Flow Traders Bundle

Who are Flow Traders' Key Players?

In the fast-paced world of financial technology, understanding the Flow Traders SWOT Analysis is critical. Flow Traders, a leading liquidity provider, thrives on a deep understanding of its customer base. But who exactly are the individuals and institutions that fuel Flow Traders' success, and how does the company tailor its services to meet their specific needs? This exploration dives into the customer demographics and the ever-evolving Flow Traders target market.

Since its inception, Flow Traders has strategically expanded its reach, moving beyond its initial European focus. This expansion necessitates a comprehensive Flow Traders analysis of its Flow Traders clients and Flow Traders investors, including their geographical distribution and investment preferences. Understanding the Flow Traders audience is not just about knowing who they are, but also about how Flow Traders acquires and retains them in a competitive global market. Analyzing What are the demographics of Flow Traders customers and Flow Traders target market segmentation provides invaluable insights into the company's strategic direction.

Who Are Flow Traders’s Main Customers?

Understanding the customer base is crucial for analyzing the operations of any financial institution. In the case of Flow Traders, the focus is on institutional clients. This Flow Traders analysis reveals a specific target market that drives its business model.

Flow Traders operates primarily in a Business-to-Business (B2B) model, catering to a sophisticated clientele. These clients are typically large financial institutions. The customer demographics are defined by their operational needs and financial sophistication rather than traditional demographic factors.

The primary customer segments of Flow Traders include a variety of institutional entities. These entities rely on Flow Traders for efficient liquidity provision across various financial instruments, highlighting the importance of understanding the company's target market.

The core of Flow Traders' customer base comprises financial institutions. These entities require seamless execution and competitive pricing in global markets. While specific age or gender breakdowns aren't applicable, their 'income level' is reflected in their significant trading volumes.

Flow Traders' clients include banks, asset managers, pension funds, insurance companies, family offices, and hedge funds. These institutions depend on Flow Traders for liquidity in various financial instruments. The company's role is to enable these investors to buy or sell financial instruments efficiently, ensuring market stability.

Flow Traders has strategically expanded its target segments. This expansion includes diversifying its asset class coverage and geographical reach. This shift is in response to market research. For example, the global fixed income ETP value traded increased to €2.901 trillion in 2024, up from €2.836 trillion in 2023, highlighting a significant growth opportunity.

The company is also focusing on digital assets. Flow Traders plays an instrumental role in providing 24/7 liquidity. This helps bridge traditional finance with digital asset ecosystems. This highlights the evolving nature of the company's target market and its ability to adapt to new financial instruments.

The ideal customer characteristics for Flow Traders involve sophisticated financial institutions. These institutions require efficient trading solutions. Understanding the customer profile analysis is key to the company's success.

- High trading volumes and assets under management indicate the financial capacity of these institutions.

- These institutions are typically highly educated in financial markets.

- They employ professionals in portfolio management, trading, and risk management.

- Flow Traders' role as a market maker ensures market resilience.

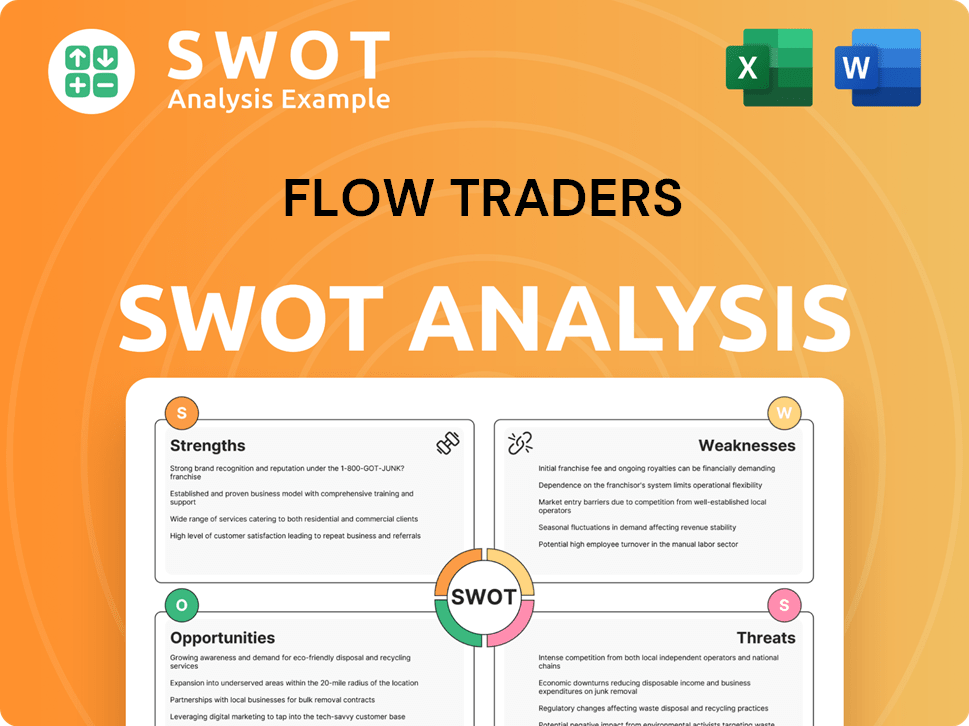

Flow Traders SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Flow Traders’s Customers Want?

Understanding the needs and preferences of institutional clients is crucial for Flow Traders' success. The company's ability to provide efficient, transparent, and reliable liquidity is a key factor in attracting and retaining its customer base. This focus allows them to serve the specific needs of diverse institutional clients across various asset classes and regions.

The primary drivers for institutional clients choosing Flow Traders revolve around execution quality, competitive bid-ask spreads, and the capacity to handle large trading volumes without significantly impacting market prices. These clients seek to minimize counterparty risk and enhance capital efficiency, especially in volatile market conditions. Flow Traders' success is built on consistent performance, technological reliability, and the ability to adapt to evolving market structures and asset classes.

Flow Traders' trading platform users, or the Flow Traders audience, continuously engage with the company's proprietary technology to quote bid and ask prices across thousands of Exchange Traded Products (ETPs) and other financial instruments. The company addresses common pain points such as market fragmentation and the need for immediate execution by providing continuous liquidity. This is a critical aspect of their client acquisition strategy.

Flow Traders' institutional clients, including Flow Traders investors, prioritize several key factors. These factors influence their decision-making and drive their loyalty. Understanding these elements is crucial for a thorough Flow Traders analysis.

- Execution Quality: Clients demand trades executed efficiently and with minimal slippage.

- Competitive Pricing: Tight bid-ask spreads are essential for cost-effective trading.

- Liquidity Provision: The ability to transact large volumes without significant market impact is crucial.

- Technological Reliability: A robust and dependable trading platform is a must.

- Transparency: Clear and open market practices are highly valued.

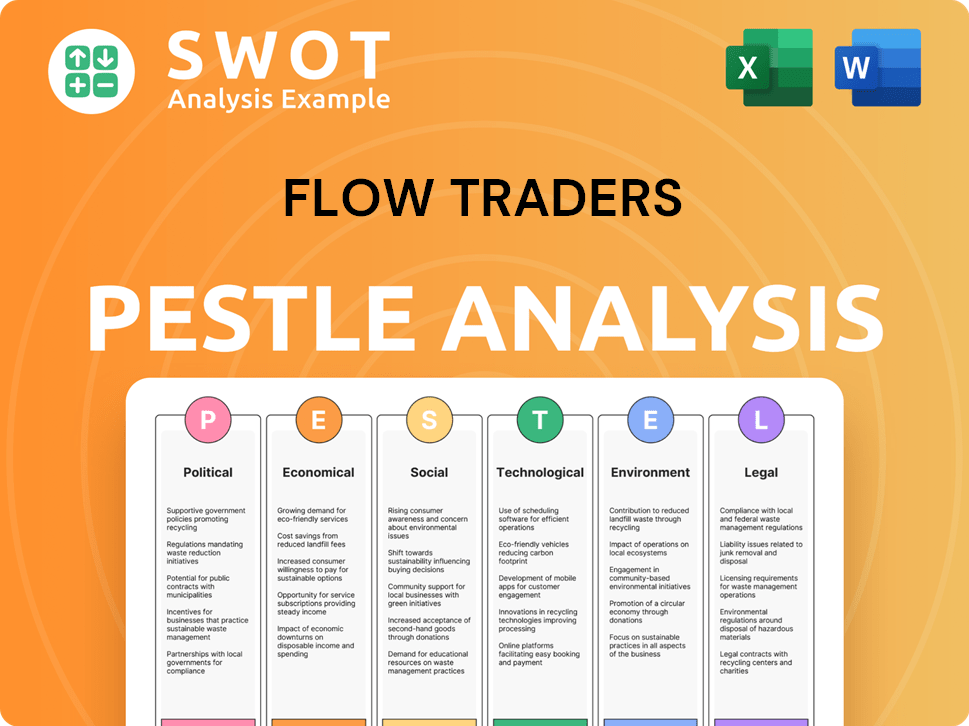

Flow Traders PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Flow Traders operate?

The company's geographical market presence is a significant aspect of its operations, with a strategic focus on three key regions: Europe, the Americas, and Asia-Pacific (APAC). The company's headquarters in Amsterdam, the Netherlands, serves as a central hub for its European activities, complemented by offices in major financial centers like London, Milan, and Paris.

In the Americas, the company has a presence in New York and Chicago, with the latter office opening in early 2023 to broaden its asset class coverage. The APAC region is covered through offices in Singapore and Hong Kong, which serves as the principal trading hub for the region. The company also expanded into China, opening an office in Shanghai in 2022.

This global footprint allows the company to serve a diverse Flow Traders target market, adapting to the varying needs and preferences of its Flow Traders clients across different regions. The company's expansion into digital assets and its partnership with Copper's ClearLoop showcase its efforts to meet evolving market demands globally.

The European operations are primarily managed from the Amsterdam headquarters. Offices in London, Milan, and Paris facilitate efficient trading within Europe's major financial hubs. This strategic positioning supports the company's ability to serve its Flow Traders investors and adapt to local market conditions.

The company's presence in the Americas includes offices in New York and Chicago. The Chicago office, opened in early 2023, aimed to expand asset class coverage. The New York office, established with support from Summit Partners in 2009, helped establish 24-hour trading capabilities.

The APAC region is covered by offices in Singapore and Hong Kong, which serves as the principal trading hub for the region. The company also obtained a QFII license in China and opened an office in Shanghai in 2022. This expansion reflects a strategic move to tap into the Chinese market.

The company addresses regional differences in customer demographics through localized offerings and partnerships. The expansion into digital assets and the partnership with Copper's ClearLoop are examples of catering to evolving market structures and client demands globally. This approach allows the company to effectively target its Flow Traders audience.

While specific regional revenue breakdowns are not always publicly detailed, the company's 1Q 2025 results indicate strong operational performance in Europe and Asia. These strong performances offset a muted performance in the Americas. This demonstrates the company's ability to adapt to different market conditions.

The company's continuous investment in expanding trading capabilities and diversifying across asset classes and regions demonstrates an adaptive market entry strategy. This strategy is designed to maximize opportunities in various markets. This approach is crucial for understanding the Flow Traders analysis.

The company's expansion into digital assets highlights its efforts to cater to evolving market structures and client demands globally. This strategic move reflects the company's commitment to innovation and adapting to new financial instruments. The company's focus on digital assets is a key part of its strategy.

The partnership with Copper's ClearLoop is a key example of how the company collaborates to meet client demands. These partnerships are vital for navigating the complexities of different markets. This helps the company to better serve its Flow Traders clients.

A software development team is located in Cluj-Napoca, Romania, since 2010. This team supports the company's technological infrastructure. This team is essential for maintaining the company's competitive edge.

The opening of an office in Shanghai in 2022 and obtaining a QFII license in China demonstrates a strategic move to tap into the Chinese market. This expansion reflects a commitment to keep abreast of regulatory initiatives and market trends in China. This is essential for future growth.

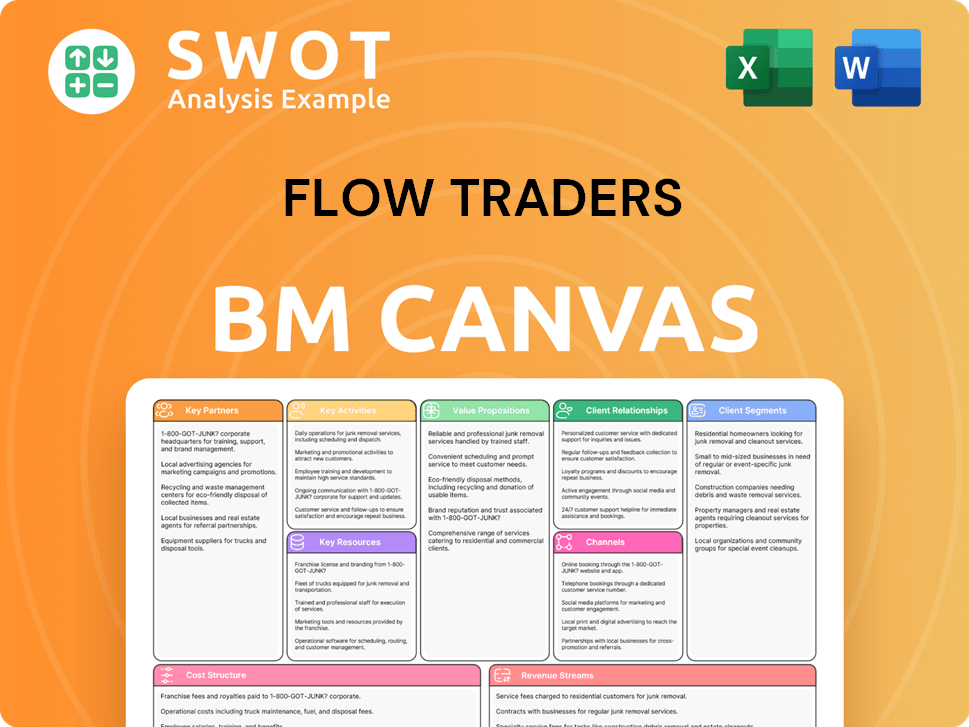

Flow Traders Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Flow Traders Win & Keep Customers?

The customer acquisition and retention strategies of Flow Traders are specialized, focusing on its role as a technology-driven liquidity provider. The firm's approach to acquiring and retaining clients is deeply intertwined with its ability to offer efficient and reliable trading services to institutional counterparties. This includes providing competitive bid and ask prices across a broad range of financial instruments, attracting order flow, and maintaining a reputation for technological innovation and consistent performance.

Given its business-to-business (B2B) model, Flow Traders' strategies are less about traditional marketing campaigns and more about maintaining a robust trading infrastructure and expanding its offerings. The company's success hinges on providing superior trading technology, expanding into new asset classes, and maintaining a strong market presence. This approach aims to build trust and loyalty among its institutional clients, ensuring they continue to use its services.

Flow Traders' focus on technological advancements and operational excellence is key. Its ability to adapt and expand into new markets and financial instruments, such as digital assets, demonstrates its commitment to innovation and client service. This strategic approach is crucial for attracting and retaining clients in a competitive financial landscape. The Marketing Strategy of Flow Traders highlights these aspects in detail.

The Flow Traders target market primarily consists of institutional investors. These include hedge funds, asset managers, and other financial institutions that require liquidity in the markets. The company's customer base is highly specialized, focusing on clients who actively trade in financial markets and value speed, efficiency, and competitive pricing.

Acquisition is achieved through continuous quoting of competitive bid and ask prices across a wide range of financial instruments. This attracts order flow from institutional clients seeking efficient execution. Expansion into new asset classes, such as digital assets, also broadens its appeal. The firm leverages its technological infrastructure and trading expertise to attract new counterparties.

Retention is centered on providing consistent performance and continuously enhancing its offerings. This includes strategic investments in technology and talent. The ability to generate consistent trading income across varying market conditions is crucial for client trust and loyalty. The company's commitment to innovation supports its ability to retain clients effectively.

Marketing channels are implicitly tied to the company's reputation for reliability, speed, and competitive pricing. Technological prowess, including the use of algorithms to minimize transaction costs, is a significant draw. Expansion into new asset classes also serves as a marketing channel, broadening its appeal to institutions with diversified trading needs.

Flow Traders leverages its technological infrastructure to provide efficient trading services. This includes the use of algorithms and advanced technologies to minimize transaction costs and capture small bid-ask spreads. These technologies are a key factor in attracting and retaining institutional clients.

Expanding into new asset classes, such as fixed income, commodities, digital assets, and FX, is a key acquisition strategy. This diversification broadens the company's appeal to institutions with diverse trading needs. This strategy aims to increase optionality for the business and positively impact customer loyalty.

The firm's commitment to strategic investments in cutting-edge technology and talent supports its ability to maintain its competitive edge. Projected fixed operating expenses for 2025 are in the range of €190-210 million, which directly supports its ability to serve its existing client base effectively. These investments are crucial for retention.

Customer data and segmentation are crucial for optimizing trading strategies and identifying new market opportunities. While not explicitly detailed as CRM systems, Flow Traders' proprietary data and knowledge drive its trading model. This allows the firm to adapt and expand into adjacent products and enhance incumbent trading strategies.

Flow Traders operates globally, with a presence in major financial markets. This geographical diversification allows the company to serve a wide range of institutional clients. The firm's ability to provide 24/7 liquidity in digital assets also contributes to its geographical reach.

Flow Traders' success is based on its ability to offer competitive pricing, speed, and reliability. The firm's technological infrastructure and trading expertise provide a significant competitive advantage. This allows it to attract and retain institutional clients in a highly competitive market.

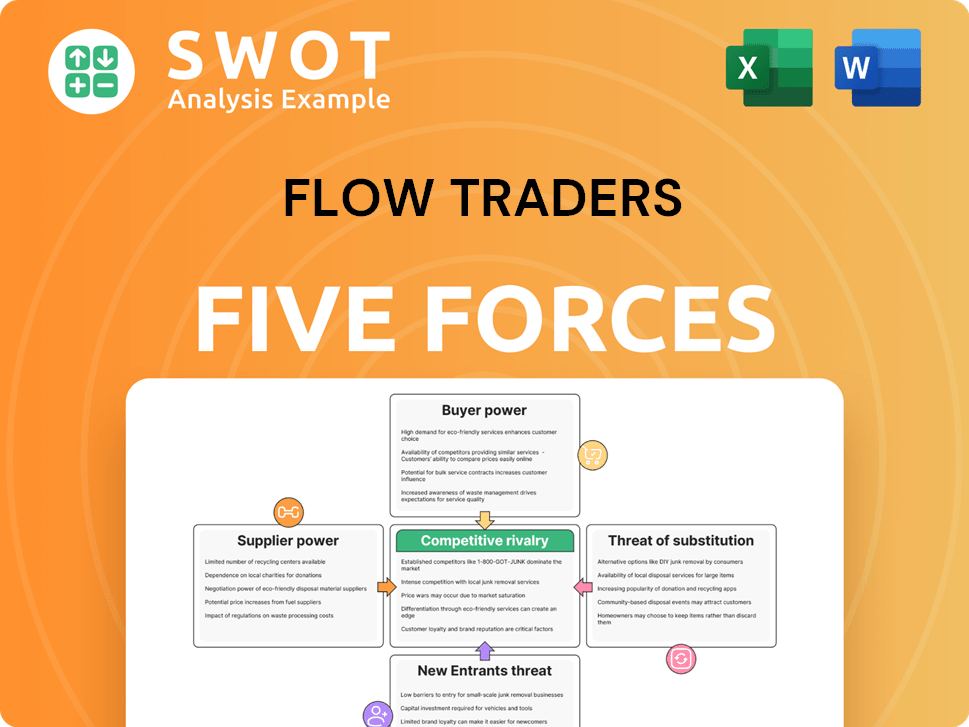

Flow Traders Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flow Traders Company?

- What is Competitive Landscape of Flow Traders Company?

- What is Growth Strategy and Future Prospects of Flow Traders Company?

- How Does Flow Traders Company Work?

- What is Sales and Marketing Strategy of Flow Traders Company?

- What is Brief History of Flow Traders Company?

- Who Owns Flow Traders Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.