Gap Bundle

Can Gap Inc. Reclaim Its Retail Throne?

In a world where trends shift faster than seasons, understanding a company's Gap SWOT Analysis is crucial to predict its trajectory. Gap Inc., a retail giant since 1969, has embarked on a strategic journey to redefine its place in the market. This exploration dives into the Gap growth strategy and the company's ambitious plans for the future.

From its humble beginnings, Gap Inc. has evolved into a global powerhouse, but what are the Gap future prospects amidst fierce competition? This analysis will dissect the Gap company analysis, examining its Gap business model, exploring its Gap market share, and assessing its Gap financial performance to provide a comprehensive view of its potential for growth, considering factors like Gap's expansion plans in Asia and its Gap's online sales strategy.

How Is Gap Expanding Its Reach?

The company is actively pursuing several expansion initiatives to drive future growth. A key element of its Gap growth strategy involves optimizing its store footprint, including opening new Old Navy and Athleta stores, while rightsizing its Gap and Banana Republic presence. This strategic approach aims to enhance accessibility and meet evolving consumer preferences.

This expansion is part of a broader effort to strengthen its position in the North American market and strategically evaluate international opportunities. The company's focus on its power brands, Old Navy and Athleta, is driven by their consistent performance and potential for market share gains. These initiatives are designed to access new customer demographics, enhance brand visibility, and adapt to evolving retail consumption patterns, contributing to the overall Gap future prospects.

The company's approach includes exploring new business models, such as partnerships with financial services companies to offer co-branded credit cards, diversifying revenue streams beyond traditional retail. This diversification strategy aligns with the evolving retail landscape and aims to capture a broader customer base.

In fiscal year 2023, Old Navy opened 10 new stores, and Athleta opened 5 new stores. The company plans to open approximately 30-40 new Old Navy and Athleta stores in fiscal year 2024. These new locations are predominantly off-mall to enhance customer accessibility.

The focus remains on strengthening the North American market position while strategically evaluating international opportunities. E-commerce channels and franchise partnerships play a crucial role in this global strategy. The company leverages its strong online presence to reach a wider audience.

Athleta continues to innovate in activewear and wellness, catering to a growing consumer segment. The company's focus is on its power brands, Old Navy and Athleta, driven by their consistent performance. This brand-centric approach aims to maximize market share and customer loyalty.

The company is exploring new business models, such as partnerships with financial services companies for co-branded credit cards. This diversification strategy aims to enhance revenue streams and customer engagement. These initiatives support the overall Gap business model.

These initiatives are designed to access new customer demographics, enhance brand visibility, and adapt to evolving retail consumption patterns. The company's strategic moves, including expansion and diversification, are critical for maintaining a competitive edge in the apparel industry. For more information on the company's financial structure, you can read about Owners & Shareholders of Gap.

The company's expansion plans are focused on optimizing store locations and leveraging strong brands. The strategy includes opening new stores for Old Navy and Athleta while rightsizing the presence of other brands. This approach is designed to meet customer demand effectively.

- Off-mall store locations to enhance accessibility.

- Focus on e-commerce and franchise partnerships for international growth.

- Innovation in product categories, particularly within Athleta.

- Exploration of new business models, like co-branded credit cards.

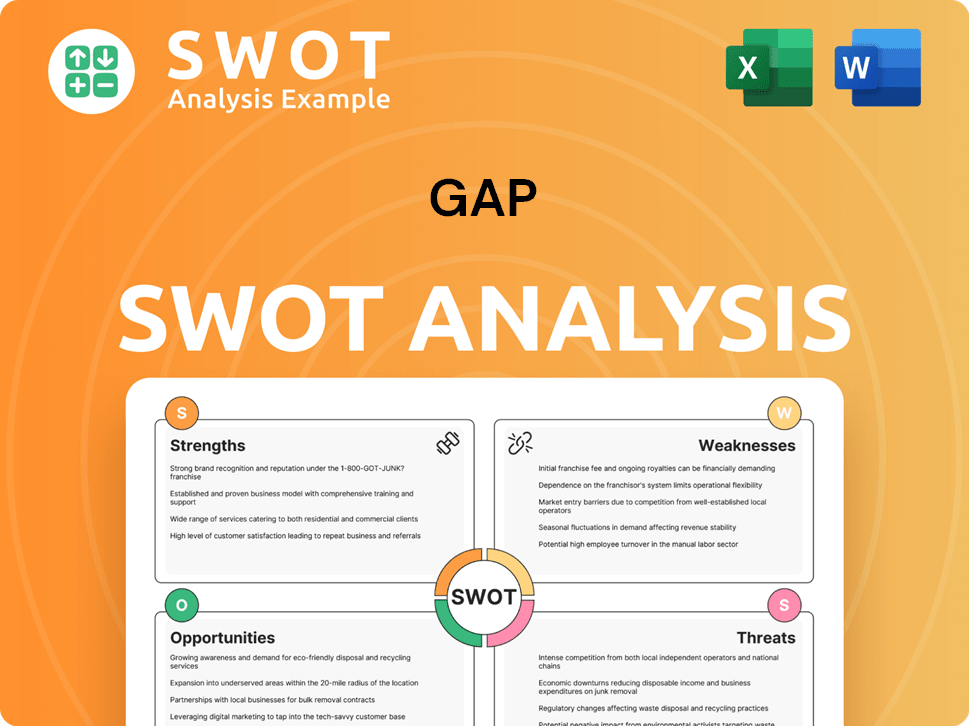

Gap SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gap Invest in Innovation?

The company is actively using technology and innovation to drive its growth strategy. This includes significant investments in digital transformation across its operations. The goal is to enhance customer experiences and optimize the supply chain.

The company is focusing on creating a seamless omnichannel experience. This involves integrating online and in-store shopping. The company is also working on improving inventory management and fulfillment capabilities.

The company's approach to innovation is also intertwined with sustainability initiatives. They are working to improve material sourcing and supply chain transparency. This aligns with the growing consumer demand for ethical and environmentally conscious products.

The company is enhancing its e-commerce platforms to create a seamless experience. This includes integrating online and in-store shopping. The focus is on improving customer engagement and conversion rates through continuous updates to mobile apps and online features.

The company is exploring the use of AI and data analytics. This is to personalize customer recommendations and optimize pricing strategies. The aim is to better understand consumer behavior and tailor offerings.

The company is investing in supply chain optimization. This includes improving inventory management systems and fulfillment capabilities. The goal is to support faster delivery and better stock accuracy.

The company is integrating sustainability into its innovation strategy. This involves efforts to improve material sourcing and supply chain transparency. This aligns with growing consumer demand for ethical products.

The company is continuously updating its mobile apps and online features. This is to enhance customer engagement and conversion rates. The company is focused on digital innovation.

The company has implemented improved inventory management systems. This helps with faster delivery and better stock accuracy. This is a key part of the company's supply chain optimization efforts.

The company's digital transformation efforts are crucial for its Gap growth strategy. The use of AI and data analytics helps in understanding consumer behavior. The focus on sustainability also aligns with current market trends. For more insights into the company's target audience, you can read about the Target Market of Gap.

The company's Gap future prospects are closely tied to its ability to innovate. Key areas of focus include:

- Enhancing e-commerce platforms and omnichannel experiences.

- Utilizing AI and data analytics for personalized customer recommendations.

- Optimizing supply chain management for faster delivery.

- Integrating sustainability initiatives through technological solutions.

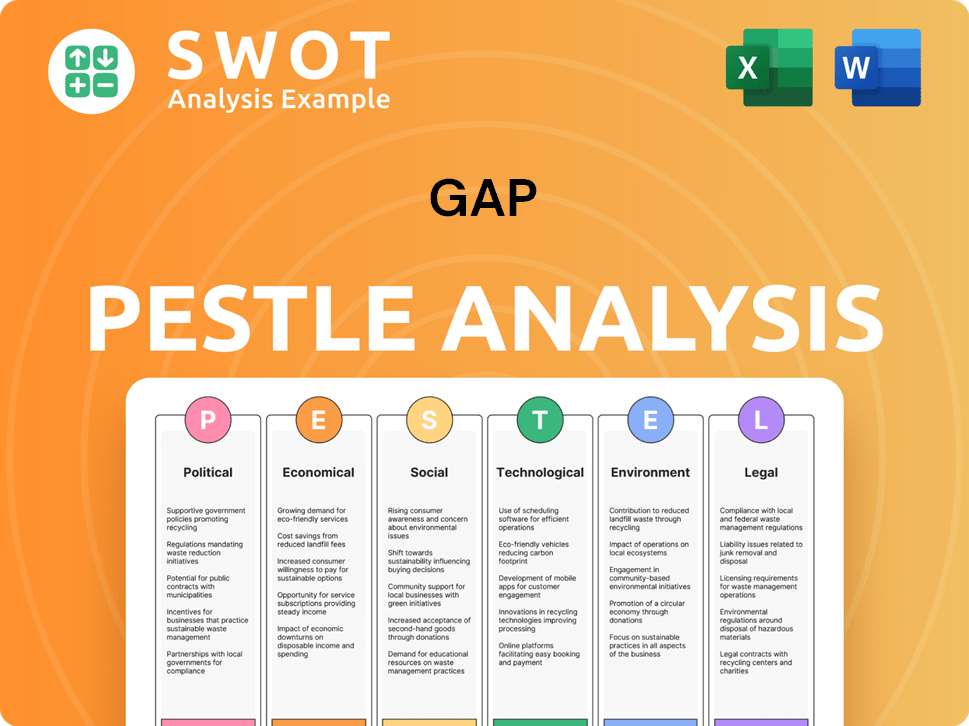

Gap PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Gap’s Growth Forecast?

The financial outlook for Gap Inc. is centered on achieving profitability and sustainable growth, primarily through its established brands. For the fiscal year 2023, the company reported net sales of $14.9 billion. This represents a 5% decrease compared to the previous year, indicating a need for strategic adjustments within the Gap growth strategy.

Despite the sales decrease, Gap Inc. demonstrated improved financial performance in fiscal year 2023. The company significantly enhanced its operating margin, reaching 3.7%, a notable increase from 0.7% in the prior year. This improvement was mainly due to higher merchandise margins and effective cost management, showcasing the company's efforts in optimizing its Gap business model.

Looking ahead to fiscal year 2024, Gap Inc. anticipates net sales to remain relatively flat compared to fiscal year 2023. The company projects an operating income between $500 million and $550 million, with an operating margin expected to be approximately 3.4% to 3.7%. Capital expenditures for fiscal year 2024 are planned to be in the range of $500 million to $525 million, focusing on store modernization, technology investments, and supply chain enhancements. These investments are crucial for improving the company's operational efficiency and supporting its Gap future prospects.

Net Sales: $14.9 billion, Operating Margin: 3.7%, Capital Expenditures: $500 million to $525 million (projected for 2024)

Store modernization, technology investments, and supply chain improvements are key areas of focus. These initiatives are designed to drive operational efficiency and enhance the customer experience, which will be crucial for Gap's e-commerce growth potential.

Gap Inc. aims to increase shareholder value through disciplined financial management. This includes a focus on generating free cash flow and returning capital to shareholders through dividends and share repurchases. Understanding Brief History of Gap can provide context to these strategies.

The company's financial strategies are supported by a healthy balance sheet and a clear plan to leverage its brand portfolio. This approach is designed to create long-term value. Gap's brand positioning strategy is vital for maintaining its market share.

Gap Inc. is focused on improving profitability and managing costs. The company is investing in store upgrades, technology, and supply chain improvements. The company's strategy aims to deliver value to shareholders by managing cash flow and returning capital.

- Flat sales growth expected in 2024.

- Operating margin improvement is a key objective.

- Capital expenditures are focused on strategic investments.

- Shareholder value is a priority through financial discipline.

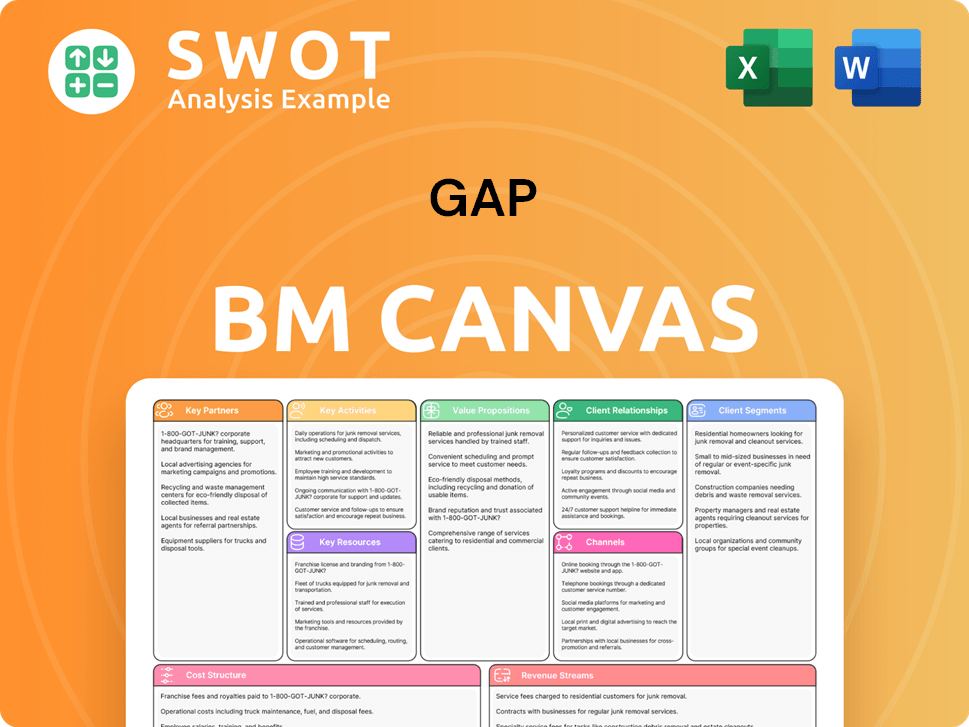

Gap Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Gap’s Growth?

The path to growth for Gap Inc. faces several potential risks and obstacles. Maintaining a strong Gap business model and adapting to market changes are crucial for success. These challenges include competition, regulatory changes, and supply chain vulnerabilities.

Intense competition from both established and emerging brands requires continuous innovation and differentiation. Furthermore, shifts in consumer preferences and macroeconomic factors, such as inflation, significantly impact sales performance. The company's ability to navigate these issues will determine its future prospects.

Technological disruption, including the rapid evolution of e-commerce, necessitates ongoing investment and adaptation. Internal resource constraints, like talent acquisition, and shifts in consumer spending habits, can also hinder growth. Ongoing efforts in risk management frameworks and scenario planning are vital for Gap Inc. to prepare for these evolving challenges.

The apparel industry is highly competitive, with numerous players vying for Gap market share. Direct-to-consumer brands and fast-fashion retailers pose significant challenges. The company must continually innovate its product design and brand positioning strategy to stay ahead.

Supply chain vulnerabilities can lead to inventory issues and increased expenses. Recent global disruptions have highlighted these risks. The company mitigates these risks by diversifying sourcing strategies and investing in supply chain resilience and supply chain management.

Macroeconomic factors, such as inflation and changes in consumer spending habits, can significantly impact sales. The company must adapt its pricing and inventory strategies to manage these pressures. Gap's recent financial results are closely tied to these economic conditions.

The rapid evolution of e-commerce and new retail technologies requires continuous investment. The company needs to prioritize digital transformation and leverage data analytics. This includes focusing on Gap's online sales strategy and e-commerce growth potential.

Changes in regulations, particularly concerning international trade and labor practices, could impact supply chain costs. These changes may affect operational flexibility. The company needs to monitor and adapt to these evolving regulatory landscapes.

Talent acquisition and retention in a competitive labor market can hinder growth initiatives. The company must focus on attracting and retaining skilled employees. This can impact the execution of Gap's expansion plans in Asia and other international market strategies.

Gap Inc. employs various strategies to mitigate risks. These include supply chain diversification, investment in digital transformation, and data analytics. The company also focuses on brand positioning and customer loyalty programs to retain and attract customers. These measures are crucial for sustaining Gap's future prospects and ensuring long-term financial performance.

The apparel industry is highly competitive, with players like H&M, Zara, and online retailers. Understanding the Gap's competitive landscape in the apparel industry is vital for strategic planning. The company must differentiate itself through product design, customer experience, and effective marketing. This includes analyzing Gap's target market demographics to tailor offerings.

Gap Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.