Gap Bundle

How Does the Gap Company Thrive in Today's Market?

Gap Inc., a global leader in the fashion industry, has consistently adapted to the ever-evolving retail business landscape. From its humble beginnings, the Gap brand has expanded its reach, evolving into a multi-brand powerhouse. With a diverse portfolio including Old Navy, Banana Republic, and Athleta, Gap Inc. continues to be a significant player in the clothing retailer sector.

This deep dive into Gap Inc. explores its core operations, revenue streams, and strategic positioning within the competitive fashion industry. Understanding the Gap SWOT Analysis is crucial to deciphering the company's strengths, weaknesses, opportunities, and threats. Learn how this retail giant navigates challenges and capitalizes on market trends to maintain its position.

What Are the Key Operations Driving Gap’s Success?

Gap Inc. operates as a multi-brand clothing retailer, delivering value through a portfolio that includes Old Navy, Banana Republic, and Athleta, alongside the namesake Gap brand. Each brand targets distinct customer segments, offering unique value propositions from affordable family apparel to premium fashion and performance activewear. This diversified approach allows Gap Inc. to cater to a broad customer base, from budget-conscious shoppers to fashion-forward individuals.

The core operations of the Gap company involve a complex, integrated system. This includes global sourcing and manufacturing, emphasizing ethical practices and supply chain transparency. Efficient logistics and distribution are crucial for moving products from factories to distribution centers, stores, and e-commerce platforms. The company leverages a mix of company-operated and franchise stores, alongside robust e-commerce, which accounted for 38% of total net sales in fiscal year 2023.

The company's business model is centered around providing diverse product offerings and convenient shopping experiences across multiple channels. A look at the brief history of Gap reveals the evolution of the company's strategies. Gap Inc. differentiates itself through its ability to manage a diverse portfolio of brands under a centralized operational framework, optimizing sourcing, logistics, and technology while maintaining brand autonomy, which translates into tailored value for specific lifestyle needs.

Gap Inc. operates a multi-brand portfolio, each catering to different customer segments. This includes the Gap brand, Old Navy, Banana Republic, and Athleta. Each brand has a unique value proposition, from affordable family apparel to premium fashion and activewear.

Key operational processes include global sourcing, manufacturing, logistics, and distribution. The company emphasizes ethical practices and supply chain transparency. E-commerce platforms are central to the strategy, with online sales contributing significantly to total revenue.

The company offers a diverse product range and convenient shopping experiences across multiple channels. This includes company-operated stores, franchise stores, and robust e-commerce platforms. The goal is to provide tailored value to meet specific lifestyle needs.

The value proposition includes diverse product offerings, convenient shopping experiences, and perceived value tailored to specific lifestyle needs. The company aims to balance brand autonomy with centralized operational efficiency. This helps the Gap company to stand out.

Gap Inc.'s operations are characterized by a global supply chain and a multi-channel retail strategy. They focus on ethical sourcing, efficient logistics, and a strong e-commerce presence. The company's ability to manage diverse brands under a centralized framework is a key differentiator.

- Emphasis on ethical sourcing and supply chain transparency.

- Efficient logistics and distribution networks for product movement.

- Significant e-commerce presence contributing to overall sales.

- A diversified brand portfolio targeting various customer segments.

Gap SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gap Make Money?

The primary revenue stream for Gap Inc. comes from selling clothing, accessories, and personal care products across its various brands. Sales are generated through company-operated stores, franchise stores, and e-commerce platforms. The company's financial success hinges on effectively managing these diverse sales channels and adapting to changing consumer preferences.

For the fiscal year ending February 3, 2024, Gap Inc. reported net sales of $14.9 billion. This figure underscores the substantial scale of the Gap company's operations and its significant presence in the fashion industry. The company's revenue streams are carefully managed to maximize profitability and market share.

A key element of Gap Inc.'s strategy involves direct-to-consumer sales, utilizing traditional retail pricing, promotions, and loyalty programs. E-commerce has become increasingly important, offering wider reach and often higher margins. In fiscal year 2023, online sales accounted for 38% of the total net sales, highlighting the shift towards digital platforms.

Gap Inc.'s revenue is segmented by brand, with Old Navy contributing the most. The Gap brand, Banana Republic, and Athleta also play significant roles. Understanding this breakdown is crucial for assessing the company's overall financial health and performance.

The company uses tiered pricing and cross-selling to boost revenue. E-commerce growth and store footprint streamlining are key strategies. These methods allow the Gap company to maximize revenue per customer.

Online sales represent a significant portion of total revenue. E-commerce offers broader market reach and higher profit margins. This shift towards digital platforms is a key focus area for Gap Inc.

Old Navy's net sales were $8.2 billion in fiscal year 2023, representing 55% of total net sales. Gap brand net sales were $3.4 billion, Banana Republic net sales were $1.8 billion, and Athleta net sales were $1.4 billion. These figures showcase the diverse revenue streams.

Loyalty programs and promotional activities drive customer engagement. Tiered pricing caters to a wide range of budgets. These strategies enhance customer experience and boost sales.

The company continues to strengthen its e-commerce presence. Streamlining the store footprint is a strategic adaptation. These adjustments reflect the evolving retail business landscape.

Gap Inc. focuses on product sales through various channels, including company-operated stores, franchise stores, and e-commerce platforms. The company employs several strategies to maximize its revenue and profitability. For a deeper understanding, it's helpful to consider the Gap company business model explained and how it competes within the Competitors Landscape of Gap.

- Direct-to-consumer sales through retail pricing and promotions.

- E-commerce expansion to increase reach and margins.

- Tiered pricing to cater to a wider consumer base.

- Cross-selling and bundling to encourage additional purchases.

- Continuous optimization of sales channels and customer experience.

Gap PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Gap’s Business Model?

Gap Inc. has navigated the dynamic retail landscape by adapting to consumer preferences and market trends. The company has implemented strategic moves, including store optimization and digital transformation, to enhance profitability and customer experience. These efforts aim to strengthen its position in the competitive fashion industry.

A key focus has been on streamlining its brand portfolio and improving operational efficiency. This involves closing underperforming stores and investing in high-growth brands. Gap Inc. also emphasizes digital capabilities, including e-commerce and data analytics, to meet evolving consumer demands and enhance its retail business.

The company has faced challenges such as supply chain disruptions and intense competition. Its response includes diversifying sourcing, improving inventory management, and enhancing its online presence. These strategies are designed to maintain a competitive edge in the clothing retailer market.

Gap Inc. has a rich history marked by significant milestones. The company has expanded its brand portfolio and global presence over the years. Its evolution reflects its adaptability to changing market dynamics and consumer preferences.

Strategic moves include optimizing store footprints and investing in digital transformation. The company has focused on its core brands, closing underperforming stores. Investment in e-commerce and supply chain technology has been a priority.

Gap Inc.'s competitive advantages include a strong brand portfolio and economies of scale. Its extensive physical store network and robust e-commerce platform provide an omnichannel presence. The company continues to adapt to new trends through sustainability and technological advancements.

In 2024, Gap Inc. reported net sales of approximately $14.9 billion. The company's gross profit margin was around 38.8%. These figures reflect the impact of its strategic initiatives and market conditions. For more detailed insights, you can explore the Gap company's financial performance.

Gap Inc. focuses on brand strength and customer loyalty through its diverse portfolio. Economies of scale in sourcing and distribution provide cost efficiencies. The company's omnichannel presence enhances customer convenience and flexibility.

- Strong Brand Portfolio: Gap and Old Navy provide significant brand strength.

- Omnichannel Presence: Extensive store network and e-commerce platform.

- Adaptation to Trends: Investment in sustainability and new technologies.

- Cost Efficiency: Economies of scale in sourcing and distribution.

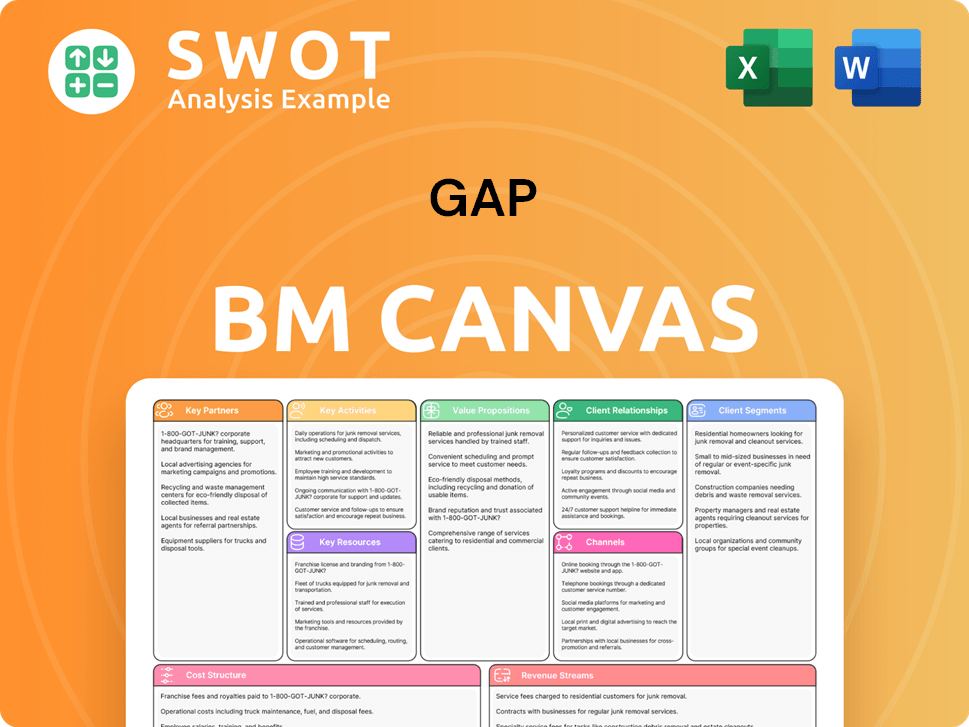

Gap Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Gap Positioning Itself for Continued Success?

Gap Inc., a prominent player in the clothing retailer sector, navigates a competitive landscape. The company's position is influenced by its diverse brand portfolio and global presence, with Old Navy being a significant contributor. However, the fashion industry constantly evolves, requiring Gap Inc. to adapt to shifting consumer preferences and new market entrants. For a deeper understanding of their consumer base, explore the Target Market of Gap.

Several factors pose risks to Gap Inc.'s operations. These include supply chain disruptions, regulatory changes concerning labor and environmental standards, and the emergence of digitally native competitors. Economic downturns and inflationary pressures also impact consumer spending, directly affecting the company's sales. Addressing these challenges requires strategic agility and a focus on operational efficiency.

Gap Inc. competes within the global apparel market, facing competition from various retailers. Its brand portfolio and global reach offer a significant market share. Old Navy's performance is key to Gap Inc.'s overall market presence.

Supply chain volatility, regulatory changes, and new competitors present risks. Consumer preference shifts and economic downturns also pose challenges. These factors require continuous adaptation and strategic responses.

The future involves optimizing the brand portfolio, strengthening omnichannel capabilities, and improving operational efficiency. Digital platforms will drive growth, and innovation in product design and sustainability is crucial. The company aims for profitable growth.

Gap Inc. focuses on profitable growth through inventory management and strategic marketing. In the fourth quarter of fiscal year 2023, the company reported an operating income of $283 million. This indicates a focus on financial health.

Gap Inc. is concentrating on several strategic initiatives to drive growth and profitability. These initiatives include optimizing its brand portfolio, enhancing its omnichannel capabilities, and improving operational efficiency. The company is leveraging its digital platforms to personalize the customer experience.

- Focus on profitable growth.

- Enhancing the customer experience.

- Adapting product offerings to meet consumer demands.

- Improving inventory management.

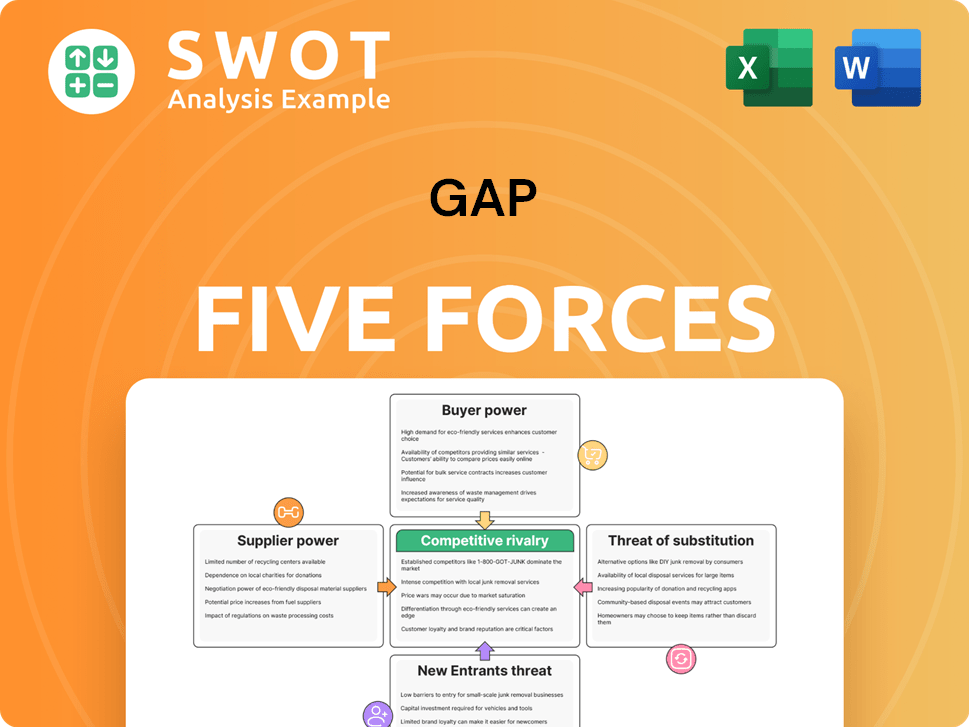

Gap Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gap Company?

- What is Competitive Landscape of Gap Company?

- What is Growth Strategy and Future Prospects of Gap Company?

- What is Sales and Marketing Strategy of Gap Company?

- What is Brief History of Gap Company?

- Who Owns Gap Company?

- What is Customer Demographics and Target Market of Gap Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.