Ashford Bundle

What's the Story Behind Ashford Company's Success?

From a single hotel to a major player in asset management, the Ashford Company's story is one of remarkable transformation. This journey, starting in 1968 with Remington Hotels, reveals a strategic evolution within the dynamic hospitality sector. Discover how Ashford SWOT Analysis can offer valuable insights into their strategic positioning.

The Ashford Company's brief history demonstrates a commitment to growth and diversification, evolving from its early roots to become a significant force in the industry. Understanding the Ashford timeline and key milestones provides a comprehensive perspective on its strategic decisions and market adaptation. Exploring the Ashford history offers crucial insights for investors and business strategists alike, highlighting the company's resilience and forward-thinking approach within the competitive landscape.

What is the Ashford Founding Story?

The story of the Ashford Company begins with Archie Bennett's vision, who established Remington Hotels in 1968. This marked the start of a journey that would eventually lead to the development of a significant real estate and hospitality services platform. The initial focus was on the expanding hospitality market, with the opening of the first Holiday Inn in Galveston, Texas.

While specific details about the initial funding are not readily available, the company's longevity, spanning over 55 years, indicates a foundation built on continuous growth and strategic financial planning. The establishment of Ashford Inc. as a separate entity occurred in 2014. This strategic move was a pivotal moment, reflecting a deeper commitment to specialized asset management within the hospitality sector.

The Ashford Company's roots trace back to 1968 with the founding of Remington Hotels by Archie Bennett, marking the beginning of a real estate and hospitality services platform.

- The primary goal was to capitalize on the growing hospitality market.

- The first Holiday Inn opened in Galveston, Texas.

- Ashford Inc. was founded in 2014, focusing on asset management and real estate services.

- The company's history reflects a commitment to strategic financial management and expansion within the hospitality sector.

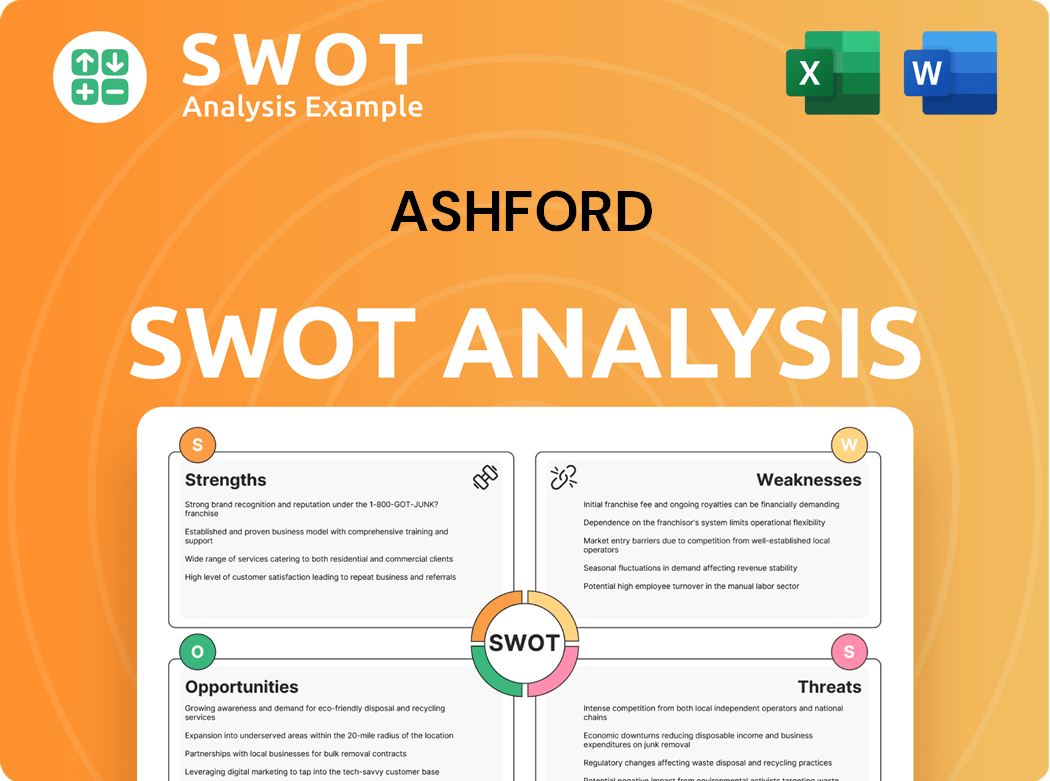

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ashford?

The early growth and expansion of the Ashford Company, a pivotal chapter in the Ashford timeline, showcases strategic moves that significantly broadened its reach. Beginning with the founding of Remington Hotels in 1968, the company's evolution included major developments in the hospitality and real estate sectors. These initiatives laid the groundwork for its future as a prominent player in the industry. The Mission, Vision & Core Values of Ashford provide further insights into the company's strategic direction.

In the 1970s, the company initiated significant hotel developments, including a 600-room hotel in downtown Houston, Texas. This expansion led to the company becoming the largest Marriott franchisee, marking a key milestone in the Ashford history. These early ventures were crucial in establishing the company's presence and expertise in the hospitality industry.

The 1990s saw Remington pioneering the all-suite concept, a strategic move that differentiated it in the market. Partnering with Embassy Suites, the company developed 150-room hotels across the United States. This innovation highlighted the company's ability to adapt to changing consumer preferences and market trends.

A significant turning point came in 2003 with the founding of Ashford Hospitality Trust as a real estate investment trust. This strategic shift enabled the company to focus on real estate investments and acquisitions. This move was pivotal in shaping the future of the Ashford Company.

In 2007, the company acquired a 51-hotel portfolio from CNL for $2.4 billion, followed by a 28-hotel portfolio in a joint venture with Prudential Real Estate Investors in 2011. These acquisitions significantly expanded the company's portfolio and market presence. These moves are crucial to understanding the Ashford timeline.

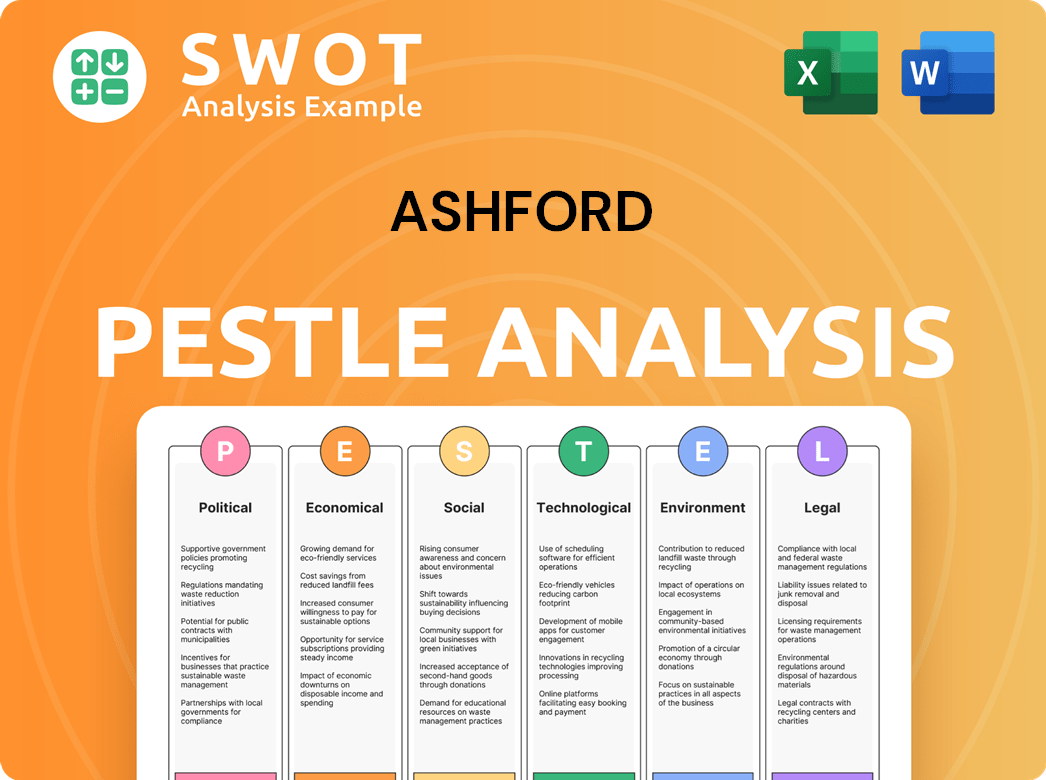

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ashford history?

The Ashford Company has a rich history marked by significant milestones in the hospitality and real estate sectors. Key moments include strategic acquisitions, the founding of key entities, and successful capital raises, demonstrating its adaptability and growth over time.

| Year | Milestone |

|---|---|

| 1990s | Remington pioneered the all-suite concept, partnering with Embassy Suites. |

| 2003 | Ashford Hospitality Trust was founded. |

| 2014 | Ashford Inc. was established as an asset manager. |

| Early 2024 | Ashford Securities raised approximately $580 million. |

| Q4 2024 | Ashford Hospitality Trust reported a 3.1% increase in comparable RevPAR to $126. |

| Early 2025 | Refinanced 16 hotels for $580 million and fully paid off strategic financing. |

One of the most notable innovations was Remington's early adoption of the all-suite hotel concept, which set a new standard in the hospitality industry. This focus on unique offerings and strategic partnerships has been a hallmark of the company's approach.

Remington's early adoption of the all-suite hotel concept, partnering with Embassy Suites, was a key innovation. This approach provided guests with more space and amenities, differentiating the company in the market.

The establishment of Ashford Inc. as an asset manager and the acquisition of real estate services companies fostered a vertically integrated business model. This structure allowed for better control over operations and strategic alignment.

Ashford Securities' success in raising approximately $580 million by early 2024 demonstrates a strong ability to secure capital. This financial maneuver supports the growth and development of its advised platforms.

Despite its successes, Ashford Inc. and its advised entities have faced challenges, including financial losses and high debt exposure. The company has implemented strategic initiatives to address these issues and improve performance.

Ashford Hospitality Trust reported a net loss of $131.1 million for Q4 2024 and $82.5 million for the full year 2024, indicating financial strain. In Q1 2025, a net loss of $27.8 million was reported.

The company has contended with high floating rate debt, which impacts profitability. This has led to increased interest expenses and financial risk.

The hospitality and real estate industries are highly competitive, putting pressure on margins. This necessitates strategic initiatives to maintain and improve market share.

The 'GRO AHT' initiative, launched in December 2024, aims to increase EBITDA by $50 million, through G&A reduction, revenue maximization, and operational efficiency. This strategic plan targets margin improvement and shareholder value enhancement.

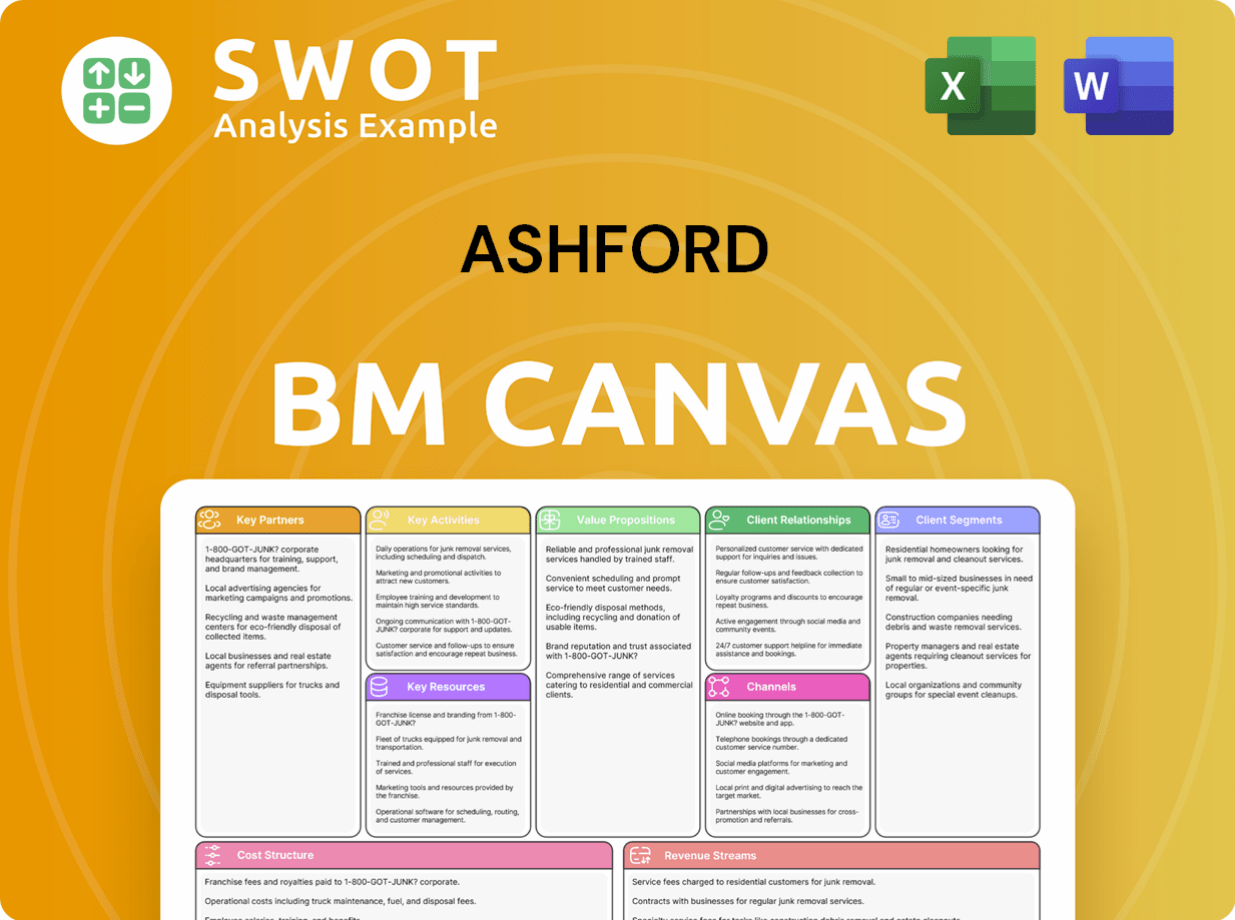

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ashford?

The Ashford Company has a rich history in the hospitality industry, marked by strategic investments and operational growth. Starting with its founding in 1968, the company has evolved through acquisitions, strategic partnerships, and financial initiatives, adapting to market changes and aiming for sustained profitability.

| Year | Key Event |

|---|---|

| 1968 | Archie Bennett founded Remington Hotels and opened the first Holiday Inn in Galveston, TX. |

| 1970s | The company developed a 600-room hotel in downtown Houston, TX, becoming the largest Marriott franchisee. |

| 1990s | Remington pioneered the all-suite concept and partnered with Embassy Suites. |

| 2003 | Ashford Hospitality Trust was founded as a real estate investment trust. |

| 2007 | Ashford purchased a 51-hotel portfolio from CNL for $2.4 billion. |

| 2011 | Ashford purchased a 28-hotel portfolio in joint venture with Prudential Real Estate Investors. |

| 2014 | Ashford Inc. was founded, serving as asset manager to Ashford real estate platforms and beginning to acquire real estate services companies. |

| 2021 | Ashford Securities, a subsidiary of Ashford Inc., began raising capital. |

| 2022 | Ashford Hospitality Trust commenced its Non-Traded Preferred Equity offering. |

| 2023 | Ashford Securities announced $500 million in capital raised since 2021, and Ashford Hospitality Trust launched the Texas Strategic Growth Fund. |

| Q4 2024 | Ashford Hospitality Trust reported a net loss of $131.1 million. |

| December 2024 | Ashford Hospitality Trust launched the 'GRO AHT' initiative targeting $50 million incremental EBITDA. |

| February 2025 | Ashford Hospitality Trust reported Q4 2024 results, including a 3.1% increase in comparable RevPAR and fully paid off its strategic financing. |

| March 2025 | Ashford Hospitality Trust extended its Morgan Stanley Pool mortgage loan secured by 17 hotels to March 2026, with options for further extensions to March 2028. |

| May 2025 | Ashford Hospitality Trust reported Q1 2025 results, with a net loss of $27.8 million, but operational improvements contributing to a $30 million run-rate EBITDA enhancement. Ashford Securities expanded its team with strategic hires. |

Ashford Inc. anticipates 2025 to be a transformational year. The company plans a capital expenditure budget of between $95 million and $115 million for portfolio optimization and deleveraging. This investment is aimed at improving the company's financial health and operational efficiency.

The 'GRO AHT' initiative is expected to substantially boost corporate EBITDA for Ashford Hospitality Trust. The goal is to achieve an increase of over 20% through strategic revenue maximization and expense reduction strategies. This initiative is a key component of the company’s growth strategy.

Ashford continues to focus on maximizing revenue and minimizing expenses across its portfolio. This approach is designed to help the company outperform in the face of industry uncertainties. The company is committed to operational excellence.

Ashford Inc. plans to maintain momentum through third-party sales and strategic acquisitions. The long-term vision is rooted in strategic real estate investment and operational excellence in the hospitality sector. Efforts to improve the balance sheet and capitalize on market opportunities remain ongoing.

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- How Does Ashford Company Work?

- What is Sales and Marketing Strategy of Ashford Company?

- What is Brief History of Ashford Company?

- Who Owns Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.