CK Infrastructure Bundle

How Does CK Infrastructure Thrive in the Global Market?

CK Infrastructure Holdings Limited (CKI), a titan in global infrastructure, operates across essential sectors like energy and transportation. Its strategic investments and operational expertise have solidified its status as a key player in delivering vital services worldwide. Understanding how this CK Infrastructure SWOT Analysis contributes to its success is crucial for anyone interested in the infrastructure market.

With a vast Investment Portfolio spanning continents, CKI, backed by the legacy of Li Ka-shing, consistently generates stable returns. Its resilience is evident in its strong financial performance, such as the HK$8,011 million profit reported in 2023. Delving into the operational model of this Infrastructure Company is essential to grasping its enduring value and strategic direction, especially when considering questions like "How does CK Infrastructure make money?" and "Is CK Infrastructure a good investment?"

What Are the Key Operations Driving CK Infrastructure’s Success?

CK Infrastructure (CKI) creates value through its comprehensive involvement in the entire lifecycle of infrastructure assets. This includes development, investment, operation, and management across various sectors. The company's core offerings span essential services in energy, transportation, water, and waste management, serving a diverse global customer base.

The company's operations are meticulously managed to ensure efficiency, reliability, and sustainability. This approach involves optimizing processes, maintaining infrastructure, and leveraging strategic partnerships. CKI's unique strengths lie in its long-term investment horizon and its ability to identify and optimize undervalued assets.

This strategy results in significant benefits for customers, such as reliable utility services and improved connectivity, while also providing stable returns for investors. If you're interested in learning more about the company's origins, you can explore a Brief History of CK Infrastructure.

CKI operates power generation and distribution facilities, as well as gas transmission and distribution networks. These services ensure a reliable energy supply to residential, commercial, and industrial customers. The company focuses on maintaining and upgrading these assets to meet evolving energy demands.

The company manages toll roads, bridges, and tunnels, optimizing traffic flow and ensuring safety. CKI's expertise in transportation infrastructure enhances connectivity and supports economic growth. They focus on efficient operations and maintenance to provide reliable transport links.

CKI provides water supply and wastewater treatment services, ensuring access to clean water and responsible waste management. Their operations focus on efficient treatment processes and network maintenance. This supports public health and environmental sustainability.

CKI's waste management operations focus on responsible disposal and recycling practices. They also invest in and manage other infrastructure-related businesses. This diversification supports sustainable development and provides additional revenue streams.

CKI's operational success hinges on several key strategies, including long-term investment, strategic asset acquisition, and operational efficiency improvements. The company focuses on acquiring undervalued assets and optimizing their performance. They also prioritize sustainable practices.

- Long-Term Investment Horizon: CKI adopts a long-term perspective, allowing it to invest in infrastructure projects with stable, predictable returns.

- Strategic Asset Acquisition: The company identifies and acquires undervalued infrastructure assets, often with significant potential for operational improvements.

- Operational Efficiency: CKI focuses on optimizing the performance of its assets, improving efficiency, and reducing costs through advanced technologies and management practices.

- Sustainable Practices: CKI is committed to sustainable development, incorporating environmental considerations into its operations and investments.

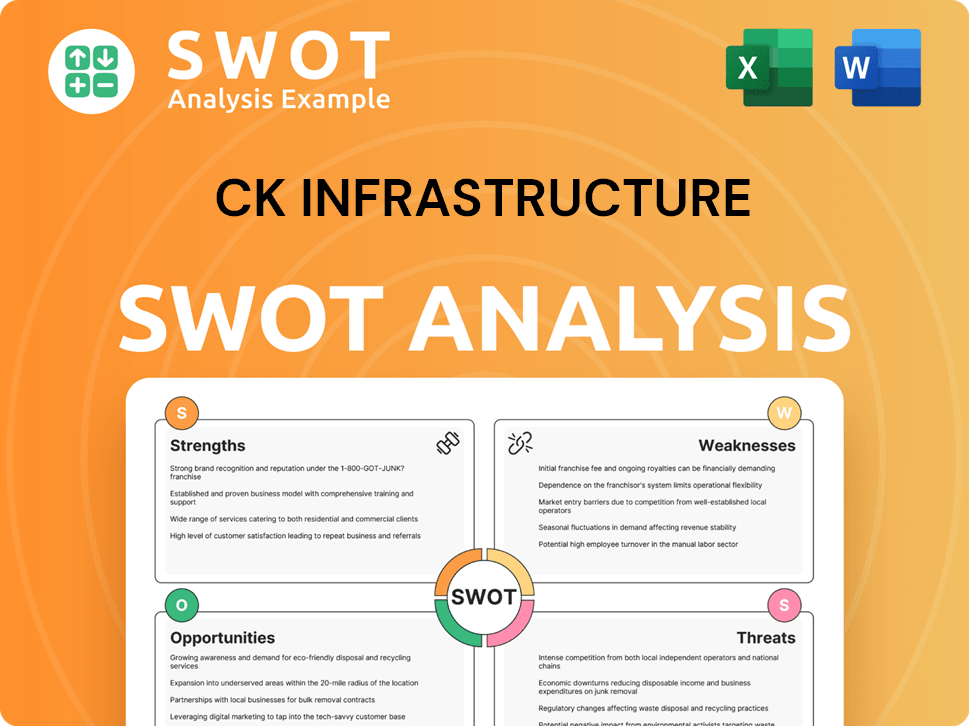

CK Infrastructure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CK Infrastructure Make Money?

The core of how CK Infrastructure (CKI) operates revolves around a diversified approach to generating revenue. This Infrastructure Company strategically invests in a global portfolio of assets, focusing on long-term, stable income streams. These streams are primarily derived from essential services and infrastructure projects, ensuring a degree of predictability in its financial performance.

CKI's revenue model is built on essential infrastructure assets, including regulated utilities, transportation networks, and waste management services. These assets provide a steady flow of income through tariffs, fees, and charges, often backed by regulatory frameworks or long-term concessions. The company's strategy emphasizes a balance across its various segments to mitigate financial risks, ensuring a resilient business model.

For the year ending December 31, 2023, CKI reported a profit attributable to shareholders of HK$8,011 million. This financial result underscores the effectiveness of its monetization strategies and its ability to generate substantial returns from its infrastructure investments. The company's approach includes acquiring mature, cash-generative assets, optimizing operational efficiency, and expanding its global footprint.

CKI's primary revenue streams include tariffs and fees from regulated utilities (electricity, gas, water), tolls from transportation networks, and charges for waste management services. These sources are characterized by their essential nature and are often supported by regulatory frameworks or long-term concessions.

The company acquires mature, cash-generative assets to immediately contribute to its revenue base. Strategic asset management, including technological upgrades and cost control, enhances profitability. Geographic diversification across regions like the UK, Continental Europe, and Australia further smooths out regional economic fluctuations.

CKI spreads its revenue streams across various regions, including the UK, Continental Europe, Australia, New Zealand, Canada, the US, and Mainland China. This global presence helps to mitigate regional economic fluctuations and regulatory changes, contributing to a stable financial outlook.

Strategic asset management plays a crucial role in enhancing profitability. This involves optimizing operational efficiency through technological upgrades, demand management initiatives, and cost control measures. These efforts ensure that existing assets generate maximum returns.

CKI consistently expands its revenue sources by acquiring new infrastructure assets and entering new markets. This reflects a consistent strategy of growth through strategic investment and asset optimization. The company's focus remains on sustainable growth and long-term value creation.

The financial performance of CKI is a testament to the effectiveness of its monetization strategies. The profit attributable to shareholders of HK$8,011 million for the year ended December 31, 2023, highlights the company's ability to generate substantial returns from its infrastructure investments.

The success of CKI's business model is built on several key elements that drive its financial performance. These include a diversified portfolio of infrastructure assets, strategic asset management, and a focus on geographic diversification. For more details, you can read about the Growth Strategy of CK Infrastructure.

- Diversified Asset Portfolio: This includes regulated utilities, transportation networks, and waste management services.

- Strategic Asset Management: Focus on operational efficiency through technological upgrades and cost control.

- Geographic Diversification: Spreading revenue across different regions to mitigate risks.

- Acquisition of Mature Assets: Acquiring assets that immediately contribute to revenue.

- Long-Term Concessions: Securing long-term contracts and regulatory frameworks for stable income.

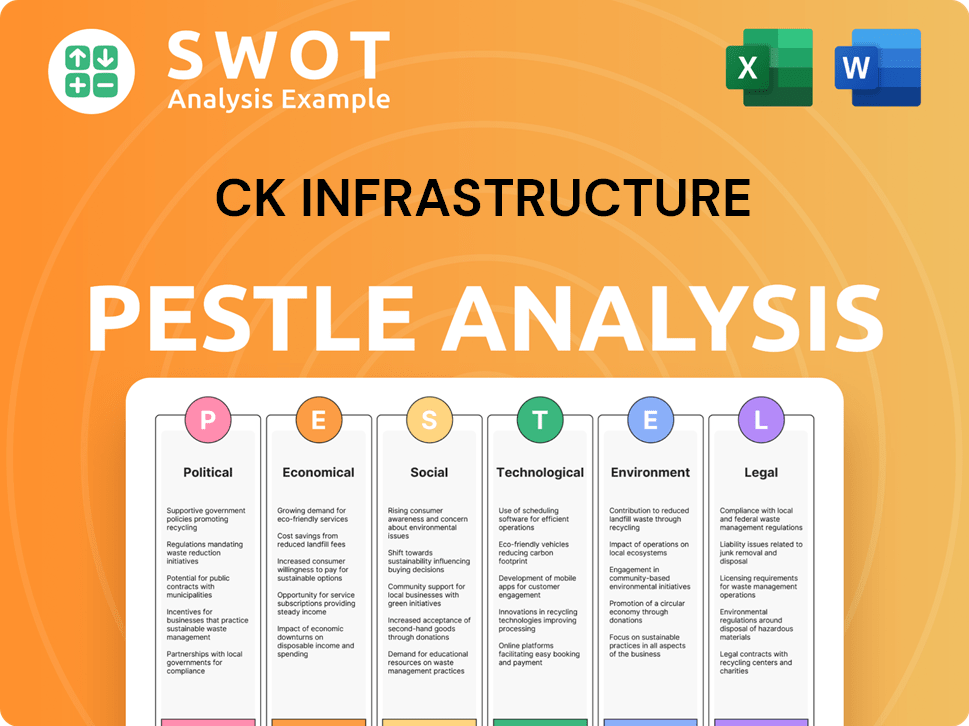

CK Infrastructure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CK Infrastructure’s Business Model?

The journey of CK Infrastructure (CKI) has been marked by significant milestones and strategic decisions that have solidified its position as a leader in the infrastructure sector. Its strategy revolves around acquiring established infrastructure assets, particularly in regulated markets, to ensure stable cash flows. This approach has enabled CKI to build a diverse and robust investment portfolio across various geographies.

Key to CKI's success has been its ability to adapt to changing market conditions and regulatory environments. The company's focus on operational efficiency and financial prudence has allowed it to navigate economic fluctuations and maintain a strong financial performance. Furthermore, CKI has consistently expanded its portfolio through strategic acquisitions, enhancing its global footprint and strengthening its market presence.

CKI's competitive advantages are multifaceted, including strong brand recognition and a reputation for reliability. Its vast asset base allows for efficient resource allocation and cost management. The company's extensive global network and relationships with governments and regulatory bodies provide a significant edge in securing new opportunities and navigating complex regulatory landscapes. For those interested in understanding the company's approach to the market, exploring the Marketing Strategy of CK Infrastructure can provide valuable insights.

CKI has achieved several key milestones, including significant acquisitions in the UK, such as UK Power Networks, Northern Gas Networks, and Northumbrian Water. These acquisitions have expanded CKI's footprint in the energy and water sectors. These strategic moves have positioned CKI as a dominant player in essential utility services across developed economies.

CKI's strategic moves involve acquiring and managing infrastructure assets across various sectors. The company focuses on assets in regulated markets, providing predictable cash flows. CKI consistently adapts to new trends, such as the increasing focus on renewable energy and sustainable infrastructure, by exploring investments in these emerging areas.

CKI's competitive advantages include strong brand recognition and a reputation as a reliable operator. Its substantial economies of scale allow for efficient resource allocation and cost management. Furthermore, its extensive global network and relationships with governments and regulatory bodies provide a significant competitive edge.

CKI's financial performance has been consistently strong, supported by its diversified portfolio and operational efficiencies. The company's financial strategy includes prudent hedging and efficient cost management. CKI's ability to generate stable cash flows has allowed it to maintain a robust financial position.

CKI's success is built on several key strengths, including a focus on regulated assets and operational excellence. The company’s strategy involves acquiring and managing infrastructure assets that provide stable and predictable cash flows. This approach has enabled CKI to build a diversified portfolio and maintain a strong financial position.

- Focus on regulated assets: This provides stable cash flows and reduces risk.

- Operational efficiency: CKI focuses on optimizing operations to improve profitability.

- Geographic diversification: The company operates in multiple countries, reducing its reliance on any single market.

- Strategic acquisitions: CKI regularly acquires new assets to grow its portfolio.

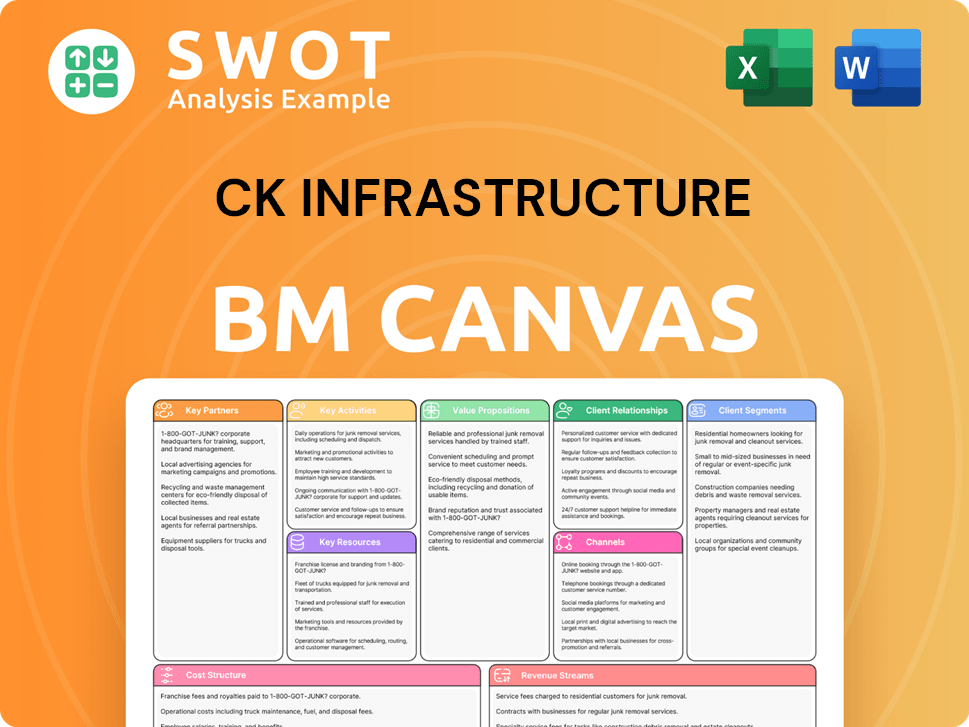

CK Infrastructure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CK Infrastructure Positioning Itself for Continued Success?

CK Infrastructure (CKI) holds a significant position as a leading global infrastructure company. Its extensive reach spans multiple continents, solidifying its status in the industry. The company's strong market share in key sectors, such as utility ownership in the UK and Australia, underscores its competitive advantage.

CKI's business model benefits from the essential nature of its services. As a provider of utilities and transportation infrastructure, the company serves captive markets with high barriers to entry. However, CKI faces risks, including regulatory changes, economic downturns, and geopolitical factors. Technological advancements also pose both opportunities and challenges.

CK Infrastructure is a major player in the global infrastructure market. Its diversified portfolio includes assets in the UK, Continental Europe, Australia, New Zealand, Canada, the US, and Mainland China. This geographical diversity helps mitigate risks and capitalize on growth opportunities.

CKI faces several risks, including regulatory changes, economic fluctuations, and geopolitical instability. Currency fluctuations and the emergence of new technologies also present challenges. Effective risk management is crucial for maintaining financial performance and shareholder value.

CKI plans to expand its revenue generation by leveraging global demand for infrastructure. The company focuses on markets with supportive regulatory environments and growth potential. It aims for sustainable returns through a prudent investment strategy.

CKI's commitment to a stable dividend policy reflects its confidence in future cash flows. For 2023, a final dividend of HK$1.87 per share was proposed. This demonstrates the company's ability to generate consistent returns, which is a key factor for investors. To understand more, you can research the Competitors Landscape of CK Infrastructure.

CK Infrastructure's strategic initiatives include acquiring quality assets globally, optimizing operations through technological advancements, and exploring renewable energy projects. These moves are designed to ensure long-term growth and sustainability. The company's focus on sustainable development is becoming increasingly important.

- Acquisition of quality infrastructure assets.

- Technological advancements to improve operational efficiency.

- Exploration of opportunities in renewable energy.

- Prudent investment strategy focused on stable returns.

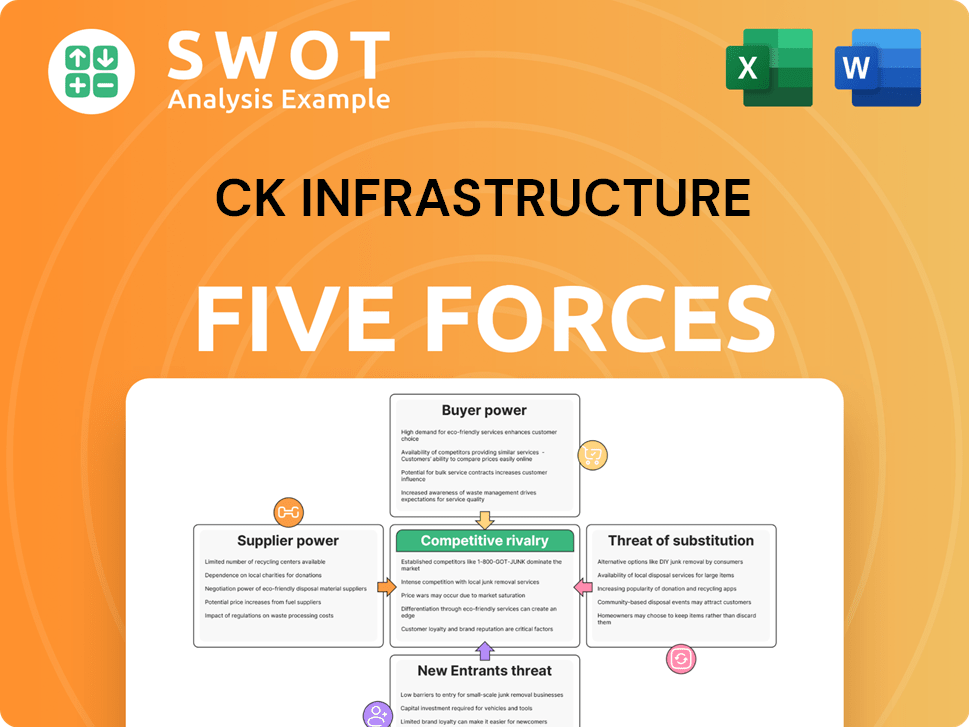

CK Infrastructure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CK Infrastructure Company?

- What is Competitive Landscape of CK Infrastructure Company?

- What is Growth Strategy and Future Prospects of CK Infrastructure Company?

- What is Sales and Marketing Strategy of CK Infrastructure Company?

- What is Brief History of CK Infrastructure Company?

- Who Owns CK Infrastructure Company?

- What is Customer Demographics and Target Market of CK Infrastructure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.