Tenet Health Bundle

Who Really Controls Tenet Healthcare?

In the ever-evolving healthcare landscape, understanding the ownership of major players is crucial. Tenet Healthcare, a significant Tenet Health SWOT Analysis, operates hospitals and outpatient facilities across the U.S., making its ownership structure a key factor in its strategic direction. Knowing who owns Tenet Healthcare directly impacts its operational strategies and its commitment to patient care.

This exploration of Tenet Health ownership will delve into the influence of early backers and significant shifts in its shareholder base. We'll examine key investors and the board of directors to understand who controls this major hospital company. Analyzing Tenet ownership provides critical insights into its future trajectory, including potential acquisitions and the company's financial performance, including the Tenet Health stock price.

Who Founded Tenet Health?

The story of Tenet Healthcare, a major hospital company, began in 1967 as National Medical Enterprises (NME). The initial structure involved a group of founders who brought together different skills to establish the company. The early days of Tenet ownership were shaped by these key figures.

The founders of NME included Richard K. Eamer, Leonard Cohen, and John C. Bedrosian. Richard K. Eamer was the first CEO and played a crucial role in the company's early vision. Cohen and Bedrosian were also key to the company's start and initial development. The company's evolution into what we know today as Tenet Health is rooted in these early decisions.

Early financial backing for NME likely came from the founders themselves, along with some private investors and possibly early loans. The healthcare sector in the late 1960s was growing, attracting businesses looking to expand. The initial goal was to build a diverse healthcare services company, which led to acquiring various medical facilities. This strategy set the stage for future growth, eventually transforming into Tenet Healthcare.

The founders of NME, later known as Tenet Healthcare, had a clear vision from the start. They aimed to create a diversified healthcare services company. This involved acquiring various medical and surgical facilities to build a broad portfolio.

- Richard K. Eamer: Served as the first CEO.

- Leonard Cohen: Instrumental in the company's inception.

- John C. Bedrosian: Also played a key role in the company's early development.

- Early funding came from a combination of personal capital, private investors, and loans.

Tenet Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Tenet Health’s Ownership Changed Over Time?

The evolution of Tenet Healthcare's ownership has been marked by its transition from National Medical Enterprises (NME) to a publicly traded entity. This shift, following its initial public offering (IPO), significantly broadened its ownership base. The company's restructuring and growth have led to a complex ownership structure, primarily influenced by institutional investors. Understanding the dynamics of Tenet ownership is crucial for anyone interested in the healthcare sector and the financial markets.

Tenet Healthcare's ownership structure is now dominated by institutional shareholders, mutual funds, and index funds. This is a common characteristic of large, publicly traded companies in the healthcare industry. The company's major shareholders include well-known investment firms, whose holdings can fluctuate based on market conditions and investment strategies. These fluctuations can affect the company's stock performance and strategic direction, although direct intervention by passive institutional investors in day-to-day operations is less common.

| Ownership Event | Impact | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transitioned from private to public ownership, broadening the shareholder base. | Not Available |

| Corporate Restructuring | Influenced the distribution of shares and the company's strategic focus. | Ongoing |

| Institutional Investment | Increased the influence of large institutional investors on share ownership and voting power. | Ongoing |

As of early 2025, major stakeholders include The Vanguard Group, BlackRock Inc., and State Street Corporation. These firms, managing substantial portfolios, hold significant percentages of Tenet's outstanding shares. For example, The Vanguard Group often holds a large stake due to its broad market index strategies. BlackRock Inc. also consistently ranks among the top shareholders, demonstrating its extensive investment in the healthcare sector. These large institutional holdings mean that a significant portion of Tenet's voting power is concentrated among a relatively small number of large asset managers. For more details, you can explore the Revenue Streams & Business Model of Tenet Health.

Tenet Healthcare's ownership is primarily held by institutional investors.

- Major shareholders include The Vanguard Group, BlackRock Inc., and State Street Corporation.

- Changes in shareholdings can influence stock performance and strategic direction.

- Detailed ownership information is available in SEC filings.

- Understanding Tenet ownership is crucial for those interested in the healthcare sector.

Tenet Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Tenet Health’s Board?

The Board of Directors of Tenet Healthcare (also known as Tenet Health) plays a critical role in the governance of the hospital company. As of early 2025, the board typically consists of a mix of independent directors and those with ties to the company's operations or major shareholders. The composition can change, but generally includes individuals with experience in healthcare, finance, and corporate governance. The board's decisions are regularly scrutinized by institutional investors and proxy advisory firms, ensuring accountability to the shareholder base. The board's oversight of executive compensation, strategic acquisitions, and financial performance directly reflects the interests of the company's diverse ownership.

The board's structure is designed to provide oversight of the company's operations and strategic direction. Independent directors often bring objective perspectives, while those with ties to the company or major shareholders may offer insights into specific areas. The board's composition is subject to change, and details can be found in the company's proxy statements and other filings with the Securities and Exchange Commission (SEC). For example, in recent years, the board has focused on areas such as improving financial performance and streamlining operations. This is crucial for a healthcare provider like Tenet Healthcare, especially considering the dynamic changes in the healthcare industry.

| Director | Role | Other Affiliations |

|---|---|---|

| Ronald A. Rittenmeyer | Chairman of the Board | Lead Independent Director of Cigna |

| Saumya Sutaria | Chief Executive Officer | |

| Matthew F. Barbini | Director | Managing Director, Silver Point Capital |

| Other Directors | Various | Diverse backgrounds in healthcare, finance, and business |

The voting structure at Tenet Healthcare generally follows the one-share-one-vote principle. Each common share typically entitles its holder to one vote on matters presented to shareholders. The standard voting structure means that the collective power of institutional investors, who hold the majority of shares, significantly influences shareholder votes. While direct proxy battles or activist investor campaigns are not a constant feature, they can emerge. These events, if they occur, can challenge the existing board and management, potentially leading to changes in leadership, strategy, or even ownership structure. To understand more about the company's strategic direction, you can read about the Growth Strategy of Tenet Health.

The Board of Directors oversees Tenet Health, with a mix of independent directors and those with ties to the company.

- The board composition is subject to change, with details found in SEC filings.

- Voting follows a one-share-one-vote principle.

- Institutional investors significantly influence shareholder votes.

- The board's decisions are scrutinized by investors and advisory firms.

Tenet Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Tenet Health’s Ownership Landscape?

In recent years, Tenet Healthcare (also known as Tenet Health) has strategically optimized its portfolio. This includes divesting from certain hospital assets while investing in its ambulatory surgery centers (ASCs) through its United Surgical Partners International (USPI) segment. This strategy aims to enhance profitability and reduce debt. For instance, the company has divested some of its smaller or less profitable hospitals. In the past year, Tenet sold four hospitals and two related operations, generating significant proceeds.

From an ownership perspective, such strategic moves often influence institutional holdings. Major institutional investors like The Vanguard Group, BlackRock, and State Street Corporation have maintained significant stakes, indicating continued confidence in Tenet's long-term strategy. The healthcare industry has seen increased institutional ownership, with a focus on companies demonstrating resilience and growth potential. The company's focus on high-growth ambulatory care has been a key factor.

| Metric | Value | Year |

|---|---|---|

| Total Revenue | Approximately $19.4 billion | 2024 (projected) |

| Number of Hospitals | Approximately 58 | Early 2025 |

| Market Capitalization | Approximately $5.5 billion | Early 2025 |

Tenet's financial reports indicate a disciplined approach to capital allocation, including potential share repurchases, which would be detailed in their SEC filings. The company has publicly stated its commitment to deleveraging and returning value to shareholders, which can attract and retain long-term investors. Furthermore, understanding the ownership structure of Tenet Healthcare is crucial for investors.

Major institutional investors like The Vanguard Group, BlackRock, and State Street Corporation hold significant stakes in Tenet Healthcare. These investors often re-evaluate their positions based on the company's evolving risk-reward profile. Their continued investment suggests confidence in Tenet's strategic direction.

Tenet Healthcare is concentrating on portfolio optimization through divestitures and acquisitions. The company is shedding non-core assets, particularly some of its smaller or less profitable hospitals. Simultaneously, it's investing in ambulatory surgery centers (ASCs) through its USPI segment.

Tenet's financial performance reflects its strategic shifts. The company's commitment to deleveraging and returning value to shareholders is evident in its capital allocation strategy. This includes potential share repurchases, which are detailed in their SEC filings.

The healthcare industry is witnessing increased institutional ownership, with a focus on companies demonstrating resilience and growth potential. This trend underscores the importance of strategic initiatives like portfolio optimization and a focus on high-growth areas such as ambulatory care.

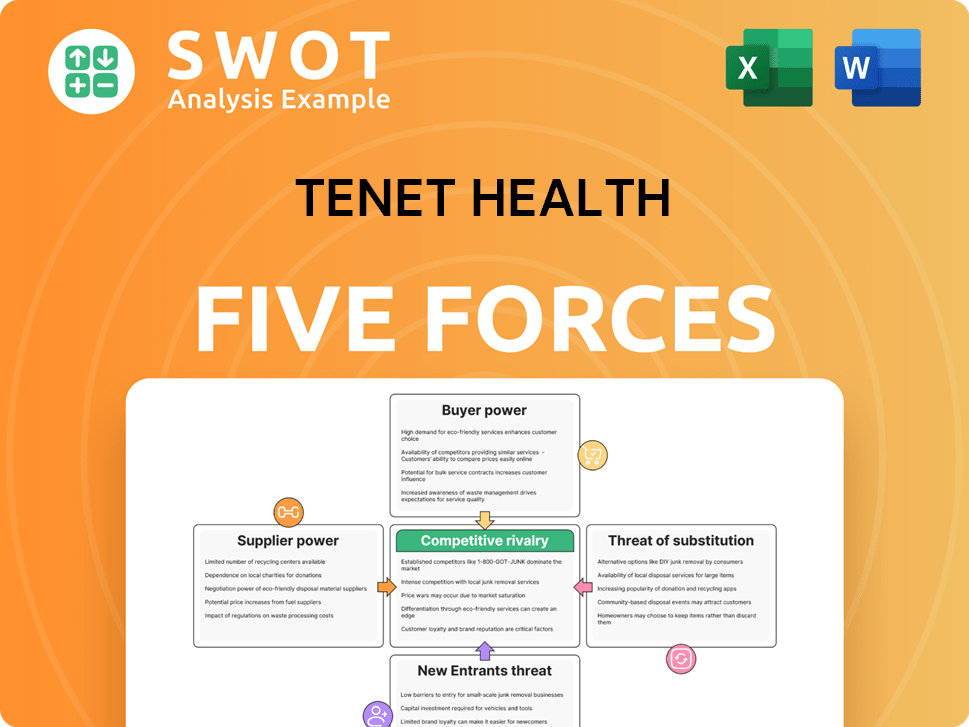

Tenet Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tenet Health Company?

- What is Competitive Landscape of Tenet Health Company?

- What is Growth Strategy and Future Prospects of Tenet Health Company?

- How Does Tenet Health Company Work?

- What is Sales and Marketing Strategy of Tenet Health Company?

- What is Brief History of Tenet Health Company?

- What is Customer Demographics and Target Market of Tenet Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.