Flow Traders Bundle

Who Really Owns Flow Traders?

Ever wondered who's truly steering the ship at a financial powerhouse like Flow Traders? Understanding the Flow Traders SWOT Analysis is just the beginning. The company's ownership structure is a key to unlocking its strategic vision, revealing the forces that shape its decisions and its future. From its humble beginnings to its current global footprint, the evolution of Flow Traders' ownership tells a compelling story.

Delving into the Flow Traders ownership unveils a fascinating narrative of growth and transformation. Knowing who owns Flow Traders provides insights into its governance and strategic direction. This exploration will examine the shift from private ownership to public shareholders, highlighting the influence of Flow Traders shareholders and executives and the impact on the company's trajectory. Examining Flow Traders history helps understand its present state and future potential.

Who Founded Flow Traders?

The story of Flow Traders begins with its founders, Jan van Kuijk and Roger Hodenius, who established the company in 2004. Their vision was to create a market maker with a global reach, setting the stage for Flow Traders' significant presence in the financial markets. The early years were crucial in shaping the company's strategy and operational framework.

Jan van Kuijk served as co-CEO from the company's inception until 2014, playing a pivotal role in its initial growth. While the exact initial ownership structure and equity splits of the founders are not publicly available, their leadership and strategic decisions were fundamental to Flow Traders' early success. Their focus was on building a profitable business.

Flow Traders' journey involved key partnerships and strategic investments that influenced its ownership and operational capabilities. These moves were essential for expanding its global footprint and strengthening its financial management.

Jan van Kuijk and Roger Hodenius co-founded Flow Traders in 2004. Jan van Kuijk was co-CEO until 2014, driving early strategic decisions. Their focus was on building a global market maker.

In 2008, Summit Partners invested in Flow Traders. This investment aided in establishing 24-hour trading capabilities. It also supported expansion in North America, Europe, and Asia.

Dennis Dijkstra joined as CFO and later became co-CEO. The New York office was opened within three months of Summit's investment. These moves were crucial for shaping Flow Traders' structure.

The early strategic investments and leadership additions were critical. These shaped Flow Traders' foundational ownership and operational structure. The company aimed for global expansion and robust financial management.

The founders' vision was to build a rapidly growing and highly profitable market maker. Their goal was to achieve global reach. This vision guided Flow Traders' early development and strategic decisions.

Specific initial equity splits for the founders are not publicly detailed. The early focus was on building a successful business. The company's early ownership structure supported its growth.

The early ownership of Flow Traders, shaped by its founders and early investors like Summit Partners, set the stage for its expansion and success. The company's history, as detailed in Brief History of Flow Traders, highlights the importance of strategic partnerships and leadership in its growth. Understanding the early ownership structure is key to grasping the evolution of Flow Traders, including its current market position and future prospects. The company's commitment to global expansion and robust financial management, initiated in its early years, continues to influence its operational strategies.

Flow Traders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Flow Traders’s Ownership Changed Over Time?

The transition of Flow Traders to a publicly traded company in July 2015, via its Initial Public Offering (IPO) on Euronext, fundamentally reshaped its ownership landscape. This pivotal event opened the door for a wide array of investors, including institutional investors, mutual funds, and individual shareholders, to acquire stakes in the company. This shift from private to public ownership marked a significant milestone in the company's history, influencing its corporate governance and strategic direction.

As a publicly listed entity, Flow Traders' ownership structure reflects a diverse portfolio of stakeholders. The company's shares are now held by a multitude of investors, including prominent institutional holders. This diversification is typical of a public company and underscores the broad market interest in Flow Traders.

| Shareholder | Shares Held (as of May 8, 2025) | Notes |

|---|---|---|

| Vanguard Total International Stock Index Fund Investor Shares (VGTSX) | Data not available | Major Institutional Shareholder |

| Vanguard Developed Markets Index Fund Admiral Shares (VTMGX) | Data not available | Major Institutional Shareholder |

| iShares Core MSCI EAFE ETF (IEFA) | Data not available | Major Institutional Shareholder |

As of May 8, 2025, there are 59 institutional owners and shareholders of Flow Traders Ltd. (NL:FLOW) who have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These institutions collectively hold a total of 2,735,581 shares. Key institutional shareholders include Vanguard and iShares. The shareholders' equity stood at €787 million at the end of Q1 2025, an increase from €631 million at the end of Q1 2024, and €766 million for the full year 2024.

The ownership of Flow Traders has evolved significantly since its IPO in 2015. The company is now publicly traded, with a diverse shareholder base.

- Institutional investors hold a significant portion of the shares.

- The company's shareholders' equity has increased over the past year.

- The shift to public ownership has impacted the company's structure.

Flow Traders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Flow Traders’s Board?

The current board of directors at Flow Traders plays a vital role in the company's governance. Rudolf Ferscha chairs the board. Jan van Kuijk, one of the co-founders, serves as a Non-Executive Director and chairs the Trading & Technology Committee. Linda Hovius and Delfin Rueda also serve as Independent Non-Executive Directors, with Rueda chairing the Audit Committee. These individuals, along with other key personnel, shape the strategic direction of Flow Traders.

As of April 2025, Mike Kuehnel, who was appointed CEO in February 2023, conveyed his intention not to seek re-election for another full term at the 2025 Annual General Meeting (AGM) and will leave by the end of August 2025. He was re-elected as CEO at the AGM on June 13, 2025, with his term extending until August 31, 2025, to ensure a seamless transition. The Board has initiated a search for his successor. Marc Jansen and Alex Kieft have been appointed as Co-Chief Trading Officers, effective immediately, and will jointly manage the Global Trading Division. Marc Jansen will also be nominated for election as an Executive Director of Flow Traders Ltd. at the forthcoming AGM. Hermien Smeets-Flier was elected as CFO and Executive Director in September 2023 and formally assumed the role of CFRO in 2025. Owain Lloyd joined Flow Traders in May 2024 as Director of Technology.

| Director | Role | Committee Membership |

|---|---|---|

| Rudolf Ferscha | Chairman of the Board | N/A |

| Jan van Kuijk | Non-Executive Director | Chair of Trading & Technology Committee, Audit Committee, Risk & Sustainability Committee, Remuneration & Appointment Committee |

| Linda Hovius | Independent Non-Executive Director | N/A |

| Delfin Rueda | Independent Non-Executive Director | Chair of Audit Committee |

Flow Traders encourages management and employee share ownership to align interests with the company's long-term success. A share plan introduced in 2020 allows up to 50% of variable remuneration in shares. As of December 31, 2024, Mike Kuehnel held 27,464 shares, representing 0.1% of total outstanding shares, and Hermien Smeets-Flier held 1,524 shares. The voting structure generally follows a one-share-one-vote principle. To understand more about their strategies, you can read about the Growth Strategy of Flow Traders.

The board of directors, including the Chairman and Non-Executive Directors, oversees Flow Traders. The company promotes employee share ownership to align interests. The voting structure is based on one share, one vote.

- The board includes key figures like Rudolf Ferscha and Jan van Kuijk.

- Employee share schemes are in place to incentivize performance.

- The company follows a standard voting structure for shareholders.

Flow Traders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Flow Traders’s Ownership Landscape?

Over the past few years, significant developments have influenced the ownership profile of Flow Traders. In 2024, the company launched a Trading Capital Expansion Plan, contributing to its second-best financial year, with a total income of €479.3 million. This plan is designed to boost growth and broaden the firm's trading capital.

In August 2024, Flow Traders completed a €15 million share buyback program, repurchasing 850,882 shares at an average price of €17.63, representing 1.9% of the total outstanding shares. Portions of previously repurchased shares from a €25 million share buyback program in July 2022 will be reallocated to employee incentive plans.

| Development | Details | Year |

|---|---|---|

| Trading Capital Expansion Plan | Aimed at accelerating growth and expanding trading capital. | 2024 |

| Share Buyback Program | €15 million, repurchasing 850,882 shares at €17.63 per share. | 2024 |

| Leadership Transition | CEO Mike Kuehnel to depart by August 2025; Marc Jansen and Alex Kieft appointed Co-Chief Trading Officers. | Q1 2025 |

A notable leadership transition occurred in Q1 2025, with CEO Mike Kuehnel announcing his departure by August 2025. Marc Jansen and Alex Kieft were appointed Co-Chief Trading Officers, effective immediately. This leadership succession aims to ensure a seamless transition and continue the firm's strategic growth agenda, particularly in expanding into underserved markets and focusing on automation. The company is also expanding into digital assets, forming a joint venture called AllUnity and joining the Blockchain Association. With technology investments and expert additions, fixed operating expenses for 2025 are projected between €190 million and €210 million.

The ownership of Flow Traders involves institutional investors and key executives. The company's structure is designed to support its trading activities and strategic growth. Understanding the ownership structure is important for investors looking at Revenue Streams & Business Model of Flow Traders.

Flow Traders' financial performance in 2024 was strong, with a total income of €479.3 million. The company's trading capital expansion plan is expected to drive further growth. Key financial metrics reflect the company's robust market position and strategic initiatives.

The upcoming leadership transition, with the departure of CEO Mike Kuehnel, marks a strategic shift. The appointments of Marc Jansen and Alex Kieft as Co-Chief Trading Officers are aimed at ensuring continuity. The company's strategy focuses on expansion and efficiency.

Flow Traders is actively expanding into digital assets, forming a joint venture and joining the Blockchain Association. This move indicates the company's commitment to the future of electronic trading. The company anticipates continued growth in this area.

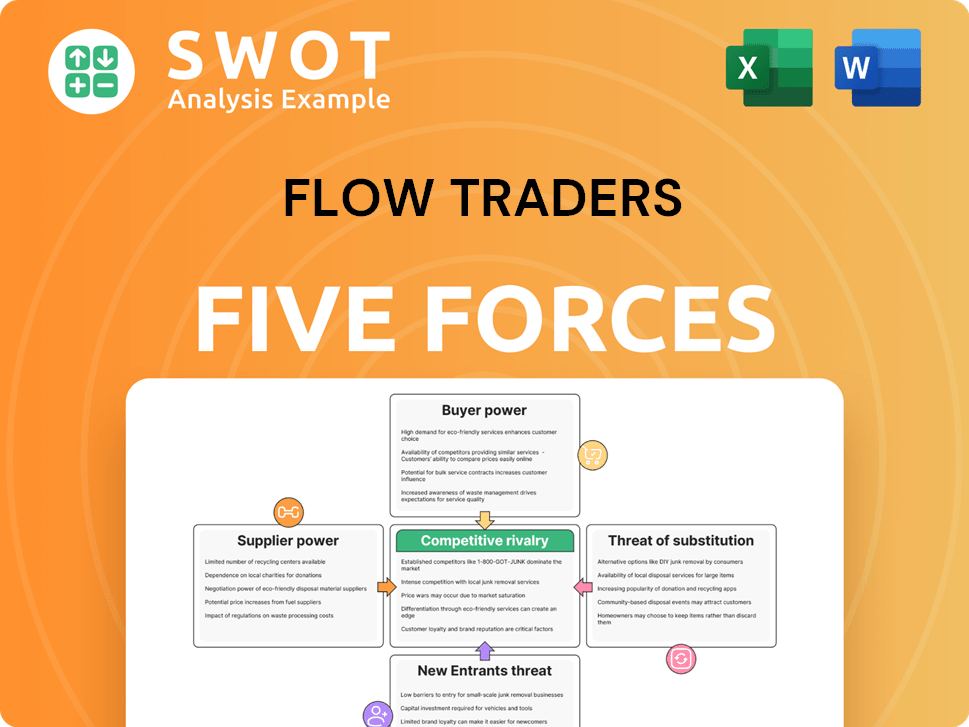

Flow Traders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flow Traders Company?

- What is Competitive Landscape of Flow Traders Company?

- What is Growth Strategy and Future Prospects of Flow Traders Company?

- How Does Flow Traders Company Work?

- What is Sales and Marketing Strategy of Flow Traders Company?

- What is Brief History of Flow Traders Company?

- What is Customer Demographics and Target Market of Flow Traders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.