CK Infrastructure Bundle

Who Does CK Infrastructure Serve?

In the ever-shifting landscape of global infrastructure, understanding the "who" behind the "what" is crucial. For a giant like CK Infrastructure, navigating the complexities of its CK Infrastructure SWOT Analysis and its diverse customer base is key to sustained success. This involves a deep dive into customer demographics and target market dynamics to ensure strategic alignment and market relevance.

To truly grasp the intricacies of CK Infrastructure's operations, we must dissect its customer profile. This includes a detailed market analysis of its customer demographics, target market segments, and geographic distribution. Analyzing demographic data allows for a better understanding of CK Infrastructure's customer needs and preferences, enabling the company to tailor its services effectively. This exploration will reveal the infrastructure company's strategies for adapting to evolving consumer behaviors and industry trends.

Who Are CK Infrastructure’s Main Customers?

Understanding the customer base of CK Infrastructure is crucial for a thorough Growth Strategy of CK Infrastructure. The company operates primarily in the B2B sector, focusing on infrastructure development and operation. This means their target market consists mainly of institutional and governmental entities.

The customer demographics for CK Infrastructure differ from those of a typical consumer-facing business. Instead of individual consumers, the company serves entities that require essential services like energy, transportation, and water management. This B2B model influences how the company approaches market analysis and strategic planning.

CK Infrastructure's success is indirectly linked to the economic and demographic trends of the regions it serves. Growing populations and urbanization drive demand for infrastructure, which benefits the company. The company's focus on stable industries suggests a preference for long-term contracts and predictable revenue streams.

CK Infrastructure's primary customer segments include national power grids, local distribution companies, and large industrial consumers in its energy segment. In transportation, the company serves government authorities and public-private partnerships. Municipal water authorities and local governments are key clients in water and waste management.

While demographic data like age and income aren't directly applicable, regional population growth and urbanization influence demand for infrastructure projects. For example, the Asia-Pacific region is expected to see significant infrastructure investment in the coming years, driven by population growth and economic development. This trend directly impacts CK Infrastructure's potential customer base.

CK Infrastructure adapts its investment strategies based on global infrastructure trends, such as the increasing demand for renewable energy and smart city solutions. The company's focus on essential services suggests a commitment to meeting the long-term needs of its customers. This market analysis helps identify opportunities and maintain a stable revenue stream.

- Customer Needs: Reliable and efficient infrastructure services.

- Buying Behavior: Long-term contracts and partnerships.

- Industry Sectors: Energy, transportation, water, and waste management.

- Geographic Distribution: Primarily in regions with stable economies and growing populations.

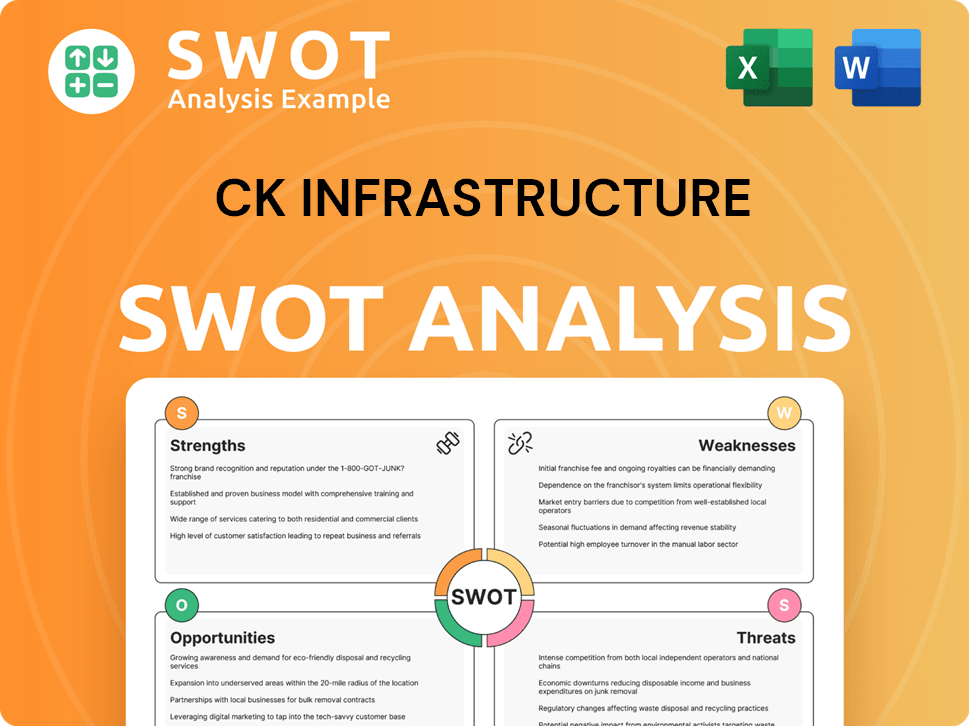

CK Infrastructure SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CK Infrastructure’s Customers Want?

Understanding the customer needs and preferences is crucial for CK Infrastructure's (CKI) success. As a business-to-business (B2B) entity, CKI's primary customers are governmental bodies, municipalities, and large industrial clients. These clients have specific requirements that drive their decisions regarding infrastructure services.

The core needs of CKI's customers revolve around reliability, efficiency, and long-term stability. They seek consistent and uninterrupted delivery of essential services, such as electricity, gas, water, and transportation. For instance, a municipality requires assurance of a clean water supply, adherence to environmental regulations, and efficient operational management. These factors are essential to meet the demands of their citizens.

The decision-making process for these clients is often complex, involving rigorous due diligence, regulatory compliance, and a focus on the infrastructure provider's technical expertise. This includes long-term financial viability and the ability to meet evolving regulatory standards. The purchasing behaviors are characterized by extensive tendering processes and long-term contractual agreements.

CKI's target market prioritizes several key factors when selecting an infrastructure provider. These include the following:

- Reliability and Consistency: Uninterrupted service delivery is paramount. Customers need assurance that services like electricity, gas, and water will be consistently available.

- Efficiency and Cost-Effectiveness: Clients seek solutions that optimize operational efficiency and provide long-term value. This includes minimizing operational costs and maximizing the lifespan of infrastructure assets.

- Regulatory Compliance: Adherence to environmental regulations and other industry standards is critical. CKI must demonstrate a strong track record in meeting and exceeding regulatory requirements.

- Technical Expertise and Innovation: Customers value providers with proven technical capabilities and a commitment to innovation. This includes the adoption of new technologies to improve efficiency and sustainability.

- Long-Term Stability: Clients look for providers with a strong financial standing and a history of successful project delivery. This ensures that the infrastructure assets will be well-maintained and operational for the duration of the contract.

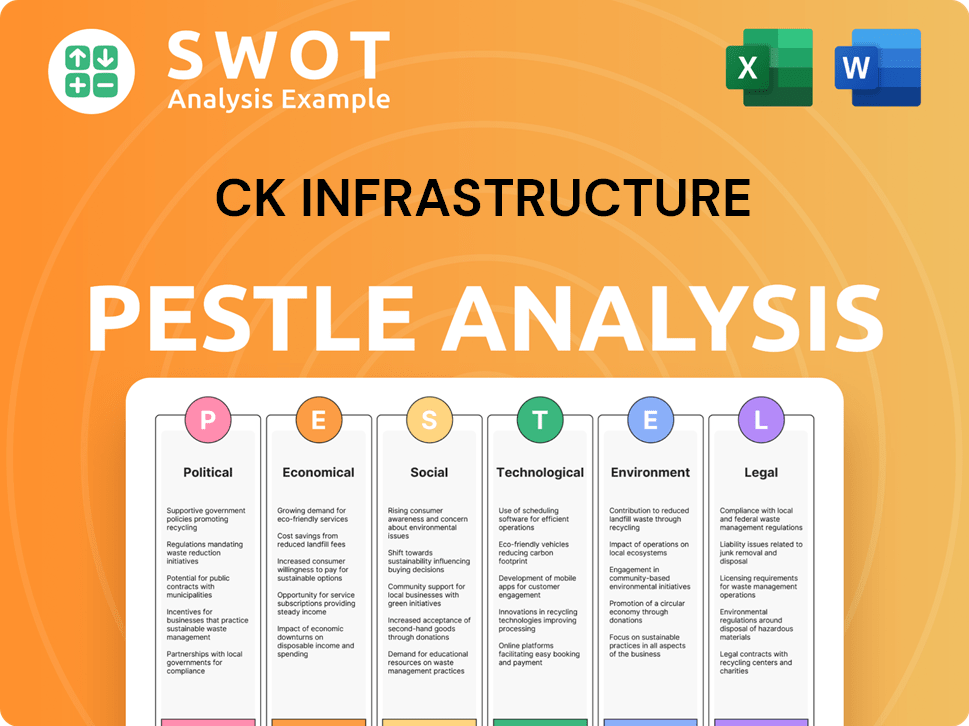

CK Infrastructure PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CK Infrastructure operate?

CK Infrastructure Holdings Limited (CKI) strategically focuses its operations in regions with stable regulatory environments and robust infrastructure needs, demonstrating a clear understanding of its target market. The company's geographical market presence is primarily concentrated in developed economies. This strategic focus is crucial for long-term sustainability and profitability in the infrastructure sector.

Its primary markets include the United Kingdom, Australia, Continental Europe (Netherlands, Portugal, and Germany), and North America (Canada and the United States), alongside its home base in Hong Kong and Mainland China. This diversified geographical spread helps mitigate risks and capitalize on various economic cycles. The company's approach to market analysis emphasizes the importance of adapting to local market dynamics.

This strategy allows CKI to cater to specific customer needs and preferences within each region, ensuring effective market segmentation. CKI's investments in regulated utilities, such as UK Power Networks and Northumbrian Water in the UK, reflect a preference for stable, mature markets. Understanding the demographic breakdown of CK Infrastructure clients is key to its operational success.

CKI's primary markets include the UK, Australia, Continental Europe, North America, Hong Kong, and Mainland China. These regions offer stable regulatory environments. CKI’s diversified portfolio helps mitigate risks and capitalize on economic cycles.

CKI operates through local subsidiaries and management teams. They understand market dynamics, regulatory landscapes, and cultural nuances. This approach allows for effective adaptation and responsiveness to regional policy shifts.

The company strategically invests in regulated assets. These investments provide stable returns and predictable cash flows. CKI's focus on regulated assets in the UK and Australia highlights its preference for stable markets.

The geographic distribution of sales and growth is influenced by asset performance and economic stability. CKI's annual reports highlight the resilient performance of its UK utility businesses. These businesses significantly contribute to overall revenue.

CKI's approach to its target market involves a deep understanding of customer demographics and regional regulatory frameworks. For example, the company adapts its operational practices to meet specific infrastructure demands in the UK and Australia. This includes engaging with local stakeholders and responding to regional policy shifts. CKI's strategy is detailed in Revenue Streams & Business Model of CK Infrastructure, which provides insights into its diverse revenue streams and how it navigates its target market. The company's success is closely tied to its ability to adapt to local market dynamics and maintain strong relationships with its customer base. Recent financial reports indicate that CKI's investments continue to generate stable returns, particularly in regulated utility sectors.

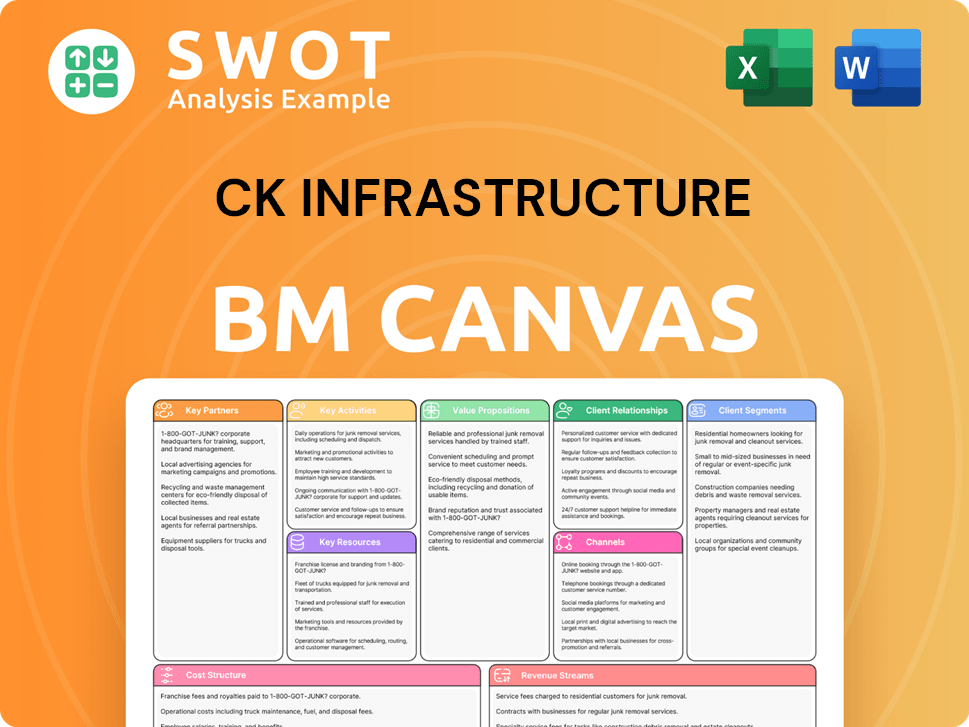

CK Infrastructure Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CK Infrastructure Win & Keep Customers?

For CK Infrastructure Holdings Limited (CKI), understanding customer acquisition and retention is crucial, but the approach differs significantly from consumer-focused businesses. Their customer base primarily comprises entities involved in infrastructure projects and investments. This includes governments, regulatory bodies, and financial institutions. The company's success relies on securing new infrastructure projects, winning bids, or acquiring stakes in operational utilities.

Acquisition focuses on strategic investments, mergers, and acquisitions within the infrastructure sector. Retention, on the other hand, centers on maintaining the operational efficiency and profitability of existing assets. This involves ensuring regulatory compliance, fostering strong relationships with stakeholders, and continuous investment in asset maintenance and upgrades. Understanding the dynamics of the CK Infrastructure customer profile is essential for sustained growth and profitability.

The company's strategies are finely tuned to the long-term nature of infrastructure investments, focusing on stable returns. This involves continuous investment in infrastructure and ensuring reliable service delivery. Therefore, the company uses sophisticated financial modeling and risk assessment tools to evaluate investments and manage its portfolio. The market analysis and demographic data are crucial to their success.

CKI prioritizes building and maintaining long-term relationships with governments, regulatory bodies, and financial partners. This is essential for securing projects and ensuring smooth operations. These partnerships are vital for long-term asset management and value creation. The infrastructure company relies on these established relationships for sustained success.

Operational excellence is a cornerstone of CKI's retention strategy. This includes regular maintenance, upgrades, and optimization of infrastructure assets. These improvements are aimed at ensuring reliable service delivery and meeting stringent regulatory targets. This commitment to operational excellence directly impacts the company's financial performance.

Adhering to regulations and effectively engaging with stakeholders are crucial for maintaining a positive reputation. CKI actively works to meet regulatory requirements and build strong relationships with local authorities. This approach helps in securing long-term operational stability and fostering trust. This is a key aspect of their target market approach.

Strategic reinvestment in existing assets and proactive portfolio management are essential for long-term viability. This includes evaluating and optimizing the performance of existing assets. This ensures the portfolio remains robust and generates stable returns, which is critical for investors. Analyzing customer demographics helps in making informed decisions.

CKI's strategies are continuously adapted to global economic trends and regulatory changes. The company's focus remains on maximizing long-term shareholder value and ensuring stable returns from its diverse asset base. Understanding the needs and preferences of their customer is a key focus for CK Infrastructure.

- Financial Strength: CKI's strong financial backing is a critical factor in both acquiring new projects and managing existing assets.

- Operational Expertise: Proven operational capabilities are essential for managing infrastructure assets efficiently and profitably.

- Reputation: A strong reputation for long-term asset management and value creation is crucial for attracting investment and securing projects.

- Relationship Management: Cultivating strong relationships with governments, regulatory bodies, and financial institutions is vital for long-term success.

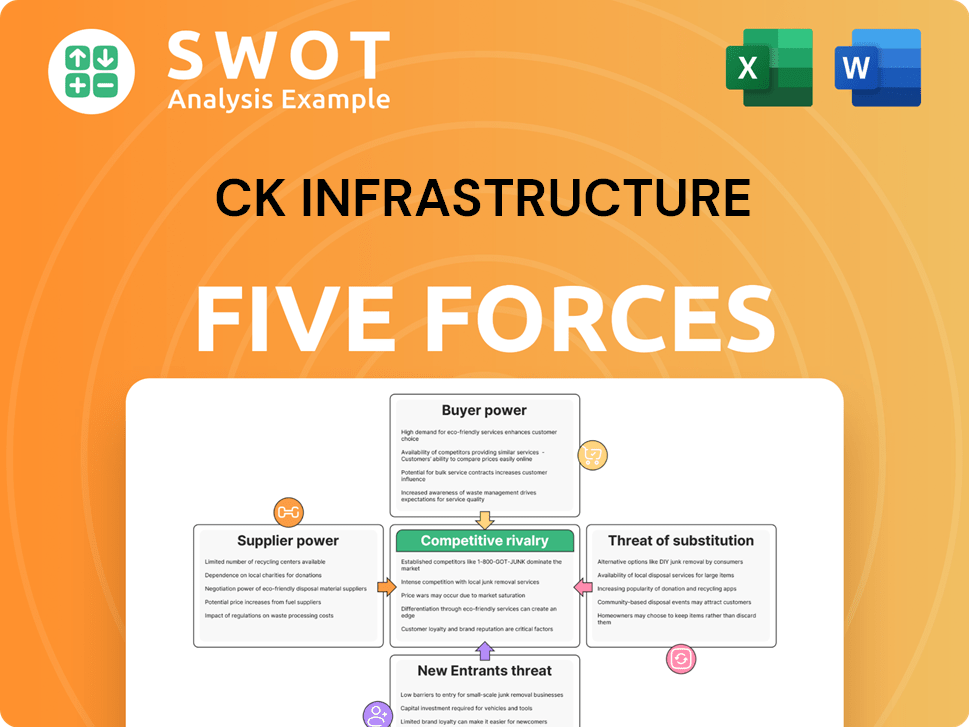

CK Infrastructure Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CK Infrastructure Company?

- What is Competitive Landscape of CK Infrastructure Company?

- What is Growth Strategy and Future Prospects of CK Infrastructure Company?

- How Does CK Infrastructure Company Work?

- What is Sales and Marketing Strategy of CK Infrastructure Company?

- What is Brief History of CK Infrastructure Company?

- Who Owns CK Infrastructure Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.