Ashford Bundle

Unveiling Ashford Company's Strategic Compass: What Drives Them?

Every successful company needs a strong foundation, and for Ashford Company, that foundation is built on a clear understanding of its mission, vision, and core values. These elements are the cornerstones of their strategic direction, influencing everything from daily operations to long-term goals.

In the dynamic world of hospitality asset management, understanding the Ashford SWOT Analysis, mission, vision, and core values is crucial for navigating market complexities and achieving sustainable growth. This exploration delves into Ashford Company's guiding principles, providing insights into their commitment to ethical standards and how they define their mission. Discover how Ashford Company's mission statement examples, vision for the future, and core values shape their culture and drive their strategic goals.

Key Takeaways

- Ashford Inc. prioritizes asset performance and shareholder value creation.

- 'GRO AHT' initiative shows a vision for operational and financial improvement.

- Operational excellence, strategic acumen, and collaboration are key values.

- Alignment with guiding principles is crucial for future growth in hospitality.

- Focus on efficiency and revenue is vital for long-term success.

Mission: What is Ashford Mission Statement?

Ashford Inc.'s de facto mission is to enhance the performance and value of its advised entities' hotel portfolios, primarily within the upscale and upper upscale full-service hotel market in the United States.

Delving into the Ashford Company Mission, we find that while a formal, consolidated mission statement isn't readily available, the company's actions speak volumes. Ashford Inc. operates as an advisor to REITs, most notably Ashford Hospitality Trust (AHT), focusing on asset management, investment management, and related services within the hospitality sector. Their core objective revolves around optimizing the financial performance and asset value of the hotels within their advisory portfolio. This operational mission is heavily geared towards generating returns for their advised entities and, by extension, their investors. The Target Market of Ashford is primarily focused on the hospitality sector.

The Ashford Company Mission is deeply rooted in improving the financial health of its advised hotel portfolios. This includes driving revenue, optimizing operational efficiency, and reducing costs. For example, the "GRO AHT" initiative demonstrates a commitment to significant EBITDA growth.

A key component of the Mission Statement is a focus on creating value for shareholders. This is achieved through strategic asset management, investment decisions, and operational improvements. The ultimate goal is to increase shareholder value.

Ashford Inc.'s Company Values are centered around specialized knowledge of the hospitality sector. Their integrated approach, leveraging affiliated entities, provides a competitive advantage in managing and advising hotel assets. This expertise is critical in navigating the complexities of the hotel market.

The Vision Statement is clearly directed towards the upscale and upper upscale full-service hotel market within the United States. This focused approach allows Ashford Inc. to concentrate its resources and expertise on a specific, high-value segment of the hospitality industry. This targeted strategy is evident in their investment decisions and operational strategies.

Ashford Inc. provides a comprehensive suite of services, including asset management, investment management, and potentially hotel management, design, and construction. This integrated approach allows for greater control and optimization across the entire hotel lifecycle. This comprehensive service model is a key element of their Ashford Company Core Values.

While the primary focus is on investors, the Ashford Company's Guiding Principles also indirectly support a customer-centric approach at the hotel level. Driving revenue market share and optimizing operations at the hotel level contributes to a positive guest experience, which in turn, boosts financial performance. This is a critical component of their overall mission.

The Mission Statement is not just a declaration; it's reflected in their actions. For instance, in Q1 2024, AHT reported a RevPAR (Revenue Per Available Room) increase, demonstrating the effectiveness of Ashford's strategies. Furthermore, initiatives like the GRO AHT program, which aims to cut G&A expenses by $10 million, highlight the company's commitment to operational efficiency. This focus on financial performance is further underscored by the company's efforts to navigate the fluctuating occupancy rates and average daily rates (ADR) within the hospitality sector. The Ashford Company's Ethical Standards are implicitly reflected in their commitment to transparency and responsible financial management within the REIT structure.

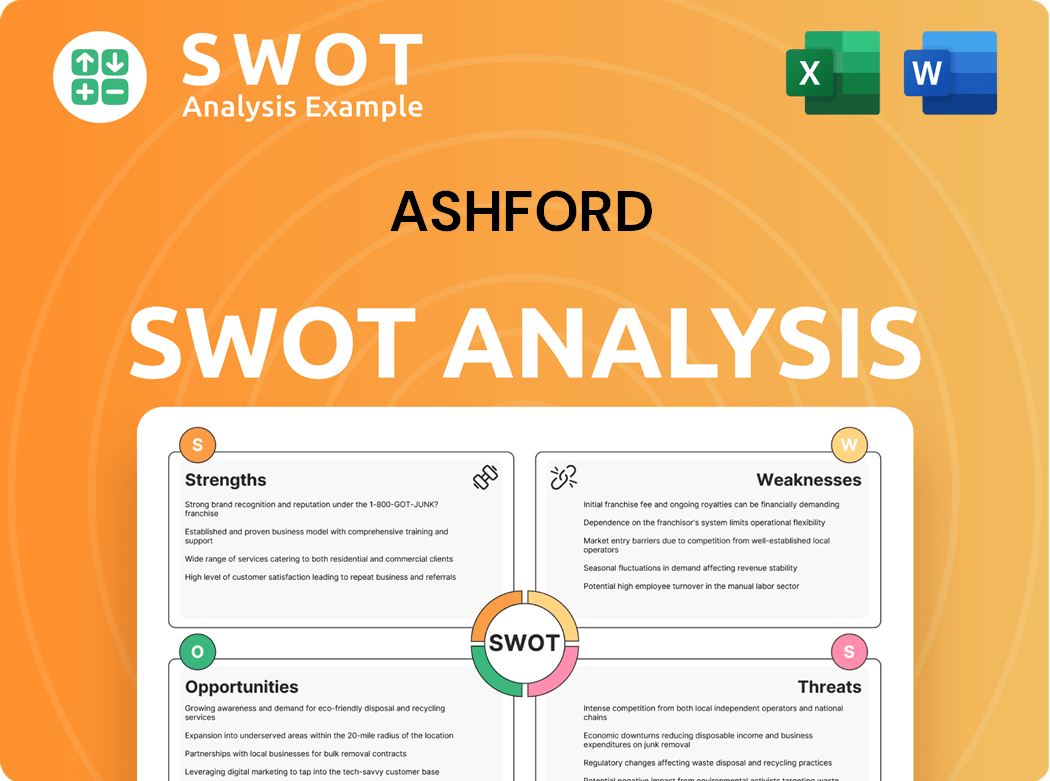

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Ashford Vision Statement?

While a formal, concise vision statement for Ashford Inc. isn't readily available, the company implicitly envisions itself as a leader in hospitality asset management, driving substantial financial and operational improvements for its advised entities.

Let's delve deeper into the implied Ashford Company Vision based on its strategic direction.

The core of Ashford Company's Vision revolves around maximizing the performance and value of its hotel portfolio. This is evident in the "GRO AHT" initiative, which aims for significant EBITDA growth. The company is implicitly striving for market leadership within the hospitality sector.

A key element of the vision is a strong focus on financial outcomes. The goal of "outsized EBITDA growth" and "substantially improve shareholder value" underscores this. The company is aiming to increase room revenue market share by over 200 basis points in 2025, demonstrating a commitment to tangible financial results.

The vision is supported by concrete strategic initiatives. The "GRO AHT" initiative, for example, has already identified $30 million of run-rate EBITDA improvement towards a $50 million goal. Successful debt refinancing and asset sales contribute to a stable foundation for future growth. You can find more details about the Ashford Company Mission and values in this article Mission, Vision & Core Values of Ashford.

Ashford's vision includes a strong aspiration for market leadership. This is reflected in the desire for its advised properties to outperform competitors. The focus on increasing room revenue market share is a clear indicator of this ambition.

The vision appears to be both realistic and aspirational. While Ashford Hospitality Trust reported a net loss in Q1 2025, the operational improvements and progress on the "GRO AHT" initiative demonstrate a tangible plan to achieve its goals. The company's vision is ambitious, but the detailed initiatives suggest a concrete plan to achieve it.

The ultimate goal of the Ashford Company Vision is long-term value creation for investors. This is achieved through improved operational performance, strategic asset management, and a commitment to enhancing shareholder value. The company is focused on building a sustainable and profitable future.

In essence, the Vision Statement for Ashford Company is implicitly focused on achieving market leadership in hospitality asset management through superior financial performance, strategic initiatives, and long-term value creation for investors.

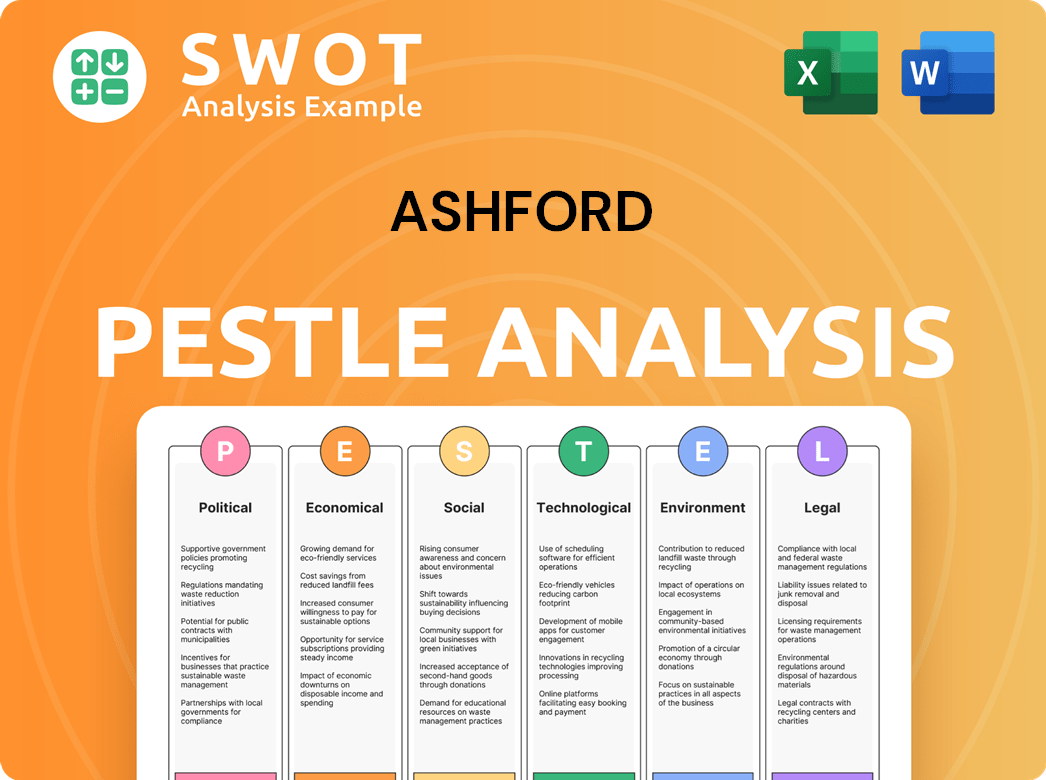

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Ashford Core Values Statement?

While a formal, consolidated statement of core values for Ashford Inc. isn't readily available, the company's actions and strategic initiatives strongly suggest a set of guiding principles that drive its operations. These implicit values shape Ashford's approach to the hospitality sector and its commitment to delivering results.

Ashford Inc. prioritizes operational excellence by focusing on improving the performance of the hotels they advise. This is evident in initiatives like 'GRO AHT,' which aims to drive efficiency and profitability through G&A reduction, revenue maximization, and operational efficiency. For example, they implement energy-saving measures and optimize labor costs to enhance property-level performance, contributing to a more sustainable and profitable business model.

A core value for Ashford Inc. is creating value for its shareholders. The 'GRO AHT' initiative, with its goal of substantial EBITDA growth, directly reflects this focus. Furthermore, strategic decisions like asset dispositions, such as the sale of the Courtyard Boston Downtown for $123 million, and debt refinancing efforts are geared towards generating returns and improving the financial health of the advised REITs, ultimately increasing shareholder value.

Ashford Inc. demonstrates strategic acumen in its approach to portfolio management, debt management, and identifying growth opportunities. The successful refinancing of $580 million in debt secured by 16 hotels highlights their strategic financial management capabilities. Their pursuit of growing third-party business and acquiring or incubating additional businesses underscores a forward-thinking approach to expanding their market presence and diversifying revenue streams.

Collaboration is a key value, as Ashford Inc. emphasizes working closely with property managers and its advisor to achieve shared goals. The revenue-focused hires made by Ashford Inc. and Remington, their largest property manager, to enhance top-line performance illustrate this collaborative approach. This teamwork fosters a unified approach to problem-solving and enhances the overall performance of the hotels under their management.

Understanding the Ashford Company's mission and how these core values are implemented provides a deeper insight into the company's operational strategies and its commitment to the hospitality sector. Next, we will explore how the company's mission and vision influence its strategic decisions and overall business direction.

How Mission & Vision Influence Ashford Business?

While the specific Ashford Company Mission and Ashford Company Vision may not be explicitly stated in all available documentation, their influence permeates the company's strategic decision-making processes. This influence is particularly evident in initiatives designed to enhance shareholder value and drive operational excellence.

The 'GRO AHT' initiative, launched in December 2024, exemplifies how the underlying Ashford Company Mission and Ashford Company Vision shape strategic direction. This program, focused on outsized EBITDA growth, directly reflects the company's commitment to maximizing shareholder returns.

- 'GRO AHT' aims to drive significant EBITDA improvement.

- The initiative underscores a focus on enhancing performance and creating value.

- It demonstrates a clear link between strategic goals and the Company Values.

- Measurable success includes a target of $50 million in incremental EBITDA improvement.

The Vision Statement influences product development and market expansion. This is achieved through aggressive sales efforts to grow room revenue market share by over 200 basis points in 2025.

Ashford focuses on increasing ancillary revenues through pricing audits and rolling out new revenue streams. These actions demonstrate a commitment to optimizing the performance and offerings of the hotels under their asset management.

Strategic decisions like the conversion of properties, such as the Le Pavillon Hotel to a Tribute Portfolio property, and the grand opening of Le Meridien Fort Worth, enhance the portfolio. These actions capitalize on market opportunities.

Executive statements, such as those from Stephen Zsigray, President and CEO of Ashford Trust, highlight the influence of guiding principles. He emphasizes the focus on enhancing performance and creating value for shareholders, which aligns with the Ashford Company's guiding principles.

The Mission Statement shapes day-to-day operations through efficiency measures, cost controls, and revenue-maximizing strategies at the property level. These actions are crucial for achieving the company's strategic goals.

Long-term planning is influenced by the focus on improving the capital structure, deleveraging the balance sheet, and exploring strategic dispositions and acquisitions. These actions are essential for sustainable growth.

The influence of the Ashford Company Mission and Ashford Company Vision is also evident in the company's commitment to its core objectives. The company's focus on improving its financial performance is a direct reflection of its Vision Statement and its strategic goals. For more insights into Ashford's strategic approach, consider exploring the Marketing Strategy of Ashford. Next, we will delve into the Core Improvements to Company's Mission and Vision.

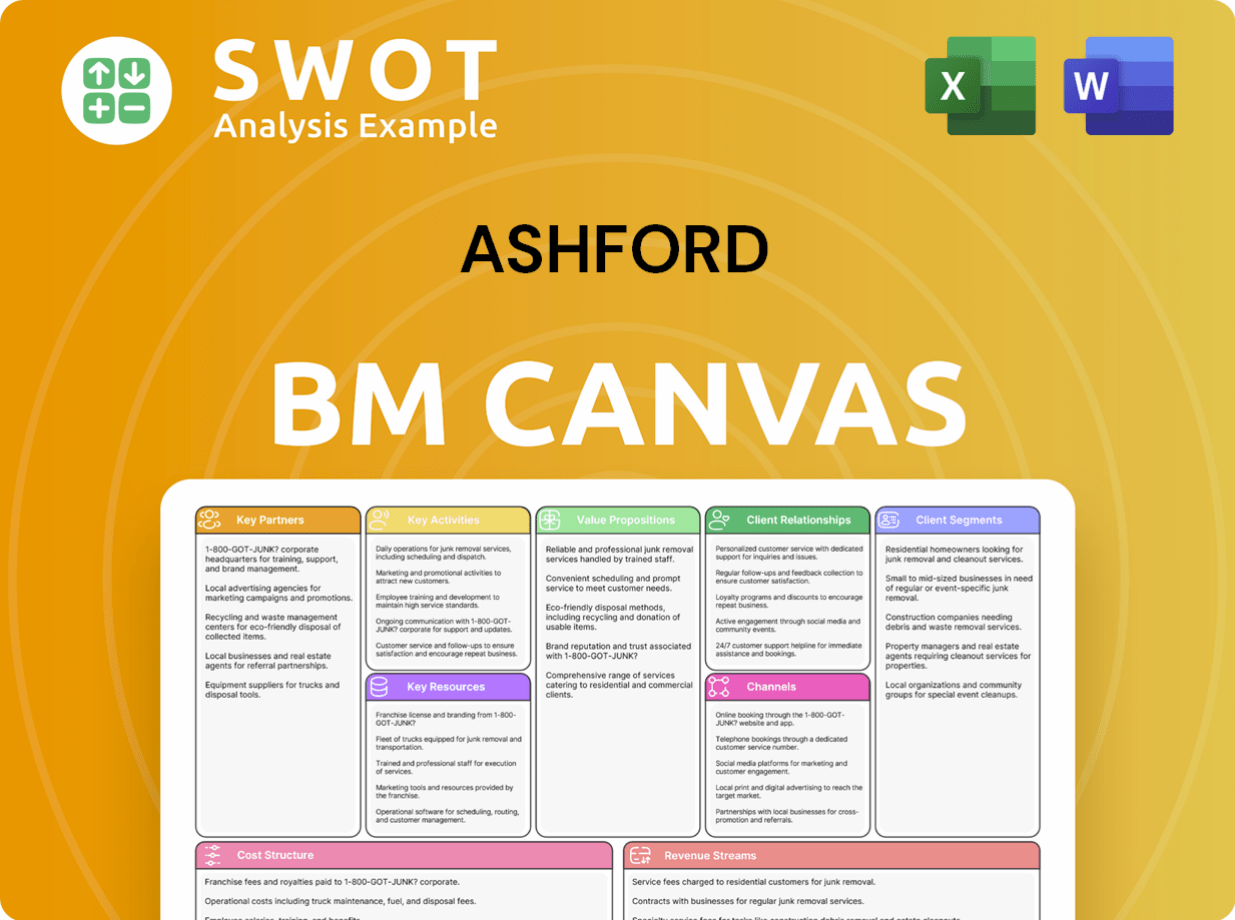

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Ashford Inc. demonstrates a commitment to enhancing the performance of its advised entities, there's room to refine the articulation of its own corporate identity. Focusing on improvements to its mission and vision statements can significantly benefit Ashford Inc.'s strategic positioning and stakeholder engagement.

A primary improvement involves crafting a clear and concise Mission Statement that explicitly defines Ashford Inc.'s purpose as an asset manager and service provider within the hospitality sector. This statement should articulate its core business and value proposition, independent of its advised REITs, to resonate with a broader audience. This clarity would help potential partners and investors immediately understand Ashford's role in the market.

Ashford Inc. should establish an aspirational Vision Statement outlining its desired future position and impact within the asset management landscape. This should encompass growth targets, such as increasing Assets Under Management (AUM), expanding third-party business, and innovating in hospitality asset management. As of Q1 2024, Ashford Inc. reported managing approximately $4.5 billion in assets; an ambitious vision could target a significant increase in AUM within a specific timeframe.

The Ashford Company Mission and Ashford Company Vision should explicitly address technology adoption to reflect the evolving hospitality landscape. Integrating technology-focused language into its statements could signal a commitment to innovation, which is increasingly vital for operational efficiency and guest experience. For instance, incorporating "leveraging data analytics for enhanced asset performance" or "pioneering digital solutions in hospitality" would be beneficial.

To align with current market trends, Ashford Inc. should explicitly incorporate elements related to sustainability and Environmental, Social, and Governance (ESG) factors into its Ashford Company Core Values or Ashford Company Vision. This could involve statements about reducing environmental impact or promoting sustainable practices within its portfolio. Given the growing importance of ESG considerations, this would likely attract investors and partners who prioritize these factors. For more insights into Ashford's financial structure, consider reading Revenue Streams & Business Model of Ashford.

How Does Ashford Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible results. This section examines how Ashford Inc. operationalizes its guiding principles to drive performance and create value.

Ashford Inc. demonstrates its commitment to its Ashford Company Mission and Ashford Company Vision through specific business initiatives. The 'GRO AHT' initiative, launched in December 2024, serves as a prime example of putting strategy into action. This initiative, with its three core pillars, directly reflects the company's commitment to driving performance and value.

- The 'GRO AHT' initiative likely focuses on Growth, Revenue, and Optimization within Ashford Hospitality Trust (AHT).

- The three core pillars of 'GRO AHT' are designed to improve key performance indicators (KPIs) such as RevPAR (Revenue Per Available Room) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

- Initiatives like menu engineering and parking optimization are examples of revenue enhancement projects.

- Refinancings and asset sales are strategic actions taken to improve financial health.

Leadership plays a critical role in reinforcing the Ashford Company Core Values and strategic priorities. Statements from Stephen Zsigray, President and CEO of Ashford Trust, consistently highlight the importance and progress of the 'GRO AHT' initiative. This top-down emphasis ensures that the strategic priorities are communicated effectively throughout the organization.

Communication of the Mission Statement and Vision Statement, while not necessarily through formal standalone statements, occurs through investor presentations, earnings calls, and press releases. The focus on key metrics like RevPAR growth, EBITDA improvement, and debt reduction reinforces the company's priorities to investors and the market.

Concrete examples of alignment between stated Company Values (such as operational excellence and value creation) and actual business practices are evident in the specific actions taken under 'GRO AHT.' These actions include cost control measures, revenue enhancement projects, and strategic financial maneuvers. For example, in Q4 2024, AHT reported a RevPAR increase of 5.2% year-over-year, demonstrating the impact of these initiatives.

While formal programs explicitly for mission and vision alignment weren't detailed, the structure of Ashford Inc. as an advisor to REITs suggests an inherent system for implementing strategy and operational improvements across the portfolio. The close collaboration between Ashford Inc. and its advised entities, as well as property managers like Remington, facilitates the execution of these initiatives. For a broader view of the competitive environment, consider the Competitors Landscape of Ashford.

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Competitive Landscape of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- How Does Ashford Company Work?

- What is Sales and Marketing Strategy of Ashford Company?

- Who Owns Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.