Ashford Bundle

How Does Ashford Inc. Navigate the Hospitality Market?

Ashford Inc., a key player in the hospitality asset management arena, has consistently refined its Ashford SWOT Analysis and overall sales and marketing strategies. Established in 2014, the firm has evolved from advising hospitality-focused REITs to strategically investing in companies that service the industry. This evolution reflects a dynamic approach to market challenges and opportunities within the lodging sector.

This article explores the strategies behind Ashford Inc.'s success, examining its Ashford Company sales strategy and Ashford Company marketing strategy to understand how it drives growth. We'll analyze its recent initiatives, like the 'GRO AHT' program, and delve into its Ashford Company sales and marketing goals, providing insights into its competitive positioning and future prospects. Furthermore, we will conduct an Ashford Company market analysis to better understand its performance.

How Does Ashford Reach Its Customers?

The sales strategy of the [Company Name] centers on its advisory role, primarily serving its advised REITs, Ashford Hospitality Trust and Braemar Hotels & Resorts. This approach acts as a core sales channel for asset management and related services. The company's sales and marketing efforts are strategically aligned to support its business objectives.

Ashford Securities LLC, a wholly-owned subsidiary and FINRA member firm, is a key component of the company's sales strategy. It focuses on distributing alternative investment products to financial intermediaries. The company's growth strategy involves expanding its reach through various channels, including direct sales and partnerships.

The company's sales and marketing strategy involves a multi-faceted approach, integrating various channels to reach its target audience. This includes leveraging its advisory relationships, distributing investment products through Ashford Securities, and fostering growth through its 'Hospitality Products and Services' initiative.

The company leverages its advisory role to Ashford Hospitality Trust and Braemar Hotels & Resorts as a primary sales channel. This approach supports the distribution of asset management and related services. The company's market analysis indicates a strong demand for its specialized services within the hospitality sector.

Ashford Securities LLC is a key sales channel for distributing alternative investment products. These products include publicly registered redeemable preferred stock offerings and Reg D private placements. The company's sales process optimization has been enhanced through this channel.

Ashford Securities has successfully placed significant offerings, such as $460 million of Series E & M Redeemable Preferred Stock for Braemar Hotels & Resorts. Approximately $212 million was placed for the Series J & K Redeemable Preferred Stock Offering for Ashford Hospitality Trust. The company's sales and marketing goals include expanding its investment product offerings.

The 'Hospitality Products and Services' initiative involves investing in operating companies within the hospitality industry. This strategy leverages industry relationships and consulting to drive growth. A key partnership with Remington Hospitality supports this initiative.

The company's sales channels include advisory services, investment product distribution, and strategic partnerships. The company's marketing strategy for target audiences involves a multi-channel approach. For further insights, consider reading the Growth Strategy of Ashford.

- Leveraging advisory roles for REITs.

- Distributing alternative investment products through Ashford Securities.

- Growing through the 'Hospitality Products and Services' initiative.

- Building relationships with institutional broker-dealers and RIAs.

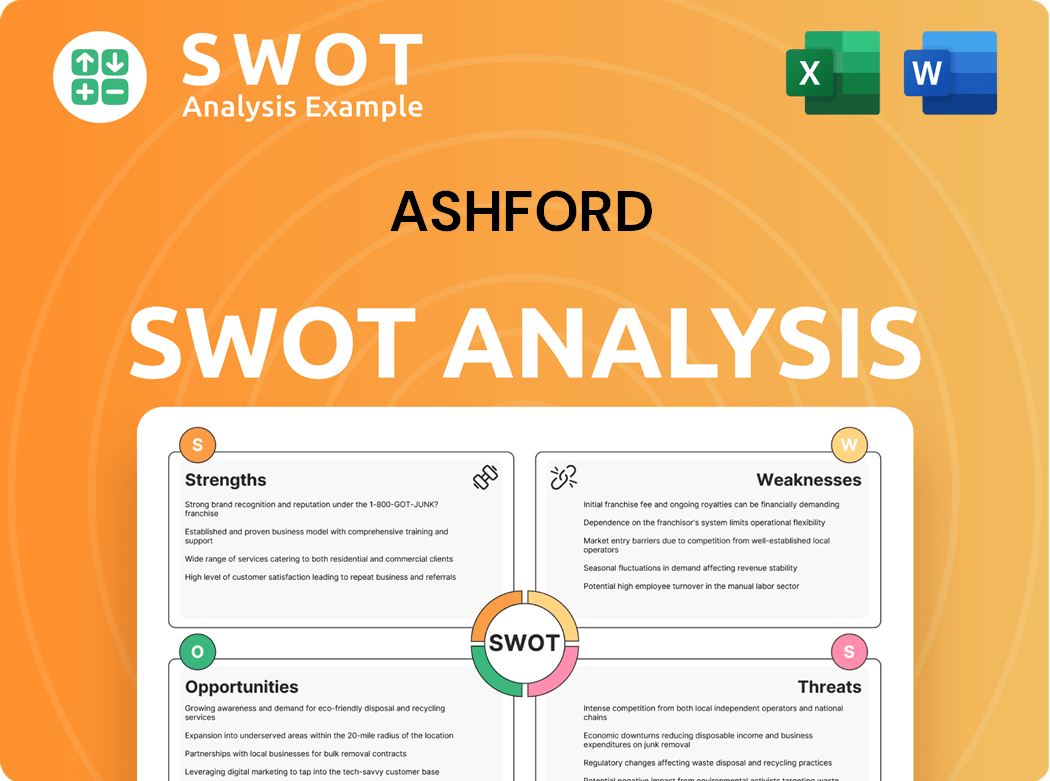

Ashford SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Ashford Use?

The Ashford Company sales and marketing strategy is primarily business-to-business (B2B) focused. This approach is due to its role as an asset management firm. It advises Real Estate Investment Trusts (REITs) and distributes alternative investment products to financial intermediaries. The core of their strategy emphasizes data-driven methods, strategic communication, and building strong relationships within the financial and hospitality sectors.

Digital marketing tactics are likely to include content marketing. Here, they share insights into the hospitality market, investment strategies, and performance metrics. Search Engine Optimization (SEO) and paid advertising are crucial for increasing visibility among financial professionals. Email marketing is used to nurture leads, distribute reports, and announce new offerings and financial results.

Data-driven marketing, customer segmentation, and personalization are essential in the financial services industry. The company likely segments its target audience based on investment profiles and geographical considerations. The communication of financial results, such as the Q4 2024 Comparable RevPAR increase of 3.1% to $126, demonstrates a focus on providing key performance indicators to its stakeholders. Technology platforms and analytics tools play a significant role in tracking engagement with communications.

Content marketing, SEO, and paid advertising are key digital tactics. These are used to attract potential investors and partners. Email marketing is crucial for lead nurturing and distributing financial updates.

Customer segmentation and personalization are vital. The company tailors its outreach based on investment profiles and geographical considerations. They use technology platforms and analytics tools to track engagement.

Transparency through earnings calls and press releases is a key tactic. The company communicates financial results, such as the Q1 2025 Comparable RevPAR increase of 3.2% to $133 for Ashford Hospitality Trust. This demonstrates a commitment to providing key performance indicators.

The Ashford Company marketing strategy is designed to reach financial professionals and institutions. It focuses on providing detailed information and building strong relationships. The strategy includes data-driven approaches and strategic communication.

- Content Marketing: Sharing insights into the hospitality market, investment strategies, and performance metrics.

- SEO and Paid Advertising: Increasing visibility among financial professionals.

- Email Marketing: Nurturing leads and distributing financial updates.

- Data-Driven Marketing: Segmenting the target audience based on investment profiles and geographical considerations.

- Financial Reporting: Providing key performance indicators through earnings calls and press releases.

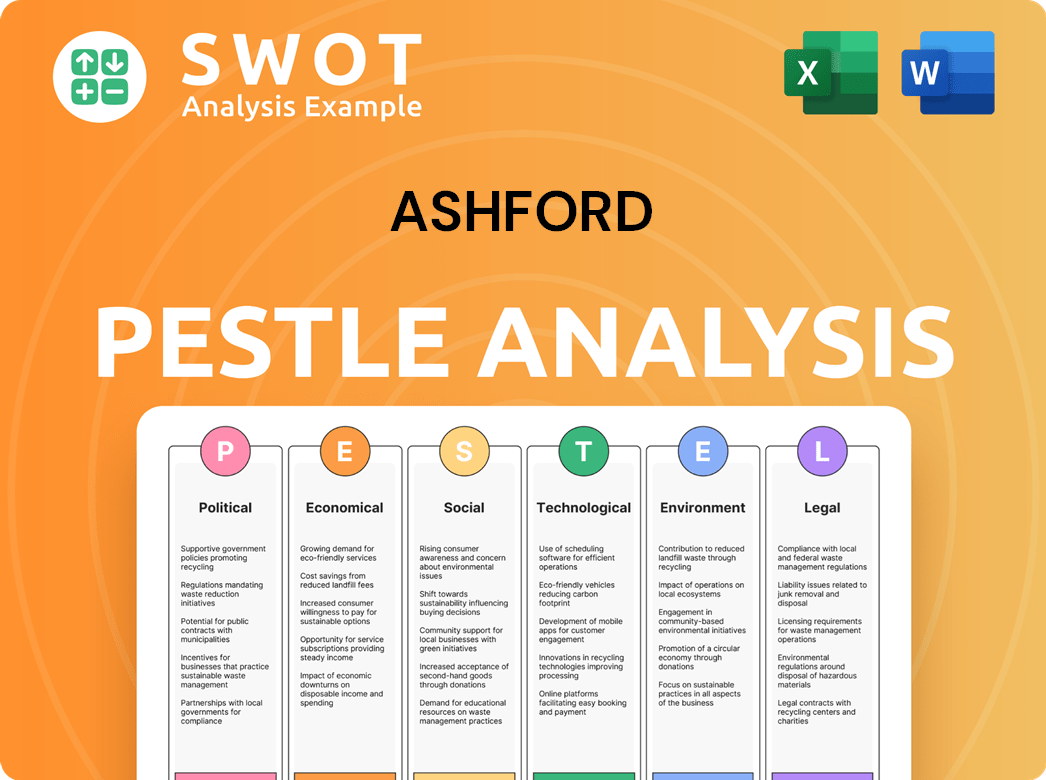

Ashford PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Ashford Positioned in the Market?

The Growth Strategy of Ashford positions itself as a leading alternative investment management firm within the lodging sector. Its core message centers on leveraging substantial experience to optimize asset performance and deliver strong investment returns. The company emphasizes its integrated platform and its role as an advisor to NYSE-listed REITs, showcasing its significant presence with over $6.5 billion in assets under management.

The visual identity and tone of voice likely convey professionalism, expertise, and reliability, appealing to financially literate decision-makers. The customer experience promises comprehensive financial data, strategic frameworks, market analysis, and actionable insights. This approach aims to attract and retain investors by offering specialized knowledge and a proven track record within the hospitality industry.

Ashford differentiates itself through its deep specialization in the hospitality sector and its 'Hospitality Products and Services' initiative. This involves strategic investments in operating companies that service the industry, creating synergies and offering attractive pricing and higher service levels to its hotel platforms. The company's focus on this niche allows it to build a strong brand reputation and attract investors looking for expertise in this specific market.

Focuses on leveraging extensive experience in the lodging sector to optimize asset performance and deliver strong investment returns. This core message is central to the company's brand positioning.

Primarily targets financially literate decision-makers, including individual investors, financial professionals, and business strategists. The brand's communication is tailored to appeal to this audience.

Specialization in the hospitality sector and the 'Hospitality Products and Services' initiative. This focus allows for creating attractive pricing and higher service levels, setting it apart from competitors.

Adheres to five guiding principles: ethical, innovative, profitable, engaging, and tenacious. These values are integral to its business practices and brand reputation.

The Ashford Company sales strategy focuses on its deep specialization in the hospitality sector. The Ashford Company marketing strategy emphasizes an integrated platform and advisory role to NYSE-listed REITs. The Ashford Company sales and marketing efforts are geared towards attracting and retaining investors by offering specialized knowledge and a proven track record within the hospitality industry.

- Focus on the lodging sector to build a strong brand reputation.

- Continuous efforts to optimize its portfolio and capital structure.

- Maximizing revenue and operational efficiency within its advised platforms.

- Strategic investments in operating companies that service the industry.

- Emphasis on ethical, innovative, profitable, engaging, and tenacious principles.

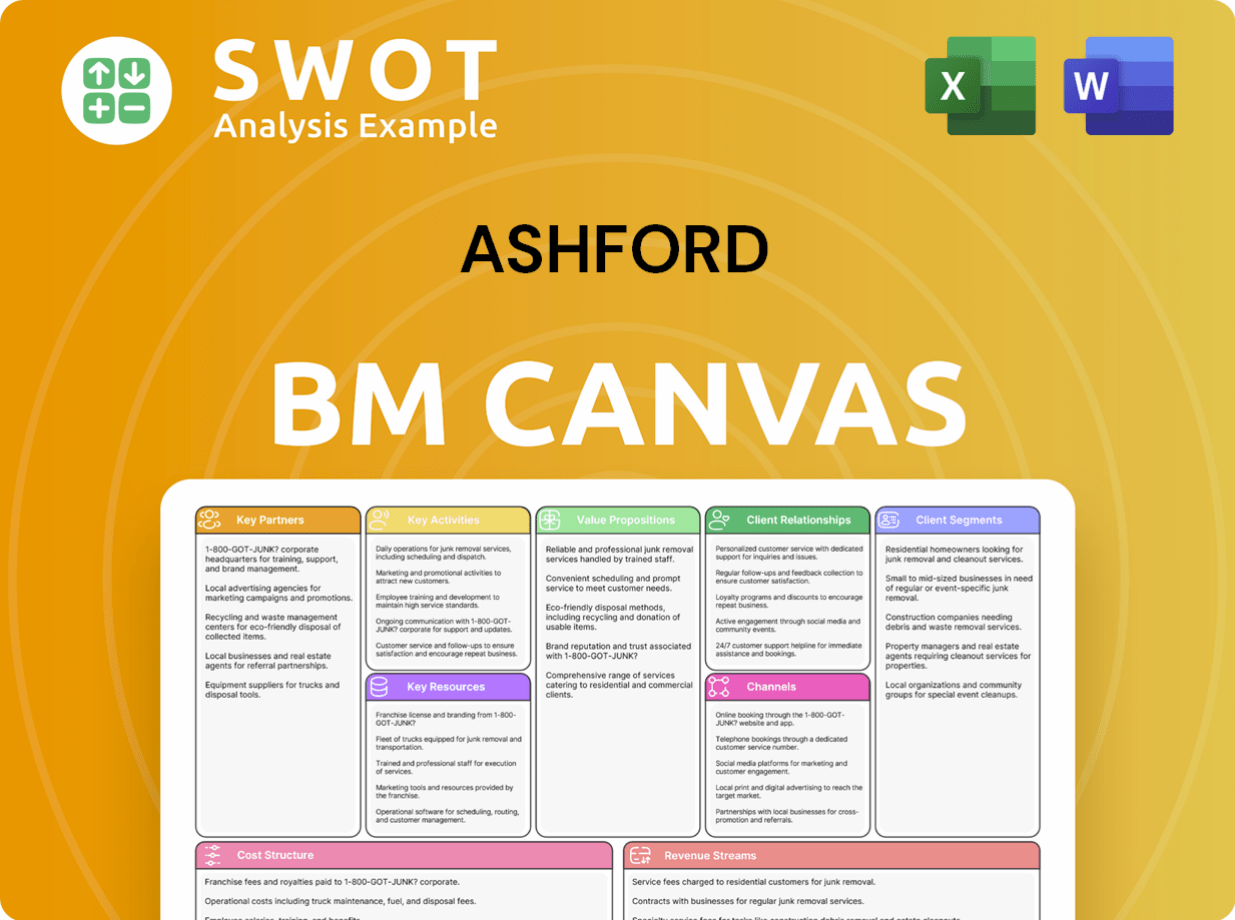

Ashford Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Ashford’s Most Notable Campaigns?

The Ashford Company sales strategy and marketing efforts are primarily focused on strategic initiatives and capital-raising campaigns. These campaigns are designed to offer differentiated investment solutions to financial intermediaries, aiming to provide diversification, income, and attractive returns. The effectiveness of these offerings is directly measured by their success in driving capital, making them a critical component of the company's approach to growth and market analysis.

A key element of the

The 'GRO AHT' plan, launched in mid-December 2024 by Ashford Hospitality Trust, with Ashford Inc. as an advisor, represents a significant strategic initiative. This campaign aims to drive substantial EBITDA growth and enhance shareholder value through a combination of G&A reduction, revenue maximization, and operational efficiency. The company's approach includes internal operational changes and communication to investors through earnings calls and press releases, highlighting the importance of transparent communication in achieving its goals.

Ashford Securities LLC has been instrumental in raising capital through redeemable preferred stock offerings. The Braemar Hotels & Resorts offering in 2021 raised $460 million. A subsequent offering for Ashford Hospitality Trust closed on March 31, 2025, raising approximately $212 million. As of December 31, 2024, approximately $195 million was raised from the sale of Series J and Series K non-traded preferred stock.

Launched in mid-December 2024, this initiative aims to boost EBITDA and shareholder value. The plan focuses on G&A reduction, revenue maximization, and operational efficiency. The goal is to achieve an incremental $50 million of EBITDA improvement to run-rate corporate EBITDA, an increase of more than 20%.

Ashford Inc. collaborates with its advised REITs and their hotel management companies to implement operational efficiencies and revenue strategies. Remington Hospitality's efforts to increase room revenue market share by more than 2% in 2025, as measured by RevPAR index, directly contribute to the success of the 'GRO AHT' initiative. This collaborative approach is key to achieving the company's sales and marketing goals.

In Q1 2025, Ashford Hospitality Trust reported a 3.2% increase in Comparable RevPAR to $133, and a $30 million run-rate EBITDA enhancement as part of the 'GRO AHT' initiative. These early positive results indicate the effectiveness of the strategic changes. These performance metrics are crucial for evaluating the success of the

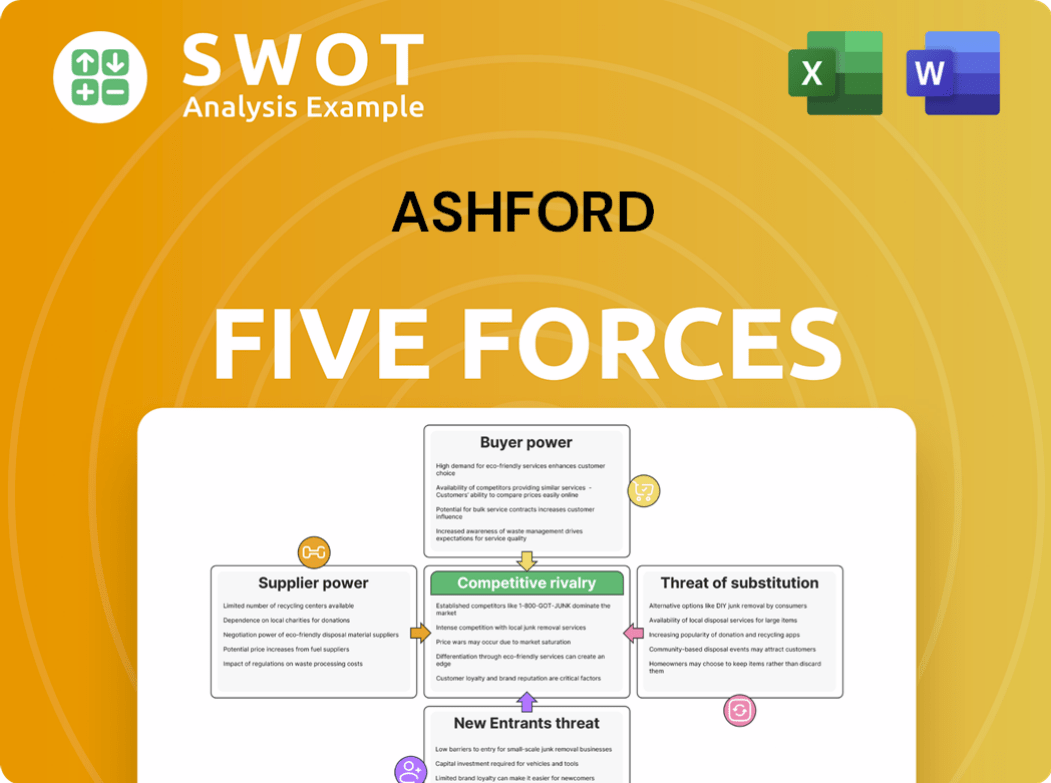

Ashford Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ashford Company?

- What is Competitive Landscape of Ashford Company?

- What is Growth Strategy and Future Prospects of Ashford Company?

- How Does Ashford Company Work?

- What is Brief History of Ashford Company?

- Who Owns Ashford Company?

- What is Customer Demographics and Target Market of Ashford Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.