Gap Bundle

Can Gap Inc. Thrive in Today's Retail Arena?

The apparel industry is a battlefield, and Gap Inc. has been a key player since 1969. Navigating shifting consumer demands, technological leaps, and intense rivalry is crucial for survival. This analysis delves into Gap's competitive landscape, examining its market positioning and the strategies it employs to stay ahead.

This exploration into the Gap SWOT Analysis will dissect the company's strengths and weaknesses, and analyze its market share, to understand its current position in the fashion industry. We'll conduct a thorough Gap market analysis, comparing its financial performance to its competitors, and assessing its brand positioning. Understanding the Gap competitive landscape is essential for investors and strategists seeking to navigate the complexities of the retail market and make informed decisions about Gap's future growth prospects.

Where Does Gap’ Stand in the Current Market?

Gap Inc. holds a significant position in the global apparel retail market. In fiscal year 2023, the company reported net sales of approximately $14.9 billion, showcasing its substantial presence within the industry. This figure reflects the company's operational scale and its ability to generate revenue across its diverse brand portfolio.

The company operates a multi-brand strategy, including Gap, Old Navy, Banana Republic, and Athleta. Each brand targets distinct customer segments, contributing to the overall market position. Old Navy is a key driver, focusing on value-conscious families, while Athleta has shown strong growth in the activewear sector.

Gap Inc.'s market position is also defined by its geographical footprint. It has a considerable presence in North America and operates in over 40 countries through company-operated and franchise stores. The company's e-commerce platform is a vital component of its strategy, reflecting its adaptation to evolving consumer shopping habits. Understanding the Marketing Strategy of Gap is crucial for grasping its market dynamics.

Gap's market share varies across its brands and regions. It competes with both specialty retailers and mass-market brands. The company's overall share reflects its competitive position in the apparel industry.

Gap Inc. has increased its emphasis on digital transformation and direct-to-consumer sales. This has been a strategic response to changing consumer behavior. The company has invested heavily in its online capabilities.

Gap Inc. faces intense competition from fast-fashion retailers and online pure-plays. Sales declines in some core brands have added to the pressure. The company's financial health is affected by these competitive dynamics.

The company consistently works to optimize inventory and supply chain efficiency. These efforts aim to improve profitability. This is a key aspect of Gap's business strategy.

Gap Inc.'s market position is shaped by its brand portfolio, geographical presence, and digital strategy. The company's ability to adapt to changing consumer preferences and competitive pressures is crucial for its long-term success.

- Multi-brand strategy with Gap, Old Navy, Banana Republic, and Athleta.

- Significant presence in North America and over 40 countries.

- Emphasis on digital transformation and direct-to-consumer sales.

- Facing competition from fast-fashion retailers and online platforms.

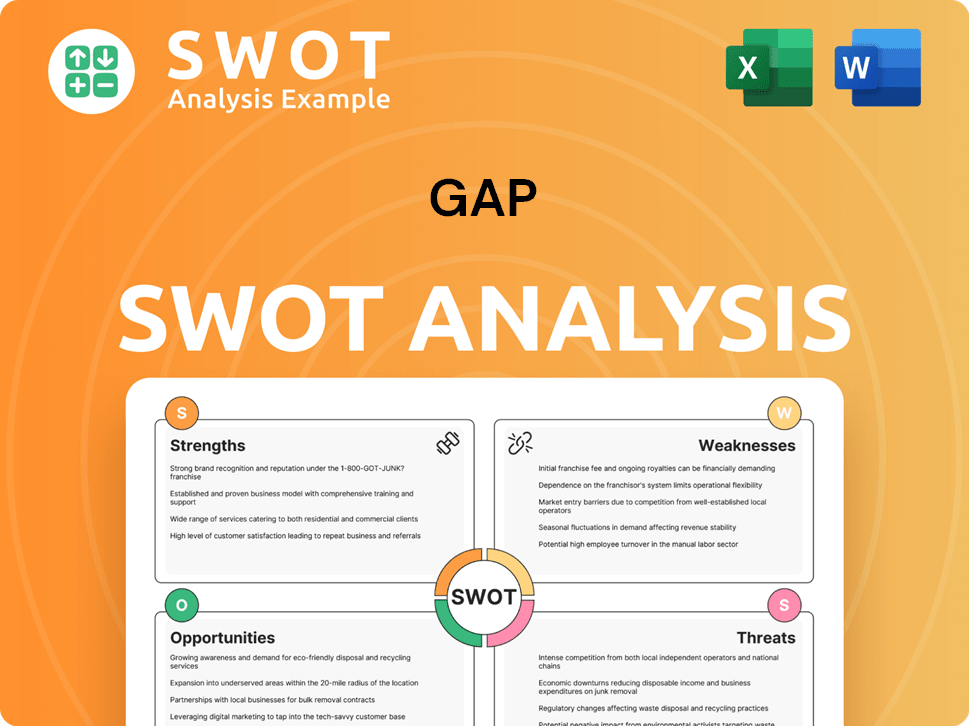

Gap SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Gap?

The Growth Strategy of Gap faces a complex and dynamic competitive landscape. Understanding the key players and their strategies is crucial for any comprehensive Gap market analysis. This analysis helps in assessing Gap's current position in the fashion industry and its future growth prospects.

Gap Inc. operates in the highly competitive apparel industry, with rivals spanning various retail formats and business models. These competitors range from value-priced retailers to fast-fashion giants and online platforms. This diversity necessitates a detailed examination of Gap's main rivals and their impact on Gap's market share analysis.

Gap Inc. faces competition across its brands, necessitating a nuanced understanding of its competitive environment. The following sections detail the key competitors in different segments.

Direct competitors include established players like TJX Companies (TJ Maxx, Marshalls), Ross Stores, and Burlington Stores. These retailers offer value-priced apparel, attracting price-sensitive consumers. In 2024, TJX Companies reported net sales of approximately $54.1 billion, highlighting their significant market presence.

Department stores such as Macy's and Kohl's also compete with Gap, offering a wide range of clothing and accessories. These stores often have a broader product assortment and a strong physical retail presence. Macy's reported net sales of approximately $23.1 billion in fiscal year 2024.

Fast-fashion giants like Zara (Inditex) and H&M pose a significant challenge due to their rapid trend adoption and efficient supply chains. These companies can quickly bring new styles to market, attracting fashion-conscious consumers. Inditex's sales reached approximately €35.9 billion in 2024.

Online retailers such as Amazon and Shein also represent a growing competitive threat, leveraging vast product selections and competitive pricing. Amazon's apparel sales continue to grow, with an estimated $45 billion in apparel sales in 2024. Shein's rapid growth is also noteworthy.

Old Navy competes directly with affordable family apparel retailers like Target and Walmart. These retailers offer a wide range of clothing at competitive prices. Walmart's apparel sales were significant in 2024, reflecting their strong market position.

Banana Republic, positioned in the premium casual wear segment, competes with brands such as J.Crew and Ann Taylor. These brands target a similar customer demographic with a focus on quality and style. J.Crew's performance and market share are key factors in this segment.

Athleta, Gap Inc.'s activewear brand, is in direct competition with industry leaders like Lululemon and Nike, as well as emerging direct-to-consumer athletic apparel brands. Lululemon's strong brand recognition and innovative products make it a formidable competitor. Nike's vast resources and global presence also pose a significant challenge. The activewear market is experiencing rapid growth, with new brands entering the market frequently. The competitive landscape is further complicated by the entry of new, digitally native brands that often have lower overheads and can quickly adapt to niche markets. Mergers and alliances within the retail sector, such as the acquisition of smaller brands by larger conglomerates, also continually reshape the competitive dynamics, intensifying the fight for market share.

- Lululemon: Known for premium quality and strong brand loyalty. Lululemon's revenue in fiscal year 2024 was approximately $9.6 billion.

- Nike: A global leader in athletic apparel, with significant market share and diverse product offerings. Nike's revenue in 2024 was approximately $51.2 billion.

- Direct-to-Consumer Brands: Emerging brands that focus on specific niches and online sales. These brands often have lower overheads and can quickly adapt to market trends.

- Market Dynamics: The apparel industry is subject to mergers and acquisitions, which can shift the competitive landscape.

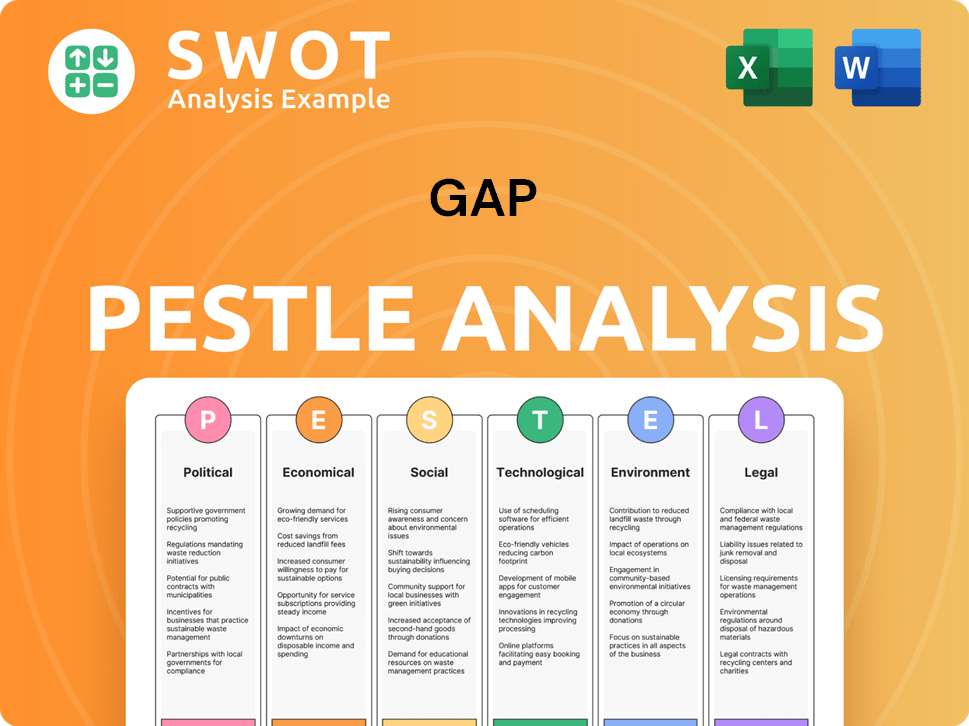

Gap PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Gap a Competitive Edge Over Its Rivals?

The competitive advantages of Gap Inc. stem from its diverse brand portfolio, robust brand equity, and extensive global presence. This allows the company to cater to a wide range of consumers, from budget-conscious shoppers to those seeking premium athletic wear. The company's multi-channel distribution network, encompassing stores, franchises, and e-commerce, provides broad accessibility. The apparel industry is highly competitive, and understanding the Target Market of Gap is crucial for sustained success.

Gap Inc. faces competition from both traditional retailers and online platforms. Its ability to adapt to changing consumer preferences, invest in supply chain efficiency, and innovate in product offerings will be key to maintaining its competitive edge. The company's strategic partnerships and marketing efforts also play a vital role in reinforcing its brand image and customer loyalty. A thorough Gap market analysis reveals the complexities of the retail market and the need for continuous strategic adjustments.

In the ever-evolving retail landscape, Gap Inc. must continually leverage its strengths to navigate challenges and capitalize on opportunities. Understanding the competitive landscape, including Gap's main rivals, is crucial for strategic decision-making. The company's financial performance compared to competitors and its ability to adapt to online sales competition will significantly impact its future growth prospects.

Gap Inc. benefits from a diverse brand portfolio, including Gap, Old Navy, Banana Republic, and Athleta. This diversification allows the company to target various customer segments and mitigate risks associated with relying on a single brand. The presence of both value-oriented (Old Navy) and premium brands (Banana Republic, Athleta) enhances its market reach. In fiscal year 2023, Old Navy accounted for approximately $8.2 billion in sales, demonstrating its significance.

Gap Inc. operates a comprehensive global distribution network that includes company-operated stores, franchise locations, and a strong e-commerce presence. This multi-channel approach enhances accessibility and allows the company to reach consumers in various markets. In 2024, the company has a significant international presence, with stores and online operations in numerous countries. The company's ability to manage this complex network is a key competitive factor.

Gap and Old Navy have built strong brand recognition and customer loyalty over decades. This translates into recurring sales and a competitive advantage in the market. Brand equity allows the company to command premium pricing and maintain customer trust. Customer loyalty programs and effective marketing strategies further strengthen this advantage. The brand's heritage and established reputation are valuable assets.

Gap Inc.'s scale allows it to achieve economies of scale in sourcing and production, potentially leading to cost advantages over smaller competitors. This can translate into better pricing and higher profit margins. The company can leverage its size to negotiate favorable terms with suppliers and optimize its supply chain. These efficiencies contribute to the company's overall financial performance. In 2024, the focus on supply chain optimization continues.

Gap Inc.'s competitive advantages include a diversified brand portfolio, a global distribution network, strong brand equity, and economies of scale. These factors enable the company to reach a broad customer base and maintain a competitive position in the apparel industry. The company's ability to adapt to changing consumer preferences and invest in innovation is critical for long-term success.

- Diverse Brand Portfolio: Catering to various customer segments.

- Global Footprint: Extensive distribution network.

- Brand Recognition: High customer loyalty.

- Economies of Scale: Cost advantages in sourcing and production.

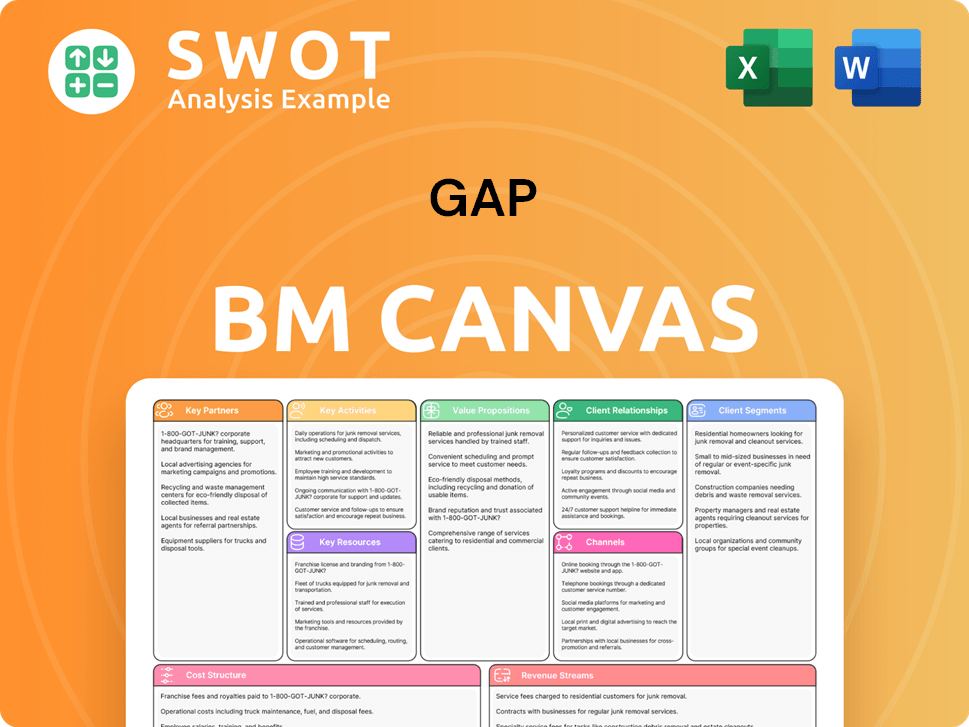

Gap Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Gap’s Competitive Landscape?

The apparel retail industry is experiencing significant shifts driven by technological advancements, changing consumer preferences, and the rise of e-commerce. This dynamic environment presents both challenges and opportunities for companies like Gap Inc. Adapting to these trends is crucial for maintaining a competitive edge in the retail market.

Gap Inc. faces the ongoing need to balance its established physical retail presence with the rapid growth of online sales. The company must also navigate the complexities of supply chain management, evolving consumer demands for sustainability, and increased competition from fast-fashion brands. Understanding these challenges is vital for effective Gap market analysis and strategic planning.

The apparel industry is seeing a surge in online shopping, accelerated by recent global events. Consumer demand for sustainable and ethically produced clothing is increasing. There's a growing emphasis on comfort and versatility in clothing styles.

Adapting to fast-changing fashion cycles and consumer demands is a key challenge. Managing a large physical retail footprint while competing with agile online retailers is crucial. Regulatory changes related to labor practices and environmental impact add complexity.

Emerging markets offer growth potential due to rising disposable incomes. Product innovation, especially in sustainable materials, could create new revenue streams. Strategic partnerships can enhance digital capabilities and market reach.

Gap Inc. is focusing on accelerating its digital transformation, managing its brand portfolio effectively, and innovating to meet evolving consumer values. Efficiency and agility are key to remaining competitive in the dynamic market. A Brief History of Gap provides additional context.

To thrive, Gap Inc. needs to strengthen its digital presence and supply chain. The company must also focus on brand portfolio management and innovation. Sustainability and ethical sourcing are increasingly important to consumers, which requires attention.

- Digital Transformation: Enhance e-commerce platforms and customer experience.

- Brand Portfolio: Optimize the performance of brands like Athleta, Old Navy, and Gap.

- Supply Chain: Improve efficiency and responsiveness to meet changing demands.

- Sustainability: Focus on sustainable materials and ethical production practices.

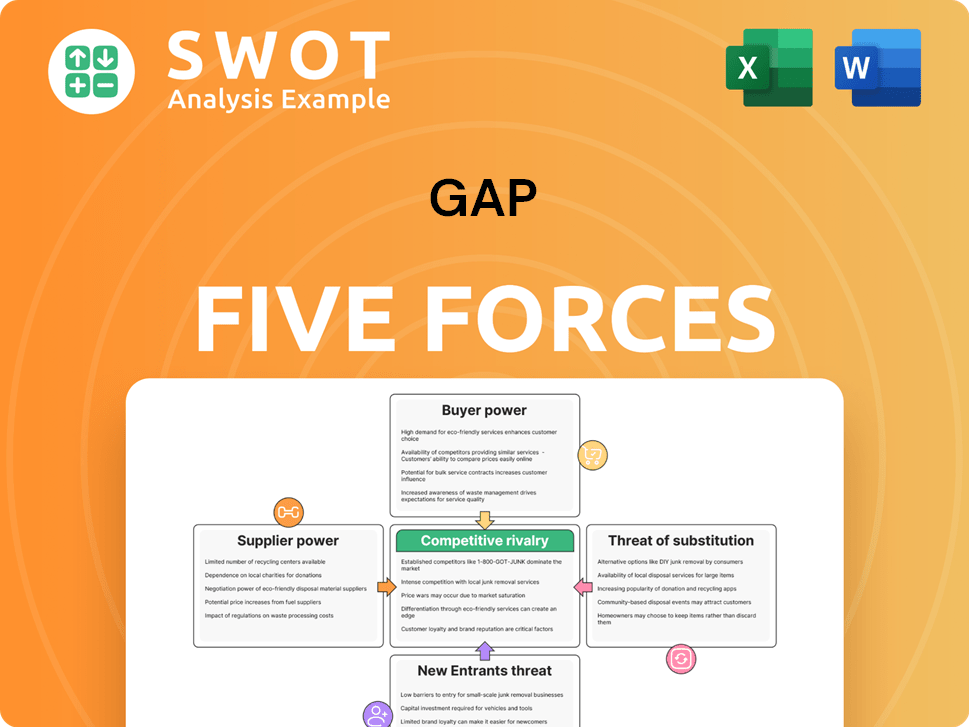

Gap Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gap Company?

- What is Growth Strategy and Future Prospects of Gap Company?

- How Does Gap Company Work?

- What is Sales and Marketing Strategy of Gap Company?

- What is Brief History of Gap Company?

- Who Owns Gap Company?

- What is Customer Demographics and Target Market of Gap Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.