Tenet Health Bundle

How Does Tenet Healthcare Thrive in Today's Healthcare Landscape?

Tenet Healthcare, a major player in the U.S. healthcare sector, has demonstrated remarkable financial success, particularly through its ambulatory surgery center division, USPI. With impressive 2024 results, including $20.7 billion in net operating revenues, the company is strategically expanding and adapting to the evolving needs of patients. This strategic agility is crucial for investors and healthcare professionals alike.

Tenet's Tenet Health SWOT Analysis reveals a company focused on acute care and ambulatory surgical services. Understanding the intricacies of this healthcare company, its hospital network, and its financial performance is key to grasping its potential. This analysis will explore the company's operations, revenue streams, and strategic direction to provide a comprehensive view of Tenet hospitals and their future.

What Are the Key Operations Driving Tenet Health’s Success?

Tenet Healthcare, a prominent healthcare company, generates value through its diverse healthcare services. The company operates primarily through three key segments: United Surgical Partners International (USPI), Hospital Operations, and Conifer Health Solutions. These segments work together to deliver a wide range of healthcare services, from outpatient surgeries to comprehensive hospital care and revenue cycle management.

USPI, the largest ambulatory platform in the country, is a significant part of Tenet Healthcare's operations. The Hospital Operations segment includes a network of acute care and specialty hospitals. Conifer Health Solutions provides healthcare-focused revenue cycle management and value-based care services. This structure allows Tenet Health to offer a broad spectrum of healthcare solutions, catering to various patient needs and healthcare provider requirements.

The company's focus on efficiency, quality, and strategic partnerships contributes to its value proposition. Tenet Healthcare aims to provide accessible, high-quality care while maintaining a strong market presence. The company's commitment to improving operational efficiency and expanding high-acuity service lines further enhances its ability to deliver value to patients and stakeholders.

USPI offers surgical services through ambulatory surgery centers and surgical hospitals. It partners with over 50 not-for-profit health systems and thousands of physicians. This segment focuses on efficiency and the growth of higher-acuity procedures.

The Hospital Operations segment includes 49 acute care and specialty hospitals. It also has around 160 outpatient centers across nine states. These facilities provide a wide range of medical and surgical services.

Conifer Health Solutions offers revenue cycle management and value-based care services. They serve 660 clients nationwide. Services include revenue cycle management and patient engagement support.

Tenet Health focuses on expanding high-acuity services and improving operational efficiencies. They also emphasize service quality. This approach helps the company offer accessible, high-quality care.

Tenet Healthcare distinguishes itself through its comprehensive approach to healthcare delivery. The company's focus on ambulatory services, hospital care, and revenue cycle management creates a vertically integrated model. This model allows for better coordination of care and improved patient outcomes. You can learn more about the company's origins in the Brief History of Tenet Health.

- Diverse Service Lines: Offers a broad range of services from outpatient to inpatient care.

- Strategic Partnerships: Collaborates with health systems and physicians to enhance access.

- Efficiency and Quality: Focuses on operational efficiency and high-quality care delivery.

- Market Differentiation: Strong presence in ambulatory services sets it apart from competitors.

Tenet Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tenet Health Make Money?

Tenet Healthcare, a prominent healthcare company, generates revenue through a diversified portfolio of services. Its primary revenue streams come from Hospital Operations, Ambulatory Care (USPI), and Conifer Health Solutions. The company's financial performance reflects its strategic focus on these key areas.

In 2024, Tenet Healthcare reported net operating revenues of $20.665 billion. The first quarter of 2025 saw net operating revenues of $5.223 billion. These figures highlight the company's financial standing and its ability to navigate the complexities of the hospital network industry.

The Ambulatory Care segment, specifically United Surgical Partners International (USPI), is a significant revenue driver for Tenet Healthcare. USPI's net operating revenues for the full year 2024 were $4.5 billion, up from $3.9 billion in 2023. The fourth quarter of 2024 saw revenues of approximately $1.3 billion, showcasing strong growth. This growth is fueled by acquisitions and increased service lines.

The Hospital Operations segment also significantly contributes to Tenet hospitals' revenue. While the fourth quarter of 2024 saw a decrease in net operating revenues to $5.072 billion due to divestitures, the company experienced same-facility revenue growth. In the first quarter of 2025, the hospital business unit's net operating revenues declined 7.9% year-over-year, impacted by divestitures, but partially offset by strong same-hospital admissions growth and favorable payer mix.

- USPI Growth: USPI's revenue growth is driven by strong net revenue per case, acquisitions, and expanded service lines.

- Hospital Performance: Despite divestitures, same-facility revenue growth and favorable payer mix have helped stabilize the Hospital Operations segment.

- Medicaid Impact: Medicaid supplemental payments provided a $40 million pre-tax boost in the first quarter of 2025.

- Strategic Focus: Tenet Health is focused on high-acuity services and expanding ambulatory services through mergers and acquisitions to drive future growth. For more insights, see Growth Strategy of Tenet Health.

Tenet Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tenet Health’s Business Model?

Tenet Healthcare, a prominent healthcare company, has undergone significant transformations, strategically shifting its focus and operations. These changes reflect a deliberate effort to enhance value and improve financial outcomes. The company's evolution highlights its adaptability and strategic foresight in a dynamic healthcare landscape.

A key strategic move for Tenet Healthcare has been the expansion of its ambulatory surgery center (ASC) footprint through United Surgical Partners International (USPI). This shift involves deemphasizing the hospital business. This focus on high-acuity cases within the ambulatory setting is a core growth engine for Tenet Health.

In 2024, Tenet sold 14 hospitals and added nearly 70 new ASCs to its portfolio. The company plans to invest approximately $250 million annually in mergers and acquisitions in the ambulatory space and anticipates adding 10 to 12 de novo centers in 2025. This strategic direction is a central element of its growth strategy.

Tenet Health has achieved several key milestones, including the expansion of its ASC network and operational efficiencies. The company has demonstrated strong cost management, particularly in labor costs. Adjusted EBITDA margin expanded to 19.3% in 2024, with the fourth quarter margin at 20.7%.

The primary strategic move is the shift towards ambulatory services and ASCs. Tenet Healthcare is actively investing in mergers and acquisitions within the ambulatory space. The company also focuses on high-acuity cases, such as total joint replacements and cardiovascular interventions.

Tenet's competitive advantages include its extensive network of hospitals and outpatient centers, strong brand recognition, and commitment to quality patient care. The company's scale and scope, coupled with its financial stability, allow it to invest in facilities, technology, and staff.

Tenet Health's financial performance has been marked by improved margins and strategic investments. The company faces challenges, including policy uncertainty related to the potential expiration of Affordable Care Act (ACA) exchange subsidies at the end of 2025. The company's focus on ASCs, operating under freestanding ASC rates, may insulate it from potential changes to site-neutral payment policies.

Tenet has focused on operational efficiencies, particularly in managing labor costs. The company's adjusted EBITDA margin expanded by approximately 200 basis points year-over-year to 19.3% in 2024. Challenges include policy uncertainty, such as potential changes to ACA subsidies and Medicaid funding. For more details, you can read about Owners & Shareholders of Tenet Health.

- Focus on high-acuity cases in ambulatory settings.

- Expansion of surgical robotics programs.

- Strategic investment in mergers and acquisitions.

Tenet Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tenet Health Positioning Itself for Continued Success?

Tenet Healthcare, a major player in the diversified healthcare services sector, holds a strong market position, particularly through its ambulatory platform, United Surgical Partners International (USPI). As of December 31, 2024, USPI had interests in a substantial number of ambulatory surgery centers and surgical hospitals across multiple states, cementing its status as the largest ambulatory platform in the U.S.

The company competes with other large healthcare providers, such as HCA Healthcare and Community Health Systems, in a fragmented market. Key risks include policy uncertainty, such as potential changes to ACA exchange subsidies and Medicaid funding, and labor market challenges. Despite these hurdles, Tenet is strategically focused on its ambulatory space, aiming for continued growth and operational efficiency.

Tenet Healthcare is a leading healthcare company, especially known for its ambulatory surgery centers. Its USPI platform is the largest in the country. The company's market share in the ambulatory surgical center (ASC) market is approximately 7%, which is significantly larger than its closest competitors.

Tenet faces risks from policy changes, like potential adjustments to ACA subsidies and Medicaid funding. Labor shortages and wage inflation in the healthcare sector also pose challenges. These factors could potentially impact the company's financial performance.

Tenet plans to invest significantly in its ambulatory space through mergers, acquisitions, and new center openings. The company anticipates net operating revenues between $20.6 billion and $21.0 billion and adjusted EBITDA between $3.975 billion and $4.175 billion for 2025. Tenet is focused on expanding its high-margin ambulatory surgery business.

Tenet is actively investing in its ambulatory space, planning to add 10 to 12 new centers in 2025. The company is also focusing on high-acuity service lines within its hospitals. This strategy aims to enhance profitability and maintain a strong financial position. Explore Growth Strategy of Tenet Health for more insights.

Tenet Healthcare's financial performance is closely watched by investors. The company's focus on ASCs and high-acuity services is expected to drive future growth. For 2025, the company anticipates robust financial results, reflecting its strategic initiatives.

- Net operating revenues are projected to be between $20.6 billion and $21.0 billion in 2025.

- Adjusted EBITDA is expected to range from $3.975 billion to $4.175 billion.

- The company plans to invest approximately $250 million annually in mergers and acquisitions.

- Tenet plans to add 10 to 12 de novo centers in 2025.

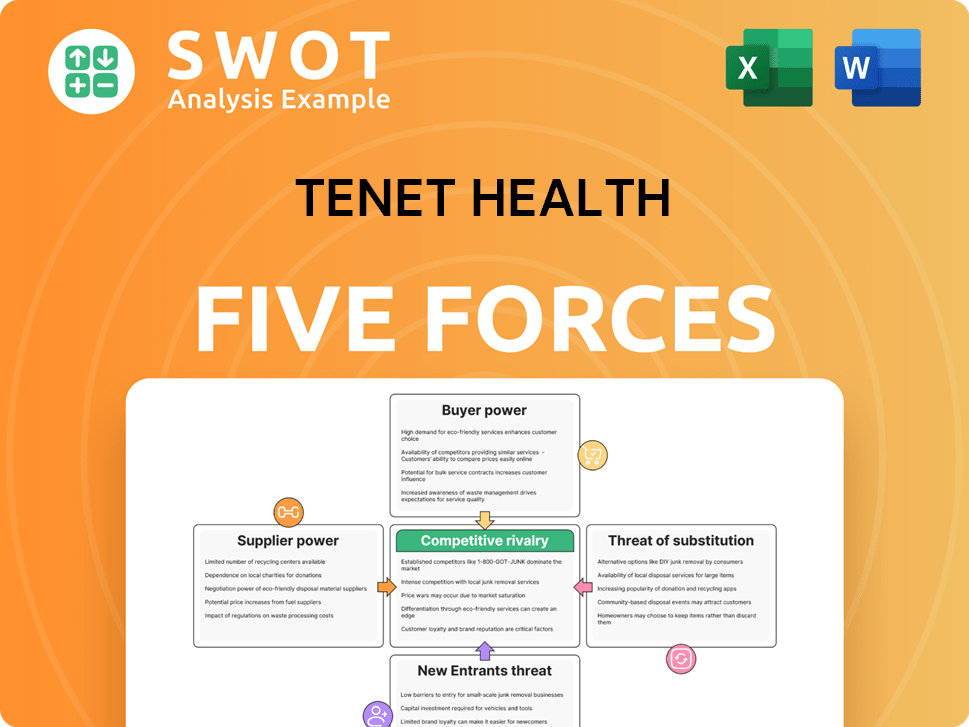

Tenet Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tenet Health Company?

- What is Competitive Landscape of Tenet Health Company?

- What is Growth Strategy and Future Prospects of Tenet Health Company?

- What is Sales and Marketing Strategy of Tenet Health Company?

- What is Brief History of Tenet Health Company?

- Who Owns Tenet Health Company?

- What is Customer Demographics and Target Market of Tenet Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.