AutoZone Bundle

Can AutoZone Maintain Its Dominance?

AutoZone, a titan in the auto parts industry since 1979, has consistently demonstrated a remarkable ability to adapt and thrive. From its initial footprint in Arkansas to its expansive presence across the US, Mexico, and Brazil, AutoZone's growth trajectory is a testament to its strategic foresight. But what does the future hold for this automotive retail giant?

This deep dive into AutoZone SWOT Analysis and its future prospects will explore the company's strategic pillars, including expansion, innovation, and financial management. We'll examine how AutoZone is navigating the evolving auto parts market and capitalizing on automotive industry trends, including the rise of electric vehicles. Understanding AutoZone's competitive advantages and its approach to customer service is crucial for investors and business strategists alike, providing insights into its potential for continued success and its long-term business model.

How Is AutoZone Expanding Its Reach?

The AutoZone growth strategy is significantly shaped by its ongoing expansion initiatives. These initiatives focus on both expanding its geographical presence and diversifying its service offerings to meet evolving customer needs. The company's approach involves strategic planning and investment to capitalize on opportunities within the auto parts market.

A key component of AutoZone's expansion strategy is the consistent opening of new stores. This includes targeting underserved markets and regions with high growth potential. AutoZone's focus on international expansion is critical for reaching new customer segments and diversifying revenue streams. The company continues to adapt to automotive industry trends to maintain its competitive edge.

Beyond physical store expansion, AutoZone is exploring new product categories and service offerings. This includes enhancing its inventory with parts for newer vehicle models, electric vehicles (EVs), and advanced driver-assistance systems (ADAS). The company also refines and promotes existing services, like diagnostic testing and the loan-a-tool program, to provide added value and differentiate itself.

AutoZone has a strong focus on expanding its footprint, particularly in Latin America. This includes significant growth in Mexico and Brazil, which are key markets. International expansion is crucial for accessing new customer segments and diversifying revenue streams. AutoZone's international presence helps mitigate risks and capitalize on global automotive industry trends.

AutoZone is continuously working to enhance its service offerings to meet changing customer needs. This includes expanding its inventory to include parts for electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Diagnostic testing and the loan-a-tool program are constantly refined. Partnerships with service providers could broaden its offerings.

AutoZone's expansion plans in 2024 and beyond include strategic store openings and service enhancements. The company is focused on growing its presence in international markets, particularly in Latin America. AutoZone's competitive advantages are enhanced through its ability to adapt to evolving automotive industry trends and customer demands.

- Store Openings: AutoZone continues to open new stores, focusing on underserved markets and regions with high growth potential.

- Product Expansion: The company is expanding its inventory to include parts for newer vehicle models, EVs, and ADAS.

- Service Enhancements: AutoZone refines and promotes existing services, such as diagnostic testing and the loan-a-tool program.

- International Growth: The company is actively expanding its international presence, especially in Latin America, to diversify its revenue streams.

AutoZone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AutoZone Invest in Innovation?

The company actively uses innovation and technology to support and speed up its growth. This approach to digital transformation is visible in its continuous investments in e-commerce platforms and mobile apps. These are designed to offer customers a smooth, omnichannel experience.

This includes features like online ordering, in-store pickup, and detailed product information. These improvements aim to boost customer convenience and engagement. The company also uses data analytics to better manage its inventory, give personalized customer recommendations, and streamline its supply chain operations, leading to greater efficiency and lower costs. This strategy is a key part of the overall Target Market of AutoZone.

While specific details about research and development investments are not always public, the company's focus on improving its operational efficiency and customer experience through technology suggests ongoing internal development and possible partnerships. The company is likely exploring how new technologies like artificial intelligence (AI) could be used for predictive maintenance, customer service chatbots, or even optimizing delivery routes. Automation within its distribution centers and stores is another area where the company can boost efficiency and speed up service.

The company has invested heavily in its online platforms and mobile apps. This helps provide a seamless shopping experience for customers, including online ordering and in-store pickup. These digital tools are crucial for meeting the changing needs of today's customers.

Data analytics is used to optimize inventory levels and personalize customer recommendations. This approach helps streamline supply chain operations, which leads to better efficiency and cost savings. This is a key part of the company's strategy for the future.

The company is exploring the use of AI for predictive maintenance and customer service. This could include chatbots and optimized delivery routes. AI is expected to play a larger role in the company's operations.

Automation is being implemented to increase efficiency and improve service speed. This includes automating processes in distribution centers and stores. This helps the company to serve its customers more effectively.

The company is known for its strong supply chain technology. This allows it to quickly adapt to new vehicle technologies. This is important for keeping the right parts in stock.

The company is preparing for the growth of electric vehicles. This includes stocking parts for EVs and adapting its services. This is part of the company's long-term strategy.

The company's technological advancements are focused on improving customer experience and operational efficiency. These efforts are crucial for maintaining a competitive edge in the Auto parts market.

- E-commerce Enhancements: Continuous improvements to online platforms and mobile apps for better customer experience.

- Data-Driven Decisions: Using data analytics for inventory management, personalized recommendations, and supply chain optimization.

- AI Integration: Exploring AI applications for predictive maintenance and customer service.

- Automation: Implementing automation in distribution centers and stores to increase efficiency.

- Supply Chain Optimization: Leveraging technology to streamline supply chain operations and adapt to new vehicle technologies.

AutoZone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AutoZone’s Growth Forecast?

The financial outlook for AutoZone reflects a trajectory of consistent growth, supported by robust revenue generation and strategic investments. AutoZone's AutoZone growth strategy is evident in its consistent financial performance and strategic initiatives aimed at long-term value creation.

In the second quarter of fiscal year 2024, AutoZone reported net sales of $3.86 billion, marking a 4.6% increase compared to the same period in fiscal year 2023. This growth underscores the company's ability to maintain and expand its market presence. Domestic same store sales increased by 3.5%, while international same store sales grew by 7.9%, demonstrating the company's strong performance across different markets.

The company's diluted earnings per share for the second quarter of fiscal year 2024 were $28.89, up from $27.20 in the prior year, showcasing its profitability. AutoZone's consistent financial performance is a key indicator of its potential for future success. The Auto parts market is a crucial factor in the company's financial outlook.

AutoZone has demonstrated strong profit margins, reflecting efficient operations and effective pricing strategies. This efficiency contributes to the company's financial stability and its ability to generate returns for shareholders. The company's financial health is further supported by its consistent share repurchase program.

Future revenue growth for AutoZone is expected to be driven by ongoing store expansion, the resilience of the aftermarket demand for automotive parts, and potential gains from its digital initiatives. These factors are key to understanding the AutoZone future prospects.

AutoZone's disciplined capital allocation, including investments in technology and supply chain improvements, supports its long-term financial goals. These investments are crucial for sustaining competitive advantages in the Automotive industry trends.

The company's commitment to shareholder value is evident through its share repurchase program. This program signals confidence in AutoZone's financial health and its ability to generate sustainable returns.

For a more detailed analysis, you can explore the comprehensive AutoZone company analysis.

AutoZone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AutoZone’s Growth?

The future of AutoZone, like any major player in the auto parts market, faces inherent risks and obstacles. Competition, evolving consumer preferences, and economic factors all play significant roles in shaping its trajectory. Understanding these potential challenges is crucial for assessing the company's long-term viability and making informed decisions about its Owners & Shareholders of AutoZone.

Several external and internal factors could impact AutoZone's performance. From supply chain disruptions to technological shifts, the company must navigate a complex landscape to maintain its market position and achieve its growth objectives. Continuous adaptation and strategic planning are essential for mitigating these risks and capitalizing on emerging opportunities within the automotive industry.

The auto parts market is dynamic, and AutoZone's ability to adapt to these changes will be key to its success. The company must strategically manage its resources, anticipate market shifts, and proactively address potential vulnerabilities to ensure sustained growth and profitability in the years to come.

AutoZone faces stiff competition from national chains like Advance Auto Parts and O'Reilly Auto Parts, as well as independent auto parts stores and online retailers. These competitors often offer similar products, leading to price wars and pressure on profit margins. The rise of e-commerce necessitates a strong omnichannel strategy for AutoZone to remain competitive.

Online retailers offer competitive pricing and convenience, posing a significant challenge to traditional brick-and-mortar stores. AutoZone must invest heavily in its online sales strategy and digital marketing to compete effectively. As of 2024, online sales in the auto parts market continue to grow, requiring constant innovation.

Disruptions from geopolitical events, natural disasters, or labor shortages can significantly impact AutoZone's supply chain. Maintaining a robust and resilient supply chain is crucial for ensuring product availability and managing costs. These disruptions can lead to increased costs and decreased customer satisfaction.

The accelerating transition to electric vehicles (EVs) presents both an opportunity and a challenge. While EVs require different maintenance and parts, AutoZone must adapt its inventory and expertise to cater to this evolving vehicle parc. The company needs to invest in training and new product offerings to stay relevant.

Changes in vehicle emissions standards, safety regulations, or trade policies could affect demand for certain parts or alter supply chain dynamics. Economic downturns can also impact consumer spending on auto parts. Monitoring these external factors is crucial for strategic planning.

Managing a vast network of stores and a large workforce efficiently, while integrating new technologies, requires strong operational execution. Resource allocation, employee training, and effective inventory management are essential for maintaining profitability and customer satisfaction. Internal challenges can impact overall performance.

AutoZone mitigates these risks through strategic inventory management, diversifying its supplier base, continuously monitoring industry trends, and investing in employee training to adapt to new technologies. The company's proactive approach includes analyzing market data and consumer behavior to adjust its strategies. For example, in Q1 2024, the company reported a focus on supply chain optimization to navigate potential disruptions.

The auto parts market is highly competitive, with AutoZone, Advance Auto Parts, and O'Reilly Auto Parts being major players. AutoZone's market share is a key indicator of its success. In 2024, understanding competitive dynamics and adapting to changes in the automotive industry are critical. The company's ability to innovate and respond to market trends is crucial for maintaining its competitive edge.

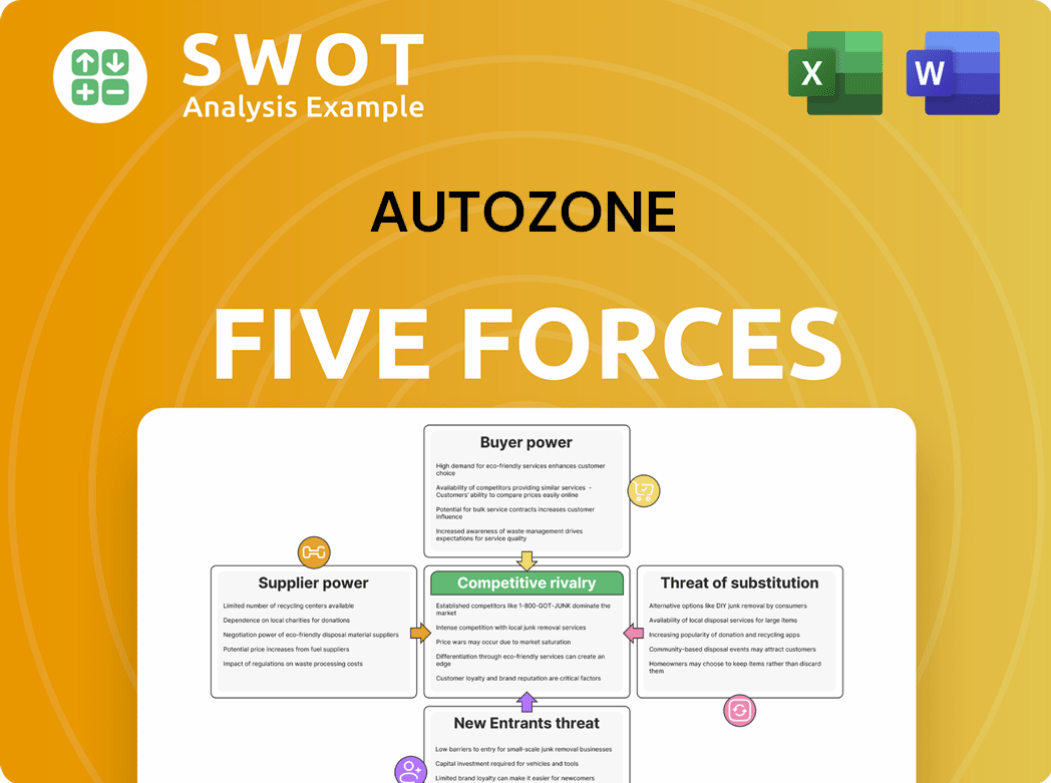

AutoZone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoZone Company?

- What is Competitive Landscape of AutoZone Company?

- How Does AutoZone Company Work?

- What is Sales and Marketing Strategy of AutoZone Company?

- What is Brief History of AutoZone Company?

- Who Owns AutoZone Company?

- What is Customer Demographics and Target Market of AutoZone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.