Gap Bundle

Who Really Owns Gap Inc.?

Ever wondered who's truly steering the ship at Gap Inc.? Understanding the Gap SWOT Analysis is key to grasping its trajectory. From its humble beginnings in 1969, Gap has evolved into a retail giant. This exploration dives deep into the ownership dynamics.

Knowing "Who owns Gap" is vital for investors and anyone interested in the Gap brand. Gap Inc., a publicly traded company, has a complex ownership structure. This article breaks down the evolution of Gap's ownership, from its founders to today's key players. We will explore how these ownership changes impact Gap's strategic direction and financial performance.

Who Founded Gap?

The story of Gap Inc. began on August 21, 1969, with Donald Fisher and Doris F. Fisher at the helm. The initial concept was born from Donald Fisher's frustration in finding well-fitting jeans, leading to the establishment of the first store in San Francisco, California.

This initial venture, located on Ocean Avenue, offered a unique mix of Levi's jeans and LP records, targeting a teenage demographic. This strategy proved successful, and the company quickly expanded.

By 1973, Gap had grown to 25 stores across the U.S., marking the early stages of its retail presence. The company's evolution included a shift towards private-label clothing in 1974, diversifying its offerings beyond third-party brands.

Donald and Doris F. Fisher founded Gap Inc. in 1969 in San Francisco, California. The first store was located on Ocean Avenue.

The initial focus was on selling Levi's jeans and LP records. This strategy targeted teenage customers and proved immediately successful.

Gap Inc. expanded rapidly in its early years, with a second store opening in San Jose by 1970. By 1973, it had grown to 25 locations across the U.S.

In 1974, Gap began developing its own private-label clothing line. This marked a shift away from solely selling third-party brands.

Gap Inc. went public in 1976, offering 1.2 million shares. This was a crucial step in diversifying ownership beyond the founding family.

The Fisher family has maintained a substantial collective ownership stake and deep involvement in the company since its inception.

The early years of Gap Inc. saw rapid expansion and strategic shifts, including the move to private-label clothing and going public. The Fisher family's continued involvement has been a constant throughout. The company's initial success was driven by a unique retail concept that resonated with its target audience. For more details on the company's strategic moves, you can read about the Growth Strategy of Gap.

- Donald Fisher, a real estate developer, founded Gap after struggling to find well-fitting jeans.

- The first store's success led to rapid expansion, with 25 stores by 1973.

- In 1976, Gap Inc. went public, diversifying its ownership.

- The Fisher family has maintained significant ownership and influence.

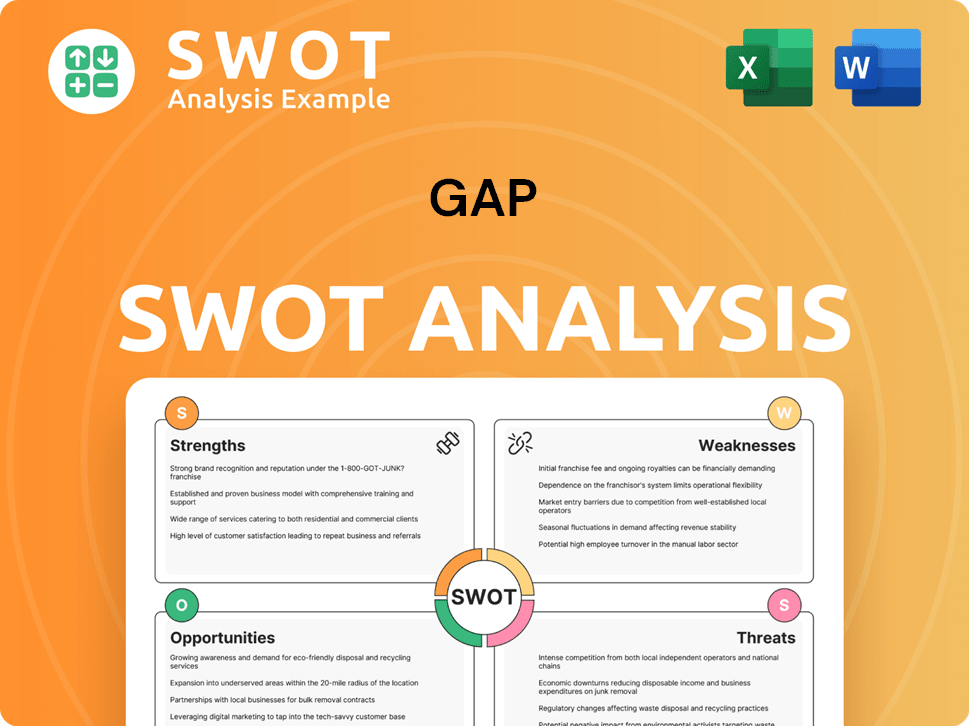

Gap SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Gap’s Ownership Changed Over Time?

The evolution of Gap Inc.'s ownership reflects its journey from a private startup to a publicly traded global retailer. The company went public in 1976, marking a significant shift in its ownership structure. The Fisher family, who founded the company, has maintained considerable influence over the years. This transition has been marked by strategic decisions, including acquisitions and brand launches, reflecting the dynamic interplay between ownership, market trends, and corporate strategy. The Brief History of Gap provides further insights into the company's early days and growth.

The enduring presence of the Fisher family, coupled with the increasing influence of institutional investors, shapes the company's strategic direction. The company's history of acquisitions, such as Banana Republic in 1997, and the establishment of brands like Old Navy in 1994, illustrate how ownership structure and market dynamics influence Gap's strategic decisions. The company's stock performance and market share also play a crucial role in the decisions of shareholders.

| Ownership Category | As of January 2024 | As of April 2025 |

|---|---|---|

| William Sydney Fisher | Approximately 26.07% | Not Available |

| John J. Fisher | Approximately 24.58% | Not Available |

| Institutional Investors | Not Available | 64.58% |

The ownership structure of Gap Inc. is a mix of family control and institutional investment. As of April 2025, institutional investors hold a significant portion of the company's shares. Key institutional shareholders include Dodge & Cox (7.70%), Vanguard Group Inc. (6.80%), and BlackRock, Inc. (5.67%). The Fisher family, however, maintains a substantial stake, ensuring their continued influence on the company's direction.

The ownership of Gap Inc. is a blend of family and institutional investors, with the Fisher family holding considerable influence.

- William Sydney Fisher held approximately 26.07% of the company as of January 2024.

- Institutional investors held 64.58% of the shares as of April 2025.

- Major institutional shareholders include Dodge & Cox, Vanguard Group Inc., and BlackRock, Inc.

- Mutual funds increased their holdings from 43.73% to 43.81% in April 2025.

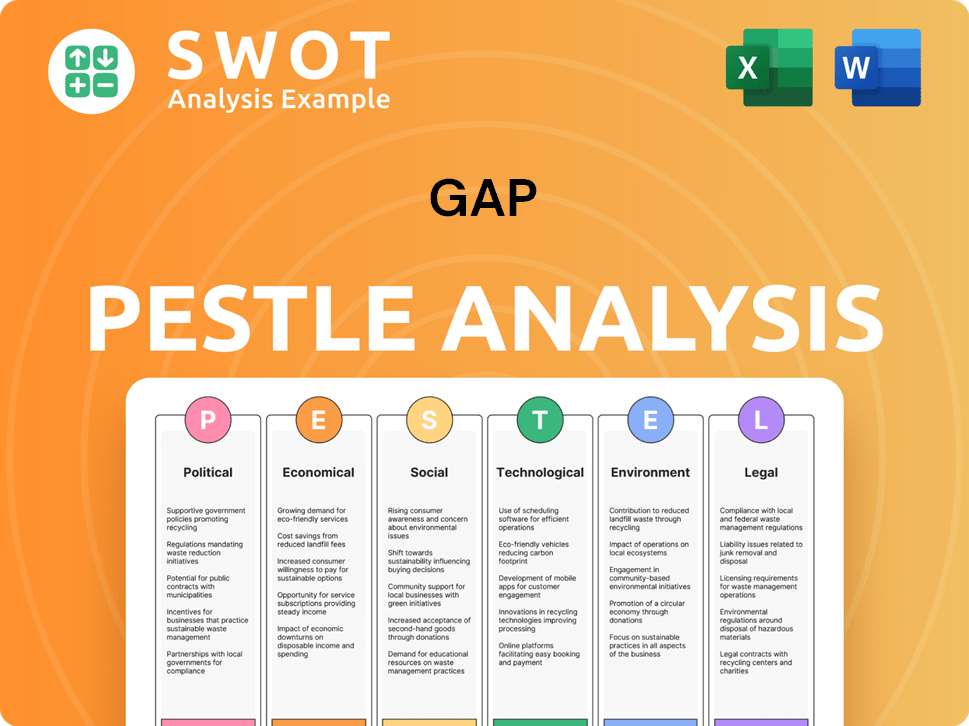

Gap PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Gap’s Board?

As of June 2024, the Board of Directors for Gap Inc. comprises individuals such as Mayo A. Shattuck III, serving as Chair of the Board, and Richard Dickson, who is the CEO. Other board members include Salaam Coleman Smith, Lisa Donohue, Robert J. Fisher, William S. Fisher, Tracy Gardner, Kathryn A. Hall, Amy Miles, Chris O'Neill, and Tariq Shaukat. The presence of Robert J. Fisher and William S. Fisher highlights the continued influence of the founding family, reflecting their significant stake in the company. The board's primary responsibilities include setting strategic direction, overseeing company performance, selecting executives, and approving major investments to ensure the company's long-term success.

The board's structure emphasizes accountability to shareholders through annual elections and majority voting for director elections. The company maintains a board composed of two-thirds independent members, independent board committees, and a separation of the board chair and CEO roles to ensure independence. This structure is designed to ensure transparent and effective corporate governance, which supports shareholder interests and helps drive sustainable business practices. These measures are in place to protect shareholder value and ensure that the company is managed in a responsible and ethical manner.

| Board Member | Title | Key Role |

|---|---|---|

| Mayo A. Shattuck III | Chair of the Board | Oversees board activities and strategic direction. |

| Richard Dickson | CEO | Leads the company's overall operations and strategy. |

| Robert J. Fisher | Director | Represents the founding family's continued influence. |

The voting structure at Gap Inc. generally follows a one-share-one-vote system for common stock. As of March 21, 2025, there were 376,603,723 shares of common stock outstanding, each entitled to one vote. While the company's Certificate of Incorporation allows for a Class B common stock with two votes per share, no such shares have been issued, and the company is not permitted to issue them as long as its common stock is listed on the New York Stock Exchange. This structure ensures that the majority voting standard applies for director elections, as outlined in the company's bylaws. Understanding the Revenue Streams & Business Model of Gap is crucial for investors.

The Board of Directors plays a crucial role in Gap Inc.'s strategic direction and performance oversight.

- The board ensures accountability through annual elections and independent board members.

- Voting structure is primarily one-share-one-vote for common stock.

- The company's bylaws dictate the voting process for director elections.

- The company's governance structure supports shareholder interests.

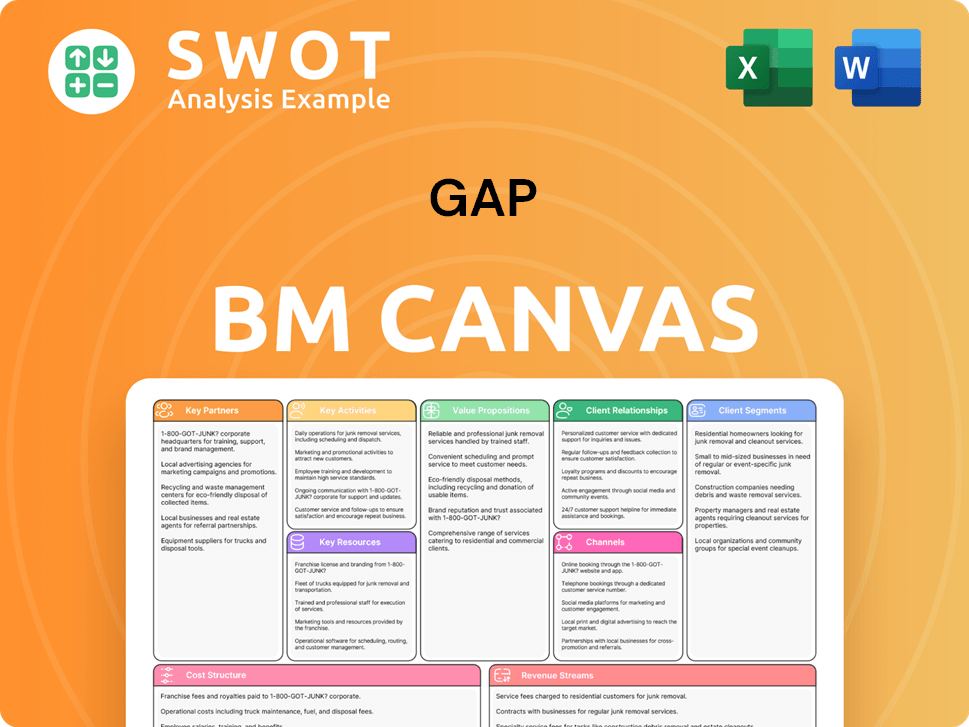

Gap Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Gap’s Ownership Landscape?

Over the past few years, Gap Inc. has actively managed its capital and ownership structure. In fiscal year 2024, the company repurchased approximately 3 million shares for around $75 million. This brought the total outstanding shares to 374 million at the end of the fiscal year. Additionally, Gap Inc. distributed $300 million to shareholders through dividends and share repurchases during the same period. The Board of Directors approved a first-quarter fiscal year 2025 dividend of $0.165 per share, a 10% increase from the prior quarter. As of May 3, 2025, Gap had about $374 million available for share repurchases and bought back $70 million in shares in the first quarter of fiscal 2025.

Leadership changes also played a role. Richard Dickson became President and Chief Executive Officer of Gap Inc. in August 2023. In February 2024, Zac Posen was appointed Creative Director of Gap Inc. and Chief Creative Officer for Old Navy, signaling strategic efforts to revitalize the Gap brand. These moves reflect Gap Inc.'s ongoing efforts to adapt and strengthen its market position.

| Metric | Details | Date |

|---|---|---|

| Share Repurchases (Fiscal Year 2024) | 3 million shares for $75 million | Fiscal Year 2024 |

| Outstanding Shares (End of Fiscal Year 2024) | 374 million | End of Fiscal Year 2024 |

| Shareholder Distributions (Fiscal Year 2024) | $300 million | Fiscal Year 2024 |

| Q1 2025 Dividend | $0.165 per share | Approved for Q1 2025 |

| Share Repurchase Authorization (May 3, 2025) | Approximately $374 million | May 3, 2025 |

| Shares Repurchased (Q1 Fiscal Year 2025) | $70 million | Q1 Fiscal Year 2025 |

Institutional investors are holding a larger stake in the company. As of April 2025, institutional investors held 64.58% of Gap Inc. This trend aligns with industry-wide patterns and may impact corporate governance. While the Fisher family remains a significant shareholder, the increased presence of institutional investors contributes to a more diverse ownership structure. Gap Inc. aims to continue delivering long-term value for its shareholders, focusing on becoming a high-performing house of iconic American brands. To understand more about their target market, you can read about the Target Market of Gap.

Gap Inc. is a publicly traded company, so its ownership is distributed among various shareholders, including institutional investors and the Fisher family.

The ownership structure includes a mix of institutional investors, individual shareholders, and the Fisher family, who hold a significant stake.

Founded in 1969, Gap Inc. has grown to include several well-known brands. The company has evolved over the years, adapting to changing market trends.

The Gap brand portfolio includes the Gap brand, Old Navy, Banana Republic, and Athleta, among others, each targeting different market segments.

Gap Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gap Company?

- What is Competitive Landscape of Gap Company?

- What is Growth Strategy and Future Prospects of Gap Company?

- How Does Gap Company Work?

- What is Sales and Marketing Strategy of Gap Company?

- What is Brief History of Gap Company?

- What is Customer Demographics and Target Market of Gap Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.