Tenet Health Bundle

How Does Tenet Health Stack Up in Today's Healthcare Market?

The healthcare industry is a battlefield of innovation, regulation, and patient demand. Tenet Healthcare Corporation, a long-standing player, navigates this complex terrain, facing both opportunities and intense competition. Founded in 1969, Tenet has evolved from a hospital operator to a diversified healthcare services company. Understanding its position is crucial for anyone invested in the Tenet Health SWOT Analysis.

This exploration delves into the Tenet Health competitive landscape, providing a detailed market analysis of its rivals and strategic positioning within the healthcare market. We'll examine its competitive advantages and the broader trends shaping the future of the hospital industry and healthcare providers.

Where Does Tenet Health’ Stand in the Current Market?

Tenet Healthcare Corporation holds a significant position within the U.S. healthcare market, primarily through its acute care hospitals and a vast network of ambulatory surgery centers (ASCs) operated by United Surgical Partners International (USPI). This dual approach allows Tenet to serve a broad range of patient needs, from critical care to outpatient procedures. The company's strategic focus on both hospital-based services and the expanding outpatient sector, especially through USPI, reflects its adaptability to industry trends.

In fiscal year 2023, Tenet reported net operating revenues of $20.5 billion, demonstrating its substantial scale and market presence. The contribution from USPI is particularly noteworthy, with its adjusted EBITDA reaching $1.3 billion in 2023. This financial performance highlights the importance of USPI to Tenet's overall success and its strategic shift toward higher-growth, less capital-intensive ambulatory care.

Tenet's primary product lines include a wide array of medical and surgical services offered through its hospitals, complemented by a growing emphasis on outpatient services provided via its ASCs. Geographically, Tenet has a strong presence in key regions such as California, Florida, and Texas. The company caters to a diverse customer segment, from general medical and surgical patients to those requiring specialized care in its hospitals and outpatient centers. For a deeper understanding of how Tenet generates revenue, explore Revenue Streams & Business Model of Tenet Health.

Tenet's market share varies across different service lines and geographic locations. However, its substantial revenue of $20.5 billion in 2023 underscores its position as a major player in the hospital industry and healthcare market. This revenue figure reflects the company's ability to capture a significant portion of healthcare spending across the regions it serves.

USPI's adjusted EBITDA of $1.3 billion in 2023 highlights its crucial role in Tenet's financial success. The expansion of USPI's facility count is a key element of Tenet's strategy, aligning with the industry's shift towards value-based care and cost-effective outpatient settings. This strategic focus allows Tenet to capitalize on the growing demand for ambulatory services.

Tenet's strong presence in states like California, Florida, and Texas is a strategic advantage. These regions have large populations and significant healthcare needs, providing a robust customer base. This geographic concentration allows Tenet to optimize its resources and tailor its services to meet the specific demands of these key markets.

Tenet serves a broad range of customer segments, from general medical and surgical patients to those requiring specialized care. This diverse patient base allows Tenet to capture a wide spectrum of healthcare needs, ensuring a steady flow of patients across its facilities. The ability to cater to various patient needs is a key factor in maintaining its competitive advantage.

Tenet's strategic shift towards ambulatory care, particularly through USPI, reflects a broader industry trend. This move is driven by the demand for value-based care and cost-effective outpatient settings. This strategic focus positions Tenet well for future growth in the healthcare market.

- Emphasis on outpatient services.

- Expansion of USPI's facility count.

- Alignment with value-based care models.

- Cost-effective healthcare solutions.

Tenet Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Tenet Health?

The competitive landscape for Tenet Health is multifaceted, encompassing direct and indirect rivals across its various business segments. Understanding this landscape is crucial for a comprehensive market analysis of Tenet Health and its position within the broader healthcare market. The company faces competition in both the acute care hospital sector and the ambulatory surgery center (ASC) market, as well as from indirect sources like academic medical centers and telehealth providers.

This competitive environment is dynamic, shaped by mergers, acquisitions, and the continuous evolution of healthcare delivery models. Analyzing Tenet Health's competitors list and their strategies provides insights into the challenges and opportunities the company faces. Factors such as geographic reach, service offerings, and technological advancements play significant roles in determining the competitive edge of each player.

Analyzing Tenet Health's financial performance and its strategic initiatives requires a deep dive into its competitive positioning. For example, Tenet Health's market share in specific regions and service lines is directly impacted by the actions of its competitors. This chapter will detail the key players and the competitive dynamics shaping Tenet Health's business.

Tenet Health competes directly with other large investor-owned hospital systems. These competitors have extensive hospital networks and significant financial resources. Their strategies often involve expanding service offerings and investing in advanced technologies.

HCA Healthcare is a major competitor due to its vast network and market capitalization. Community Health Systems (CHS) and Universal Health Services (UHS) also pose significant competition. These companies often compete on factors such as geographic presence and service diversification.

Tenet Health's USPI subsidiary competes within the ASC market. This market is experiencing rapid growth, with various players vying for market share. Competition is fierce, with factors such as physician recruitment and patient convenience playing key roles.

AmSurg (a subsidiary of Envision Healthcare) is a significant competitor in the ASC space. SurgCenter Development also competes, along with physician-owned centers and hospital-affiliated outpatient facilities. Competition focuses on specialized services and patient experience.

Indirect competition for Tenet Health comes from academic medical centers, non-profit hospital systems, and integrated delivery networks (IDNs). These entities offer a wide array of healthcare services. The rise of telehealth and digital health also presents a challenge.

Mergers and acquisitions continuously reshape the competitive landscape. Larger, more consolidated competitors emerge, increasing market power. These changes influence Tenet Health's ability to compete effectively.

Tenet Health's ability to maintain and grow its market share depends on several factors. These include its ability to adapt to changing healthcare delivery models, invest in technology, and form strategic partnerships. The company must also navigate regulatory changes and evolving patient preferences.

- Geographic Presence: Tenet Health's geographic footprint, including its presence in key states like Texas and Florida, influences its competitive position.

- Service Offerings: The breadth and depth of services offered, from acute care to outpatient procedures, are critical.

- Technological Investments: Investments in electronic health records, telehealth, and other technologies are vital for efficiency and patient care.

- Strategic Partnerships: Collaborations with other healthcare providers and technology companies can enhance competitiveness.

- Regulatory Compliance: Navigating the complex web of healthcare regulations is essential for success.

For more details on Tenet Health's strategic direction, including its growth strategies and recent acquisitions, see Growth Strategy of Tenet Health.

Tenet Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Tenet Health a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Tenet Health requires a deep dive into its strengths and strategic positioning within the healthcare market. Marketing Strategy of Tenet Health plays a crucial role in its success, influencing its market share and financial performance. This analysis considers the hospital industry's dynamics, market analysis, and the strategies employed by healthcare providers to maintain a competitive edge.

Tenet Health's competitive advantages are multifaceted, enabling it to navigate the complexities of the healthcare market effectively. Its diversified portfolio, particularly the robust performance of United Surgical Partners International (USPI), is a key differentiator. USPI, a leading operator of ambulatory surgery centers, benefits from the industry's shift towards outpatient care, providing a stable revenue stream less susceptible to the volatility of acute care hospital operations.

The company's geographic footprint and scale also provide significant advantages. Operating hospitals and outpatient centers across numerous states allows for economies of scale in purchasing, shared services, and best practice implementation. This broad presence allows Tenet to cater to diverse patient populations and adapt to regional healthcare demands, contributing to its industry position.

USPI's strong performance, driven by the growth in outpatient services, provides a stable revenue stream. This diversification helps mitigate risks associated with the hospital industry's fluctuations. Tenet's strategic focus on outpatient care aligns with industry trends, enhancing its competitive edge.

Operating across multiple states allows Tenet to leverage economies of scale. This broad presence facilitates adaptation to regional healthcare demands and diverse patient populations. Established brand recognition and relationships with healthcare professionals enhance patient volume.

Tenet's focus on operational efficiency, particularly within its hospital segment, helps maintain profitability. Investments in technology and data analytics improve patient outcomes and operational workflows. These efforts contribute to a sustainable competitive advantage.

Tenet's strategic partnerships and acquisitions support its growth strategies. These moves enhance its market position and expand its service offerings. Recent acquisitions and partnerships showcase Tenet's commitment to innovation.

Tenet Health's competitive advantages include a diversified portfolio, geographic scale, and operational efficiency. These strengths position the company well within the healthcare market, allowing it to adapt to evolving industry dynamics.

- Diversified Portfolio: USPI's strong performance and outpatient focus.

- Geographic Footprint: Economies of scale and regional adaptation.

- Operational Efficiency: Cost management and technology investments.

- Strategic Partnerships: Supporting growth and market expansion.

Tenet Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Tenet Health’s Competitive Landscape?

The healthcare market is currently experiencing a significant transformation, driven by technological advancements, regulatory changes, and evolving consumer preferences. These factors influence the competitive landscape for companies like Tenet Health. The shift towards value-based care and the growing demand for convenient healthcare services are reshaping the industry, creating both challenges and opportunities for healthcare providers.

Tenet Health faces various risks, including rising labor costs, inflationary pressures, and increased competition. However, the company also has opportunities for growth through its outpatient services segment and strategic partnerships. Understanding these trends is critical for assessing Tenet Health's industry position and future outlook.

Technological advancements, such as AI in diagnostics and telemedicine, are reshaping healthcare delivery. Regulatory changes, particularly concerning reimbursement models, impact revenue streams. The shift towards value-based care, where providers are reimbursed based on patient outcomes, is another significant trend. These trends influence the hospital industry and the broader healthcare market.

Managing rising labor costs and navigating inflationary pressures on supplies are key challenges. Increased scrutiny over healthcare costs and potential government regulation pose ongoing threats. Aggressive competition from traditional rivals and new entrants, including tech companies, could impact Tenet Health's market share.

Continued expansion of the USPI segment, both organically and through acquisitions, remains a growth driver. Investing in digital health solutions like telehealth can enhance patient access. Partnerships with payers, physician groups, and tech companies can create new revenue streams. The company’s strategic direction is key.

Tenet Health is likely evolving towards a more integrated and outpatient-focused model. The company is leveraging technology and strategic alliances to remain resilient. This approach aims to capitalize on the growing demand for accessible and efficient healthcare services. This is part of the company’s growth strategies.

Tenet Health's ability to adapt to industry changes and capitalize on opportunities will be crucial. Strategic investments in technology and outpatient services will be key. The company's financial performance and competitive advantages will depend on these factors.

- Market Analysis: Understanding the competitive analysis of Tenet Health and its position in the healthcare market is essential.

- Financial Performance: Monitoring Tenet Health's financial performance, including revenue and profitability, is crucial for assessing its success.

- Strategic Partnerships: Forming Tenet Health's strategic partnerships can enhance its capabilities and market reach.

- Regulatory Impact: Assessing the impact of regulations on Tenet Health is vital for understanding future challenges.

For more information, you can review a Brief History of Tenet Health. The company's success will depend on its ability to navigate these trends and challenges effectively. Tenet Health's strategic decisions in response to these industry dynamics will shape its future.

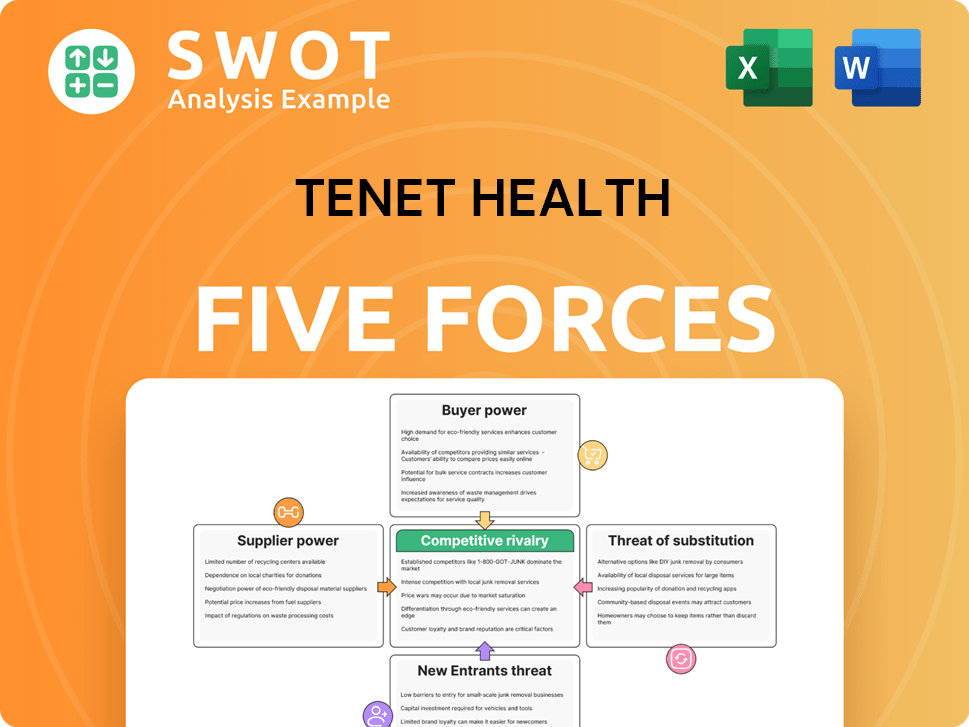

Tenet Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tenet Health Company?

- What is Growth Strategy and Future Prospects of Tenet Health Company?

- How Does Tenet Health Company Work?

- What is Sales and Marketing Strategy of Tenet Health Company?

- What is Brief History of Tenet Health Company?

- Who Owns Tenet Health Company?

- What is Customer Demographics and Target Market of Tenet Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.