Flow Traders Bundle

How Does Flow Traders Navigate the Complex World of Finance?

Flow Traders, a global leader in technology-driven market making, has consistently redefined its approach to stay ahead in the fast-paced financial world. Their Flow Traders SWOT Analysis reveals a dynamic strategy, constantly evolving to capitalize on emerging opportunities. This article explores the core of their success: their sales and marketing strategy, which has been instrumental in driving growth and establishing a strong market presence.

From its roots in ETP trading to its expansion into digital assets and beyond, Flow Traders' sales strategy and marketing efforts are a testament to their adaptability. Understanding Flow Traders' business model and how they leverage algorithmic trading to provide liquidity is crucial. We will analyze their recent marketing campaign examples, examining how they build brand awareness and engage their target audience to maintain a competitive advantage in the market.

How Does Flow Traders Reach Its Customers?

The sales and marketing strategy of Flow Traders centers on direct engagement and electronic channels, serving as a principal trading firm. Their approach is tailored to institutional counterparties, focusing on providing liquidity across various financial instruments. This strategy is supported by a global presence and strategic partnerships to enhance market access and trading efficiency. This is how Flow Traders sales strategy works.

Flow Traders' business model relies heavily on its ability to provide liquidity. They quote bid and ask prices on exchanges globally, primarily for Exchange Traded Products (ETPs) like equities, fixed income, commodities, and currencies. This on-exchange presence is complemented by off-exchange liquidity provision through Request-for-Quote (RFQ) to over 2,400 institutional counterparties in 40 countries.

The firm's sales strategy is built upon a foundation of direct market access and electronic trading platforms. This approach allows them to efficiently serve their target audience. The company's growth strategy is also supported by a strong financial performance. For instance, trading capital has increased by 32% since the end of Q1 2024 to €803 million by Q1 2025, according to their financial reports.

Flow Traders provides liquidity directly on numerous exchanges worldwide. They quote bid and ask prices for a wide range of ETPs. This on-exchange presence ensures continuous market access for institutional clients.

They offer off-exchange liquidity via Request-for-Quote (RFQ) to over 2,400 institutional counterparties. This channel allows for tailored trading solutions. It supports direct engagement with clients like banks and asset managers.

Flow Traders has expanded its product offerings beyond European equity ETPs. They now include FX, digital assets, fixed income, and spot precious metals. This diversification supports their growth strategy and broadens their market reach.

The company has established trading offices in key financial hubs like New York, Singapore, and Hong Kong. They also have offices in London, Milan, Paris, Chicago, and Shanghai. These offices enable 24-hour liquidity provision across major exchanges.

Flow Traders' sales strategy is enhanced through strategic partnerships and investments. The 'AllUnity' joint venture with DWS and Galaxy Digital is an example of their innovative approach. Investments in companies like ClearToken and partnerships with Börse Stuttgart Digital and Wormhole Foundation are also important.

- The 'AllUnity' venture aims to bridge traditional finance and digital assets.

- Investments in ClearToken focus on enhancing market infrastructure.

- Partnerships with Börse Stuttgart Digital expand their connectivity.

- These initiatives indirectly increase their efficiency in serving clients.

Flow Traders' sales strategy is deeply rooted in providing liquidity and leveraging technology. Their approach has evolved from a focus on European equity ETPs to a more diversified portfolio. Their expansion into new markets and asset classes, along with strategic partnerships, has significantly broadened their reach and enhanced their competitive advantage. Learn more about their journey by reading a Brief History of Flow Traders.

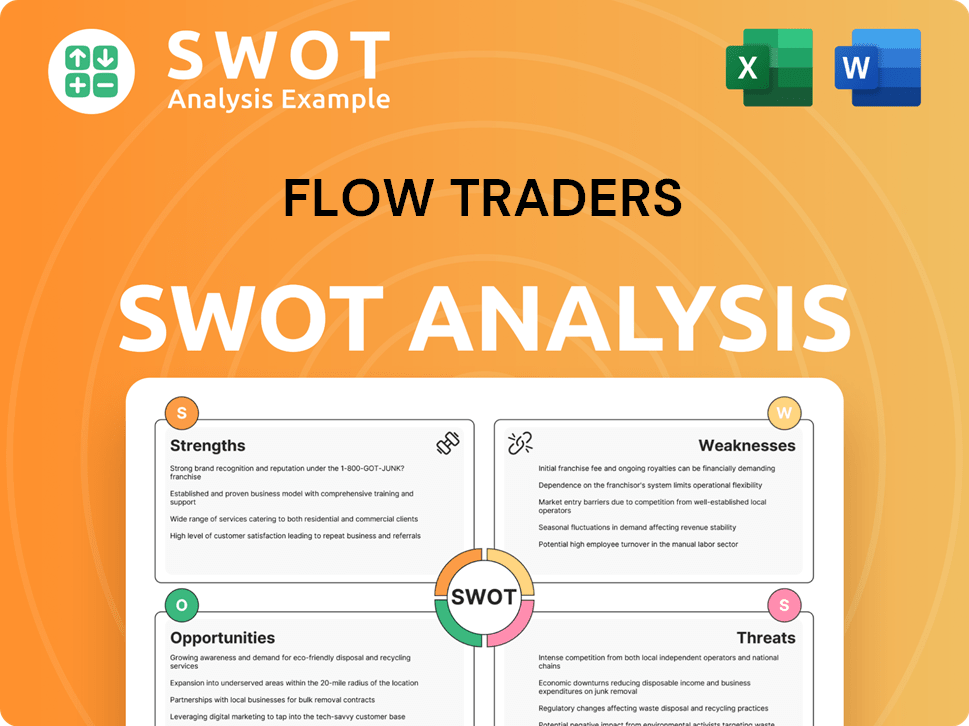

Flow Traders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Flow Traders Use?

The marketing tactics of Flow Traders are primarily geared towards a business-to-business (B2B) approach, focusing on building and maintaining relationships with institutional clients. This strategy emphasizes thought leadership and industry engagement to enhance brand awareness and solidify its reputation as a leading liquidity provider. Flow Traders' sales strategy is deeply intertwined with its marketing efforts, aiming to reach a specific target audience of financial professionals.

Digital marketing plays a crucial role, with content marketing as a key component. Flow Traders leverages its market expertise to produce informative reports and insights, such as the '2024 Crypto ETP Report,' which are distributed through its website and financial news platforms. The company's approach to customer segmentation is inherent in its core business model, constantly analyzing market data to optimize its liquidity provision and risk management.

The company's focus on data-driven marketing and customer segmentation is inherent in its core business model. As a principal trading firm, Flow Traders constantly analyzes market data to optimize its liquidity provision and risk management. This deep understanding of market dynamics and participant behavior informs their strategic decisions and, by extension, their targeted outreach to specific institutional segments. Their strategic investments in technology and increasing research capabilities further underscore their commitment to a data-driven approach, aiming to drive innovation across financial markets. Their fixed operating expenses for 2025 are projected to be in the range of €190-210 million, partly driven by continued technology investments.

Flow Traders utilizes content marketing to share its market expertise. This includes reports, insights, and data analysis. This helps to establish the company as a thought leader in the financial industry.

Flow Traders maintains a strong online presence to ensure visibility among financial professionals. This includes a corporate website and investor relations portals. They also publish financial results and market statistics.

Email marketing is used for direct communication with institutional clients. This includes market updates, insights, and access to trading services. This helps to maintain direct engagement with their extensive network.

Social media platforms, such as LinkedIn, are used to share company news and market commentary. This helps to target financial professionals and potential hires. It also enhances brand awareness.

Flow Traders uses a data-driven approach to marketing and customer segmentation. This is inherent in its core business model. They analyze market data to optimize liquidity provision and risk management.

While not explicitly highlighted, the nature of institutional trading often involves bespoke solutions. This implies a high degree of personalized engagement. This approach helps to build strong relationships with clients.

Flow Traders' marketing strategy is designed to support its revenue streams and business model. The company's focus on data-driven decision-making and targeted outreach is critical for its competitive advantage. By leveraging digital marketing, content creation, and direct communication, Flow Traders aims to maintain its position as a leading market maker. This approach is complemented by strategic investments in technology and research, which are projected to contribute to the company's fixed operating expenses, estimated between €190-210 million in 2025.

Flow Traders employs several key tactics to reach its target audience and achieve its marketing goals. These tactics are integral to the company's overall sales and marketing strategy.

- Content Marketing: Creation of informative reports and insights.

- Digital Presence: Maintaining a strong online presence through its website and financial news platforms.

- Email Marketing: Direct communication with institutional clients.

- Social Media: Utilizing platforms like LinkedIn to share company news and market commentary.

- Data-Driven Marketing: Analyzing market data to optimize liquidity provision and risk management.

- Personalized Engagement: Offering bespoke solutions and direct relationships with institutional clients.

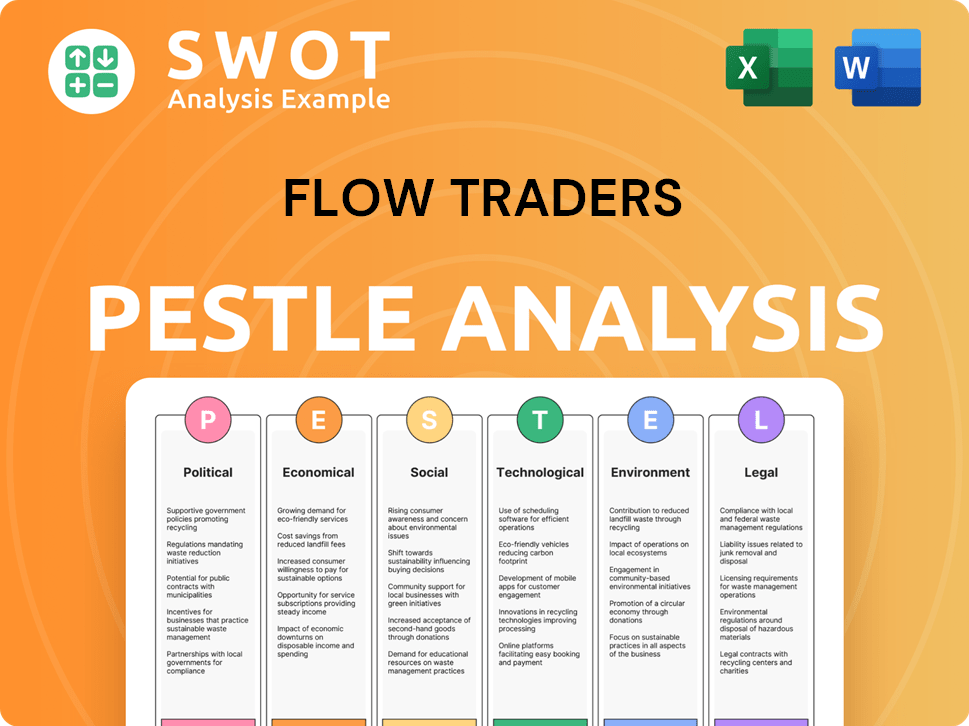

Flow Traders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Flow Traders Positioned in the Market?

Flow Traders positions itself as a leading global technology-enabled liquidity provider, focusing on Exchange Traded Products (ETPs) and promoting efficient financial markets. Their brand emphasizes continuous liquidity across various asset classes, ensuring investors can trade financial instruments efficiently. This highlights reliability and accessibility within the financial ecosystem, which is a key part of their target market strategy.

The visual identity and tone of voice, inferred from corporate communications, convey professionalism and technological sophistication, targeting an institutional audience. Flow Traders' unique selling proposition includes deep ETP expertise, cutting-edge technology, robust risk management, and a strong team-driven culture. This approach helps them stand out in the competitive landscape of Flow Traders sales and Flow Traders marketing.

Flow Traders maintains consistent brand messaging across its website, investor materials, and press releases, reinforcing its expertise. The company's strategic focus on growth and diversification, particularly in digital assets, demonstrates its adaptability to market changes. This is crucial for their long-term Flow Traders strategy and sustained success in the financial sector.

Flow Traders' core message emphasizes continuous liquidity and efficient trading across various asset classes. This commitment ensures investors can buy or sell financial instruments under all market conditions. This reliability is a key aspect of their Flow Traders business model.

The brand's visual identity suggests professionalism, technological sophistication, and a data-driven approach. This aligns with their institutional target audience. This approach is vital for effective Flow Traders trading and maintaining a strong market presence.

Flow Traders differentiates itself through deep ETP expertise, advanced proprietary technology, and robust risk management. Their team-driven culture is also a key differentiator. This USP supports their Flow Traders market making activities.

Brand consistency is maintained across all touchpoints, including the website and investor relations materials. This consistency reinforces their mission and expertise. This helps build Flow Traders brand awareness.

In 2024, Flow Traders reported a Net Trading Income of €467.8 million and a Net Profit of €159.5 million. These figures highlight the company's strong financial performance and market standing. This data is crucial for Flow Traders investor relations.

The company's strategic focus includes growth and diversification, particularly in digital assets. This demonstrates responsiveness to market shifts and competitive threats. This strategy helps with Flow Traders growth strategy.

Flow Traders has received recognition, such as 'Best Market Maker' awards, which validate their market position. Sustained growth and strong financial performance are key indicators of their market standing. This helps with Flow Traders competitive advantage.

The primary target audience is institutional investors, who value reliability, technology, and efficient trading. The company's communications and services are tailored to this group. Understanding the Flow Traders target audience is key.

Flow Traders actively invests in technological advancements, including strategic partnerships. This commitment supports their ability to provide stable liquidity. This is a part of their Flow Traders algorithmic trading approach.

The company's responsiveness to market changes, particularly in digital assets, shows a strong ability to adapt. This is supported by continuous market analysis. This approach is crucial for Flow Traders market analysis.

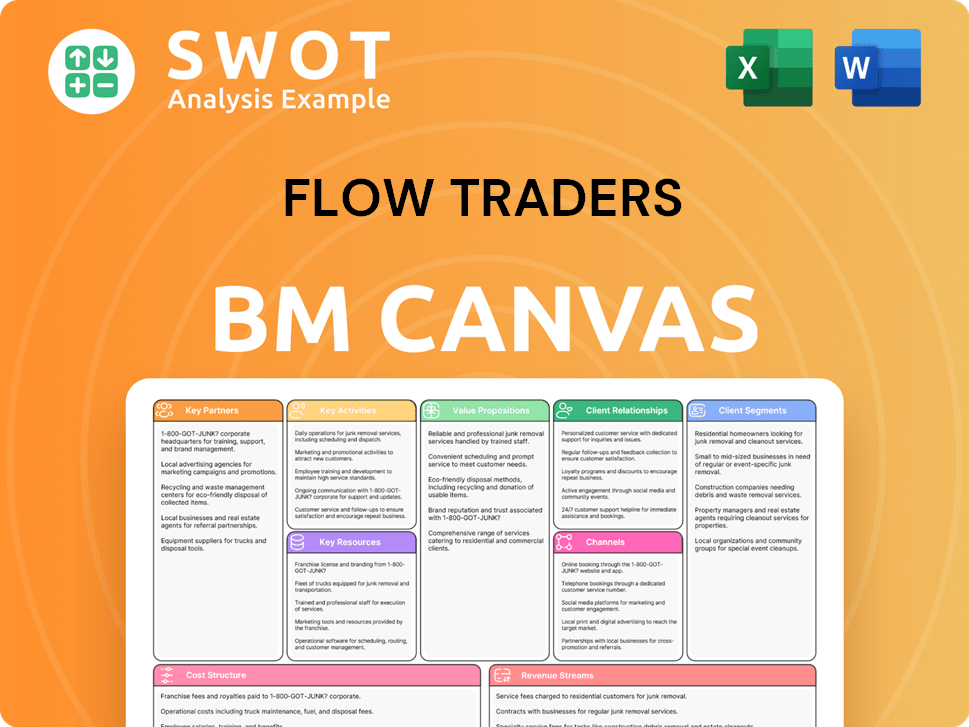

Flow Traders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Flow Traders’s Most Notable Campaigns?

For a principal trading firm like Flow Traders, traditional marketing campaigns are less relevant. Instead, the firm focuses on strategic initiatives and partnerships to expand its reach, enhance capabilities, and solidify its position as a leading liquidity provider. These efforts, better described as strategic campaigns, drive its business model and impact its overall success. This approach is crucial for Flow Traders' sales strategy, which prioritizes building strong relationships and providing top-tier market-making services.

These strategic campaigns are primarily aimed at institutional investors and the broader financial community. The goal is to leverage their expertise in traditional finance and bridge the gap with digital asset ecosystems, capitalizing on the growing market for cryptocurrencies and related products. This approach is vital for Flow Traders' trading activities and market making capabilities. The company has demonstrated its ability to adapt and thrive in the evolving financial landscape.

Flow Traders' sales strategy is not about mass-market advertising; it's about strategic investments and partnerships. This includes targeting institutional players and the broader financial community. These initiatives aim to enhance their trading capabilities and counterparty network. For more insights into the company's ownership and structure, you can explore Owners & Shareholders of Flow Traders.

Flow Traders has significantly invested in digital assets since 2017, with accelerated efforts in 2024 and 2025. The 'AllUnity' initiative, a Euro-denominated stablecoin joint venture, is a key component. This campaign aims to bridge traditional finance with digital assets. This strategic focus is crucial for Flow Traders' growth strategy.

Flow Traders strategically invests in financial market infrastructure providers. This includes investments in ClearToken and partnerships with Börse Stuttgart Digital, Wormhole Foundation, and OpenYield. These efforts are designed to enhance trading capabilities and expand the counterparty network. This approach is crucial for their competitive advantage.

These strategic initiatives significantly impact Flow Traders' financial performance. The digital asset focus, including the 'AllUnity' initiative, has increased trading activity. Strategic investments in infrastructure providers are designed to enhance trading capabilities and expand the counterparty network. These efforts contribute to Flow Traders' strong financial performance.

- Digital Asset Growth: In Q1 2024, currency, crypto, and commodity values saw a 24% year-over-year increase.

- Financial Performance: Net Trading Income for the full year 2024 reached €467.8 million.

- Profitability: Net Profit for 2024 was €159.5 million, demonstrating the effectiveness of the firm's strategic initiatives.

- Market Position: These campaigns reinforce Flow Traders' position as a leading liquidity provider.

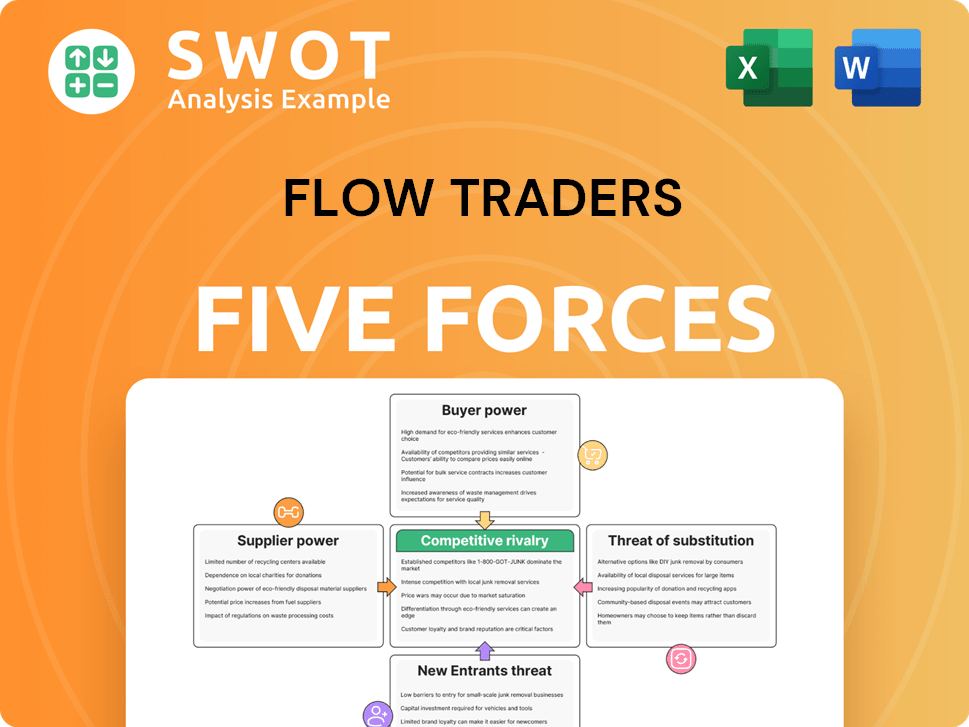

Flow Traders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flow Traders Company?

- What is Competitive Landscape of Flow Traders Company?

- What is Growth Strategy and Future Prospects of Flow Traders Company?

- How Does Flow Traders Company Work?

- What is Brief History of Flow Traders Company?

- Who Owns Flow Traders Company?

- What is Customer Demographics and Target Market of Flow Traders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.