Ashford Bundle

Who are Ashford Company's Key Players?

In the fast-paced world of hospitality asset management, understanding the Ashford SWOT Analysis is more than just a good practice; it's a necessity. For Ashford Company, a deep dive into its customer demographics and target market is essential for strategic alignment and sustained success. This exploration is crucial for tailoring services and maximizing returns in a dynamic market.

This analysis will uncover the core customer demographics and target market of Ashford Company, providing a detailed look at who they serve and how they adapt. By understanding the specific needs of their clientele, we can analyze the strategies employed for effective customer segmentation and market analysis. We'll explore the Ashford business model and the factors that drive their success.

Who Are Ashford’s Main Customers?

Understanding the Owners & Shareholders of Ashford is key to grasping its customer base. The company primarily operates in a business-to-business (B2B) model, focusing on institutional and sophisticated investors. This strategic focus shapes its customer demographics and target market, which are crucial for its market analysis and business success.

The core customer segment for the company includes real estate investment trusts (REITs) and other investment vehicles. These entities are specifically focused on the hospitality sector, indicating a targeted approach to the market. This customer segmentation allows for a more focused and efficient allocation of resources.

As of December 31, 2023, the company advised three REIT platforms: Ashford Hospitality Trust, Braemar Hotels & Resorts, and Stirling Hotels & Resorts. These platforms collectively held ownership interests in 113 hotels with approximately 25,000 rooms and about $7.5 billion in gross assets, demonstrating the scale of their operations and the importance of their customer relationships.

The primary customer demographics include real estate investment trusts (REITs) and other investment vehicles. These entities are the core of the company's business model. These customers are focused on the hospitality sector.

This REIT focuses on upper upscale, full-service hotels. This segment represents a significant portion of the company's portfolio. Understanding this segment is crucial for market analysis.

This REIT targets luxury hotels and resorts. This segment caters to a high-end clientele. Analyzing this segment provides insights into customer buying behavior.

A newly formed private NAV REIT, planning to invest in a diverse portfolio of hotels and resorts. This expansion indicates growth and diversification strategies. This REIT focuses on both growth and income.

In 2021, the company launched Ashford Securities, its fundraising platform, which raised approximately $580 million of capital by the end of 2023. This expansion includes a broader range of financial intermediaries. The growth in third-party business, including hotel management, design and construction, and watersports services, indicates a wider array of hotel owners and operators. This diversification strategy is key to the company's success.

The company's primary customer segments are institutional and sophisticated investors, REITs, and financial intermediaries. These segments are crucial for the company's operations. The company's target market analysis report shows the importance of these segments.

- REITs focused on hospitality.

- Sophisticated investors through fundraising platforms.

- Hotel owners and operators through third-party services.

- Financial intermediaries and their underlying investors.

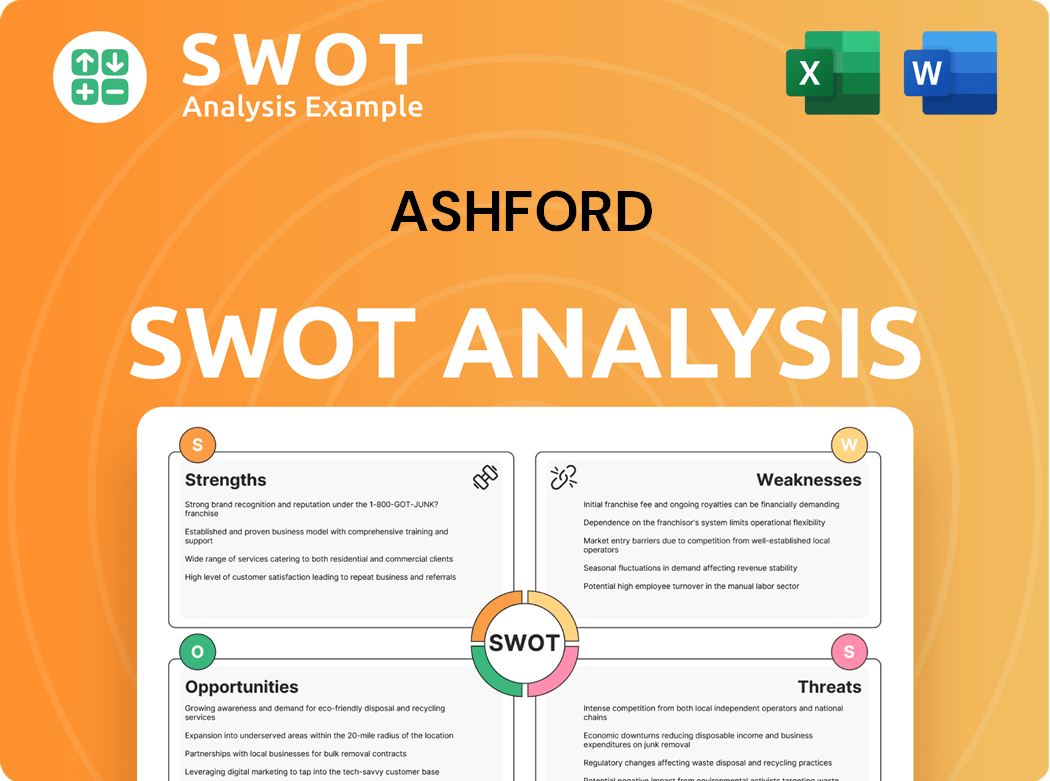

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Ashford’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the [Company Name], this involves a deep dive into the priorities of its primary customer base: REITs and institutional investors within the hospitality sector. These investors are primarily focused on maximizing the value of their assets, optimizing operational performance, and achieving strong financial returns. This focus shapes their purchasing behaviors and decision-making processes, making it essential for the company to align its strategies with these key drivers.

The company's customer base is heavily influenced by factors such as RevPAR growth, EBITDA improvement, and efficient capital deployment. The company's initiatives, like the 'GRO AHT' program launched in December 2024, directly address these needs by targeting specific financial improvements, such as a $50 million EBITDA increase. This proactive approach demonstrates a clear understanding of what matters most to its clients and a commitment to delivering solutions that meet these demands.

Furthermore, customers prioritize strategic capital management and deleveraging. The company's focus on paying off corporate financing through asset sales and refinancing in 2024 showcases its responsiveness to these preferences. The demand for diversified investment solutions is also evident, with the company raising approximately $580 million in capital since 2021 by offering alternative investment products. This highlights the importance of adaptability and providing a range of options to meet diverse investor needs.

The company's customer needs and preferences are centered around maximizing asset value, optimizing operational performance, and achieving strong financial returns. The company's strategies are designed to meet these needs, focusing on RevPAR growth, EBITDA improvement, and efficient capital deployment. Understanding these factors is critical for the company to maintain a competitive edge and deliver value to its clients. For more insights, explore the Competitors Landscape of Ashford.

- Asset Value Maximization: Customers seek strategies that enhance the overall value of their hotel assets.

- Operational Efficiency: Investors prioritize solutions that improve operational performance and reduce costs.

- Financial Returns: Strong financial returns, including RevPAR and EBITDA growth, are key drivers of investment decisions.

- Capital Management: Strategic capital management and deleveraging are important for maintaining a healthy financial position.

- Diversified Investment Solutions: Customers value a range of investment options to meet their varied needs and risk profiles.

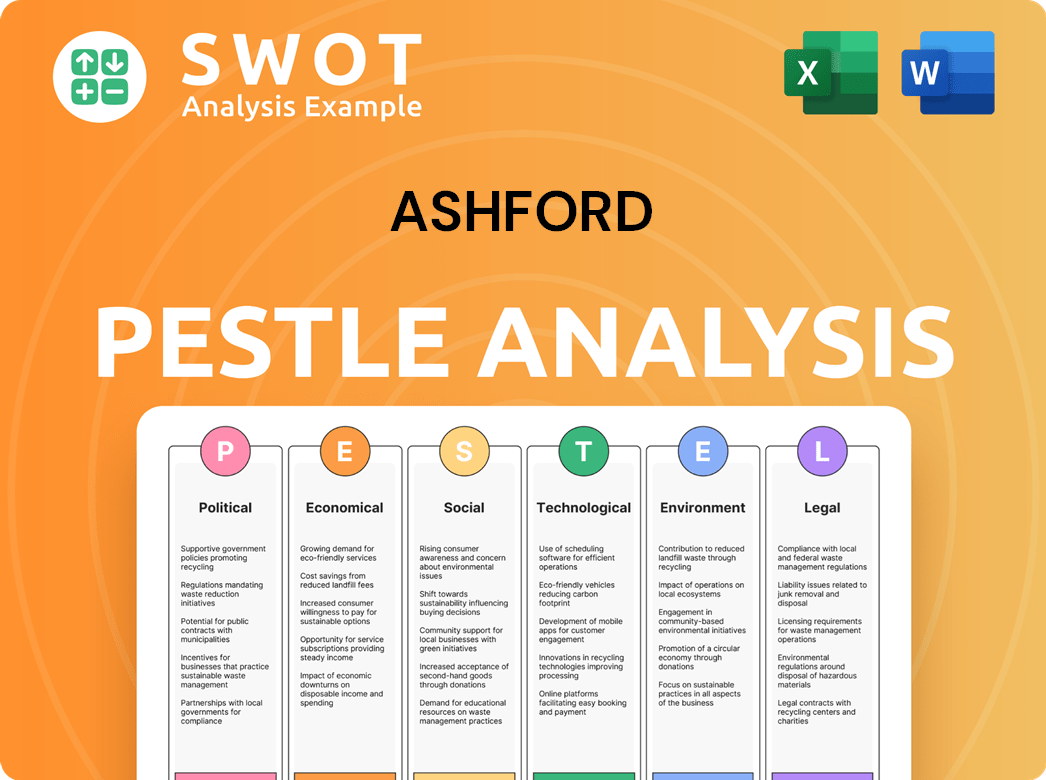

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Ashford operate?

The geographical market presence of the [Company Name] is primarily focused on the United States. This is evident through its investments and operations within the hospitality sector. The company's strategy involves a geographically diversified portfolio to mitigate risks and capitalize on various hospitality trends across different U.S. markets.

Its advised REITs, Ashford Hospitality Trust and Braemar Hotels & Resorts, hold a substantial portfolio of hotels. As of December 31, 2023, these REITs owned a combined total of 83 hotels with over 20,000 rooms and approximately $6.8 billion in gross assets. While the exact geographical distribution of all 113 hotels under its advised platforms is not fully detailed, it includes a mix of upper upscale, full-service hotels and luxury hotels and resorts.

The company's strategic initiatives also highlight a focus on specific regions. This includes the Texas Strategic Growth Fund, launched in late 2022, which is focused on real estate investments in Texas. Additionally, RED Hospitality, one of the company's operating businesses, provides watersports and travel services in the U.S. Virgin Islands, Puerto Rico, Florida Keys, and Turks & Caicos, indicating a presence in key leisure and resort destinations. For more details, explore the Brief History of Ashford.

The company's core market is the United States, with a significant number of hotels and assets concentrated within the country. This focus allows the company to leverage its expertise and relationships within the U.S. hospitality market.

The company emphasizes a geographically diversified portfolio to spread risk and capture opportunities in various U.S. markets. This strategy helps to mitigate the impact of regional economic downturns or specific market challenges.

Strategic initiatives, such as the Texas Strategic Growth Fund, demonstrate a focus on specific regions within the U.S. This targeted approach allows the company to capitalize on local market dynamics and growth opportunities.

The company's presence in leisure destinations, such as the U.S. Virgin Islands, Puerto Rico, Florida Keys, and Turks & Caicos, indicates a focus on capturing the tourism and leisure travel market. This is a key aspect of their target market strategy.

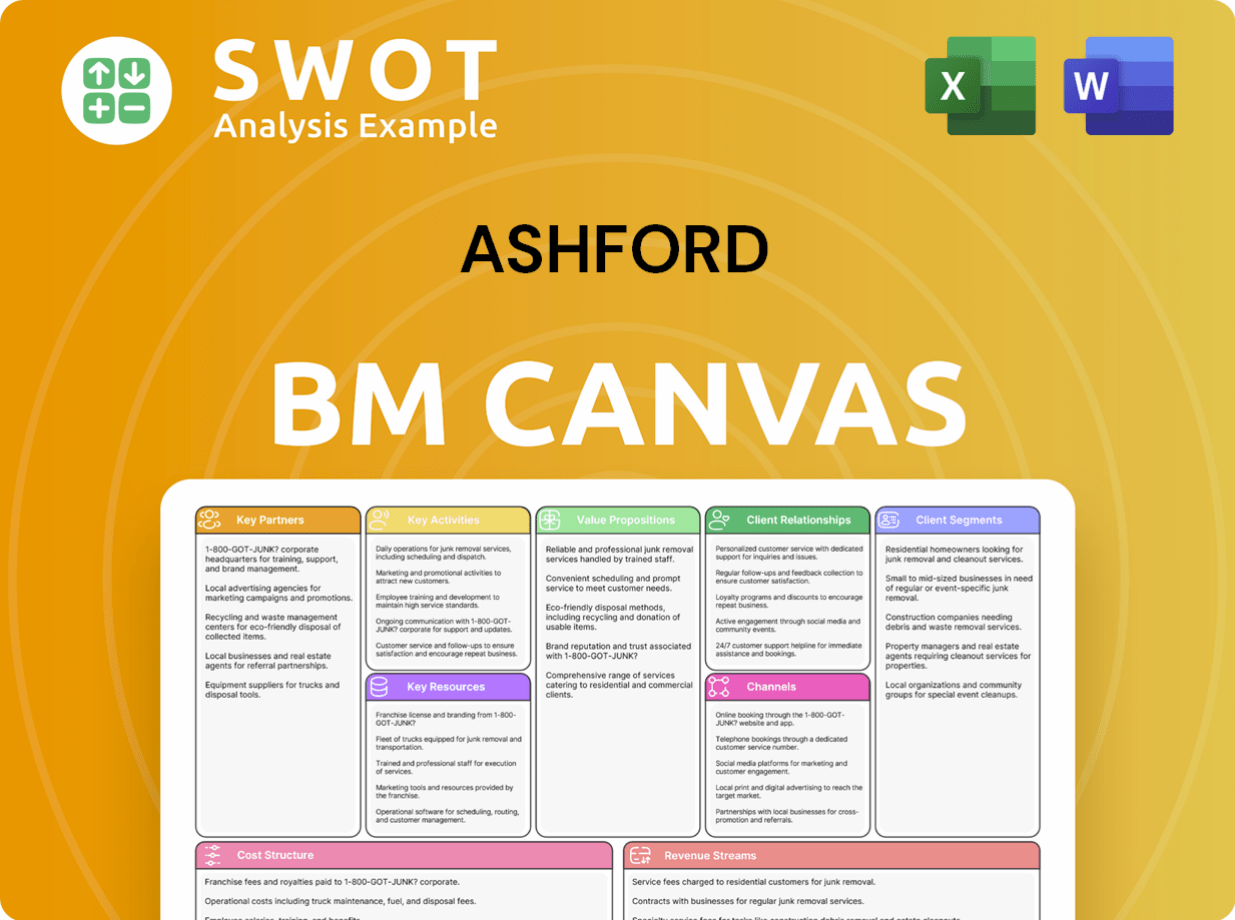

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Ashford Win & Keep Customers?

The customer acquisition and retention strategies of the company are centered around its expertise in hospitality asset management and its vertically integrated platform. A key channel for acquiring customers is through Ashford Securities, a dedicated fundraising platform. This platform has raised approximately $580 million in capital since its launch in 2021 by engaging with institutional investors, broker/dealers, and RIA relationships. This is crucial for attracting new capital for its advised REITs and other investment vehicles, including recent offerings like the redeemable non-traded preferred stock for Ashford Hospitality Trust.

Retention is significantly influenced by the performance and value creation for its advised REITs, such as Ashford Hospitality Trust and Braemar Hotels & Resorts. The company employs a 'targeted revenue optimization model' and leverages 'expertise from diverse specialist groups' to maximize value for each hotel, which is critical for satisfying and retaining clients. This includes initiatives like the 'GRO AHT' plan for Ashford Hospitality Trust, which focuses on G&A reduction, revenue maximization, and operational efficiency to drive EBITDA growth and improve shareholder value. These efforts, which commenced in December 2024, are anticipated to contribute over $30 million per year in incremental EBITDA once fully implemented.

The company also focuses on growing its third-party business for its portfolio companies like Remington (hotel management) and Premier (design and construction), expanding its client base beyond its advised REITs. The company emphasizes personalized experiences through its asset management team, which conducts regular site visits, monthly P&L reviews, and annual operating budget reviews, demonstrating a hands-on approach to client service. The strategic focus on deleveraging and improving financial flexibility for its advised REITs, as seen with Ashford Hospitality Trust's efforts to pay off its corporate financing in 2024, also serves as a critical retention strategy by enhancing the attractiveness and stability of its investment platforms.

The primary customer acquisition channel is Ashford Securities, a fundraising platform. This platform focuses on engaging with institutional investors, broker/dealers, and RIA relationships. It has raised approximately $580 million in capital since 2021, attracting new capital for its advised REITs and other investment vehicles.

Retention is driven by the performance and value creation for advised REITs. The company employs a 'targeted revenue optimization model' and leverages specialist groups. Initiatives like the 'GRO AHT' plan, which began in December 2024, are expected to contribute over $30 million annually in incremental EBITDA.

The company focuses on expanding its third-party business, including Remington and Premier. This strategy aims to broaden the client base beyond its advised REITs. This expansion leverages existing expertise and strengthens market position.

The company emphasizes personalized experiences through its asset management team. This includes regular site visits, monthly P&L reviews, and annual operating budget reviews. This hands-on approach enhances client relationships and satisfaction.

The strategic focus on deleveraging and improving financial flexibility enhances the attractiveness of investment platforms. For instance, Ashford Hospitality Trust's efforts to pay off corporate financing in 2024 demonstrate a commitment to financial health.

- Improved financial stability enhances investor confidence.

- Deleveraging efforts improve the company's financial profile.

- This strategy supports long-term value creation for investors.

- Focus on financial health is a key part of the overall strategy.

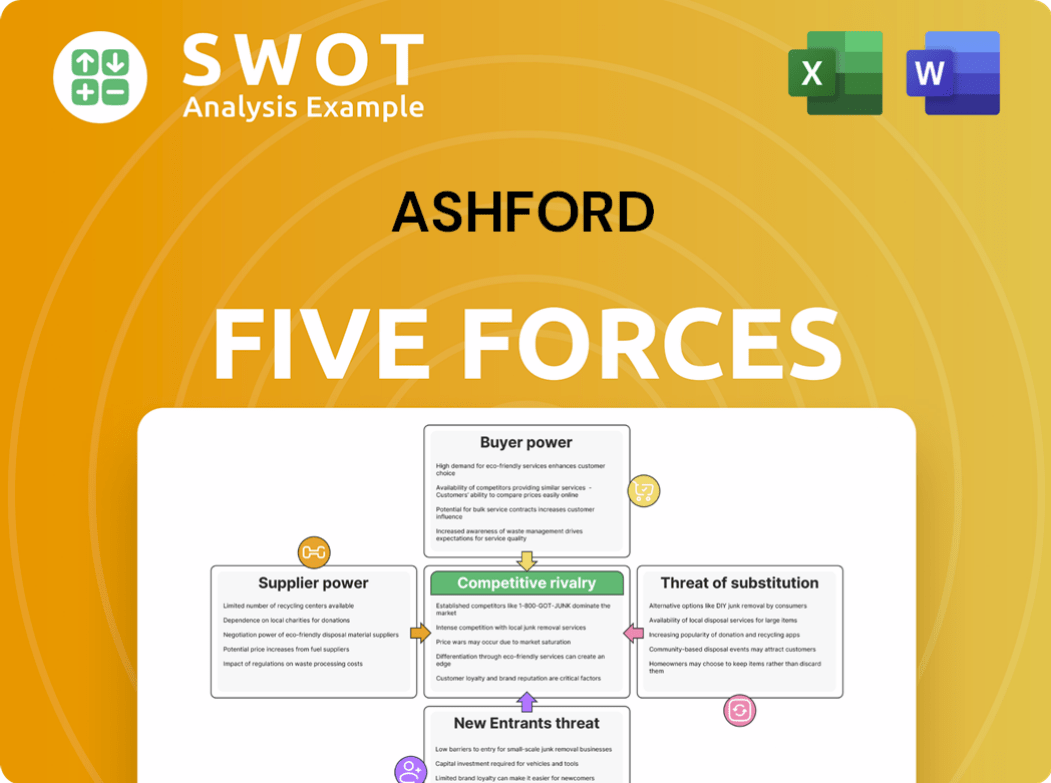

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Competitive Landscape of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- How Does Ashford Company Work?

- What is Sales and Marketing Strategy of Ashford Company?

- What is Brief History of Ashford Company?

- Who Owns Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.