CK Infrastructure Bundle

How Does CK Infrastructure Navigate the Global Infrastructure Market?

Founded in 1996, CK Infrastructure (CKI) has become a global powerhouse in infrastructure investment. Its diverse portfolio spans energy, transportation, and more, across continents. This piece delves into CKI's CK Infrastructure SWOT Analysis, exploring its sales and marketing strategies in a complex global landscape.

CKI's recent secondary listing on the London Stock Exchange in August 2024 highlights its ambitions. The company's 2024 performance, despite economic headwinds, showcases the strength of its regulated businesses. We'll examine the CKI sales and marketing approach, focusing on how CKI business development fuels its growth and how it maintains its position as a leading infrastructure investment.

How Does CK Infrastructure Reach Its Customers?

The sales channels for CK Infrastructure (CKI) differ significantly from those of typical consumer-facing businesses. CKI's approach centers on attracting investment, forming strategic partnerships, and acquiring infrastructure projects. This strategy is crucial for its business development and sustained growth within the infrastructure investment sector. CKI's sales and marketing efforts are geared towards securing capital and identifying new infrastructure opportunities.

CKI functions similarly to an infrastructure trust, managing a portfolio of regulated utilities and infrastructure-related businesses. Its primary goal is to generate consistent income streams. The core of CKI's 'sales' involves attracting institutional investors, securing strategic partnerships, and acquiring new infrastructure assets. This approach is fundamentally different from traditional sales models, focusing instead on long-term investment and strategic growth.

The evolution of CKI's sales channels reflects a strategic shift towards expanding its capital base and pursuing global growth opportunities. A key development in 2024 was CKI's secondary listing on the London Stock Exchange, a move designed to access a broader investor pool and facilitate overseas acquisitions. This strategic move enhances its credibility and standing in international markets, shifting from a potential reliance on the Hong Kong Stock Exchange for capital raising. The company's financial strength, with HKD8 billion in cash and a net debt-to-total capital ratio of 7.8% as of December 31, 2024, enables it to pursue significant acquisitions.

CKI's sales strategy heavily relies on attracting capital from institutional investors. This involves a strong investor relations program. The company's financial performance and strategic acquisitions are key factors in attracting investment.

Partnerships are crucial for CKI's growth, such as the acquisition of a stake in Phoenix Energy in April 2024. These joint ventures are a key part of CKI's market share strategy. Partnerships enhance CKI's ability to secure investments and expand its market presence.

CKI actively seeks opportunities for new infrastructure development and acquisition. This involves identifying and evaluating potential projects. The company's focus is on investments with high structural liquidity and sustainable returns.

CKI deploys capital in various sectors and geographies worldwide. This global approach is supported by its financial strength and strategic partnerships. The company's international focus is evident in its acquisitions and investments.

CKI's sales and marketing strategy focuses on long-term value creation through strategic acquisitions and partnerships. The company's approach involves a detailed analysis of potential investments, focusing on regulated markets and stable income streams. The company's financial performance, including its net debt-to-total capital ratio of 7.8% as of December 31, 2024, is a key metric for investors.

- Financial Performance: CKI's strong financial position is a key factor in attracting investors and securing new projects.

- Strategic Partnerships: Collaborations with other companies are vital for market expansion and project acquisition.

- Global Diversification: CKI's strategy includes investing in various sectors and geographies to reduce risk and increase returns.

- Market Analysis: CKI's investment decisions are driven by detailed market analysis and due diligence.

For further insights into CKI's strategic direction, consider reading about the Growth Strategy of CK Infrastructure. This article provides additional context on CKI's long-term goals and operational strategies.

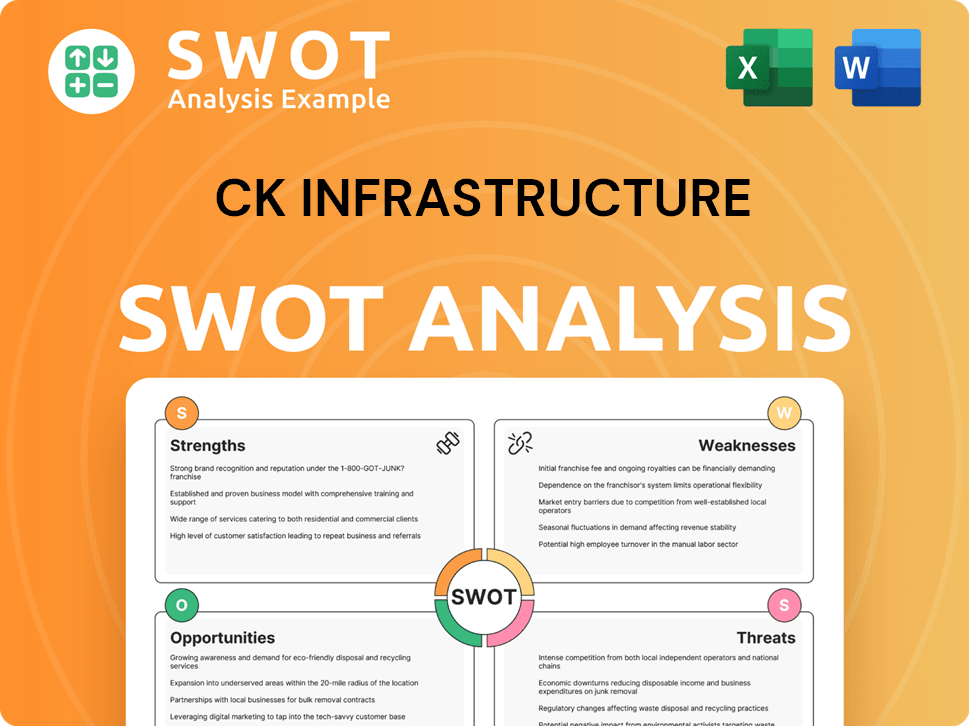

CK Infrastructure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does CK Infrastructure Use?

The marketing tactics of CK Infrastructure (CKI) are primarily focused on investor relations. This approach emphasizes financial stability, strategic growth, and a commitment to sustainability, rather than traditional consumer-focused advertising. CKI uses a data-driven strategy to communicate its value proposition to a diverse group of financially-literate decision-makers, making it an effective CKI sales and marketing strategy.

CKI's marketing efforts are geared toward showcasing its financial health and strategic initiatives. They aim to attract and retain investors by highlighting the company's stable, recurring income streams from regulated businesses. This approach is crucial for building trust and demonstrating long-term value to shareholders and potential investors, which is a key part of the CKI sales strategy.

The company's digital marketing strategy revolves around its website, cki.com.hk, where it publishes essential documents. These documents include annual reports, sustainability reports, and financial results, serving as key marketing tools to inform shareholders and the public. For instance, the Annual Report and Accounts 2024 and the Sustainability Report 2024 were released on April 15, 2025, providing detailed insights into financial and sustainability performance. This is a crucial part of CKI's digital marketing initiatives.

CKI maintains a comprehensive website, cki.com.hk, for publishing key documents. These include annual reports and sustainability reports. The website serves as a central hub for disseminating financial and strategic information.

Financial announcements and strategic updates are distributed through platforms like the London Stock Exchange. This includes details such as the 2024 annual results and secondary listing. The company ensures broad dissemination of its financial performance.

Traditional media is likely used for broad corporate announcements and investor briefings. Participation in events like the annual general meetings (AGMs) allows direct engagement with shareholders. This is a part of CKI's overall CKI marketing campaign effectiveness.

CKI's approach focuses on regulated businesses, ensuring stable income for investors. The company highlights its strong financial position, including HKD8 billion in cash as of December 31, 2024. This appeals to investors seeking predictable returns.

The company emphasizes environmental stewardship and decarbonization. The 2024 Sustainability Report outlines these initiatives. Acquisitions of renewable energy businesses in 2024 support these sustainability goals.

CKI's financial health is a key selling point. The company had HKD8 billion in cash and a net debt-to-total capital ratio of 7.8% as of December 31, 2024. This is a critical aspect of their CKI sales process analysis.

CKI's marketing strategy centers around financial stability, strategic growth, and sustainability. This approach is designed to attract investors seeking predictable returns and align with global ESG trends. The company's focus on regulated businesses and environmental stewardship are crucial components of its marketing efforts.

- Financial Stability: Highlighting a strong financial position, including HKD8 billion in cash and a net debt-to-total capital ratio of 7.8% as of December 31, 2024.

- Strategic Growth: Showcasing acquisitions and investments in renewable energy businesses.

- Sustainability: Emphasizing environmental stewardship and decarbonization efforts, as detailed in the 2024 Sustainability Report.

- Investor Relations: Utilizing digital platforms and traditional media for disseminating information and engaging with shareholders.

- Data-Driven Approach: Using data to communicate value to financially-literate decision-makers.

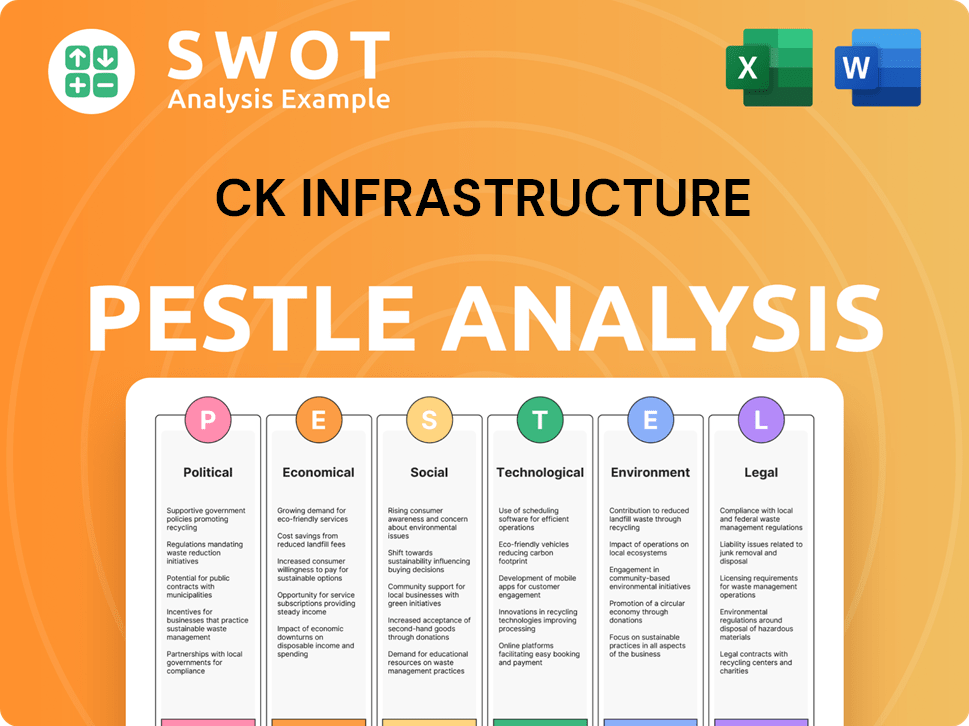

CK Infrastructure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is CK Infrastructure Positioned in the Market?

CK Infrastructure (CKI) strategically positions itself as a global leader in infrastructure investment, emphasizing financial and operational resilience. This brand identity is built on reliability, customer service, and innovative projects designed to benefit communities. The company's approach focuses on delivering stable, recurring income, which is a key element of its brand message. This strategy resonates with institutional investors and financial professionals seeking dependable returns.

A core aspect of CKI's brand positioning is its commitment to long-term sustainable growth and prudent financial management. CKI consistently highlights its strong financial position to showcase its stability. This includes its cash reserves and a low net debt-to-total capital ratio, which demonstrates financial health. CKI's consistent dividend growth further reinforces its image as a reliable investment for those seeking steady income.

Innovation and sustainability are increasingly central to CKI's brand positioning. The company actively invests in innovation and technology to support the global transition to green energy and achieve carbon neutrality ambitions. Acquisitions in 2024, such as renewable energy businesses and gas distribution networks with biomethane and hydrogen potential, underscore this commitment. CKI's sustainability reports, published annually, detail its strategies and accomplishments in sustainable practices, including efforts to reduce GHG emissions and promote a circular economy. This focus helps the company appeal to a growing segment of investors prioritizing environmental, social, and governance (ESG) factors.

CKI emphasizes its robust financial health, a critical element of its brand. As of December 31, 2024, the company reported approximately HKD8 billion in cash, demonstrating a strong liquidity position. This financial strength is crucial for attracting investors seeking stability and long-term value. The low net debt-to-total capital ratio of 7.8% further supports this image.

The company's focus on sustainable growth is a key aspect of its brand. CKI invests in renewable energy projects and technologies to align with global sustainability goals. This includes acquisitions in the renewable energy sector, such as those made in 2024, which are designed to support the transition to green energy. This focus helps CKI attract investors who prioritize environmental, social, and governance (ESG) factors.

CKI's consistent dividend payments are a cornerstone of its brand. The company has maintained a track record of dividend growth for 28 consecutive years since its listing in 1996. This demonstrates CKI's commitment to providing reliable returns to shareholders. This consistent dividend performance enhances its appeal to investors looking for a steady income stream.

CKI's commitment to customer service is a key differentiator. For instance, its UK Power Networks business earned the top spot among utilities in the UK Customer Satisfaction Index. This focus on service excellence enhances CKI's reputation and strengthens its brand. This commitment ensures customer loyalty and reinforces a positive brand image.

Maintaining brand consistency is crucial for CKI. Regular financial reporting and investor communications ensure that the message of stability, growth, and sustainability is consistently conveyed across all touchpoints. CKI also adapts to changing market conditions and regulatory environments, as seen in its engagement with new climate reporting requirements. For a deeper dive into CKI's strategic direction, consider reading about the Growth Strategy of CK Infrastructure.

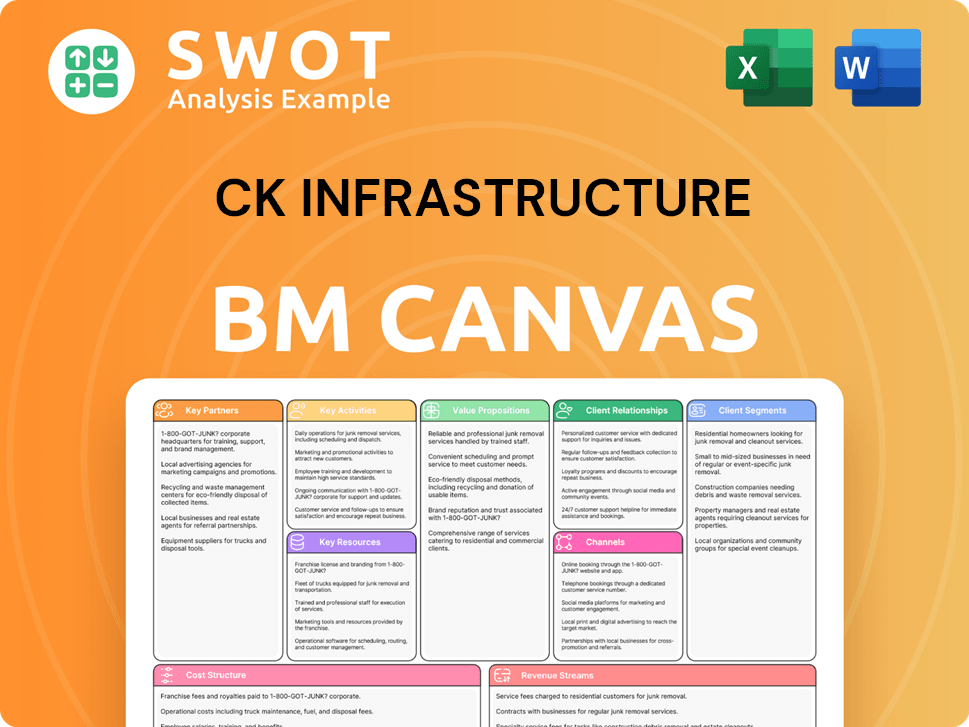

CK Infrastructure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are CK Infrastructure’s Most Notable Campaigns?

The sales and marketing strategies of CK Infrastructure (CKI) are less about flashy campaigns and more about long-term value creation and strategic positioning. CKI focuses on solidifying its reputation as a reliable infrastructure investment, primarily through consistent financial performance and smart acquisitions. This approach is clearly visible in how the company communicates with investors and the market, emphasizing financial stability and strategic growth initiatives.

CKI's sales and marketing strategies are deeply integrated into its business development and investment decisions. The company's approach is to build a strong, sustainable business model that inherently attracts investors. This is achieved through consistent dividend growth, strategic acquisitions, and a focus on sustainable infrastructure. The goal is to maintain a robust financial profile that appeals to a broad investor base.

The company's key 'campaigns' are designed to enhance its market position and financial performance. These campaigns are not traditional marketing efforts but strategic initiatives that resonate with investors. This includes the consistent growth of dividends, expansion into renewable energy, and strategic listings on stock exchanges. These initiatives are essential for CKI's long-term growth and market stability.

One of the core sales and marketing strategies of CKI is to maintain and grow its dividends. In 2024, CKI announced its 28th consecutive year of dividend growth, with a total dividend of HK$2.58 per share, representing a 0.8% increase over the prior year. This consistent growth is a key factor in attracting and retaining investors seeking reliable income, especially in uncertain economic times. This strategy reinforces CKI's image as a stable, income-generating investment.

CKI's expansion into renewable energy is another crucial aspect of its sales and marketing strategy. In 2024, CKI made significant acquisitions, including Phoenix Energy and UK Renewables Energy. These acquisitions support the company's commitment to environmental sustainability and the global transition to green energy. The objective is to diversify their portfolio and capitalize on the growing market for sustainable infrastructure, enhancing their ESG profile.

The secondary listing on the London Stock Exchange on August 19, 2024, was a strategic move to broaden its investor base. This initiative was carefully communicated to the market, highlighting CKI's strong financial position and proactive approach to growth. The listing enhanced CKI's standing as a global infrastructure company and created additional channels for raising funds for large-scale acquisitions. This move was successful in increasing the company's visibility in international markets.

CKI's sales and marketing strategy is centered on building long-term value. This involves consistent dividend growth, strategic acquisitions, and a commitment to sustainable infrastructure. The company aims to attract and retain investors who are looking for stable, income-generating investments. This approach is supported by its strong financial performance and proactive expansion into new markets. For more on the company's origins, see Brief History of CK Infrastructure.

CK Infrastructure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CK Infrastructure Company?

- What is Competitive Landscape of CK Infrastructure Company?

- What is Growth Strategy and Future Prospects of CK Infrastructure Company?

- How Does CK Infrastructure Company Work?

- What is Brief History of CK Infrastructure Company?

- Who Owns CK Infrastructure Company?

- What is Customer Demographics and Target Market of CK Infrastructure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.