Equinox Gold Bundle

How Does Equinox Gold Stack Up in the Gold Mining Arena?

The gold mining industry is a high-stakes game, and Equinox Gold, a prominent Canadian Gold Mining Company, is a key player. With billions of dollars at stake and fluctuating commodity prices, understanding the Competitive Landscape is crucial. This analysis dives deep into Equinox Gold's position, its rivals, and the factors shaping its future.

Equinox Gold's journey, starting with a strategic merger, has led to impressive growth in Gold Production and asset portfolio. This detailed Market Analysis will reveal how Equinox Gold navigates the competitive arena, identifying its primary rivals and showcasing its distinct advantages. For investors seeking a comprehensive Equinox Gold investment overview, understanding the Equinox Gold SWOT Analysis is essential to assess the company's strengths, weaknesses, opportunities, and threats within the Mining Industry.

Where Does Equinox Gold’ Stand in the Current Market?

Equinox Gold is an intermediate gold producer, primarily focused on the Americas. The company's core operations involve the extraction of gold from its mines, with a portfolio spanning across Canada, the United States, Mexico, and Brazil. Equinox Gold's value proposition centers on its ability to produce and sell gold, a commodity in high demand globally, while maintaining a diversified geographic footprint to mitigate risks.

The company's strategic focus on the Americas offers a degree of geopolitical stability. Equinox Gold has consistently pursued growth through both organic development of its existing assets and strategic acquisitions. This approach has enabled the company to expand its production capacity and asset base, enhancing its market standing within the gold mining industry.

Equinox Gold aims to be a top-tier producer, with a 2024 production guidance between 660,000 and 700,000 ounces of gold. This positions them among the more substantial intermediate players in the gold mining space. The company's financial health, as reflected in its market capitalization and revenue figures, places it as a significant entity within the intermediate gold mining sector, often compared to peers with similar production profiles and geographic concentrations. For more details, you can explore the Growth Strategy of Equinox Gold.

Equinox Gold's primary focus is on gold production, serving the global gold market. Its operations are concentrated in the Americas, including Canada, the United States, Mexico, and Brazil. This geographic diversification helps in managing geopolitical risks and operational challenges.

Equinox Gold's 2024 production guidance is between 660,000 and 700,000 ounces of gold. The company has a history of growth through acquisitions, such as the Leagold Mining acquisition in 2020. This strategy enhances its production capacity and market presence.

Equinox Gold's financial performance places it as a significant entity within the intermediate gold mining sector. The company's market capitalization and revenue figures reflect its position. The company's operational efficiency is a key factor in its financial success.

The acquisition of Leagold Mining in 2020 was a key strategic move. This acquisition significantly expanded Equinox Gold's production capacity and asset base, particularly in Brazil. Such acquisitions demonstrate the company's commitment to growth and diversification.

Equinox Gold holds a strong position as an intermediate gold producer, with a focus on the Americas. It competes within the gold mining industry, aiming for top-tier status. The company's strategic mine locations and production guidance are central to its market standing.

- Geographic Focus: Operations primarily in the Americas.

- Production Target: 2024 production guidance between 660,000 and 700,000 ounces of gold.

- Growth Strategy: Acquisitions and organic development.

- Market Share: Aims to be a top-tier producer within the intermediate gold mining sector.

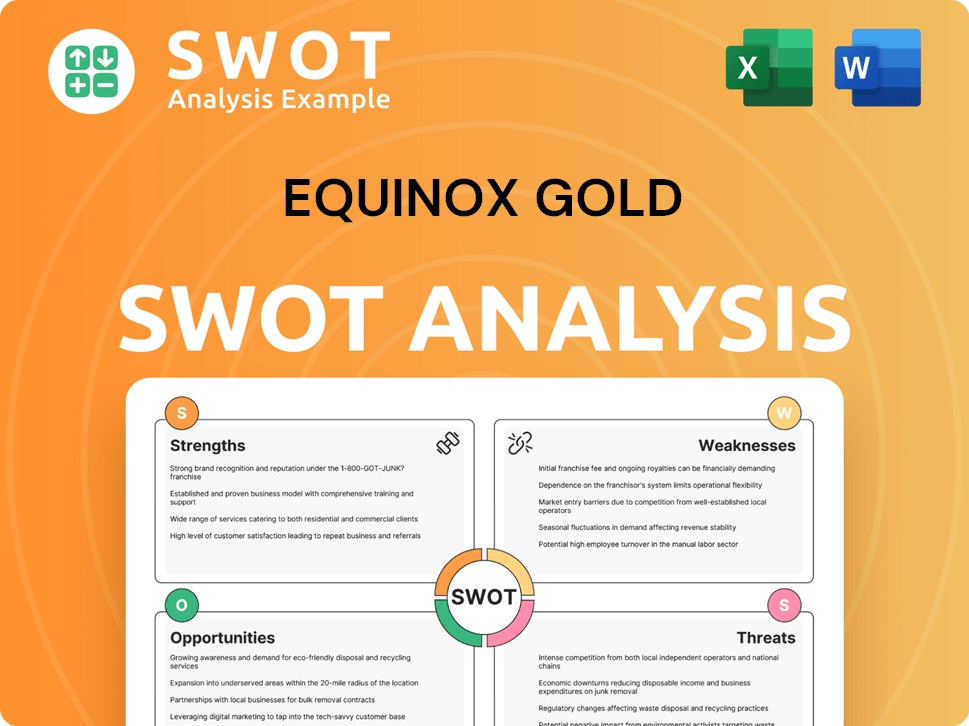

Equinox Gold SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Equinox Gold?

The Equinox Gold operates within a highly competitive global gold mining company industry. It faces both direct and indirect competition from a range of companies. This competitive landscape requires strategic navigation to maintain and improve market position.

Its main rivals challenge Equinox Gold across various fronts. These include access to capital, acquisition opportunities, operational efficiency, and talent retention. Understanding these competitive dynamics is critical for investors and stakeholders.

Major direct competitors include Agnico Eagle Mines Limited, with operations in Canada, Australia, Finland and Mexico. Barrick Gold Corporation and Newmont Corporation, are also significant competitors. Kinross Gold Corporation and Yamana Gold (now part of Pan American Silver and Agnico Eagle) are also key players.

Larger companies leverage economies of scale, potentially leading to lower operating costs. They also have greater financial capacity for acquisitions and exploration. Smaller, agile competitors focus on niche deposits or innovative mining techniques.

Competition extends to securing permits, attracting labor, and managing community relations. High-profile 'battles' often involve bidding wars for exploration properties. Mergers and acquisitions, such as the Newmont-Newcrest deal in 2023, reshape the competitive environment.

The gold production industry is dynamic. Companies continually adjust strategies to maintain a competitive edge. For example, in 2023, Newmont's acquisition of Newcrest Mining created a significantly larger entity, affecting the Equinox Gold market share and the overall mining industry. This consolidation highlights the ongoing need for strategic adaptation and operational efficiency. The Equinox Gold vs. other gold miners comparison is constantly evolving.

Several factors influence the competitive dynamics within the gold mining company sector. These include operational efficiency, financial strength, and strategic acquisitions. Understanding these aspects is crucial for a comprehensive competitive analysis of Equinox Gold.

- Operational Efficiency: Minimizing costs and maximizing gold production per ounce.

- Financial Strength: Ability to fund exploration, development, and acquisitions.

- Strategic Acquisitions: Expanding resources and market presence through mergers and acquisitions.

- Exploration Success: Discovering new deposits to sustain long-term growth.

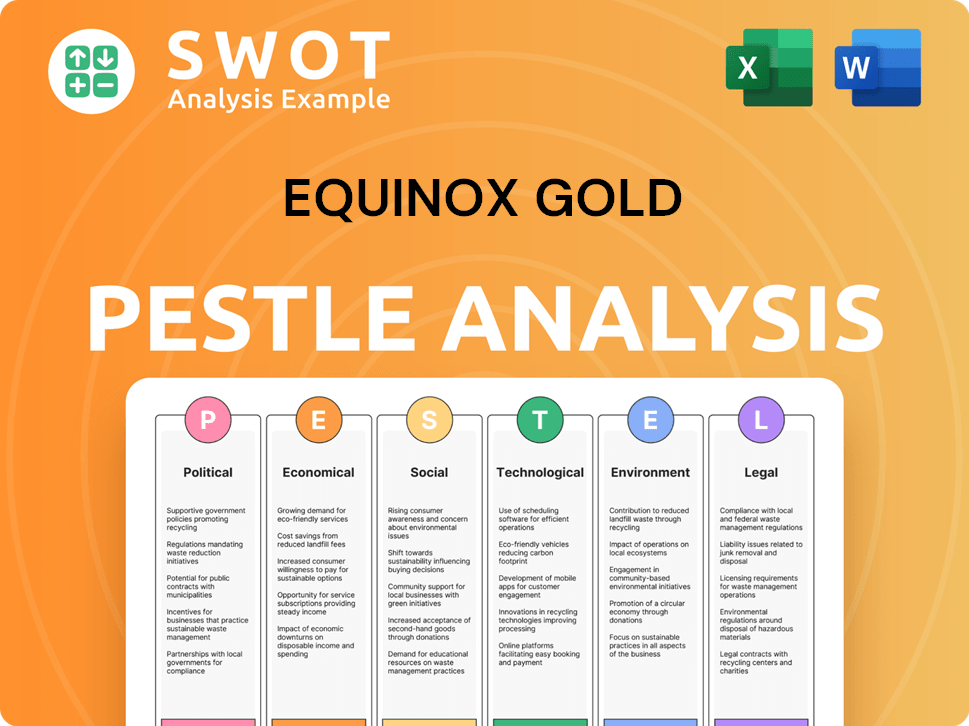

Equinox Gold PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Equinox Gold a Competitive Edge Over Its Rivals?

Analyzing the Competitive Landscape of a Gold Mining Company like Equinox Gold involves understanding its strengths and how it positions itself against rivals. A key element is evaluating its competitive advantages, which determine its ability to succeed in the Mining Industry. These advantages are critical for long-term sustainability and profitability.

Equinox Gold's strategic moves, including acquisitions and operational efficiencies, are vital in shaping its competitive edge. For instance, the successful integration of Leagold Mining significantly boosted its asset base. Examining Equinox Gold's Gold Production figures and future projects provides insight into its growth trajectory and market position. The company's commitment to sustainable practices also plays a crucial role in its competitive standing.

Equinox Gold's performance is influenced by various factors, including its geographic diversification and the expertise of its management team. The company's ability to navigate market fluctuations and maintain operational excellence also contributes to its competitive advantage. For a deeper dive into the company's growth strategy, consider reading about the Growth Strategy of Equinox Gold.

Equinox Gold's diverse portfolio of mines across the Americas reduces geopolitical risks. This strategic distribution, including operations in Canada, the United States, Mexico, and Brazil, provides a balanced production profile. The company's operational spread enhances its resilience to regional economic downturns.

Equinox Gold has a proven track record of acquiring and integrating new assets efficiently. This expertise accelerates its expansion and resource inventory growth, as seen with the Leagold Mining acquisition. Successful integration is key to realizing synergies and boosting overall production capacity.

The company focuses on organic growth through optimizations and expansions at existing mines. The Greenstone project, expected to begin production in Q2 2024, exemplifies this strategy. Such initiatives unlock additional value from current operations and boost production.

Equinox Gold benefits from a management team with extensive experience in mine development and capital markets. This expertise is crucial for navigating the complexities of the Mining Industry. Their leadership ensures efficient operations and strategic decision-making.

Equinox Gold's competitive advantages stem from its diversified asset base, proven M&A strategy, and experienced leadership. These strengths contribute to its sustainable competitive edge in the Competitive Landscape.

- Geographic diversification across stable mining jurisdictions.

- Proven ability to acquire and integrate new assets effectively.

- Focus on organic growth through mine optimizations and expansions.

- Experienced management team with deep industry knowledge.

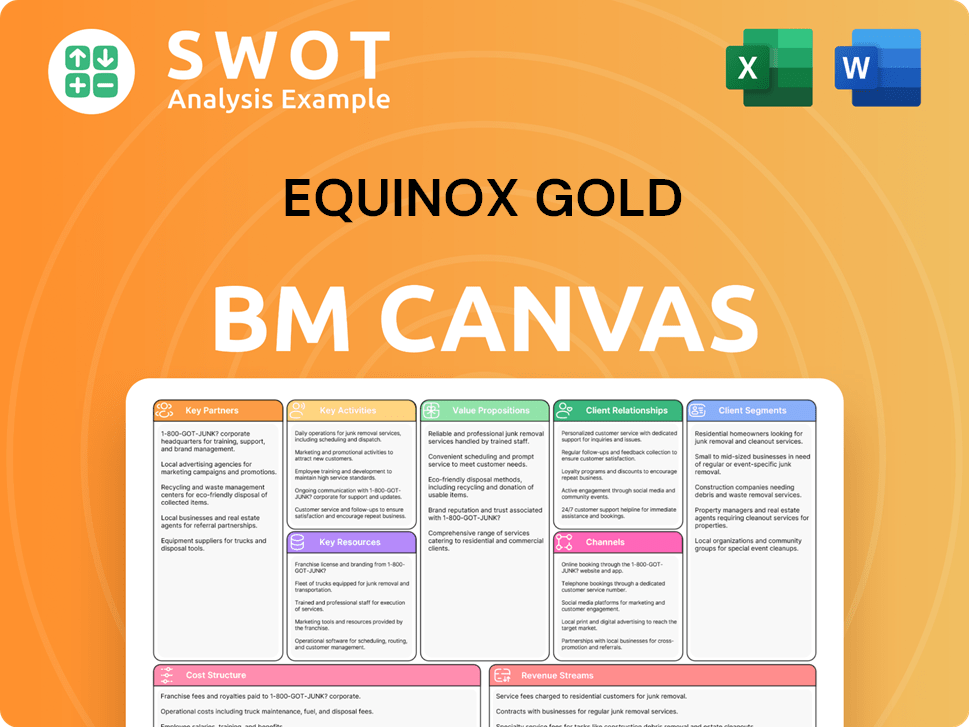

Equinox Gold Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Equinox Gold’s Competitive Landscape?

The gold mining industry is currently experiencing significant shifts driven by technological advancements, evolving regulatory landscapes, and global economic dynamics. These factors present both challenges and opportunities for companies like Equinox Gold. Understanding the Owners & Shareholders of Equinox Gold and its position within the competitive landscape is crucial for assessing its future prospects.

Equinox Gold, as a gold mining company, must navigate these trends to maintain and enhance its competitive position. This involves adapting to new technologies, adhering to stringent ESG standards, and responding to fluctuations in gold prices and operational costs. Strategic decisions regarding project development, acquisitions, and operational efficiency will be vital for success.

Technological advancements, including automation and data analytics, are optimizing mining operations. Regulatory pressures are increasing the focus on ESG factors. Economic shifts, such as inflation and interest rate changes, impact gold prices and operational costs.

Managing capital expenditures for growth projects and maintaining a healthy balance sheet is crucial. Discovering new, high-grade gold deposits is becoming more difficult and costly. Sustained periods of low gold prices and increased resource nationalism pose risks.

The ongoing demand for gold as a store of value and investment asset provides a stable market. Emerging markets continue to drive demand for gold jewelry and investment products. Product innovations in mining technology can lead to further operational efficiencies.

Equinox Gold focuses on optimizing existing operations, advancing its project pipeline, and pursuing accretive acquisitions. Commitment to ESG principles is a strategic move to secure its social license and attract investors. Project execution, technology integration, and market adaptability are key.

Equinox Gold's competitive landscape is shaped by its ability to adapt to industry trends and capitalize on emerging opportunities. The company's financial performance and strategic decisions will be critical.

- Gold Production: Equinox Gold's gold production in 2024 is projected to be approximately between 500,000 and 600,000 ounces.

- Operational Efficiency: Implementing advanced technologies to improve efficiency and reduce costs.

- Project Execution: Successfully bringing projects like Greenstone online on time and within budget is essential.

- ESG Performance: Enhancing sustainability practices and community engagement to attract responsible investors.

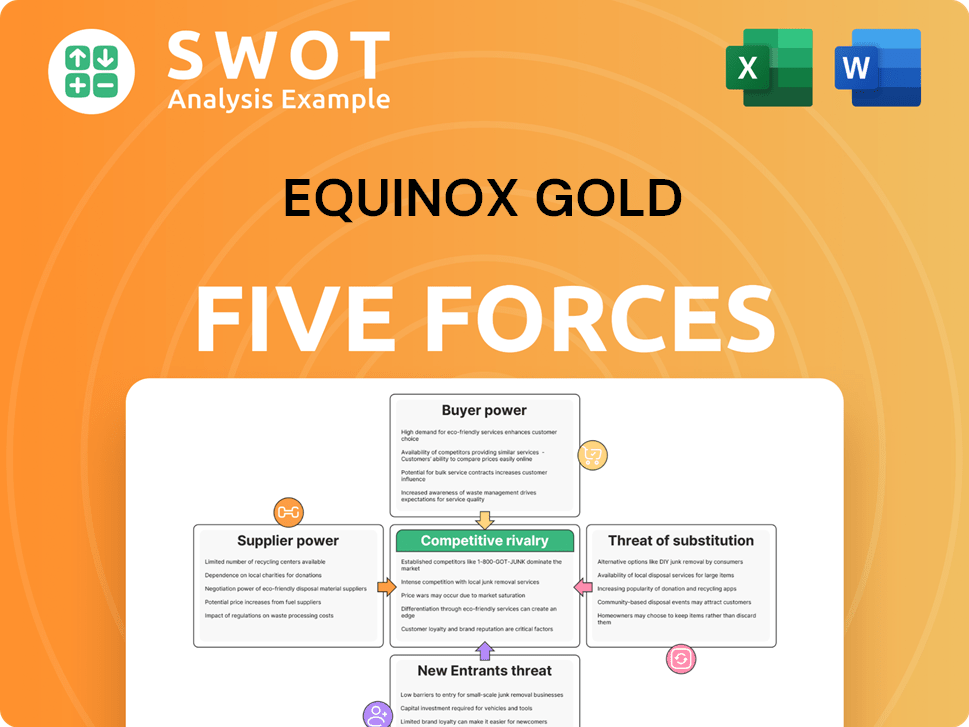

Equinox Gold Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Equinox Gold Company?

- What is Growth Strategy and Future Prospects of Equinox Gold Company?

- How Does Equinox Gold Company Work?

- What is Sales and Marketing Strategy of Equinox Gold Company?

- What is Brief History of Equinox Gold Company?

- Who Owns Equinox Gold Company?

- What is Customer Demographics and Target Market of Equinox Gold Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.