Flow Traders Bundle

How Does Flow Traders Thrive in the Financial Markets?

Flow Traders, a leading global technology-enabled liquidity provider, plays a pivotal role in today's fast-paced financial markets, especially within the Exchange Traded Products (ETPs) sector. Its ability to provide continuous liquidity is crucial for efficient trading across global exchanges. But how does this Flow Traders SWOT Analysis reveal the secrets behind its success?

Understanding the Flow Traders business model is essential for investors and industry professionals alike. This deep dive explores the core Flow Traders operations, revealing how this market maker leverages its proprietary technology and trading strategies to generate revenue. We will examine the company's role in high-frequency trading and its impact on market efficiency.

What Are the Key Operations Driving Flow Traders’s Success?

Flow Traders operates as a principal trading firm and a leading global liquidity provider, focusing primarily on Exchange Traded Products (ETPs). Their core business revolves around enhancing market efficiency by consistently quoting bid and ask prices for a wide array of ETPs, including ETFs, ETCs, and ETNs, across numerous global exchanges. This continuous quoting ensures investors can buy or sell ETPs efficiently, minimizing price dislocations and contributing to tighter spreads.

The company's value proposition centers on providing liquidity and reducing trading costs for investors. By acting as a market maker, Flow Traders facilitates smoother trading of ETPs, which benefits both institutional and retail investors. Their activities indirectly contribute to more liquid and transparent ETP markets, making it easier and more cost-effective for investors to access these products.

Flow Traders' operational process is driven by a highly advanced proprietary technology platform. This platform integrates sophisticated algorithms, real-time data analytics, and automated trading systems. Traders leverage this technology to manage risk, identify arbitrage opportunities, and execute trades at high speeds. The company's operational effectiveness is further bolstered by its robust infrastructure, which allows for low-latency connectivity to exchanges and efficient processing of vast amounts of market data.

Flow Traders functions as a market maker, providing liquidity for ETPs. They quote bid and ask prices, enabling efficient trading. Their operations rely heavily on advanced technology and automated trading systems.

The company enhances market efficiency and reduces trading costs. They offer tighter spreads and greater price discovery for ETPs. This benefits institutional and retail investors by improving market liquidity.

Flow Traders utilizes a proprietary technology platform. This includes sophisticated algorithms and real-time data analytics. They have low-latency connectivity to exchanges for efficient trade execution.

Their primary customers are institutional investors, brokers, and financial intermediaries. They indirectly benefit retail investors by improving market conditions. The focus is on providing efficient access to ETP liquidity.

Flow Traders distinguishes itself through its expertise in ETPs, cutting-edge proprietary technology, and disciplined risk management. These capabilities translate into enhanced liquidity and tighter spreads for ETPs, setting them apart in the market-making landscape. The company's focus on technology and risk management enables it to navigate the complexities of high-frequency trading effectively.

- Deep ETP Expertise: Specialization in Exchange Traded Products.

- Proprietary Technology: Advanced algorithms and trading systems.

- Disciplined Risk Management: Robust framework for managing trading risks.

- Market Liquidity: Providing continuous bid and ask prices.

The company's supply chain is primarily digital, relying on reliable data feeds, secure network infrastructure, and colocation facilities near exchanges to minimize latency. Understanding the Growth Strategy of Flow Traders can offer insights into how the company plans to sustain and expand its operations in the future. As of 2024, Flow Traders has shown consistent growth in trading volumes, reflecting the increasing demand for ETPs and the company's ability to provide efficient market-making services. The company's financial performance, particularly its revenue and profitability, is closely tied to market volatility and trading activity, with periods of high volatility often leading to increased trading volumes and higher revenues. In 2024, the company continues to invest in its technology platform to maintain its competitive edge and expand its market reach.

Flow Traders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Flow Traders Make Money?

The core of the Flow Traders business model revolves around its role as a market maker, generating revenue primarily through trading activities. This involves providing liquidity in the market by quoting bid and ask prices for various financial instruments, particularly Exchange Traded Products (ETPs). The firm's monetization strategy is centered on capturing the spread between these bid and ask prices and capitalizing on arbitrage opportunities.

Flow Traders' revenue streams are not diversified in the traditional sense, such as through product sales or subscriptions. Instead, their income is derived from the efficiency and volume of their trading operations across a broad spectrum of asset classes and geographical locations. The firm's financial success is closely tied to its ability to execute trades effectively and manage risk in dynamic market conditions.

The firm's financial performance is heavily reliant on its market-making activities, which are driven by sophisticated algorithms and risk management strategies. The company continuously seeks to expand its product coverage and geographical reach to enhance its revenue-generating capabilities, including venturing into new markets like fixed income and cryptocurrency ETPs.

Flow Traders' revenue generation is primarily through market-making, focusing on the bid-ask spread and arbitrage. Their innovative strategies are embedded in their technological infrastructure and risk management capabilities. The firm's ability to adapt to market conditions and identify arbitrage opportunities is crucial for its financial performance.

- Bid-Ask Spread: Flow Traders profits from the difference between the buying (bid) and selling (ask) prices of ETPs and other financial instruments.

- Arbitrage: The company exploits price differences across different exchanges or related instruments to generate profits.

- Technological Infrastructure: Sophisticated algorithms continuously quote prices, adjusting them based on market conditions, volatility, and order flow.

- Risk Management: Effective risk management is essential to manage inventory and mitigate potential losses in volatile markets.

Flow Traders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Flow Traders’s Business Model?

The evolution of Flow Traders has been marked by strategic decisions and key milestones that have solidified its position as a leading global liquidity provider. The company's success is deeply rooted in its continuous investment in proprietary technology, which has enabled it to automate and scale its market-making operations effectively. A significant move was its initial public offering (IPO) in 2016, which provided capital for further technological advancements and market expansion.

Operational challenges, such as navigating market volatility and regulatory hurdles, are ongoing. However, Flow Traders has demonstrated resilience and adaptability, particularly during periods of extreme market fluctuations. Its ability to maintain robust risk management frameworks and adapt to evolving compliance requirements has been crucial to its sustained success.

The company's competitive advantages are multifaceted, including its technological leadership, deep expertise in Exchange Traded Products (ETPs), and global reach. These elements enable superior speed, efficiency, and risk management in its trading operations. Furthermore, the company's disciplined risk management framework ensures it can maintain liquidity provision even in turbulent market conditions.

Flow Traders' journey includes significant milestones such as its early development of automated trading systems and its IPO in 2016. These milestones have been instrumental in shaping the company's growth and market position. The IPO provided crucial capital for scaling operations and expanding into new markets, which is a key aspect of the Brief History of Flow Traders.

Strategic moves include continuous investment in technology and expansion into new asset classes. The company has expanded into emerging areas like digital assets and fixed income ETPs. These strategic decisions demonstrate its commitment to staying at the forefront of market evolution and leveraging its core capabilities to capture new opportunities.

Flow Traders' competitive edge stems from its technological leadership, global reach, and disciplined risk management. These factors allow it to provide liquidity efficiently and effectively across various markets. The company's expertise in ETPs and its ability to adapt to new market trends further enhance its competitive position.

In 2020, Flow Traders reported a net trading income of €586.4 million, demonstrating its resilience during market volatility. The company's financial performance is a testament to its robust risk management and operational efficiency. This financial strength supports its continued investment in technology and market expansion.

Flow Traders' success is built on several key advantages that set it apart in the market. These advantages include its technological prowess, deep expertise in ETPs, and a robust risk management framework.

- Technological Leadership: Superior speed, efficiency, and risk management in trading operations.

- Global Reach: Extensive network across numerous exchanges, providing economies of scale.

- Risk Management: Disciplined framework ensuring liquidity provision even in turbulent markets.

- Market Expertise: Deep understanding of ETPs and emerging asset classes.

Flow Traders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Flow Traders Positioning Itself for Continued Success?

Flow Traders holds a significant position in global financial markets as a leading technology-driven liquidity provider, especially in Exchange Traded Products (ETPs). The company competes with other high-frequency trading firms and investment banks, leveraging its global reach across major exchanges in Europe, the Americas, and Asia. Customer loyalty relies on consistent pricing and reliable execution, where Flow Traders excels due to its technological capabilities. Understanding the Competitors Landscape of Flow Traders is crucial for assessing its market position.

Despite its strong market presence, Flow Traders faces various risks. These include regulatory changes, increased competition, technological disruption, and market downturns, all of which could affect its operations and profitability. The evolving landscape of market structure and capital requirements poses constant challenges. The company's success depends on its ability to adapt and innovate within a rapidly changing financial environment.

Flow Traders is a key market maker, providing liquidity in ETPs and other financial instruments. Its technology and global presence give it a competitive edge. The company's ability to offer competitive pricing and reliable execution is crucial for its market position.

Regulatory changes, increased competition, and technological disruptions pose significant risks. Market downturns and low volatility can also affect revenue. Continuous innovation and adaptation are essential for mitigating these risks.

Flow Traders is focused on diversifying its product coverage, including digital assets and fixed income. Investment in technology and human capital remains a priority. The company aims to leverage its strengths to capitalize on market opportunities.

Expansion into new asset classes and ongoing investment in technology are key strategies. The company is focused on maintaining its competitive edge through innovation. Risk management remains a critical aspect of Flow Traders' business model.

Flow Traders' success depends on its ability to adapt to market changes and manage risks effectively. The company's future outlook is tied to its strategic initiatives in new asset classes and technological advancements. Continued investment in technology and human capital is crucial for sustained growth.

- Diversification into new asset classes, like digital assets, is a key strategic move.

- Investment in technology and human capital is crucial for maintaining a competitive edge.

- Risk management is a constant focus, given the nature of high-frequency trading.

- Adapting to regulatory changes is essential for long-term success.

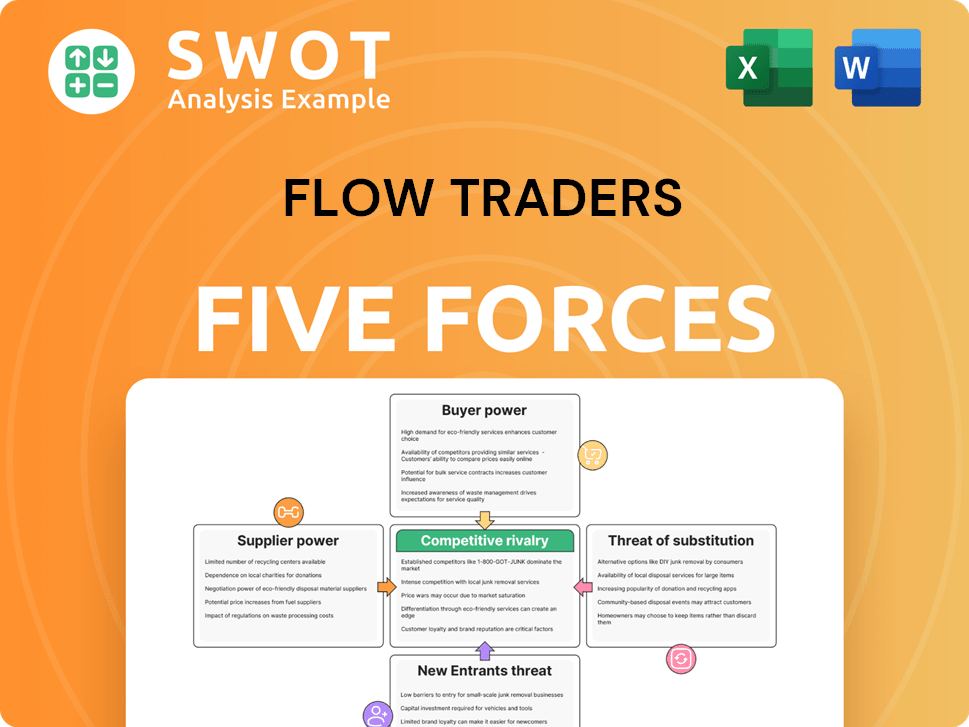

Flow Traders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flow Traders Company?

- What is Competitive Landscape of Flow Traders Company?

- What is Growth Strategy and Future Prospects of Flow Traders Company?

- What is Sales and Marketing Strategy of Flow Traders Company?

- What is Brief History of Flow Traders Company?

- Who Owns Flow Traders Company?

- What is Customer Demographics and Target Market of Flow Traders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.