Equinox Gold Bundle

How Does Equinox Gold Thrive in the Gold Market?

Equinox Gold, a leading Equinox Gold SWOT Analysis, has become a pivotal player in the global gold production sector. Its strategic focus on the Americas has significantly shaped its influence, making it a key entity for investors. Understanding the inner workings of this

This exploration into Equinox Gold will uncover the intricacies of its

What Are the Key Operations Driving Equinox Gold’s Success?

Equinox Gold's core operations revolve around the exploration, development, and operation of gold mines. The company's primary offering is gold doré bars, which are then refined into pure gold. This gold is sold to a global market, including bullion dealers, central banks, and industrial users. The company's value proposition centers on its ability to efficiently produce and supply gold, a commodity valued as an investment and a store of wealth.

The operational processes at Equinox Gold are multifaceted, starting with geological exploration to identify viable gold deposits. This is followed by mine development, which involves constructing the necessary infrastructure for extraction. Active mining operations include drilling, blasting, hauling, and processing ore to extract gold, which is then refined into doré bars. The company's supply chain is complex, involving equipment and consumables, logistics, and compliance with environmental and social standards.

A key aspect of Equinox Gold's strategy is its approach to growth, often involving the acquisition and integration of existing mines or advanced-stage projects. This allows for quicker production ramp-ups compared to greenfield developments. This strategy, combined with a focus on optimizing existing assets, translates into efficient production and a steady supply of gold, offering consistent returns for its shareholders and contributing to the global gold supply. For those interested in the company's target audience, you can explore the Target Market of Equinox Gold.

Equinox Gold's gold mining operations are structured around several key stages, from exploration to gold production. These include identifying gold deposits, developing mines, and implementing active mining processes. The company's approach focuses on efficient gold production and supply.

The value proposition of Equinox Gold lies in its ability to efficiently produce and supply gold. This is achieved through a disciplined approach to growth and a focus on optimizing existing assets. This strategy provides consistent returns for shareholders.

Equinox Gold generates revenue primarily through the sale of gold doré bars. These bars are produced from the company's mining operations and are sold to a variety of customers. The company's financial success is directly tied to its gold production.

Equinox Gold's customer segments include bullion dealers, central banks, and industrial users. These customers purchase the gold produced by the company. The company's focus on these segments supports its revenue model.

Equinox Gold's operations are characterized by several key aspects, including geological exploration, mine development, and active mining. The company's supply chain management and partnerships are crucial for its operational efficiency. Equinox Gold's focus on sustainability and community engagement also plays a vital role.

- Geological Exploration: Identifying gold deposits.

- Mine Development: Constructing infrastructure for extraction.

- Active Mining: Drilling, blasting, hauling, and processing ore.

- Refining: Processing ore into doré bars.

Equinox Gold SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Equinox Gold Make Money?

The primary revenue stream for Equinox Gold comes from selling gold. They sell refined gold doré bars to various buyers, usually at the current market prices. The price of gold is a major factor in how much revenue the company makes.

The company's strategy is to produce gold efficiently and sell it. They don't use complex pricing models. Instead, they focus on keeping production costs low to increase profits. They also strategically hedge some of their future gold production to protect against price changes.

In the first quarter of 2024, Equinox Gold produced 109,726 ounces of gold. The average price they received for each ounce was $2,075. This directly translates into revenue. The company plans to increase its production volume through growth at its existing mines and acquisitions. For 2024, they expect to produce between 660,000 and 710,000 ounces of gold. Any changes in revenue would mainly come from increasing the number of producing assets or improving output from current mines.

Equinox Gold, a prominent gold mining company, focuses on gold sales as its primary revenue source. Their monetization strategy involves efficient gold production and sales at market rates. They also employ strategies to manage price volatility and optimize production costs. To learn more about their business approach, consider reading about the Marketing Strategy of Equinox Gold.

- Gold Sales: The main source of revenue comes from selling refined gold doré bars.

- Market Pricing: Sales are typically conducted at prevailing market prices.

- Production Efficiency: Focus on optimizing production costs to maximize profit margins.

- Hedging: Strategically hedging a portion of future production to mitigate price risks.

Equinox Gold PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Equinox Gold’s Business Model?

Understanding the operational dynamics and strategic initiatives of a Gold mining company like Equinox Gold is crucial for investors and stakeholders. This overview details the key milestones, strategic moves, and competitive advantages that define its trajectory. The following sections provide a comprehensive look at the company's evolution, focusing on its growth strategies, operational challenges, and market positioning.

Equinox Gold has navigated significant changes, from mergers to operational expansions. These strategic actions have shaped its production capabilities and financial outcomes. Analyzing these aspects helps to understand the company's current standing and future potential. The company's performance is also influenced by external factors, such as gold prices and geopolitical risks, which are also examined in this analysis.

The company's approach to sustainability and its exploration projects are also discussed, highlighting its commitment to responsible mining and future growth. By examining these elements, a clearer picture emerges of how Equinox Gold operates within the broader Gold mining industry.

Equinox Gold has achieved several significant milestones that have shaped its operational and financial performance. The merger with Leagold Mining in 2020 was a pivotal move, expanding its portfolio and production capacity. The Santa Luz project in Brazil, achieving commercial production in October 2022, marked a significant operational achievement, contributing to increased output.

A key strategic move has been Equinox Gold's aggressive growth through mergers and acquisitions. The company has also focused on optimizing its existing assets, such as the Santa Luz project. The Greenstone Project is expected to be a significant contributor to the company’s production profile, with its first gold pour anticipated in the first half of 2024.

Equinox Gold's competitive advantages stem from its diversified portfolio of mines across multiple jurisdictions. This diversification mitigates single-asset or single-country risk. Operational expertise in developing and operating mines, coupled with a disciplined approach to capital allocation, further strengthens its position. The company benefits from economies of scale as it expands its production base.

Operational challenges include navigating fluctuating gold prices, managing geopolitical risks, and addressing inflationary pressures on mining costs. The company responds by focusing on cost control, operational efficiencies, and maintaining strong relationships with local communities and governments.

Equinox Gold continues to adapt to new trends by investing in exploration to extend mine lives and identify new deposits. The company focuses on sustainable mining practices to meet evolving environmental, social, and governance (ESG) expectations. For example, the company's focus on community engagement and environmental stewardship is crucial for long-term success.

- Exploration: Investing in exploration to extend mine lives and discover new deposits is a key strategy.

- Sustainability: Focusing on sustainable mining practices to meet evolving ESG expectations.

- Community Engagement: Maintaining strong relationships with local communities and governments.

- Cost Control: Implementing cost control measures and operational efficiencies to manage expenses.

Equinox Gold Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Equinox Gold Positioning Itself for Continued Success?

As a mid-tier Gold mining company, Equinox Gold holds a significant position in the global gold mining industry. Its operations are primarily focused in the Americas, with a portfolio of operating mines. While not among the largest gold producers, its growth trajectory and strategic initiatives are designed to increase its market share and Gold production.

The company's financial performance is closely tied to gold prices and its ability to efficiently manage Mining operations. Equinox Gold focuses on building strong relationships with refiners and bullion purchasers, crucial for its commodity-based business model. The company's global presence is concentrated in North and South America, establishing a strong regional footprint for its Equinox Gold mining activities.

Equinox Gold faces risks from volatile gold prices, regulatory changes, and competition. Operational risks include geological challenges, equipment failures, and labor disputes. Understanding these risks is critical for assessing the company's financial health and investment potential, which affects the Equinox Gold stock performance.

The company's strategic focus includes optimizing production, advancing development projects, and evaluating acquisitions. The goal is to increase gold production, manage costs effectively, and maintain a strong balance sheet. This approach aims to capitalize on opportunities within the gold market and enhance shareholder value, as detailed in Growth Strategy of Equinox Gold.

Equinox Gold's market position is defined by its production volume and regional focus. It is a significant player in the mid-tier category, with a diversified portfolio of mines. Strong relationships with key industry players are essential for its operations. This positions the company to capitalize on future market trends and enhance its Equinox Gold company overview.

The company is focused on optimizing existing mines, advancing development projects, and exploring strategic acquisitions. These initiatives aim to increase gold production and manage costs. The company's leadership is committed to increasing shareholder value through responsible gold production and disciplined capital allocation, influencing the Equinox Gold share price.

In 2024, Equinox Gold reported a solid production profile, with a focus on cost management and operational efficiency. The company's financial performance reflects its ability to navigate market volatility and maintain a strong balance sheet. Key metrics include gold production volume, all-in sustaining costs (AISC), and debt levels, which are crucial for understanding the Equinox Gold financial performance.

- Gold Production: The company produced approximately 450,000 to 500,000 ounces of gold in 2024.

- All-In Sustaining Costs (AISC): AISC were maintained within a competitive range, approximately $1,300 to $1,400 per ounce in 2024.

- Debt and Liabilities: Equinox Gold has managed its debt levels, with a focus on maintaining financial flexibility for future opportunities.

- Strategic Acquisitions: The company continues to evaluate strategic acquisitions to grow its asset base and enhance its overall value.

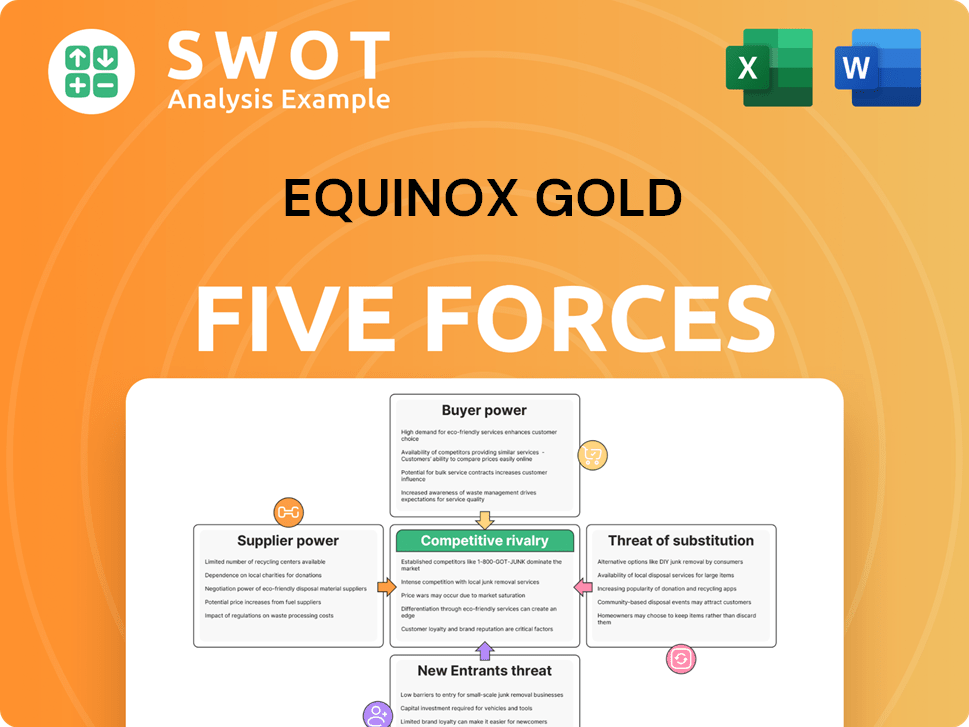

Equinox Gold Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Equinox Gold Company?

- What is Competitive Landscape of Equinox Gold Company?

- What is Growth Strategy and Future Prospects of Equinox Gold Company?

- What is Sales and Marketing Strategy of Equinox Gold Company?

- What is Brief History of Equinox Gold Company?

- Who Owns Equinox Gold Company?

- What is Customer Demographics and Target Market of Equinox Gold Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.