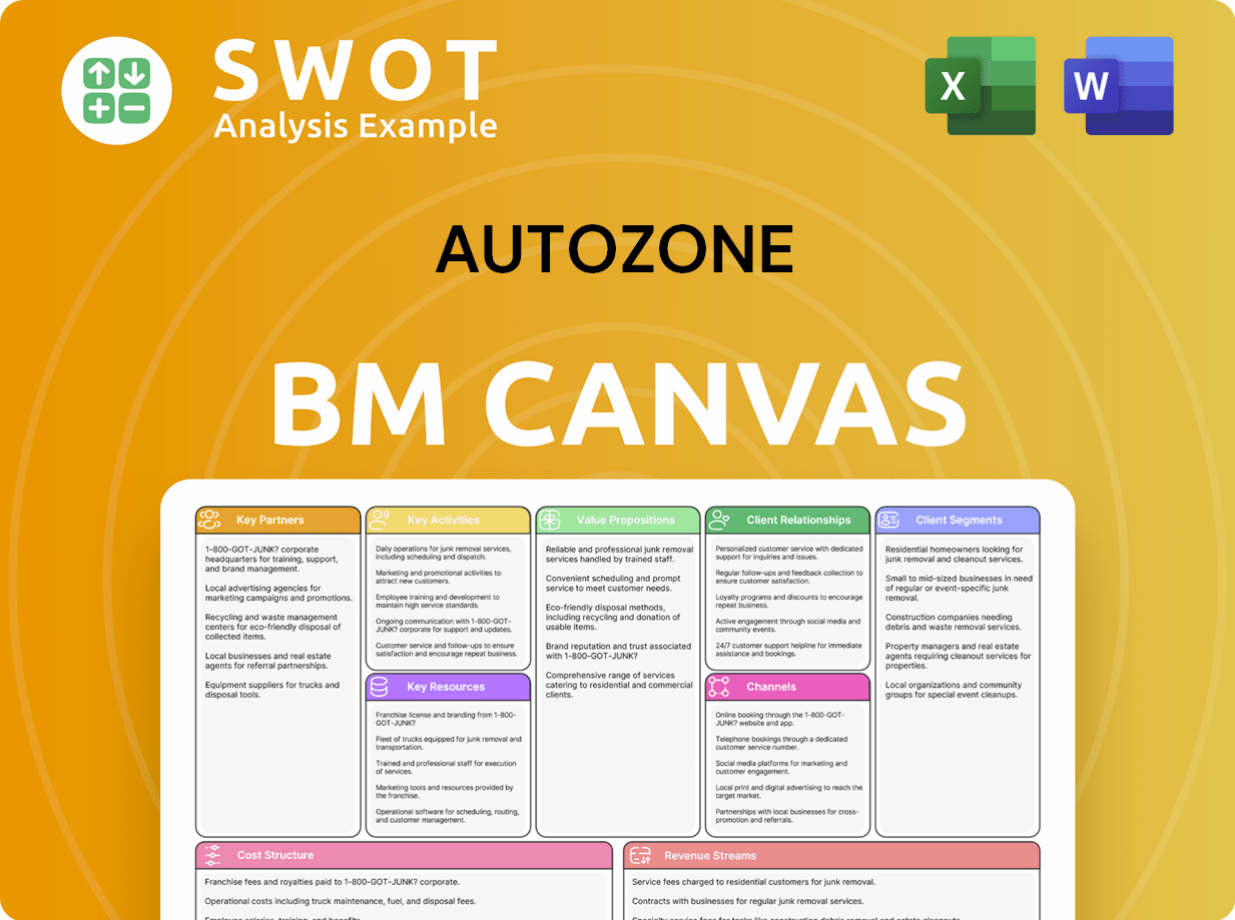

AutoZone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AutoZone Positioning Itself for Continued Success?

In the automotive aftermarket parts sector, AutoZone holds a leading position, competing with national chains like Advance Auto Parts and O'Reilly Auto Parts, as well as independent retailers and online platforms. Its extensive network of stores and strong brand recognition contribute to a significant market share and customer loyalty. With over 7,000 stores worldwide as of late 2024, AutoZone has a substantial presence across the United States, Mexico, and Brazil.

However, AutoZone faces several risks, including regulatory changes related to vehicle emissions and safety standards. The emergence of new competitors, particularly online retailers, poses a threat to its traditional brick-and-mortar model. Technological advancements, such as the rise of electric vehicles (EVs), could alter the demand for traditional internal combustion engine (ICE) parts. Changing consumer preferences, like a shift towards professional repairs, could also influence its revenue mix.

AutoZone is a key player in the auto parts industry, competing with major retailers. The company's wide network of AutoZone locations and strong brand recognition are significant assets. AutoZone's market share is substantial due to its extensive reach and customer loyalty, making it a go-to for car repair needs.

Regulatory changes and the emergence of online competitors pose risks to AutoZone. Technological advancements, such as the rise of EVs, could impact the demand for traditional parts. Shifts in consumer preferences towards professional repairs may also influence revenue. The company must adapt to these changes to maintain its market position.

AutoZone plans to continue expanding its store network, especially in international markets. Investments in its commercial business are aimed at capturing a larger share of the DIFM market. The company is also focusing on enhancing its digital presence and omnichannel capabilities. AutoZone's strategic initiatives aim to sustain and expand its ability to make money.

AutoZone is concentrating on inventory management, supply chain efficiency, and customer service. These efforts are designed to maintain its competitive edge. The company is also focused on adapting to the evolving automotive landscape. For more insights, check out the Marketing Strategy of AutoZone.

AutoZone's future depends on its ability to adapt and innovate. The company is investing in digital platforms to improve the customer experience. This includes optimizing its website and offering convenient services like AutoZone online order pickup.

- Continued store expansion, particularly in international markets.

- Enhancing its digital presence and omnichannel capabilities.

- Focus on inventory management and supply chain efficiency.

- Prioritizing customer service to maintain a competitive edge.

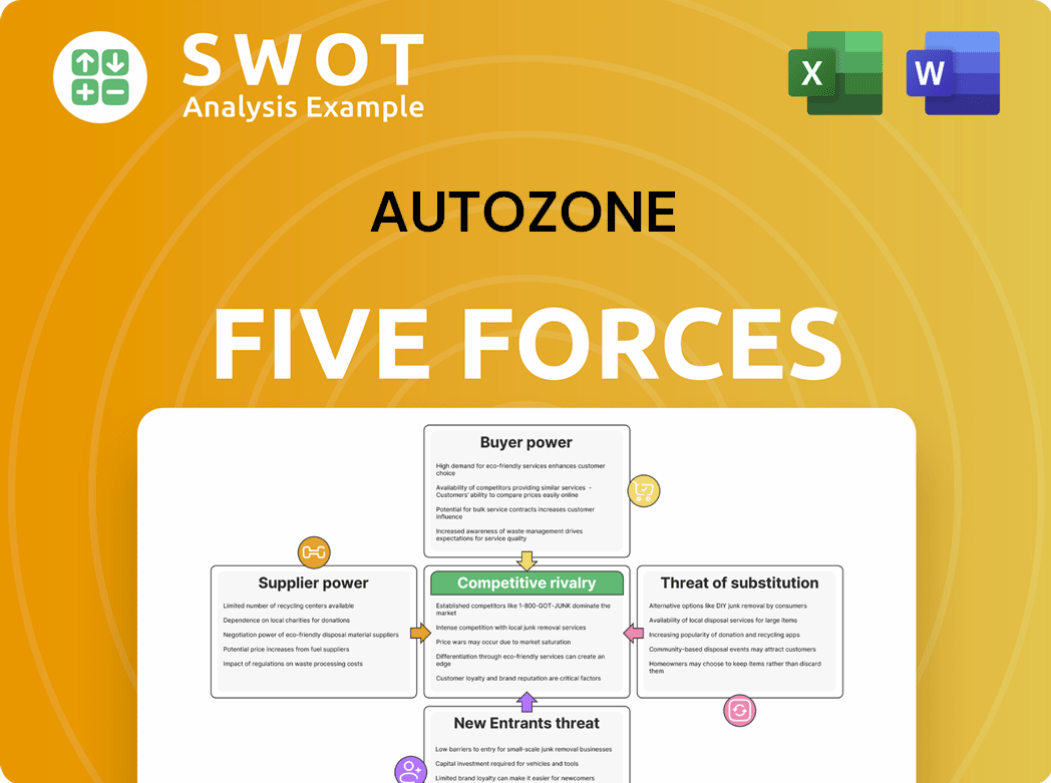

AutoZone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoZone Company?

- What is Competitive Landscape of AutoZone Company?

- What is Growth Strategy and Future Prospects of AutoZone Company?

- What is Sales and Marketing Strategy of AutoZone Company?

- What is Brief History of AutoZone Company?

- Who Owns AutoZone Company?

- What is Customer Demographics and Target Market of AutoZone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.