Equinox Gold Bundle

Who Invests in Equinox Gold?

In the high-stakes world of gold mining, understanding the Equinox Gold SWOT Analysis is crucial, but who are the key players? For a gold mining company like Equinox Gold, identifying its customer demographics and the Equinox Gold target market is essential for strategic success. This deep dive will uncover the investor profiles, geographic locations, and investment preferences that shape Equinox Gold's market position.

Equinox Gold Company's success hinges on its ability to attract and retain capital, making a thorough target audience analysis critical. This analysis will explore the demographics of Equinox Gold investors, including their interests, income levels, and investment behaviors. By understanding these factors, Equinox Gold can refine its market segmentation strategy and tailor its marketing efforts for maximum impact, ensuring alignment with its ideal customer profile and market positioning.

Who Are Equinox Gold’s Main Customers?

When considering the customer demographics for a company like Equinox Gold, it's essential to recognize that the primary customers are not end-users of gold products but rather investors and the financial markets. The target market analysis reveals a focus on attracting capital for growth and operational funding. Understanding the Equinox Gold target market is crucial for evaluating the company's financial health and strategic direction.

Equinox Gold's customer base primarily consists of institutional investors and individual investors. Institutional investors, including mutual funds, hedge funds, and pension funds, form a significant portion of the shareholder base. These entities invest based on detailed financial analysis, long-term growth prospects, and risk assessments. Individual investors are also a crucial segment, often driven by portfolio diversification, inflation hedging, or speculative interest in gold price movements.

Analyzing the Equinox Gold customer profile examples helps to understand the diverse nature of its investors. While specific demographic breakdowns are not publicly detailed, institutional investors typically represent sophisticated financial entities with substantial capital. Individual investors can vary widely in age, income level, and investment experience. The company adapts to market shifts by highlighting different aspects of their portfolio, such as production growth or cost efficiencies, as seen in their 2024 outlook.

These are major players like mutual funds, hedge funds, and pension funds. They often make investment decisions based on rigorous financial analysis and long-term growth potential. They provide a stable base of capital for the gold mining company.

Individual investors look to diversify their portfolios or hedge against inflation. Their interest often aligns with economic uncertainty or rising inflation, increasing gold's appeal as a safe haven. The Growth Strategy of Equinox Gold also influences this segment.

The fastest growth in customer interest often coincides with periods of economic uncertainty or inflation. This boosts gold's appeal as a safe-haven asset. Equinox Gold's marketing strategies focus on attracting capital for growth and operational funding.

While not explicitly detailed, the geographic location of investors is likely diverse, reflecting the global nature of financial markets. The company's operations and investor base are spread across different regions.

Understanding the customer demographics and target market of Equinox Gold Company is essential for assessing its investment potential. The company's focus on attracting capital from institutional and individual investors shapes its financial strategies. The company's ability to adapt to market shifts and highlight key aspects of its portfolio, such as production growth or cost efficiencies, is crucial for maintaining investor interest.

- Equinox Gold's primary customers are investors, both institutional and individual.

- Institutional investors include mutual funds, hedge funds, and pension funds.

- Individual investors are driven by diversification and inflation hedging.

- The company's marketing strategies focus on attracting capital for growth.

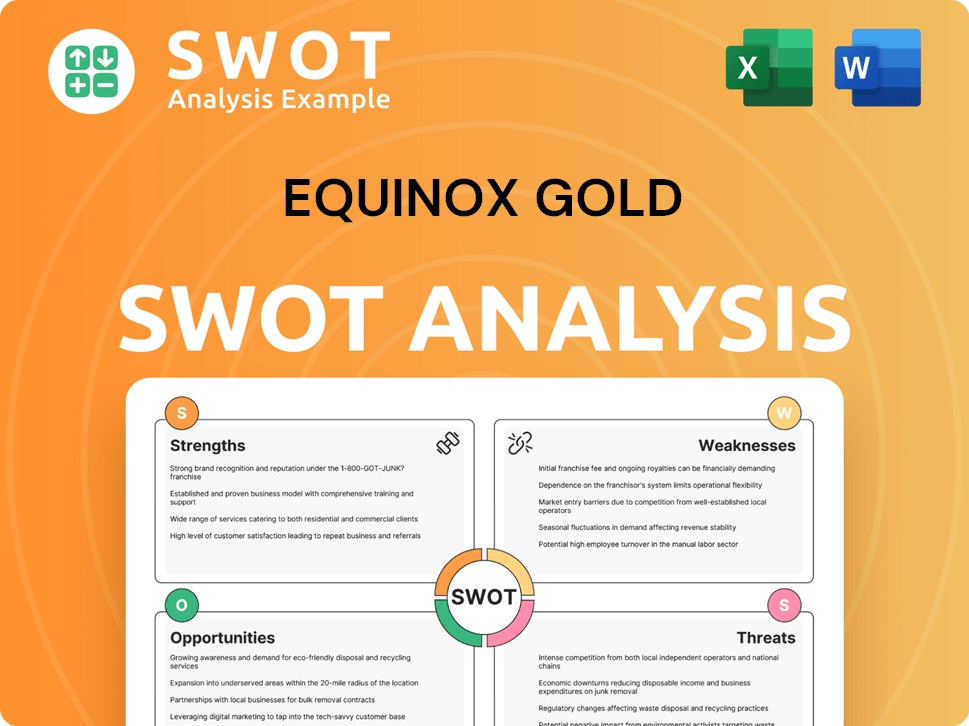

Equinox Gold SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Equinox Gold’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for a gold mining company like Equinox Gold, this means focusing on the expectations of its investors. The primary customer base, consisting mainly of investors, has specific requirements that drive their investment decisions. These needs revolve around financial performance, risk management, and transparency, all of which influence the company's strategic direction.

The Owners & Shareholders of Equinox Gold, as the main customers, are looking for consistent gold production, predictable cash flows, and a strong balance sheet. Their purchasing behaviors are influenced by global economic trends, inflation rates, interest rate policies, and geopolitical events, all of which impact gold prices. The company's success hinges on its ability to meet these expectations and deliver value to its shareholders.

Equinox Gold's target market, which includes institutional and retail investors, is driven by factors that influence gold prices. Decision-making criteria include the company's reserve base, production costs, growth pipeline, and the expertise of the management team. Investors also prioritize environmental, social, and governance (ESG) performance, increasingly viewing it as a critical factor for long-term value creation. This focus on ESG reflects a broader trend in the investment community, where responsible and sustainable practices are becoming increasingly important.

Equinox Gold addresses these needs by focusing on operational efficiency, disciplined capital allocation, and transparent reporting. For instance, the company's 2024 guidance projected significant gold production, aiming for 660,000 to 750,000 ounces, and a reduction in all-in sustaining costs, which directly addresses investor preferences for profitability and cost control. The company also emphasizes its commitment to sustainable mining practices, aligning with the growing investor demand for responsible investments. Feedback from the market, often through analyst reports and investor calls, influences strategic decisions, such as prioritizing certain growth projects or optimizing existing operations to enhance shareholder value.

- Financial Performance: Investors seek consistent gold production and predictable cash flows.

- Risk Management: Investors are concerned about the company's balance sheet and its ability to withstand economic fluctuations.

- Transparency: Investors want clear and detailed reporting on the company's operations, financial performance, and ESG practices.

- ESG Performance: Investors increasingly view ESG factors as critical for long-term value creation.

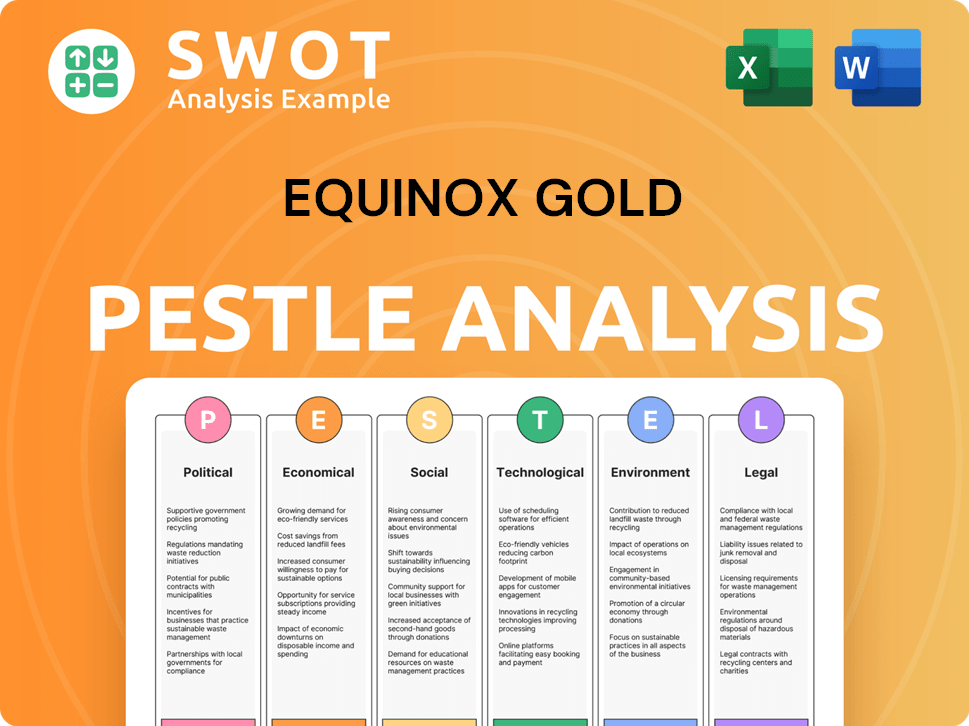

Equinox Gold PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Equinox Gold operate?

The geographical market presence of the company is primarily focused on the Americas. This strategic decision allows for operational efficiency by leveraging regional expertise and navigating similar regulatory landscapes. Key operational areas include Canada, the United States, Mexico, and Brazil. These locations host significant assets, such as the Greenstone Project in Canada and the Aurizona mine in Brazil.

The company's operations are geographically concentrated, its customer base (investors) is global. The company targets major markets to attract investment capital. These markets include North America (particularly Canada and the United States), Europe, and increasingly, Asia. The company's presence in these regions is solidified through its listings on the TSX and NYSE American.

The company tailors its investor relations efforts to suit different regional preferences. For example, European investors may emphasize Environmental, Social, and Governance (ESG) factors. North American investors might prioritize immediate returns and growth potential. The company actively participates in global mining conferences. Also, it engages with a diverse array of financial institutions to broaden its investor base. Recent advancements, such as the development of the Greenstone Project, are aimed at increasing production capacity, thereby attracting more investment.

The company's customer demographics are diverse, encompassing individual and institutional investors globally. The company's target audience analysis reveals a range of investor profiles. These profiles include those focused on long-term growth, ESG considerations, and immediate returns. The company’s market segmentation strategy targets investors in North America, Europe, and Asia.

The geographic location of the company's customers is global, with a significant concentration in North America and Europe. Equinox Gold customer geographic location is influenced by its primary listings on the TSX and NYSE American. Equinox Gold's target market segmentation strategy includes investors in Asia, reflecting its expanding global reach. The company's marketing strategies for target audience are tailored to regional preferences.

The company's customer behavior analysis indicates varying investment priorities across different regions. European investors often prioritize ESG factors, while North American investors may focus on immediate returns. The company adapts its market positioning to cater to these diverse preferences. Equinox Gold customer preferences are considered in its investor relations strategies.

The company employs targeted marketing strategies to engage its diverse customer base. Equinox Gold's marketing strategies for target audience include participation in global mining conferences. The company engages with financial institutions to broaden its investor base. The company's approach is designed to align with the preferences of its target audience.

The company strategically focuses its operations in the Americas while maintaining a global investor base. This approach allows for operational efficiency and targeted investor relations. The company's success depends on understanding and adapting to the diverse needs of its investors.

- The company's operations are primarily in Canada, the United States, Mexico, and Brazil.

- The company's target audience includes investors in North America, Europe, and Asia.

- The company tailors its investor relations to regional preferences.

- Recent expansions, like the Greenstone Project, aim to increase production and attract investment.

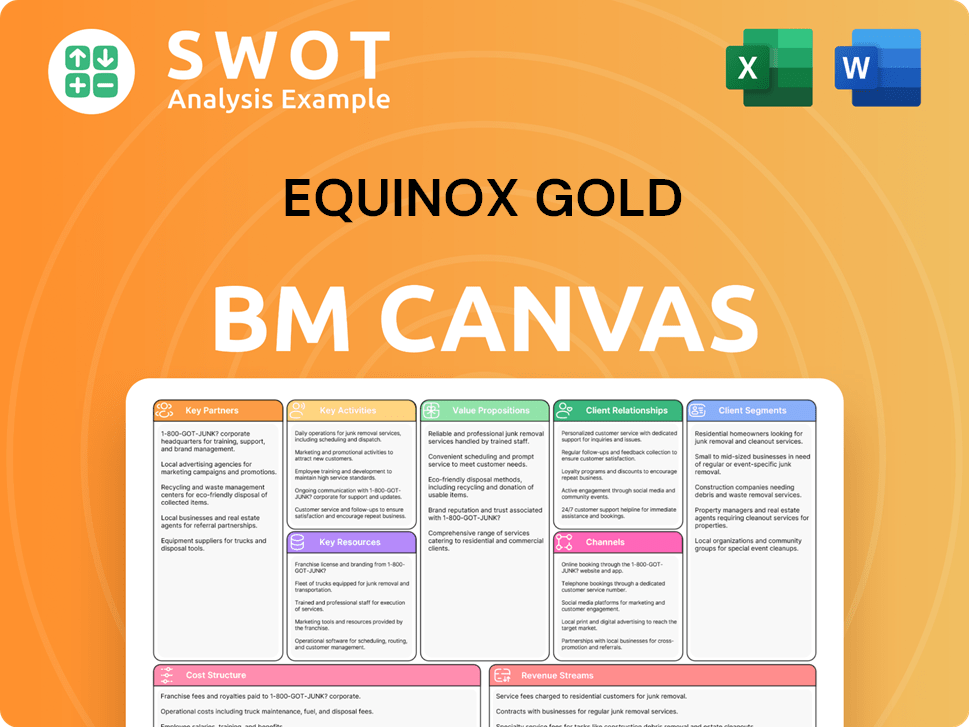

Equinox Gold Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Equinox Gold Win & Keep Customers?

Customer acquisition and retention strategies for a gold mining company like Equinox Gold are centered on attracting and retaining investor confidence and capital. The company focuses on financial market channels to acquire new investors, utilizing regular communication and transparency to maintain investor interest. This involves consistent engagement with financial analysts, participation in investor conferences, and the dissemination of information through digital channels.

Retention strategies are focused on demonstrating robust operational performance, disciplined capital management, and a clear growth pipeline. The company aims to retain investors by delivering on production targets, managing costs effectively, and outlining future expansion plans. The primary goal is to build and maintain a strong investor base through consistent performance and transparent communication. This approach helps the company maintain its position in the competitive gold mining sector.

For example, the 2024 guidance, which projects increased gold production and reduced costs, is a key retention tool, signaling to investors a commitment to improving profitability. Regular investor calls and presentations provide opportunities for direct engagement and address investor concerns. While traditional loyalty programs are not applicable, the company's consistent dividend policy, when in place, can also serve as a retention mechanism, rewarding long-term shareholders.

Equinox Gold disseminates financial results quarterly and annually to keep investors informed. The company's website and financial news platforms are key channels for delivering this information. This regular communication helps build trust and transparency with investors, crucial in the gold mining industry.

The company actively participates in investor conferences and roadshows. These events provide direct interaction with potential and current investors. They use these platforms to present their strategy and financial performance, fostering relationships and attracting investment.

Equinox Gold maintains consistent engagement with financial analysts and the media. This engagement helps shape the perception of the company. Regular updates and responses to inquiries ensure that the company's story is accurately and positively represented in the market.

Delivering on production targets and managing costs effectively are critical for retaining investors. The company's ability to meet its financial goals and manage its resources directly impacts investor confidence. In 2024, the focus on increased gold production and reduced costs is a key strategy.

Outlining future expansion plans and demonstrating a clear growth pipeline are essential for long-term investor retention. Investors are attracted to companies with a vision for the future. Highlighting exploration success and potential new projects is a key aspect of this strategy.

Regular investor calls and presentations offer opportunities for direct engagement and addressing investor concerns. These communications provide a platform for the company to build relationships and address any issues. Clear and consistent communication is vital for maintaining investor confidence.

Equinox Gold's market positioning involves emphasizing different aspects of the company's value proposition based on market conditions. During bull markets, the focus is on highlighting exploration success. In downturns, the emphasis shifts to cost control and operational efficiency. This flexibility is key to maintaining investor interest.

Understanding investor behavior is crucial for refining acquisition and retention strategies. The company monitors investor sentiment through feedback, market analysis, and engagement with financial analysts. This helps tailor communications and strategies to meet investor expectations. Analyzing investor behavior is a continuous process.

The company's marketing strategies revolve around providing transparent financial information and participating in industry events. These strategies are designed to attract and retain investors by showcasing the company's performance and future prospects. These strategies are discussed in detail in the Marketing Strategy of Equinox Gold article.

A consistent dividend policy, when in place, can be a significant retention mechanism. Rewarding long-term shareholders with regular dividends can build loyalty and encourage continued investment. The presence of dividends is an important factor for many investors.

Equinox Gold's target market includes institutional investors, high-net-worth individuals, and retail investors. The company segments its market based on investment goals, risk tolerance, and geographic location. This segmentation allows for tailored communication and engagement strategies.

The company focuses on delivering strong operational performance and maintaining transparency. Investors prefer companies that are well-managed, financially sound, and have a clear growth strategy. Addressing customer preferences is essential for long-term success.

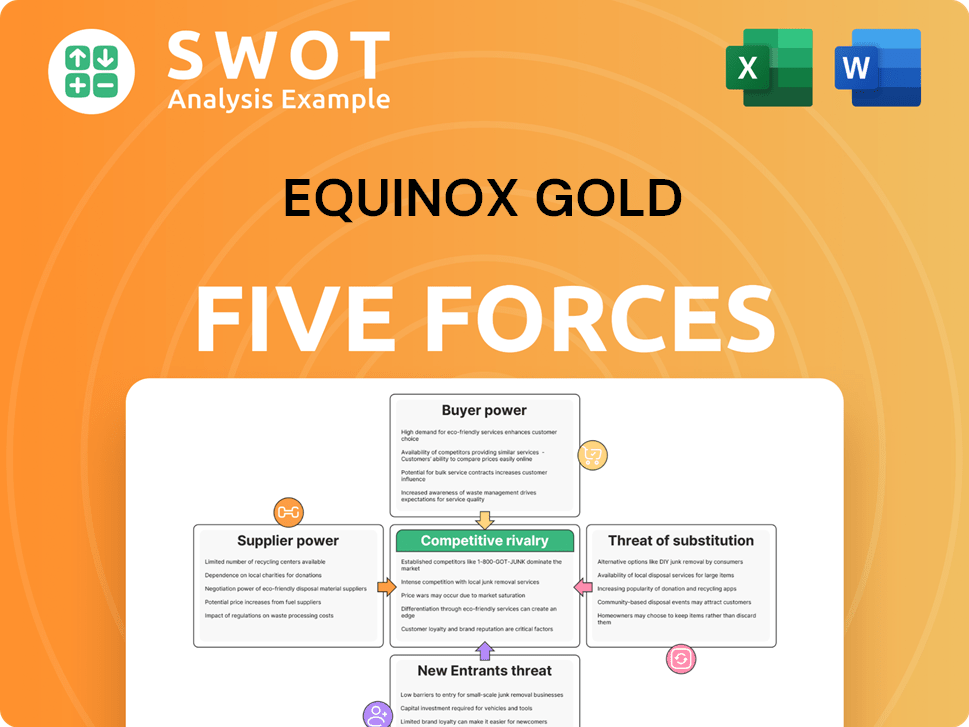

Equinox Gold Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Equinox Gold Company?

- What is Competitive Landscape of Equinox Gold Company?

- What is Growth Strategy and Future Prospects of Equinox Gold Company?

- How Does Equinox Gold Company Work?

- What is Sales and Marketing Strategy of Equinox Gold Company?

- What is Brief History of Equinox Gold Company?

- Who Owns Equinox Gold Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.