Flow Traders Bundle

How Does Flow Traders Navigate the Cutthroat World of Finance?

In the fast-paced world of finance, where milliseconds can make or break a trade, understanding the competitive landscape is crucial. Flow Traders, a leading technology-driven liquidity provider, has established itself as a key player. But what does its market position truly look like amidst fierce competition?

Flow Traders' journey from a startup to a global force in Flow Traders SWOT Analysis highlights the importance of strategic foresight. To truly grasp Flow Traders' success, we must delve into its competitive advantages, analyze its key competitors, and assess its financial performance in the context of evolving industry trends. This analysis will provide a comprehensive understanding of Flow Traders' trading strategies and its ability to maintain a strong market position.

Where Does Flow Traders’ Stand in the Current Market?

Flow Traders holds a significant position in the global financial markets, specializing in providing liquidity for Exchange Traded Products (ETPs). As a leading non-bank market maker, it facilitates trading across various asset classes, including equities, fixed income, commodities, and cryptocurrencies. Examining Flow Traders' business model reveals its core operations revolve around continuous bid and ask prices for a wide range of ETPs.

The company's value proposition lies in its ability to offer efficient execution and tight spreads, benefiting institutional investors, authorized participants, and other financial intermediaries. Flow Traders leverages advanced technology and a global presence to provide liquidity across major exchanges in Europe, North America, and Asia. This is crucial for investors seeking to trade ETPs quickly and at competitive prices.

Flow Traders' financial performance demonstrates its strength. In 2023, the company reported a normalized net trading income of EUR 320.7 million. This financial health, combined with its technological infrastructure, positions Flow Traders as a formidable player in the market. Its strong performance in regions with active ETP markets underscores its ability to navigate market volatility effectively.

Flow Traders is a leading liquidity provider, particularly in the ETP market. While precise market share figures are not always available, the company is consistently ranked among the top non-bank market makers. Its specialization in this niche allows it to focus on providing efficient trading solutions.

With offices in Amsterdam, New York, Singapore, and London, Flow Traders has a strong global footprint. This enables it to provide liquidity across major exchanges worldwide. This global reach is critical for serving a diverse customer base and facilitating international trading.

Flow Traders has expanded its offerings beyond traditional ETPs, demonstrating strategic diversification. This adaptation allows the company to stay competitive. Maintaining a core focus on technology-driven liquidity provision remains a key strategy.

The company's financial performance, including its EUR 320.7 million normalized net trading income in 2023, highlights its financial strength. This robust financial position supports its ability to invest in advanced technology and maintain a competitive edge within the industry.

Flow Traders' market position is characterized by its specialization in ETP liquidity, global presence, strategic diversification, and strong financial performance. These factors collectively contribute to its competitive advantage. Understanding the Flow Traders Competitive Landscape is crucial for investors.

- Market Specialization: Focus on ETPs allows for deep expertise.

- Global Network: Offices in key financial hubs ensure broad market access.

- Technological Advantage: Advanced infrastructure supports efficient trading.

- Financial Strength: Robust profitability enables strategic investments.

Flow Traders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Flow Traders?

The competitive landscape for Flow Traders is complex, with various players vying for market share in liquidity provision and trading. This environment demands constant adaptation and strategic refinement to maintain a strong market position. Understanding the key competitors and their strategies is crucial for assessing Flow Traders' performance and future prospects.

The firm faces competition from both direct and indirect sources. Direct competitors include other proprietary trading firms and specialist market makers, while indirect competitors encompass the market-making desks of large investment banks and brokers. This competitive dynamic is shaped by factors such as pricing, execution speed, and the range of financial instruments covered. A detailed analysis of Flow Traders' target market can provide further insights into its competitive positioning.

The industry is dynamic, with new players emerging, particularly in the cryptocurrency ETP space. Mergers and alliances can also reshape the competitive dynamics. Flow Traders continuously navigates this environment by refining its technology and expanding its product coverage to maintain its competitive edge.

Direct competitors include proprietary trading firms and specialist market makers. These firms often utilize advanced technology to provide liquidity across various financial instruments. Key players in this category include Jump Trading, Hudson River Trading, and Optiver.

Indirect competitors include the market-making desks of large investment banks and brokers. These institutions leverage their extensive client networks to capture trading flow. Their internal market-making operations can compete with Flow Traders, especially in less liquid or niche ETPs.

The competitive landscape is driven by pricing, execution speed, and the breadth of ETPs covered. High-profile 'battles' often manifest as intense competition for order flow on specific exchanges or in particular ETP segments. Technological advancements and regulatory changes also play a significant role.

The cryptocurrency ETP space has seen the emergence of specialized digital asset market makers. These new entrants are gaining traction, adding another layer of competition. The digital asset market is a rapidly evolving area.

Mergers and alliances, though less frequent among proprietary trading firms, can reshape the competitive dynamics. These strategic moves can consolidate technological expertise or market access. These changes can impact the overall market share.

Flow Traders continuously refines its technology and expands its product coverage. This ongoing effort helps maintain its competitive edge against both established and emerging rivals. This strategy is crucial for long-term success.

Flow Traders' market position is influenced by its ability to provide competitive pricing and efficient execution. The firm's technological infrastructure and risk management strategies are critical for maintaining its competitive advantages. Recent financial results and trading volumes provide insights into its performance.

- Virtu Financial: A major competitor known for high-frequency trading and market-making activities.

- Jump Trading: Another key player in the proprietary trading space.

- Hudson River Trading: Focuses on quantitative trading strategies.

- Optiver: A global market maker with a significant presence in ETPs.

- IMC: Engaged in market making and proprietary trading.

Flow Traders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Flow Traders a Competitive Edge Over Its Rivals?

The competitive landscape for Flow Traders is shaped by its robust technological infrastructure, proprietary trading systems, and specialized expertise in Exchange Traded Products (ETPs). Its advanced automated trading systems allow rapid quoting and execution across a wide range of ETPs. This technological advantage enables efficient liquidity provision, even in volatile market conditions, by quickly adapting to price movements and effectively managing risk. Flow Traders' ability to process vast amounts of market data and execute trades with minimal delay is a key differentiator.

Flow Traders' business model is highly scalable, enabling it to expand its coverage of ETPs and geographic reach without a proportional increase in operational costs. The company's deep understanding and expertise in the ETP market, built over years of focused operation, also represent a substantial competitive advantage. This includes a nuanced understanding of ETP creation and redemption mechanisms, which are critical for effective market making. These factors contribute significantly to its market position.

Continuous investment in research and development to enhance its technology and algorithms is crucial for Flow Traders to stay ahead. The company leverages these strengths in its market-making activities, attracting order flow and maintaining tight bid-ask spreads. The combination of proprietary algorithms, extensive market data, and a highly skilled talent pool creates a formidable barrier to entry in the competitive landscape.

Flow Traders utilizes sophisticated, automated trading systems for rapid quoting and execution. These systems are designed to handle a vast number of ETPs simultaneously, providing liquidity even in volatile market conditions. Proprietary algorithms and low-latency connectivity are critical for processing market data and minimizing trade delays, which is key for their Flow Traders trading strategies comparison.

The company's business model is highly scalable, allowing for expansion in ETP coverage and geographic reach without a proportional increase in operational costs. This efficiency translates into competitive pricing for its liquidity services. This scalability supports Flow Traders' ability to maintain and improve its Flow Traders market share analysis.

Flow Traders possesses deep expertise in the ETP market, including a nuanced understanding of ETP creation and redemption mechanisms. This knowledge is crucial for effective market making. The company's focused operation over the years has cultivated a significant competitive advantage in this specialized area, which is essential for its Flow Traders Analysis.

Flow Traders continuously invests in research and development to enhance its technology and algorithms. This ensures that the company remains ahead of competitors. Ongoing innovation is vital for maintaining tight bid-ask spreads and attracting order flow, which are critical for its Flow Traders key competitors 2024.

Flow Traders' competitive advantages stem from its technological infrastructure, scalable business model, and market expertise. These elements enable the company to provide efficient liquidity and maintain a strong market position. Continuous innovation and adaptation to market changes are vital for sustained success, providing a competitive edge in the dynamic landscape of ETP trading.

- Advanced Technology: Sophisticated automated trading systems for rapid execution.

- Scalability: Efficient business model allowing for expansion without proportional cost increases.

- Market Expertise: Deep understanding of ETP mechanisms and market dynamics.

- Innovation: Continuous investment in R&D to stay ahead of competitors.

Flow Traders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Flow Traders’s Competitive Landscape?

The Exchange Traded Product (ETP) industry is experiencing significant shifts, creating both challenges and opportunities for companies like Flow Traders. The competitive landscape is dynamic, influenced by technological advancements, regulatory changes, and evolving investor preferences. Understanding these factors is crucial for assessing Flow Traders' market position and future prospects. Analyzing the Marketing Strategy of Flow Traders reveals how the company adapts to these changes.

Flow Traders faces risks from increased competition and regulatory scrutiny, while also benefiting from the growth of the ETP market and innovations in financial products. The company’s future outlook depends on its ability to leverage technological expertise, expand into new markets, and adapt to evolving regulations. This involves strategic investments in technology, diversification of trading strategies, and expansion into new asset classes and geographies.

Technological advancements in areas like artificial intelligence and machine learning are refining trading algorithms and market analysis capabilities. Regulatory changes, such as MiFID II in Europe, are shaping market structure and transparency. Consumer preferences are shifting towards thematic ETPs, ESG products, and digital asset ETPs.

Increased competition from high-frequency trading firms and new market entrants could compress margins. Regulatory scrutiny could lead to higher compliance costs or limitations on trading strategies. Geopolitical instability and global economic shifts introduce market volatility, increasing risk management complexities.

The continued growth in the global ETP market, particularly in emerging economies and new asset classes, offers significant expansion potential. Innovations in product development, such as actively managed ETFs, provide new avenues for technological expertise. Strategic partnerships with asset managers and exchanges can enhance market reach.

Continued investment in proprietary technology, diversification of trading strategies, and expansion into new asset classes and geographies are key. Adapting to regulatory changes and embracing technological innovation are crucial. Strategic expansion aims to maintain leadership in the dynamic ETP liquidity provision landscape.

The global ETP market continues to expand, with significant growth in emerging economies. The increasing demand for efficient liquidity in new asset classes, like cryptocurrencies, presents opportunities. Adapting to regulatory changes and embracing technological innovation is crucial for sustained success.

- The ETP market is expected to reach a global value of over $12 trillion by the end of 2024.

- Cryptocurrency ETPs have seen substantial growth, with trading volumes increasing by over 200% in the past year.

- ESG-focused ETPs are gaining popularity, with inflows increasing by 30% in the first quarter of 2024.

- Actively managed ETFs are emerging as a significant segment, representing approximately 15% of new ETF launches in 2024.

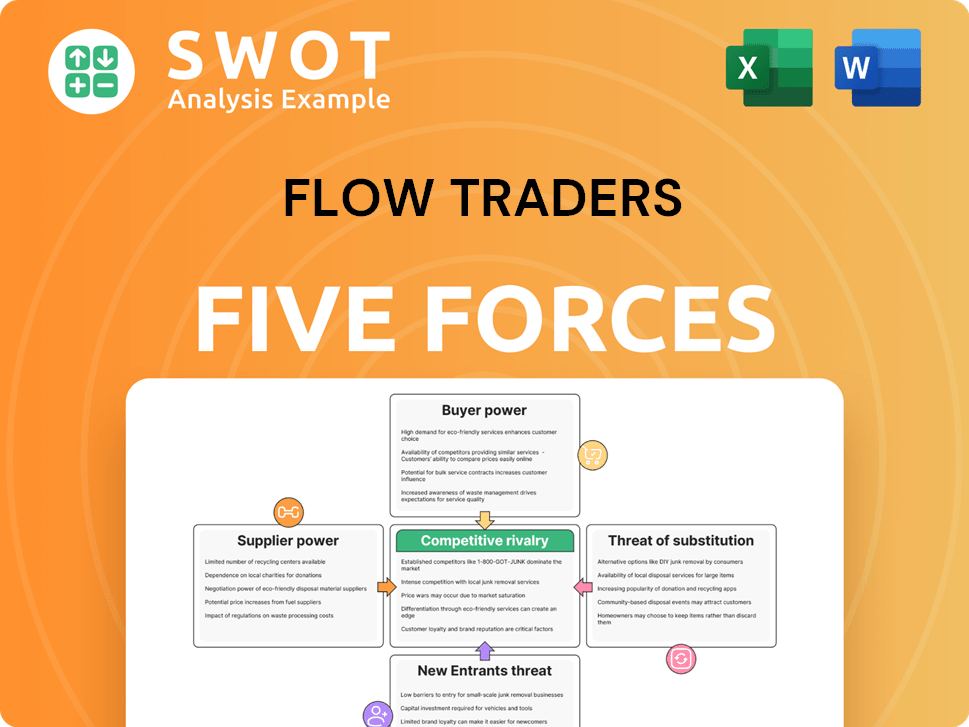

Flow Traders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flow Traders Company?

- What is Growth Strategy and Future Prospects of Flow Traders Company?

- How Does Flow Traders Company Work?

- What is Sales and Marketing Strategy of Flow Traders Company?

- What is Brief History of Flow Traders Company?

- Who Owns Flow Traders Company?

- What is Customer Demographics and Target Market of Flow Traders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.