Equinox Gold Bundle

How Does Equinox Gold Conquer the Gold Market?

In the volatile world of gold mining, understanding Equinox Gold's sales and marketing strategy is crucial. This company, with its ambitious growth plans, is reshaping its approach to become a leading Americas-focused gold producer. The upcoming merger with Calibre Mining, slated for completion by Q2 2025, underscores this strategic shift, aiming to significantly boost its production capacity.

Equinox Gold's journey, from its inception in late 2017 with a vision to become a million-ounce-per-year gold producer, showcases a dynamic sales and marketing evolution. The company's Equinox Gold SWOT Analysis reveals key strategies for navigating the competitive gold market, including operational efficiency and cost reduction. This analysis is especially relevant as the company aims to maximize cash flow in the rising gold market, making it a key player in the gold mining company landscape.

How Does Equinox Gold Reach Its Customers?

The core of the Equinox Gold sales strategy is centered on investor relations and corporate development. As a gold mining company, its 'product' is gold doré, which is sold to refiners and then enters the global gold market. Therefore, the company's 'sales channels' are primarily financial and corporate in nature, focusing on attracting and retaining investment.

These channels include direct engagement with institutional, high-net-worth, and retail investors. The company actively participates in investor conferences and hosts webcasts and in-person shareholder events to communicate its strategy and financial performance. This approach is crucial for maintaining a strong investor base and ensuring the company's financial health. The company's focus on transparency and direct communication with the investment community is a key part of its marketing strategy.

The company's digital presence is also a critical component of its sales and marketing strategy. The corporate website serves as a central hub for investor materials, presentations, and news releases, ensuring wide accessibility to financial and operational updates. This digital adoption is essential for reaching a broad audience and maintaining investor confidence. Strategic shifts also include key partnerships, such as the recently approved business combination with Calibre Mining, which is a significant move to enhance its market share and production profile. This merger is expected to close by the end of Q2 2025.

Equinox Gold actively participates in investor conferences to engage with the investment community. They attend events like the Deutsche Goldmesse Conference (May 2025), the BMO Conference (February 2025), and the Gold Forum Americas (September 2024). These events are crucial for showcasing the company's performance and future prospects.

Webcasts of quarterly results and corporate updates are vital for disseminating information to a broad audience. The Q1 2025 results webcast on May 8, 2025, and the Q4 2024 results webcast on February 20, 2025, are examples of this. The corporate website serves as a central hub for investor materials.

The focus is on attracting and retaining investment through direct engagement with various investor groups. This includes institutional, high-net-worth, and retail investors. Maintaining a strong investor base is critical for the company's financial health and future growth.

Key partnerships, such as the business combination with Calibre Mining, are strategic moves to enhance market share. This merger is expected to close by the end of Q2 2025. These partnerships are crucial for expanding the company's production profile.

Equinox Gold's sales and marketing strategy is primarily focused on investor relations and corporate development. This involves direct engagement with investors and extensive use of digital platforms. The company's approach emphasizes transparency and direct communication.

- Investor Conferences: Participation in events like the Deutsche Goldmesse Conference and the BMO Conference.

- Digital Communication: Regular webcasts and a robust online presence through the corporate website.

- Investor Engagement: Direct communication with institutional, high-net-worth, and retail investors.

- Strategic Partnerships: Business combinations like the one with Calibre Mining to boost market share.

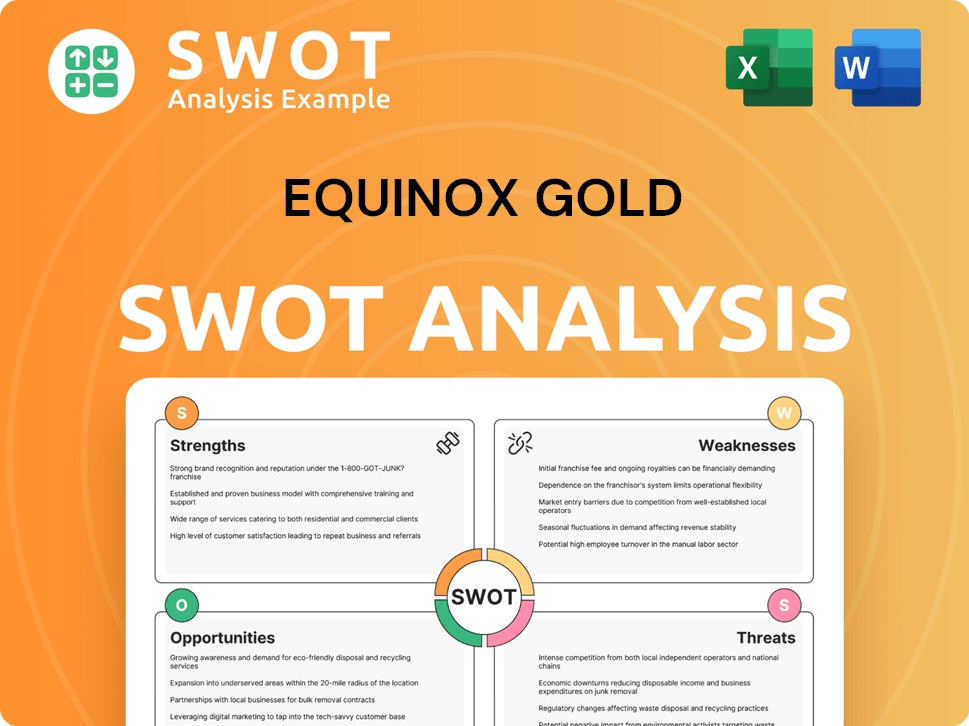

Equinox Gold SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Equinox Gold Use?

The marketing tactics of the company are primarily focused on investor relations and corporate communications. Their strategies are designed to inform and engage stakeholders, rather than targeting direct consumer sales. This approach is typical for a gold mining company, where the primary audience includes investors, analysts, and the financial community.

Digital platforms and traditional media play crucial roles in their marketing efforts. They maintain an active presence on social media and engage in industry events to disseminate information and build relationships. The company's commitment to transparency and data-driven reporting is evident in their detailed financial and operational disclosures.

The company's approach to marketing showcases a blend of digital strategies, traditional media engagement, and community involvement. This multifaceted strategy supports their goal of maintaining a strong reputation and fostering positive relationships with stakeholders.

The company leverages digital channels to communicate with its stakeholders. This includes maintaining an informative website, utilizing email marketing, and actively engaging on social media platforms. Their digital marketing efforts are crucial for disseminating information and reaching a broad audience.

The company's website serves as a central hub for corporate information, including presentations, reports, and news releases. They also use email marketing to directly communicate with their subscribers, currently numbering around 6,000. This direct communication is essential for keeping stakeholders informed.

The company actively uses social media platforms like Twitter, Facebook, and LinkedIn. They have a significant social media presence with over 100,000 followers. This engagement helps in building brand awareness and interacting with investors and the public.

The company participates in industry conferences and forums. Executives, such as President and CEO Greg Smith and VP Investor Relations Rhylin Bailie, give presentations and engage in discussions. These events are often webcast to increase their reach.

The company provides comprehensive financial and operating results, including specific guidance on production and costs. For 2025, they announced production guidance of 635,000 to 750,000 ounces of gold. Cash costs are estimated at $1,075 to $1,175 per ounce, and all-in sustaining costs are $1,455 to $1,550 per ounce.

The company highlights metrics such as its Total Recordable Injury Frequency Rate, which was 1.47 in 2023. This demonstrates a commitment to Environmental, Social, and Governance (ESG) reporting, which is increasingly important to investors.

The company's marketing strategy is tailored to its unique position as a gold mining company. Their focus on investor relations, digital platforms, and data transparency helps them build trust and maintain a strong market presence. For a deeper dive into the company's financial structure, consider exploring the Revenue Streams & Business Model of Equinox Gold.

The company uses the Greenstone Mine as a focal point for community engagement and visibility. Initiatives like the 'Ride to Greenstone' event offer branding and marketing opportunities to sponsors. They also host investor reception events to foster relationships.

- Community Engagement: The 'Ride to Greenstone' event blends corporate social responsibility with investor outreach.

- Investor Relations: Investor reception events are used to build and maintain relationships.

- Strategic Partnerships: Sponsorship opportunities are offered to enhance brand visibility.

- Transparency: Detailed financial and operational results are provided to stakeholders.

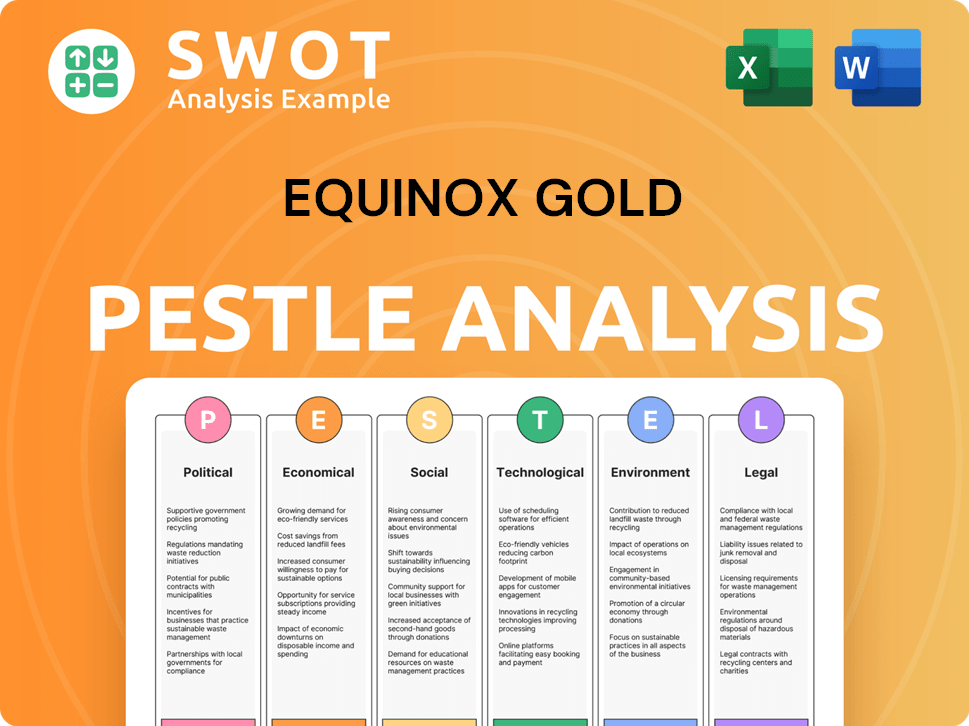

Equinox Gold PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Equinox Gold Positioned in the Market?

Equinox Gold positions itself as a growth-focused, Americas-based gold producer. Its brand emphasizes delivering superior leverage to gold through a large gold endowment and maximized gold production. The company's core message focuses on aggressive growth through strategic acquisitions and development of high-quality, long-life gold operations, aiming to achieve over one million ounces of annual gold production.

The company differentiates itself through a commitment to responsible mining and strong corporate governance, appealing to institutional and retail investors. Equinox Gold's visual identity and tone of voice are professional and transparent, reflecting its dedication to ethical practices and financial performance. Its focus on operational efficiency, cost reduction, and maximizing profitability further appeals to financially-literate decision-makers.

The company's brand strategy includes a focus on sustainability, as highlighted in its 2023 ESG Report. This demonstrates a commitment to environmental, social, and governance (ESG) standards, reinforcing its brand as a responsible mining company. The company's approach to investor relations and public disclosures aims to build trust and transparency with its stakeholders, which is crucial for its long-term success. For more details, see Growth Strategy of Equinox Gold.

The sales strategy focuses on highlighting the company's growth potential and financial strength to attract investors. This includes emphasizing its large gold endowment and maximizing gold production. Equinox Gold aims to increase its market share by showcasing its operational efficiency and cost-reduction strategies.

The marketing strategy centers around building brand awareness and investor confidence through consistent messaging. The company uses corporate presentations, investor calls, and its website to communicate its growth trajectory and financial performance. It also emphasizes its commitment to ESG standards to appeal to a broader investor base.

The primary target audience includes institutional investors, high-net-worth individuals, and retail investors. The company's messaging is tailored to appeal to financially-literate decision-makers. Equinox Gold's investor relations strategy is designed to maintain and enhance relationships with these key stakeholders.

The brand messaging emphasizes growth, financial performance, and responsible mining practices. Key messages include the company's large gold endowment, operational efficiency, and commitment to ESG. Transparency and strong corporate governance are also central to the brand's communication strategy.

Equinox Gold's sales performance indicators include gold production volume, revenue growth, and cost per ounce. Marketing KPIs focus on brand awareness, investor engagement, and the effectiveness of investor relations. The company closely monitors its financial performance to ensure it meets its growth targets.

- Gold Production: Aiming for over one million ounces of annual gold production.

- Revenue Growth: Focused on increasing revenue through production growth and strategic acquisitions.

- Cost Management: Prioritizing operational efficiency and cost reduction to maximize profitability.

- ESG Performance: Tracking environmental, social, and governance metrics to demonstrate responsible mining.

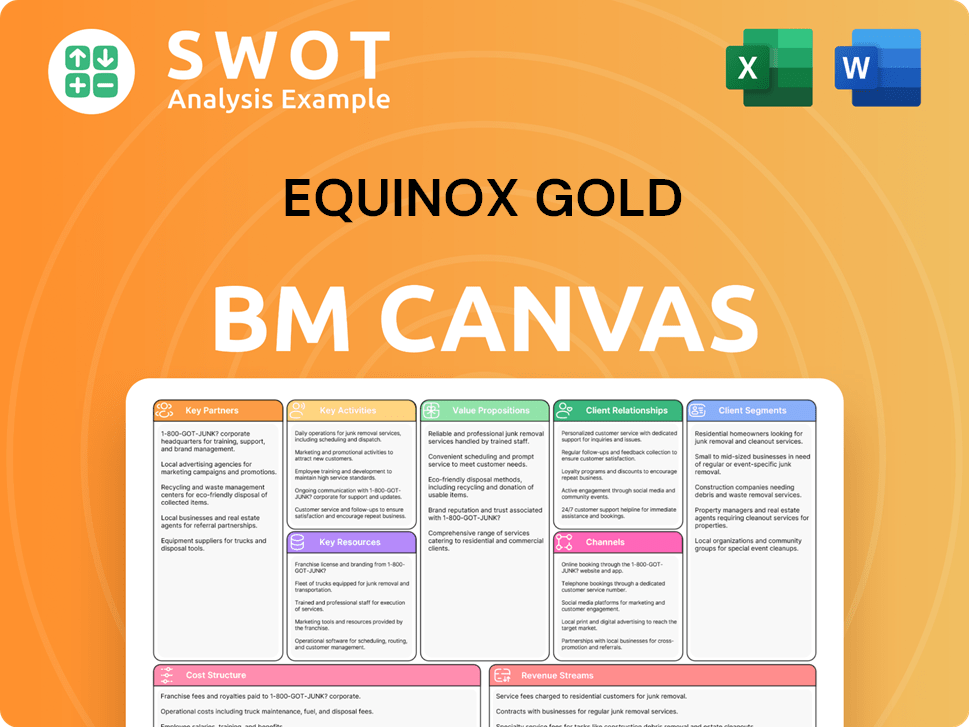

Equinox Gold Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Equinox Gold’s Most Notable Campaigns?

The sales and marketing strategies of Equinox Gold primarily revolve around investor relations and corporate communications. These efforts are designed to highlight the company's growth milestones and financial performance, crucial for maintaining investor confidence and attracting new investment. The Owners & Shareholders of Equinox Gold benefit directly from these strategies, as they aim to increase shareholder value.

A core element of Equinox Gold's strategy involves communicating its growth trajectory, especially its goal of becoming a major gold producer. This objective has been consistently emphasized in investor presentations and public statements since the company's formation. This focus on growth is a key aspect of its marketing strategy, designed to attract investors and demonstrate the company's potential.

Equinox Gold's sales and marketing strategy is heavily influenced by its operational developments and financial results. The company uses various channels, including press releases and presentations, to share information about its projects, financial performance, and strategic initiatives.

The merger with Calibre Mining, announced in February 2025, represents a key campaign to inform shareholders about the creation of a major gold producer. This initiative included joint conference calls, webcasts, and press releases. Shareholder approval was secured in May 2025.

The ramp-up and commercial production of the Greenstone Mine in Ontario is another significant campaign. First gold was poured in May 2024, with commercial production declared in November 2024. This campaign highlights successful project execution and production growth.

Equinox Gold's ongoing "campaign" emphasizes its growth towards becoming a leading gold producer, a central theme in its investor relations and public communications since late 2017. This strategy is crucial for attracting and retaining investors.

The 'Ride to Greenstone' initiative, tied to the Greenstone Mine opening, raised funds for the Geraldton District Hospital. This event showcased Equinox Gold's commitment to social responsibility, offering branding and marketing opportunities for sponsors.

Equinox Gold's marketing and sales efforts are closely tied to its production targets and financial performance. The combined company, post-merger, is expected to produce approximately 950,000 ounces of gold in 2025, excluding production from Valentine or Los Filos. The Greenstone Mine is projected to contribute 390,000 ounces of gold per year at full capacity. The company's ability to transition from a capital-intensive construction phase to a cash-flow generating producer is a key focus.

- Equinox Gold's investor relations strategy focuses on communicating its production growth and financial achievements.

- The company uses corporate presentations, financial results announcements, and website updates to share its progress.

- The merger with Calibre Mining is expected to create a major Americas-focused gold producer.

- The Greenstone Mine's successful ramp-up is a key element of the company's growth strategy.

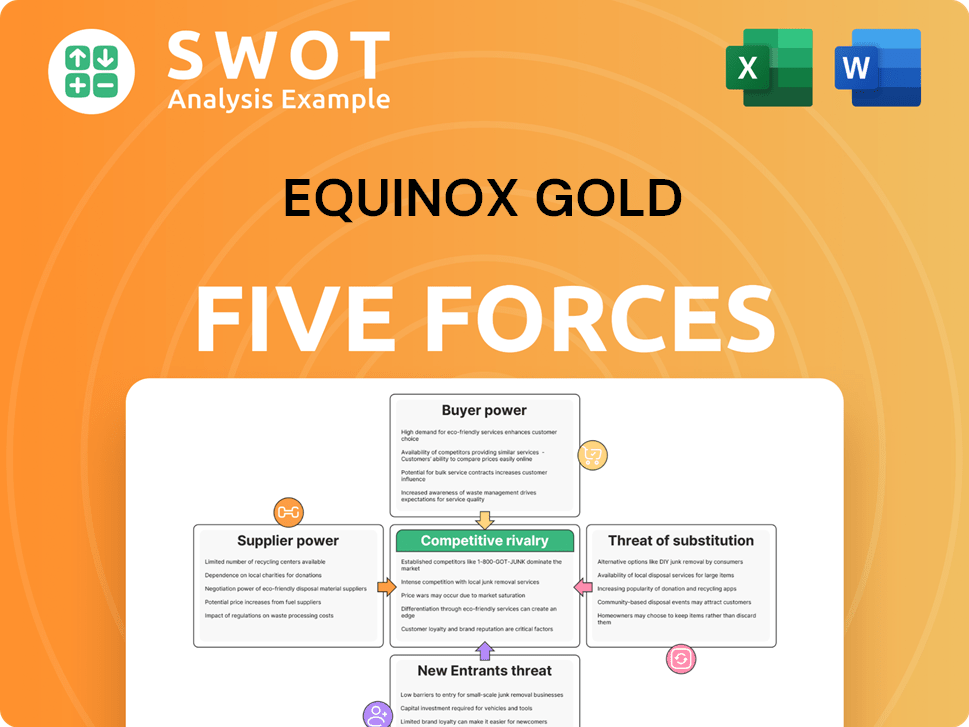

Equinox Gold Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Equinox Gold Company?

- What is Competitive Landscape of Equinox Gold Company?

- What is Growth Strategy and Future Prospects of Equinox Gold Company?

- How Does Equinox Gold Company Work?

- What is Brief History of Equinox Gold Company?

- Who Owns Equinox Gold Company?

- What is Customer Demographics and Target Market of Equinox Gold Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.