CK Infrastructure Bundle

Can CK Infrastructure Maintain Its Dominance in a Changing World?

The global infrastructure market is a battlefield of innovation and strategic maneuvering, and at the forefront is CK Infrastructure (CKI). With technology reshaping the industry and regulations constantly evolving, understanding CKI's position is crucial. This analysis dives into the competitive landscape, offering insights for investors, analysts, and strategists alike.

CK Infrastructure's journey from a regional player to a global giant is a testament to its strategic acumen. This article meticulously examines the CK Infrastructure SWOT Analysis, key competitors, and core advantages that define CKI's success. We'll dissect the CK Infrastructure SWOT Analysis to provide a comprehensive company analysis, including CKI's financial performance, strategic initiatives, and industry outlook, to help you understand the factors influencing CK Infrastructure's success in the infrastructure market. This is essential reading for anyone looking to understand and navigate the complexities of the infrastructure sector and how CKI compares to other infrastructure companies.

Where Does CK Infrastructure’ Stand in the Current Market?

CK Infrastructure Holdings Limited (CKI) has a strong market position in the global infrastructure sector. It's known for its wide-ranging portfolio, which includes energy, transportation, water, and waste management. While precise global market share numbers aren't always available for all its segments, CKI is a major player in key developed markets.

In the UK, CKI holds significant stakes in regulated utilities, such as gas distribution networks and water companies. This makes it a major infrastructure owner in the region. Similarly, in Australia, CKI has a strong presence in electricity distribution and gas transmission. CKI's main operations involve developing, operating, and investing in essential infrastructure assets like power plants, gas distribution networks, and toll roads.

Geographically, CKI has a strong presence in Hong Kong, mainland China, the United Kingdom, Continental Europe, Australia, New Zealand, and North America. It serves a wide range of customers, including residential, commercial, and industrial sectors. CKI has strategically focused on regulated assets to ensure stable cash flow, which enhances its resilience to economic changes.

CKI's primary business segments include investments in energy, transportation, water, and waste management. These segments cover a broad range of infrastructure assets, such as power plants, gas distribution networks, toll roads, bridges, and water treatment facilities. The company focuses on essential services that are vital for economic activity.

CKI operates across Hong Kong, mainland China, the United Kingdom, Continental Europe, Australia, New Zealand, and North America. Its diverse geographic footprint helps to mitigate risks and capitalize on growth opportunities in various markets. This wide presence allows CKI to serve diverse customer segments.

CKI has strategically shifted its focus towards regulated assets to ensure stable and recurring cash flows. This shift enhances the company's resilience to economic fluctuations. The company's focus on utility-like assets reflects a long-term strategy aimed at providing consistent returns.

CKI maintains a strong financial position, supported by stable dividend payouts and a robust balance sheet. Its significant asset base and diversified revenue streams contribute to its strong credit ratings. This financial strength enables CKI to undertake large-scale infrastructure projects globally.

CKI's strong market position is further supported by its expertise in managing regulated assets, particularly in markets with mature regulatory frameworks. This expertise provides a distinct advantage in the competitive landscape. The company's financial health and strategic focus on essential infrastructure contribute to its long-term success. For more insights, see this article about CK Infrastructure's market analysis.

CKI’s strengths include a diversified portfolio, a strong presence in key markets, and a focus on regulated assets. Its financial stability and expertise in managing infrastructure projects are also significant advantages. These factors contribute to its resilience and ability to capitalize on growth opportunities.

- Diversified portfolio across energy, transportation, water, and waste management.

- Strong presence in developed markets like the UK and Australia.

- Focus on regulated assets for stable cash flows.

- Robust financial health with stable dividend payouts.

- Expertise in managing large-scale infrastructure projects.

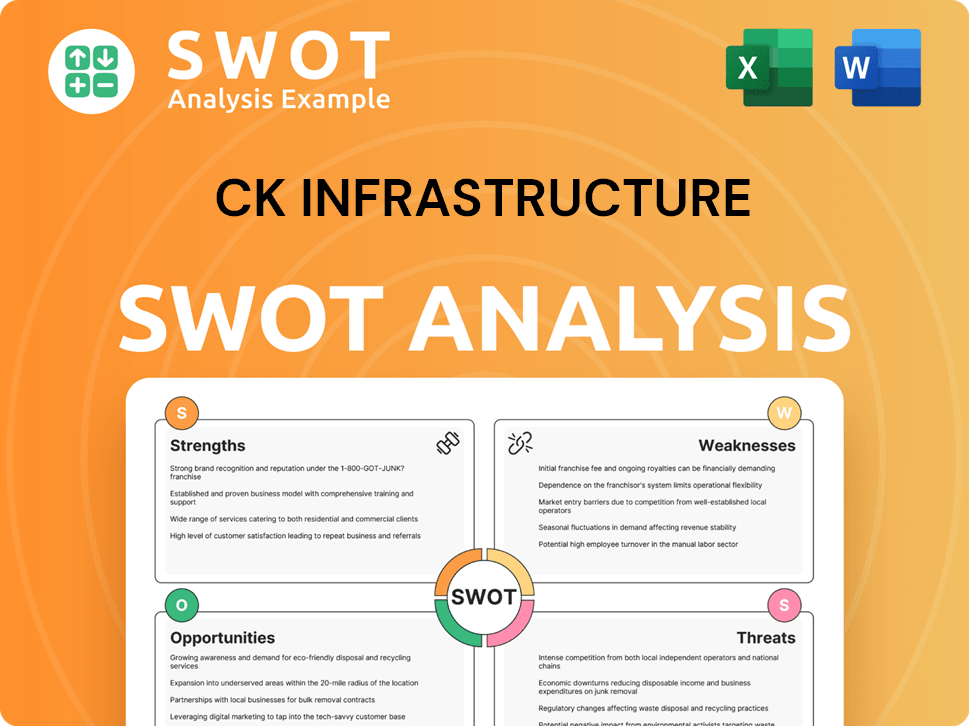

CK Infrastructure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CK Infrastructure?

The competitive landscape for CK Infrastructure Holdings Limited (CKI) is shaped by a global infrastructure market characterized by diverse players and evolving dynamics. CKI faces competition from both direct and indirect sources, including large infrastructure funds, state-owned enterprises, and specialized utility companies. Understanding these competitive pressures is crucial for assessing CKI's strategic positioning and future prospects. A thorough competitive analysis helps in evaluating CKI's strengths, weaknesses, and opportunities within the infrastructure market.

The infrastructure market is highly competitive, with companies vying for assets and projects worldwide. The competitive environment is influenced by factors such as capital availability, regulatory frameworks, and technological advancements. Analyzing the competitive landscape provides insights into CKI's ability to sustain its market position and achieve its strategic goals. This involves examining the strategies and performance of key competitors.

CKI's competitive position is influenced by its ability to adapt to market changes and leverage its strengths. The company's financial performance and strategic initiatives are often compared to those of its peers. For instance, a recent report indicated that the global infrastructure market was valued at approximately $4.5 trillion in 2023, with projections suggesting continued growth. This growth creates opportunities and intensifies competition among infrastructure companies.

Direct competitors include large, diversified infrastructure investors and operators. These companies often have significant financial resources and global reach, allowing them to compete for large-scale projects. Macquarie Group and Brookfield Asset Management are examples of direct competitors.

Macquarie Group, through its infrastructure funds, competes directly with CKI. They bid for and manage infrastructure assets across various sectors and geographies. Macquarie's financial structuring expertise is a key competitive advantage.

Brookfield Asset Management has a significant portfolio of infrastructure assets. They compete directly with CKI for acquisition opportunities and operational excellence. Brookfield's diversified portfolio includes utilities, renewables, and transport infrastructure.

State-owned enterprises, particularly from China and other emerging economies, pose a competitive challenge. These entities often have government backing, providing them with access to capital and strategic advantages. They often target developing markets.

Indirect competitors include specialized utility companies, independent power producers, and transportation network operators. These companies compete within specific segments of the infrastructure market. They may not have the same diversified portfolio as CKI but can still impact CKI's market share.

In the UK water sector, companies like Severn Trent and United Utilities compete for service provision and operational efficiency. They focus on domestic operations within a specific sector. Their performance influences the overall market dynamics.

The competitive landscape also includes emerging players and market trends. The rise of renewable energy and digital infrastructure is creating new opportunities and challenges. For example, the global renewable energy market is projected to reach $2.1 trillion by 2026, according to a recent report. This growth attracts new entrants and influences the strategies of existing players. Furthermore, mergers and alliances among competitors create larger and more formidable rivals. Understanding these dynamics is crucial for CKI's strategic planning. To learn more about CKI's strategic initiatives, consider reading about the Growth Strategy of CK Infrastructure.

Several factors influence the competitive landscape in the infrastructure market. These include financial resources, regulatory environments, technological advancements, and geographic diversification. CKI's ability to navigate these factors determines its success.

- Capital Availability: Access to capital is crucial for acquiring and developing infrastructure assets.

- Regulatory Environment: Regulations impact project approvals, operational costs, and market access.

- Technological Advancements: Innovation in areas like smart grids and renewable energy influences competitive dynamics.

- Geographic Diversification: A global presence helps mitigate risks and capitalize on diverse opportunities.

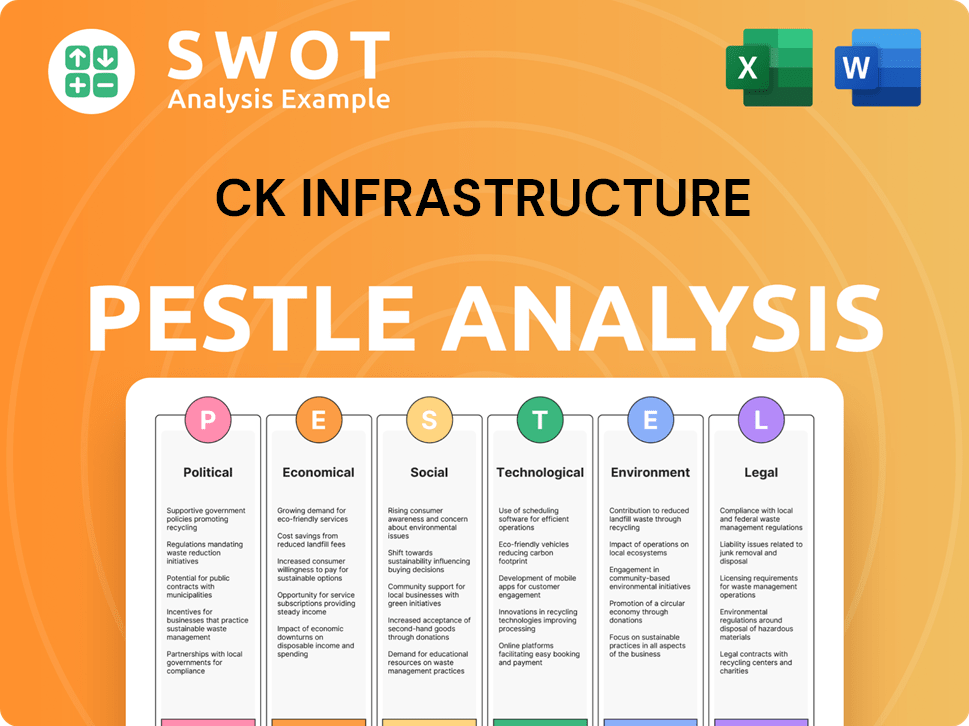

CK Infrastructure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CK Infrastructure a Competitive Edge Over Its Rivals?

The competitive landscape for CK Infrastructure (CKI) is shaped by its strategic moves and core strengths within the infrastructure market. CKI has consistently expanded its global footprint through strategic acquisitions and investments, enhancing its market position. This expansion, coupled with a focus on operational efficiency, has allowed CKI to maintain a competitive edge. For a deeper understanding of its target market, consider reading about the Target Market of CK Infrastructure.

Key milestones for CKI include significant acquisitions and project developments across various infrastructure sectors. These moves have not only broadened its portfolio but also diversified its revenue streams, providing resilience against regional economic fluctuations. CKI's ability to secure long-term concessions and operating licenses is a testament to its reputation and operational excellence.

CKI's competitive edge stems from its diversified portfolio, operational expertise, financial strength, and strong brand reputation. These factors enable the company to navigate the complexities of the infrastructure market effectively. The company's strategic initiatives focus on sustainable growth and value creation, positioning it favorably in the long term.

CKI's diversified portfolio across energy, transportation, water, and waste management sectors reduces risk. This diversification is geographically spread across Hong Kong, mainland China, the UK, Continental Europe, Australia, New Zealand, and North America. This strategy helps stabilize cash flows and mitigates the impact of economic downturns in any single region.

The company excels in managing regulated assets, particularly utilities, with a proven track record of optimizing performance. This expertise ensures stable revenue streams and predictable returns. CKI's operational efficiency and long-term asset management capabilities are significant differentiators in the infrastructure market.

CKI benefits from strong financial backing and access to capital, enabling large-scale acquisitions and development projects. Its strong balance sheet and prudent financial management support competitive bidding and strategic investments. This financial strength is crucial in the capital-intensive infrastructure industry.

CKI's reputation for reliability and operational excellence, built over decades, fosters trust with governments and regulators. This reputation is critical for securing long-term concessions and operating licenses. This strong brand equity contributes to CKI's competitive standing.

CKI's competitive advantages include a diversified infrastructure portfolio, operational expertise, strong financial backing, and a solid brand reputation. These elements enable CKI to navigate the complexities of the infrastructure market effectively and secure long-term growth.

- Diversification: CKI's diversified portfolio across various infrastructure sectors and geographies mitigates risks.

- Operational Excellence: Expertise in managing regulated assets ensures stable revenue streams.

- Financial Strength: Strong financial backing supports strategic acquisitions and investments.

- Brand Reputation: A reputation for reliability fosters trust with stakeholders.

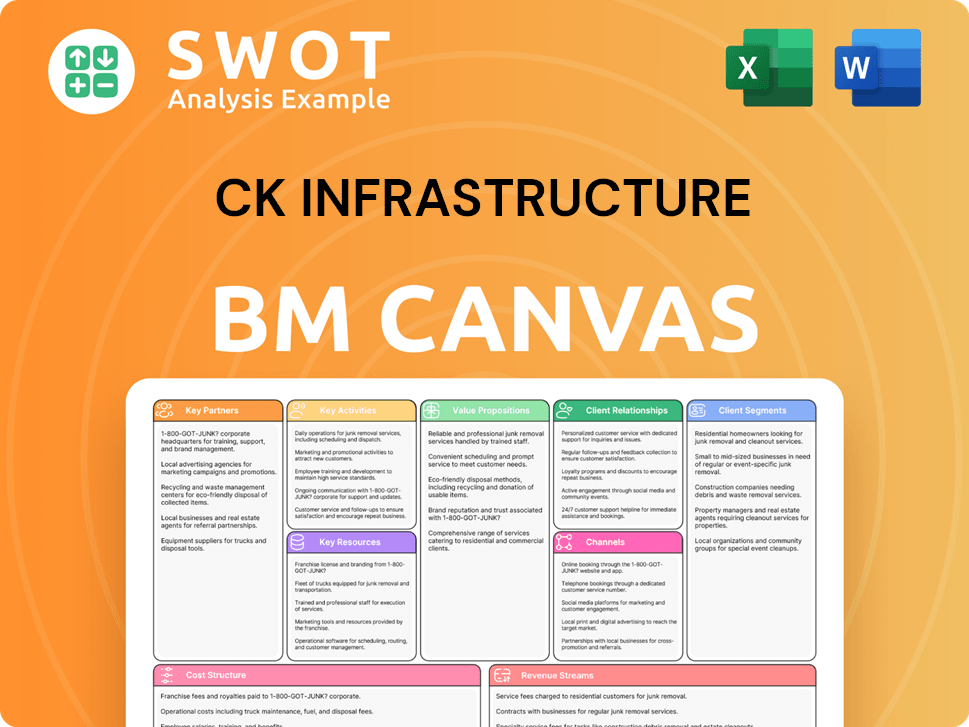

CK Infrastructure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CK Infrastructure’s Competitive Landscape?

The competitive landscape for CK Infrastructure (CKI) is shaped by evolving industry trends, presenting both opportunities and challenges. The infrastructure market is experiencing shifts towards sustainability, technological advancements, and geopolitical complexities. Understanding these factors is crucial for assessing CKI's strategic positioning and future prospects.

Analyzing the competitive landscape of CKI requires a deep dive into its strengths, weaknesses, and strategic initiatives. The company faces risks such as rising interest rates and intense competition. However, it also benefits from global infrastructure demand and the potential for strategic partnerships. This analysis helps in evaluating CKI’s ability to adapt and thrive in a dynamic environment.

The infrastructure market is increasingly focused on sustainability and decarbonization, leading to investments in renewable energy and energy-efficient assets. Technological advancements, including digitalization and AI, are driving operational efficiencies. Geopolitical shifts and protectionism pose challenges, while global infrastructure demand offers growth opportunities.

Rising interest rates can increase financing costs for new projects and acquisitions. Intense competition for high-quality infrastructure assets drives up valuations. Geopolitical risks and protectionism may complicate global expansion. The need for significant capital expenditure for technological upgrades and a skilled workforce are also challenges.

Expansion into renewable energy infrastructure, such as wind and solar farms. Capitalizing on the global demand for infrastructure development, particularly in emerging markets. Strategic pursuit of new projects in underserved markets and participation in public-private partnerships. Leveraging operational expertise and strategic partnerships for growth.

Disciplined capital allocation and strategic partnerships are key. Leveraging operational expertise to remain resilient and capture new growth avenues. Emphasis on sustainable and technologically advanced infrastructure. Adapting to regulatory changes and achieving net-zero emissions targets.

The competitive landscape for CKI is dynamic, with its success depending on its ability to navigate these trends. For a deeper understanding of CKI's ownership structure, consider exploring the article on Owners & Shareholders of CK Infrastructure. CKI’s strategic focus on sustainable and technologically advanced infrastructure, along with disciplined capital allocation, positions it to capitalize on future growth opportunities. However, the company must also manage risks related to financing costs and competition to maintain its competitive edge. In 2024, the global infrastructure market is projected to reach $3.7 trillion, with further growth expected in 2025, driven by urbanization and government investments.

Several factors will influence CKI's success in the future. These include its ability to adapt to regulatory changes focused on net-zero emissions and its capacity to leverage technological advancements for operational efficiency.

- Strategic partnerships and disciplined capital allocation.

- Expansion into renewable energy infrastructure.

- Effective management of rising interest rates and competition.

- Adaptation to geopolitical shifts and protectionism.

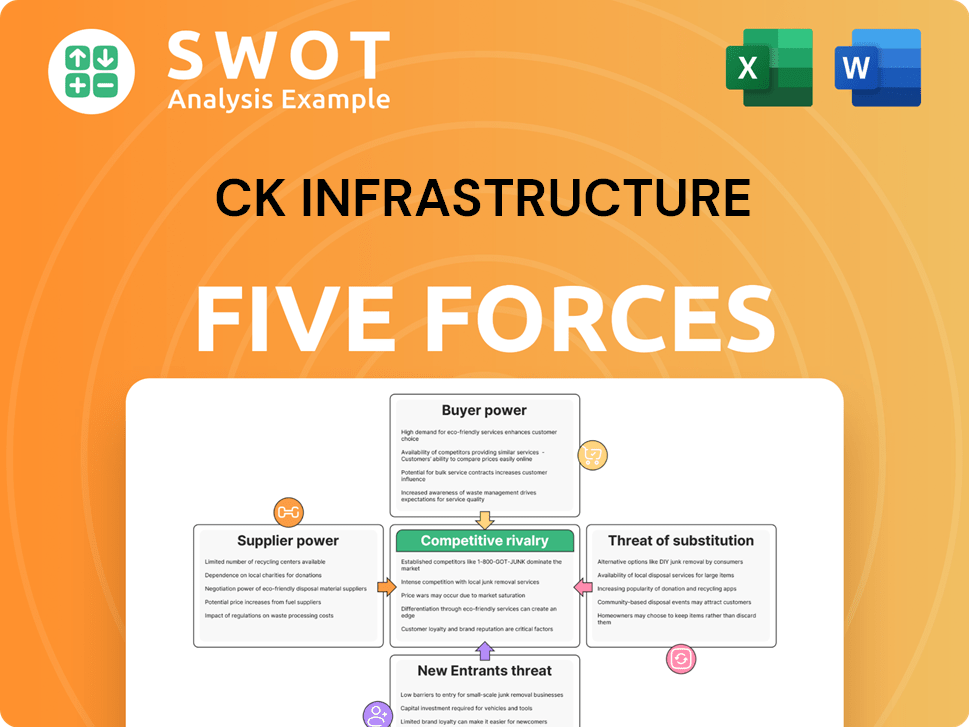

CK Infrastructure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CK Infrastructure Company?

- What is Growth Strategy and Future Prospects of CK Infrastructure Company?

- How Does CK Infrastructure Company Work?

- What is Sales and Marketing Strategy of CK Infrastructure Company?

- What is Brief History of CK Infrastructure Company?

- Who Owns CK Infrastructure Company?

- What is Customer Demographics and Target Market of CK Infrastructure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.