CK Infrastructure Bundle

Who Really Controls CK Infrastructure?

Ever wondered who pulls the strings at a global infrastructure giant? The ownership of CK Infrastructure SWOT Analysis is more than just a financial detail; it's the key to understanding its future. Knowing who owns this Hong Kong based company unlocks insights into its strategic direction, investment choices, and overall market influence. This exploration dives deep into the CK Infrastructure ownership structure.

Understanding who owns CK Infrastructure, including its parent company and major shareholders, is vital for investors and anyone interested in the infrastructure company's trajectory. From its roots to the influence of Li Ka-shing and CK Hutchison, this analysis unveils the dynamics behind this significant player in the global infrastructure market. This knowledge is crucial whether you're assessing the stock price, evaluating its financial performance, or simply curious about what CK Infrastructure does.

Who Founded CK Infrastructure?

The establishment of CK Infrastructure Holdings Limited, a prominent infrastructure company, in 1996 was a strategic move by the CK Hutchison Group. The inception of the company was primarily driven by Li Ka-shing, the head of the group. This move aimed to create a dedicated investment vehicle within the existing corporate structure.

The initial ownership of CK Infrastructure (CKI) was closely tied to the broader Cheung Kong Group. At the time of its initial public offering (IPO) in 1996, shares were distributed as a special dividend to the existing shareholders of Cheung Kong (Holdings) Limited. This method of distribution transferred a significant portion of ownership to the public while maintaining control within the Li family's conglomerate.

Early backers of the company were essentially the existing shareholders of Cheung Kong (Holdings) Limited. The early agreements focused on strategic alignment with the Cheung Kong Group, ensuring CKI would concentrate on infrastructure investments. The company's structure was designed to unlock shareholder value by creating a dedicated infrastructure investment vehicle.

CK Infrastructure was spun off from Cheung Kong (Holdings) Limited.

Li Ka-shing was the primary driving force behind CKI's inception.

Shares were distributed to existing Cheung Kong (Holdings) Limited shareholders.

Early backers were the existing shareholders of Cheung Kong (Holdings) Limited.

The focus was on infrastructure investments.

There were no notable early ownership disputes.

The initial ownership structure of CK Infrastructure was designed to leverage the existing shareholder base of Cheung Kong (Holdings) Limited, reflecting a strategic approach to unlock value. The company's formation was a corporate restructuring exercise, with no traditional early investors. The primary goal was to create a dedicated infrastructure investment vehicle within the larger group, guided by Li Ka-shing's strategic vision. As of the latest available data, CK Infrastructure remains a significant player in the infrastructure sector, with a market capitalization that reflects its strategic importance and the legacy of its founding structure. The company's strategic focus, influenced by Li Ka-shing, has led to substantial growth and diversification in its portfolio of assets. As of the end of 2023, the company reported a net profit of approximately HKD 10.5 billion.

- The ownership was primarily transferred to the public through a special dividend.

- There were no angel investors or venture capital involved in the early stages.

- The strategic focus was on infrastructure investments.

- The structure aimed to unlock value for shareholders.

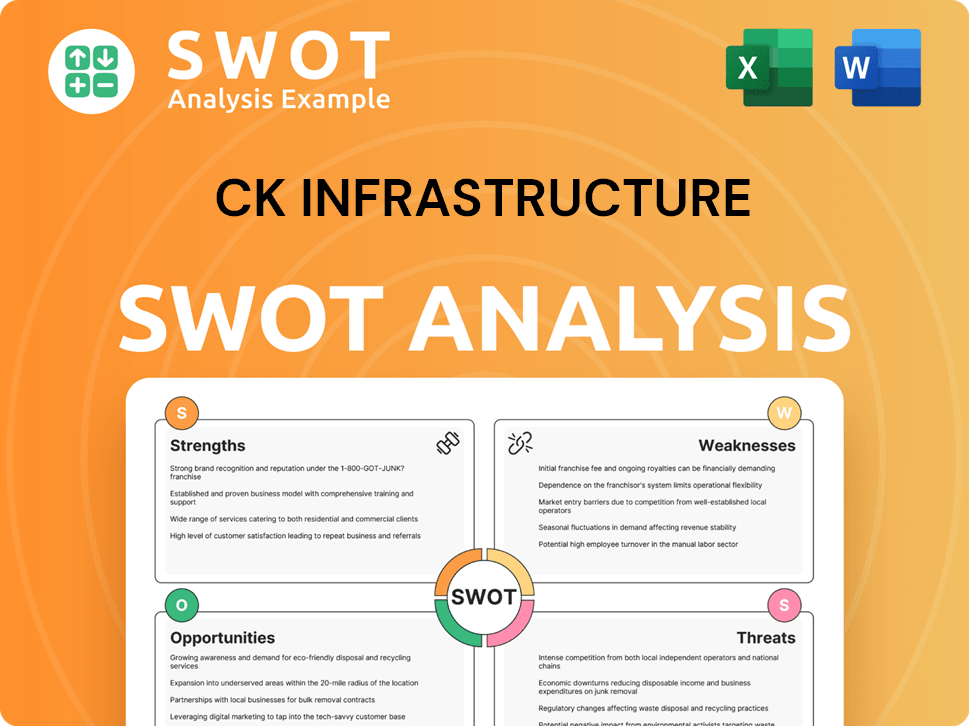

CK Infrastructure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CK Infrastructure’s Ownership Changed Over Time?

The ownership journey of CK Infrastructure (CKI) has been shaped significantly since its initial public offering (IPO) in 1996. The company's value was initially established based on its assets transferred from its parent entity. A crucial aspect of CKI's ownership has consistently been the controlling stake held by CK Hutchison Holdings Limited (CKHH), the main company of the CK Hutchison Group. As of December 31, 2024, CK Hutchison Holdings Limited remains the largest shareholder of CKI, owning approximately 75.67% of the issued share capital. This significant ownership gives CKHH considerable influence over CKI's strategic direction and operational decisions. This illustrates the long-standing relationship between the two entities, reflecting the vision of its founder, Li Ka-shing, in building a diversified infrastructure company.

Beyond the controlling stake, significant stakeholders include a variety of institutional investors, mutual funds, and index funds, given that CKI is a publicly traded company on the Hong Kong Stock Exchange. These institutional investors usually hold smaller, but collectively important, portions of the remaining public shares. The company's yearly reports and SEC filings (for any ADRs) provide details on these institutional holdings. Changes in ownership have largely been influenced by CK Hutchison's strategic decisions about its infrastructure portfolio and broader market dynamics affecting institutional investment in CKI's shares. For instance, potential divestments by CK Hutchison or substantial acquisitions by large institutional funds could change the ownership structure. These changes directly impact the company's strategy, as the dominant shareholder's goals often align with CKI's long-term growth and expansion plans in the global infrastructure sector. For insights into the marketing strategies employed by CKI, you can explore the Marketing Strategy of CK Infrastructure.

CK Hutchison Holdings Limited is the primary owner of CK Infrastructure, holding approximately 75.67% of its issued share capital as of December 31, 2024. The remaining shares are held by institutional investors and the public. The ownership structure has evolved since the IPO in 1996, with CKHH maintaining a controlling stake.

- CK Infrastructure is a Hong Kong-based infrastructure company.

- The company's headquarters are located in Hong Kong.

- CKI's business model focuses on investments in infrastructure projects.

- Li Ka-shing has a significant historical relationship with CK Infrastructure.

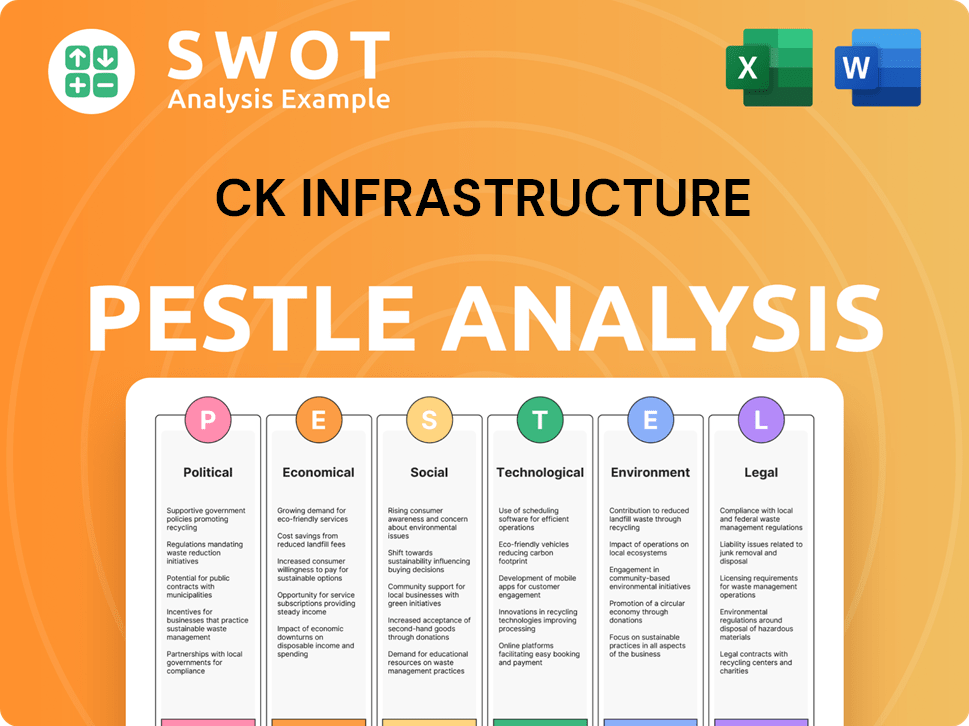

CK Infrastructure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CK Infrastructure’s Board?

The Board of Directors of CK Infrastructure Holdings Limited (CKI) mirrors its ownership structure, with CK Hutchison Holdings Limited holding significant influence. As of early 2025, the board typically includes executive directors, non-executive directors, and independent non-executive directors. Executive directors often lead operations, while non-executive directors often have ties to CK Hutchison, reflecting its substantial shareholding. For example, Mr. Victor T. K. Li, the Chairman of CKI, also serves as Chairman and Managing Director of CK Hutchison Holdings Limited, highlighting the close relationship between the two entities. This structure ensures alignment with the strategic direction set by the major shareholder, making it a key aspect of understanding who owns CK Infrastructure.

The board's composition is crucial for understanding the governance of this Hong Kong-based company. The presence of individuals with links to CK Hutchison ensures that the strategic vision of the parent company is well-represented in CKI's decision-making processes. This is particularly important given the nature of the infrastructure company's operations and its long-term investment horizons. The board's decisions often reflect the broader objectives of the CK Hutchison Group in the global infrastructure market, which is a key factor in understanding the company's strategic direction and financial performance. The relationship between CKI and CK Hutchison is a central element in understanding CK Infrastructure's ownership structure.

| Director Category | Description | Examples (Early 2025) |

|---|---|---|

| Executive Directors | Responsible for the day-to-day operations and strategic implementation. | Often include the Chief Executive Officer and other senior management. |

| Non-Executive Directors | Represent the interests of major shareholders and provide oversight. | Frequently have ties to CK Hutchison Holdings Limited. |

| Independent Non-Executive Directors | Provide independent perspectives and ensure good corporate governance. | Appointed to bring diverse expertise and objectivity to board decisions. |

The voting structure of CKI generally follows a one-share-one-vote principle. However, CK Hutchison Holdings Limited's large shareholding gives it significant control. While there are no special voting rights or founder shares, CK Hutchison's majority stake means that shareholder resolutions are largely decided by their vote. There have been no recent proxy battles challenging this control structure. The governance within CKI is largely shaped by its strategic alignment with CK Hutchison, with decisions often reflecting the broader objectives of the CK Hutchison Group. Understanding the influence of Li Ka-shing is essential when analyzing who controls CK Infrastructure.

CK Infrastructure's board is closely aligned with its major shareholder, CK Hutchison Holdings Limited.

- The voting structure is primarily one-share-one-vote, but CK Hutchison's stake gives it significant control.

- The board's composition reflects the strategic goals of the CK Hutchison Group.

- Understanding the relationship between CKI and CK Hutchison is crucial for investors.

- For more insights, check out the Target Market of CK Infrastructure.

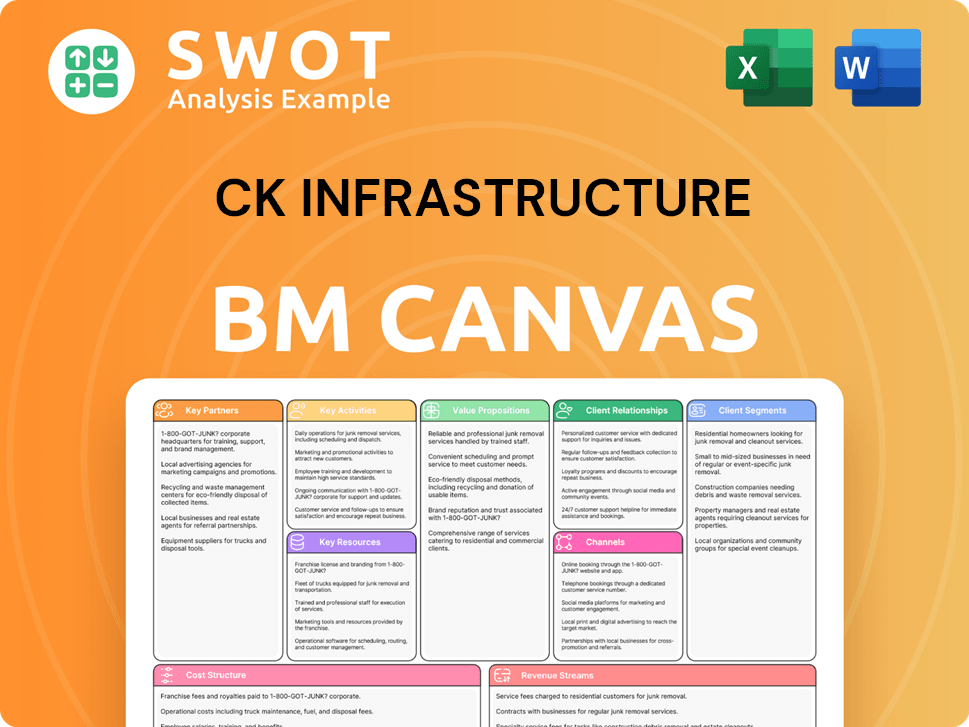

CK Infrastructure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CK Infrastructure’s Ownership Landscape?

Over the past few years, the ownership of CK Infrastructure has remained largely stable. The primary influence on this stability is the controlling stake held by CK Hutchison Holdings Limited. This structure has not seen major shifts through share buybacks or secondary offerings. However, the company’s strategic moves, such as investments in waste management and renewable energy, show its commitment to expanding its global infrastructure portfolio.

Despite industry trends like increased institutional ownership, their impact on CK Infrastructure is limited. This is due to CK Hutchison's dominant control. There have been no public announcements suggesting significant ownership changes, succession plans that would alter the core ownership, or potential privatization. The focus remains on strategic investments and operational efficiency within the existing ownership framework.

| Metric | Value | Source/Year |

|---|---|---|

| Market Capitalization | Approximately HKD 150 billion | Financial data from 2024 |

| CK Hutchison Holdings Ownership | Around 75% | Company filings, 2024 |

| Institutional Ownership | Approximately 15-20% of the public float | Market analysis, 2024 |

The relationship between CK Infrastructure and its parent company, CK Hutchison, remains a key aspect of its ownership structure. The founder, Li Ka-shing, has shaped the company's strategic direction. The company's focus is on long-term growth through strategic acquisitions and operational improvements within its existing ownership structure.

CK Infrastructure's ownership is primarily controlled by CK Hutchison Holdings. This has provided stability in the ownership structure. Strategic investments and operational efficiency are the main focus.

CK Infrastructure continues to expand its global presence. Investments in waste management and renewable energy are key. This shows a commitment to long-term growth.

Institutional ownership has a limited impact due to CK Hutchison's control. The company's performance is influenced by the overall market. The company's market capitalization is approximately HKD 150 billion.

There are no current plans to change the core ownership structure. The company will continue to focus on strategic investments. This approach is aligned with the goals of the CK Hutchison Group.

CK Infrastructure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CK Infrastructure Company?

- What is Competitive Landscape of CK Infrastructure Company?

- What is Growth Strategy and Future Prospects of CK Infrastructure Company?

- How Does CK Infrastructure Company Work?

- What is Sales and Marketing Strategy of CK Infrastructure Company?

- What is Brief History of CK Infrastructure Company?

- What is Customer Demographics and Target Market of CK Infrastructure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.